Prices aren’t inching upward—they’re surging. Since mid-2025, RAM costs have increased by 30–100%, according to multiple sources tracking wholesale and retail memory pricing. This is forcing PC builders to rethink budgets mid-purchase.

Shelves that once held affordable kits now show slim stock and premium tags, as data-center buyers crowd the same supply line and outbid everyday consumers.

The real disruption isn’t just scarcity—it’s a quiet reshuffling of who memory is made for, and builders are only starting to feel the consequences. What happens when demand keeps rising?

The Stakes Escalate

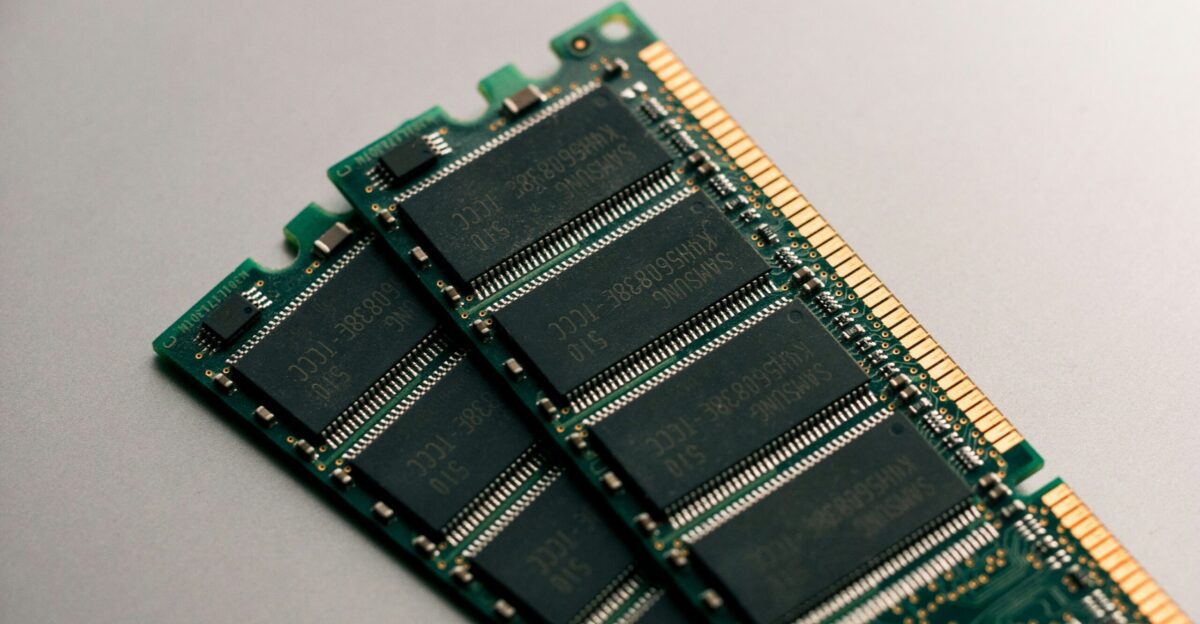

The three largest global memory producers—Micron (USA), Samsung (South Korea), and SK Hynix (South Korea)—currently control the world’s DRAM supply.

Samsung and SK Hynix together produce roughly 70% of all DRAM on the market, while Micron holds approximately 25% of global DRAM production capacity.

This concentration means fewer manufacturers serve billions of devices worldwide. When one major player shifts strategy, the ripple effect touches gamers, enterprises, and everyday consumers simultaneously. The question isn’t whether change is coming—it’s how disruptive it will be.

