On November 19, 2025, ASC Therapeutics, a gene and cell therapy startup based in Milpitas, unexpectedly declared Chapter 7 bankruptcy. This decision means the company will close down and sell off what assets remain, rather than try to fix its problems and reopen.

As one analyst put it, “Chapter 7 is the emergency exit when nothing else works”. The impact was immediate and felt throughout the Bay Area’s biotech sector, an industry already struggling with record numbers of bankruptcies and layoffs.

A Startup with Big Goals

Founded in 2019 as a spinoff from Applied StemCell, ASC Therapeutics aimed for medical breakthroughs in rare diseases, targeting hemophilia A and graft-versus-host disease.

Their research caught attention thanks to promising clinical trials and hopes for innovative treatments. Gene therapy is the gift of life for rare disease families and this breakthrough had the potential to change many lives.

ASC’s Financial Freefall

ASC’s bankruptcy filings revealed a company drowning in debt, with between $10 million and $50 million owed and only $100,000 to $500,000 in assets. That imbalance highlights either poor financial planning or fundraising efforts falling short.

Many startups build amazing science, but cash is the limiting factor usually causing them to have to stop what they are doing no matter how many lives it can end up changing. Without the right, or constant funding, it’s impossible to keep a project running.

Creditors and Courts Want Answers

The bankruptcy documents left out key details about who is owed money and how funds disappeared, prompting court officials to request more thorough explanations. More than 100 creditors, including suppliers and research partners, have been left with little information and major concerns about getting paid.

Abandoned Trials Mean Lost Hope

ASC’s two clinical trials, one for hemophilia A, one for graft-versus-host disease, were suddenly halted. Patients participating had been counting on these next-generation treatments, but the company stopped reporting to federal trial registries after 2023.

Clinical trials should never leave patients stranded. The disruption is devastating to those who had a glimpse of hope from recovering or improving a life-threatening prognosis.

Hemophilia A Patients Left Waiting

The end of the hemophilia A study affected up to 500 patients hoping for a cure through ASC’s gene therapy. With the trial gone, these families are left seeking answers and alternatives for critical care. Every trial closure delays a cure and adds uncertainty for families already battling rare disease.

ASC celebrated dosing its first hemophilia A patient in January 2024, but financial problems swiftly overpowered operational progress. In biotech, achieving a milestone doesn’t guarantee long-term survival.

Employees Lose Their Jobs Overnight

From lab researchers to administrative staff, 10 to 30 employees at ASC lost their jobs instantly. Job security in clinical-stage biotech is fragile and the fallout is intense every time a company folds.