Crucial’s Thirty-Year History

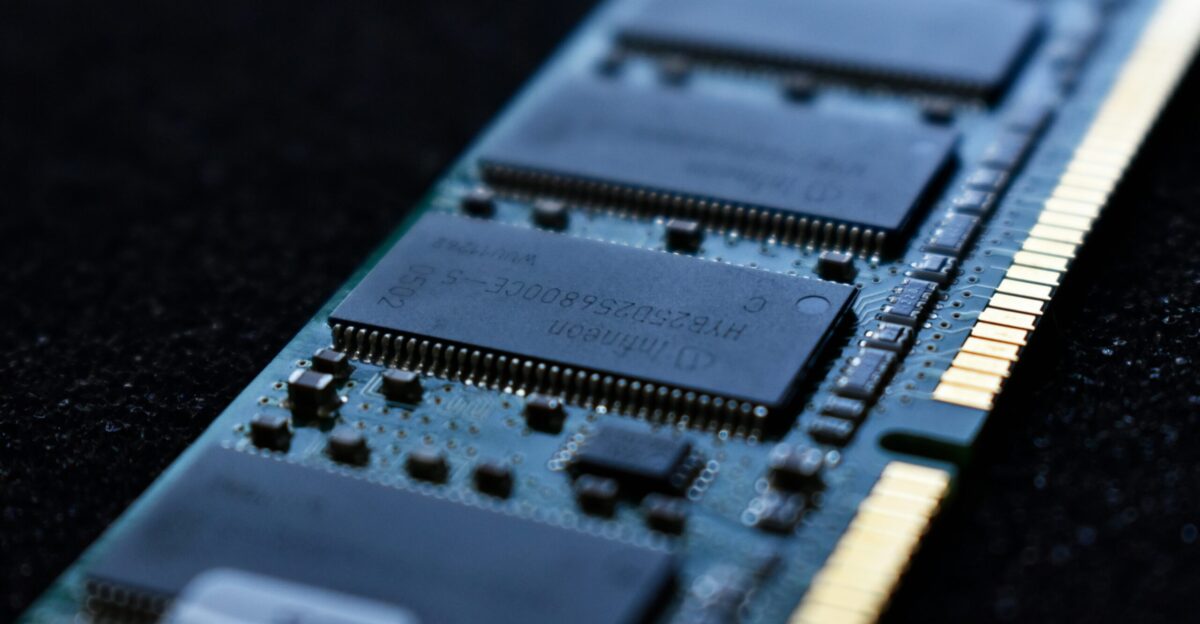

Crucial, Micron’s consumer-facing brand, emerged in the mid-1990s as a trusted name for affordable PC memory and storage. For nearly three decades, it powered gaming rigs, DIY builds, work laptops, and family computers across North America and Europe.

While Intel produced the first commercial DRAM in 1970, Micron became America’s only remaining major DRAM manufacturer by the 2020s. Crucial products sat on retailer shelves alongside competitors like Corsair and G.Skill, offering budget-conscious builders a reliable option.

The brand became synonymous with accessible performance—a gateway for millions of non-technical users. Few expected this thirty-year story would come to an abrupt end.

The AI Boom Reshapes Priorities

In 2024 and 2025, demand for artificial intelligence infrastructure exploded. Data centers raced to deploy generative AI models, each requiring massive quantities of high-bandwidth memory (HBM)—specialized chips that move data faster than conventional DRAM.

Micron’s HBM revenue alone reached nearly $2 billion in the August 2025 quarter, implying an annualized run rate of approximately $8 billion.

This market segment commands premium pricing and is expected to sustain growth through 2028 and beyond. By comparison, consumer RAM remains a low-margin commodity business. The financial calculus shifted entirely in favor of AI.