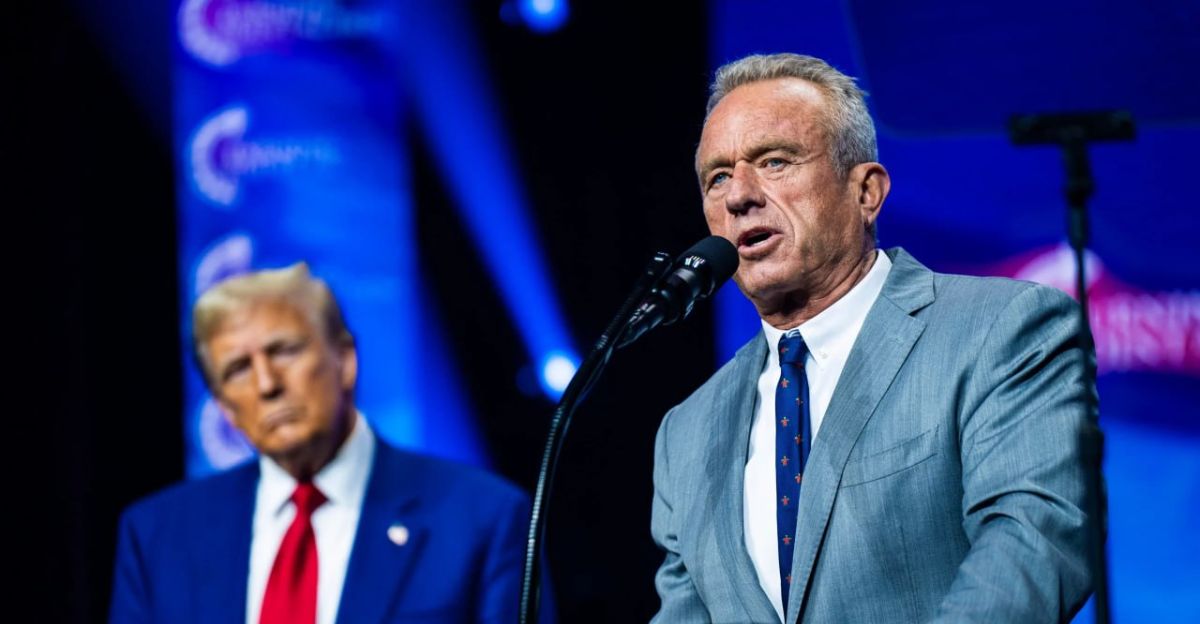

Despite strong advocacy from leaders like RFK Jr. for gene therapies, the underlying business environment remains fragile. The case of ASC Therapeutics shows why economic realities still overshadow medical breakthroughs.

Company Leaders Stay Silent

ASC’s CEO Ruhong Jiang, who filed the bankruptcy documents, hasn’t commented publicly on what happened. The rest of the executive team is also quiet, fueling speculation about internal problems. Employees and industry insiders are still waiting for answers on what caused the company’s downfall.

No clear public explanation has emerged regarding how ASC’s funds were spent, or what happened to the capital raised. This lack of transparency is troubling.

Chief Medical Officer’s Exit

ASC’s former Chief Medical Officer, Oscar Segurado, stepped down soon after the first hemophilia A patient received gene therapy in January 2024. His departure was unexpected and led to further questions about instability inside the company.

Biotech Layoffs Hit the Bay Area

ASC isn’t the only biotech to fail recently. The Bay Area has faced a wave of bankruptcies, layoffs, and closures in 2023-2025, a trend driven by tough fundraising conditions and the high risks of drug development.

The Bay Area remains a biotech powerhouse, but even big ideas need financial lifelines.

National Push for Gene Therapy

While federal officials like Health and Human Services Secretary Robert F. Kennedy Jr. have promoted gene and cell therapies, the industry is still vulnerable to market challenges. RFK Jr. recently insisted, “gene therapy could change medicine forever, but we must ensure the science survives economically”.

Debt Ratios Reach Alarming Levels

ASC’s filings show a potential $49.5 million debt with almost no assets, an astonishing ratio even for risky biotech startups. It’s rare to see such a dramatic financial gap, a sign of deep underlying issues.

What Happens Next

With ASC under Chapter 7, what remains will be auctioned. Creditors, staff, and trial partners face uncertainty about recovering anything at all. Bankruptcy is swift and ruthless and recovery for creditors is seldom more than pennies on the dollar.

Over 100 creditors, from vendors to trial partners, will face a slow, contentious claims process. Historically, recoveries in biotech bankruptcies are meager at best. The odds of full repayment are close to zero whenever a trial-stage biotech closes.

Fundraising Was the Fatal Flaw

Industry reports confirm that fundraising for new biotech ventures has been especially difficult since 2023, scuttling even the strongest scientific projects. When money stops, science stops and that’s the unfortunate reality for cutting-edge therapy development.

Pipeline and Promises Disappear

ASC’s pipeline of gene therapy candidates, once considered extremely valuable, now faces liquidation as assets rather than medicines. Hopes for life-changing treatments evaporate quickly under bankruptcy.

Families in need of advanced gene therapies, particularly those with hemophilia A, are now forced to look for alternative treatments.