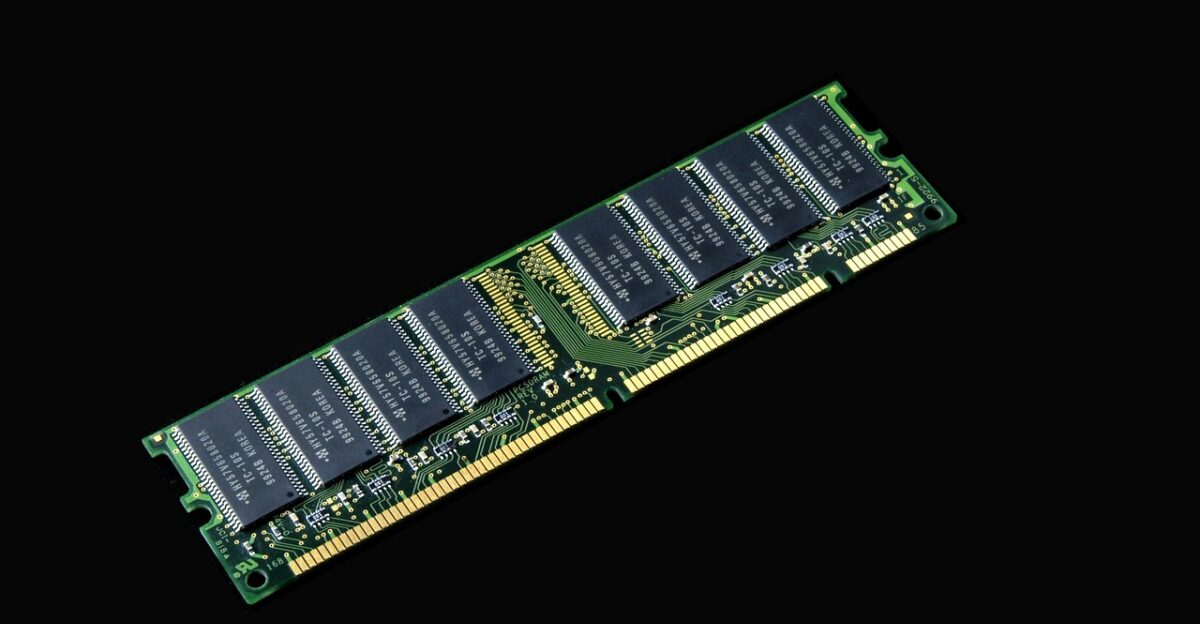

Micron Exits Consumer Market

On December 3, 2025, Micron Technology announced it will completely exit the Crucial consumer-branded business, ending sales of RAM and SSDs to retail customers, e-tailers, and distributors worldwide.

Final shipments are expected to conclude by the end of Micron’s fiscal Q2, approximately in February 2026. The company pivots exclusively to enterprise and AI data center customers, abandoning its thirty-year presence in consumer retail.

Sumit Sadana, Micron’s Chief Business Officer, stated: “Micron has made the difficult decision to exit the Crucial consumer business in order to improve supply and support for our larger, strategic customers in faster-growing segments.”

Immediate Consumer Impact

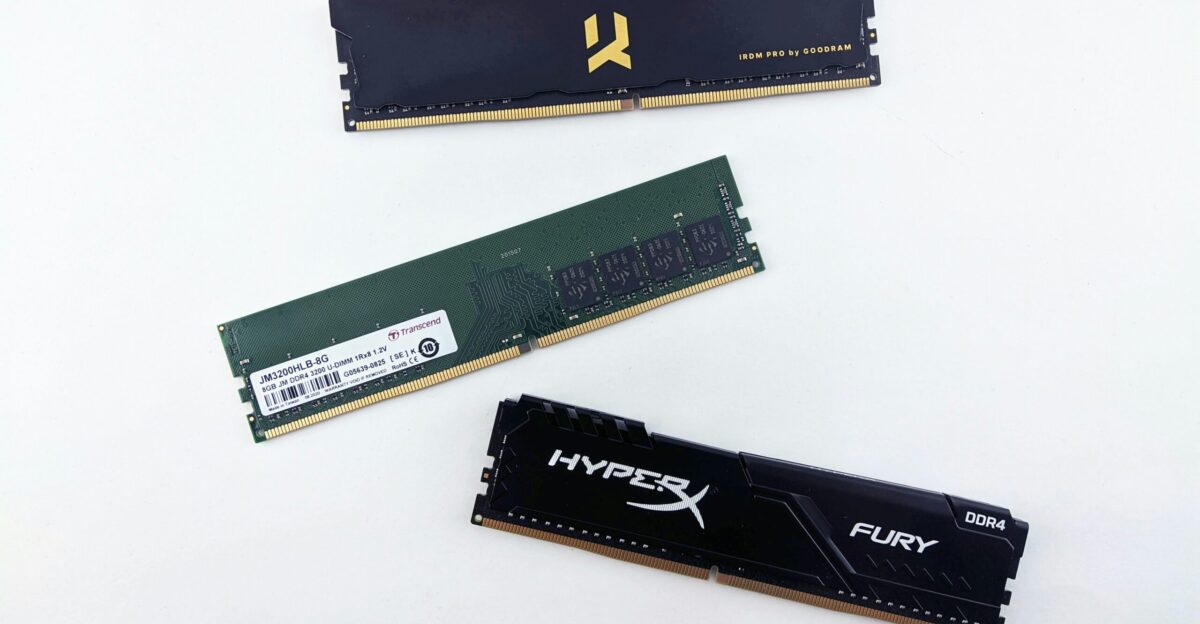

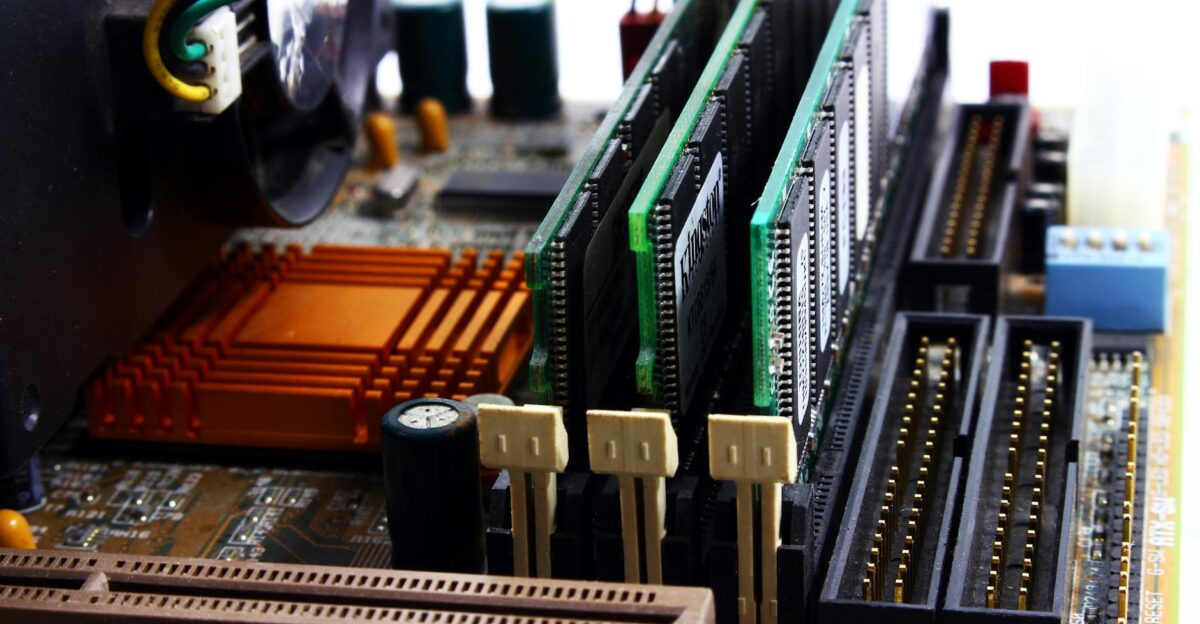

Gamers, DIY enthusiasts, and small businesses are facing an immediate supplier crunch. Micron represented roughly 25% of global DRAM production—its capacity is now fully redirected to the enterprise.

With Samsung and SK Hynix already commanding 70% of the market, competition for consumer RAM has collapsed from three major players to effectively two. Retailers such as Newegg, Amazon, and Best Buy will soon exhaust their existing Crucial inventory.

Alternative brands like Corsair and G.Skill exist, but both source their memory chips from the same Samsung and SK Hynix duopoly, amplifying supply pressure. PC builders face fewer options and steeper prices.

The Human Cost

The Micron exit creates real pressure on PC builders, but consumer reactions remain mixed. Online tech communities, including Reddit’s r/buildapc forum, report mixed responses to the announcement. Some discuss postponing builds until 2028 when new production capacity is expected to come online.

Parents shopping for gaming laptops face higher memory costs than they did six months prior. Small IT shops report customers questioning PC upgrades due to rising memory prices.

The decision resonates throughout communities built around accessible and affordable computing. For millions accustomed to budget RAM options, the era of low-cost upgrades may be shifting toward premium pricing or extended wait times.

Samsung and SK Hynix Watch Closely

Samsung and SK Hynix have not announced similar exits—yet. Both companies balance consumer and enterprise revenue streams differently from Micron.

However, the precedent is set: if AI margins remain as lucrative as current forecasts suggest, pressure on Samsung and SK Hynix leadership to follow will intensify. Industry analysts note that consolidated markets historically see copycat moves.

Some observers speculate that both competitors will eventually restrict consumer supply or raise prices substantially to chase data center profits. If all three major manufacturers pivot to enterprise, consumer memory becomes a secondary market served by smaller, less efficient suppliers.

Global Supply Shortage

The semiconductor shortage that began in 2020 has never fully resolved. Flash memory, DRAM, and advanced HBM all face simultaneous constraints. Silicon Motion CEO echoed this in recent remarks: “We’re seeing an unprecedented scenario where HDD, DRAM, HBM, and NAND are all in severe shortage simultaneously.”

New production capacity won’t arrive until late 2028 at the earliest—a three-year gap. During this window, anyone needing memory faces allocation, wait times, and premium pricing.

Governments, enterprises, and consumers compete for a limited supply. The decision by Micron to exit consumer markets accelerates this scarcity and shifts leverage entirely to remaining suppliers.

Price Spike Projections

According to Tom’s Hardware’s December 2025 analysis, if 30–50% RAM price increases persist through 2028, PC builds could face cumulative cost increases of $150–$300. This assumes a 30–50% upward price trajectory applied to typical consumer configurations.

For context, a mid-range gaming PC build today typically costs between $1,200 and $2,000. Adding $150–$300 for memory alone pushes many builds beyond casual-gamer budgets. Simultaneously, Transcend (an SSD maker) reported 50–100% cost increases in recent weeks.

If both RAM and SSD prices spike, total build costs could increase by $400–$500 per machine. For families and budget-conscious buyers, this represents a significant barrier to entry.

Stakeholder Frustration Mounts

Retailers face conflicting pressures. They want to stock affordable consumer memory to maintain customer loyalty and sales volume.

But with Micron exiting and Samsung/SK Hynix reducing consumer supply to chase higher margins, inventory becomes scarce.

E-commerce sites like Newegg are experiencing declining stock availability and margin compression as Crucial products deplete and alternatives thin out.”

Leadership’s Framing: Strategic Necessity

Micron CEO Sanjay Mehrotra has publicly framed the exit as a strategic necessity, not desperation. In investor calls, he emphasizes that enterprise and AI serve higher-margin, faster-growing markets.

Redirecting Micron’s 25% global production capacity to HBM aligns with shareholder interests and long-term growth. From a pure financial standpoint, the decision makes sense: AI HBM generates multiples of the profit margins found in consumer DRAM.

However, this logic implicitly writes off an entire consumer market segment that once defined the company’s identity and brand loyalty. It signals a deliberate choice to prioritize institutional over individual customers.

Stock Market Reaction: A Volatile Signal

Micron’s stock surged 180% in 2025 on the strength of its HBM business and AI demand forecasts. However, the December 3 announcement prompted a 2.6% afternoon decline—a rare dip in a stellar year.

The mixed reaction reflects investor ambivalence: enthusiasm for AI profits tempered by concern over long-term brand equity and consumer market abandonment.

Sell-side analysts remain bullish on Micron’s enterprise strategy, but some question whether exiting an entire market segment is a reversible move.

If AI demand cools in 2027–2028, Micron may lack the consumer production footprint to pivot back. The stock’s volatility hints at underlying uncertainty.

Expert Skepticism and Longer-Term Concerns

Industry veterans express cautious concern. Some analysts argue Micron is over-indexing on AI’s durability as a high-margin market. Others note that Samsung and SK Hynix—with more diversified revenue streams—can absorb enterprise demand without fully abandoning their consumer base.

Micron’s all-in bet on AI carries concentration risk: if data center spending cools, the company has no fallback in consumer markets.

Additionally, some observers question whether Micron can sustainably maintain 25% global DRAM capacity for enterprise-only customers. Excess capacity could force price wars or production cuts. The long-term competitive landscape remains uncertain.

Will Others Follow?

The critical open question: Do Samsung and SK Hynix follow Micron’s blueprint? If both competitors reduce consumer supply to chase AI-driven margins, the consumer memory market transitions from a commodity to a scarcity-driven luxury goods market.

PC gaming, DIY building, and budget computing become financially inaccessible for millions. Alternatively, if Samsung and SK Hynix maintain balanced consumer portfolios, they capture Micron’s former market share, consolidate power, and potentially raise prices.

Either outcome reshapes consumer computing economics through 2028. Industry observers watch the next earnings calls and investor presentations closely for signals of copycat moves.

Policy and Geopolitical Implications

U.S. policymakers are already paying attention. Micron, America’s only remaining major DRAM manufacturer, is abandoning consumer markets precisely as China and other competitors seek to build domestic memory capacity.

Some argue this decision weakens U.S. technological self-sufficiency and consumer resilience. Conversely, others contend that supporting Micron’s pivot to AI and HBM strengthens American competitiveness in cutting-edge AI infrastructure.

The Biden administration’s $200 billion Micron investment (announced in 2025) now funds exclusively enterprise-class production. This creates a strategic tension: government backing enables AI dominance but leaves American consumers dependent on foreign suppliers.

European and Asian Markets

Europe and Asia face similar pressures, albeit with varying degrees of urgency. European regulators have prioritized supply-chain resilience and pushed for domestic semiconductor production. Micron’s exit intensifies European reliance on Samsung and SK Hynix.

In Asia, particularly Japan and South Korea, domestic companies like SK Hynix benefit from geographic proximity and preferential allocation. India and Southeast Asia, lacking indigenous memory manufacturing, face acute scarcity and price inflation.

Developing nations that rely on affordable consumer RAM for education, small businesses, and public computing face significant challenges. Globally, the consumer memory market bifurcates: premium supplies are available for wealthy regions, while others face scarcity.

Antitrust and Competition Concerns

Legal experts flag potential antitrust implications. A duopoly (Samsung/SK Hynix) controlling 70%+ of DRAM supply raises competition concerns in the United States and the EU. If both companies further restrict consumer supply or coordinate pricing, regulators may intervene.

The U.S. Department of Justice and the EU Competition Commission have historically scrutinized semiconductor market concentration. Micron’s exit doesn’t violate antitrust law, but it accelerates market concentration to levels that may invite regulatory scrutiny.

Smaller competitors, such as Nanya Technology (Taiwan) or regional rivals, lack the scale to fill the gap. The legal landscape may shift, but enforcement typically lags market reality by years.

When Tech Stops Serving Everyone

Micron’s exit signals a broader cultural shift in the tech industry. For decades, semiconductor companies pursued dual markets: consumer AND enterprise. That era may be ending. As AI and data center margins continue to dominate, companies are increasingly optimizing for institutional buyers with deep pockets.

The consequence: consumer tech becomes a secondary market, served by legacy products and budget brands with lower innovation velocity. This threatens the grassroots DIY culture that built PC gaming, content creation, and technical education.

If all major manufacturers follow Micron’s lead, the notion of “affordable access to computing technology” will transition from an industry norm to a nostalgic ideal. A generation of builders and creators may be priced out.

Whose Economy Is This Building?

Micron’s decision crystallizes a fundamental question about whose economy technology serves. The company chose to invest billions in AI infrastructure—admittedly a higher-margin, strategically critical, and socially important endeavor.

Yet that choice implicitly devalues consumer computing and the millions of individuals who depend on affordable memory upgrades. This tension—between maximizing shareholder value and serving the broader needs of consumers—defines modern tech strategy.

Governments subsidize Micron’s new fabs to ensure U.S. AI competitiveness, but offer no corresponding protection for consumer affordability.

The result is a bifurcated market where the wealthy access premium AI infrastructure, while ordinary users face scarcity. Micron’s exit prompts us to reconsider the role of private enterprise in ensuring equitable access to computing technology as it becomes increasingly central to education, work, and opportunity.

Sources:

Micron Technology Official Press Release – “Micron Announces Exit from Crucial Consumer Business” – December 3, 2025

Micron Technology Investor Relations – Earnings Call Transcript – September 2025 –

NIST / U.S. Department of Commerce – “President Trump Secures $200B Investment from Micron Technology in Memory Chip Manufacturing” – June 2025

Silicon Motion CEO Public Statements – Commentary on Global Semiconductor Shortage – December 2025 – (Company press release or investor call)

Transcend Official Announcement – SSD and Memory Cost Increase Statement – December 2025 – (Company press release or public statement)

CNBC – “Micron Stops Selling Memory to Consumers, Demand Spikes From AI Chips” – December 3, 2025 PCMag – “RIP Crucial: Memory Supplier Micron Exits Consumer Market to Chase AI” – December 3, 2025 – Tom’s Hardware – “Micron is Killing Crucial SSDs and Memory in AI Pivot; Company Refocuses on HBM” – December 2, 2025