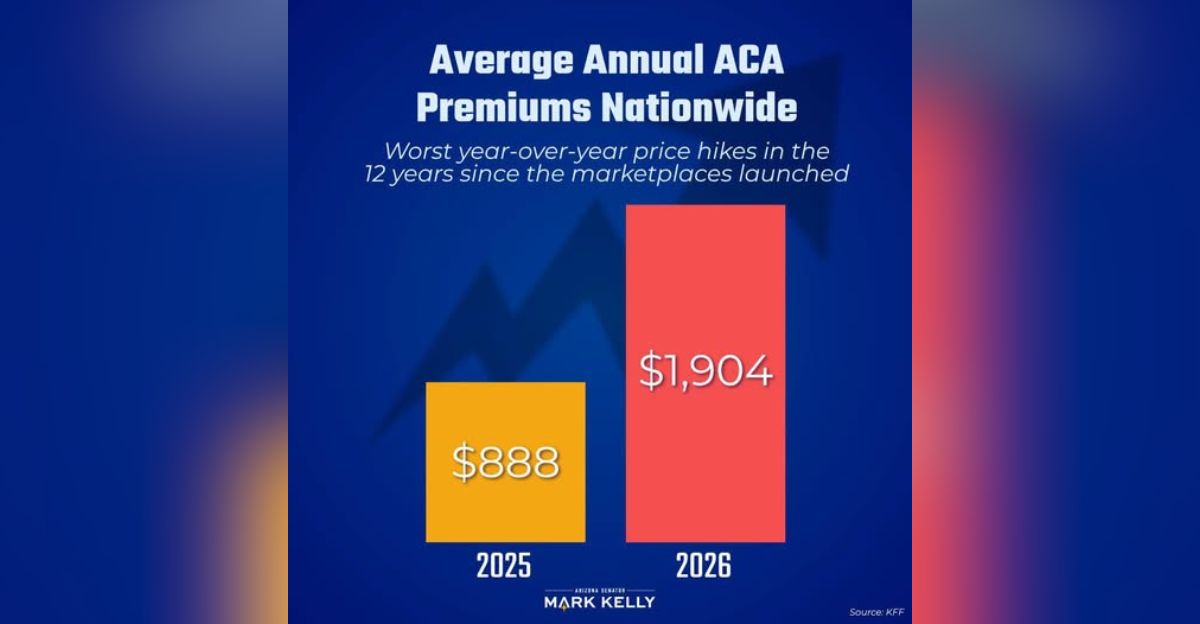

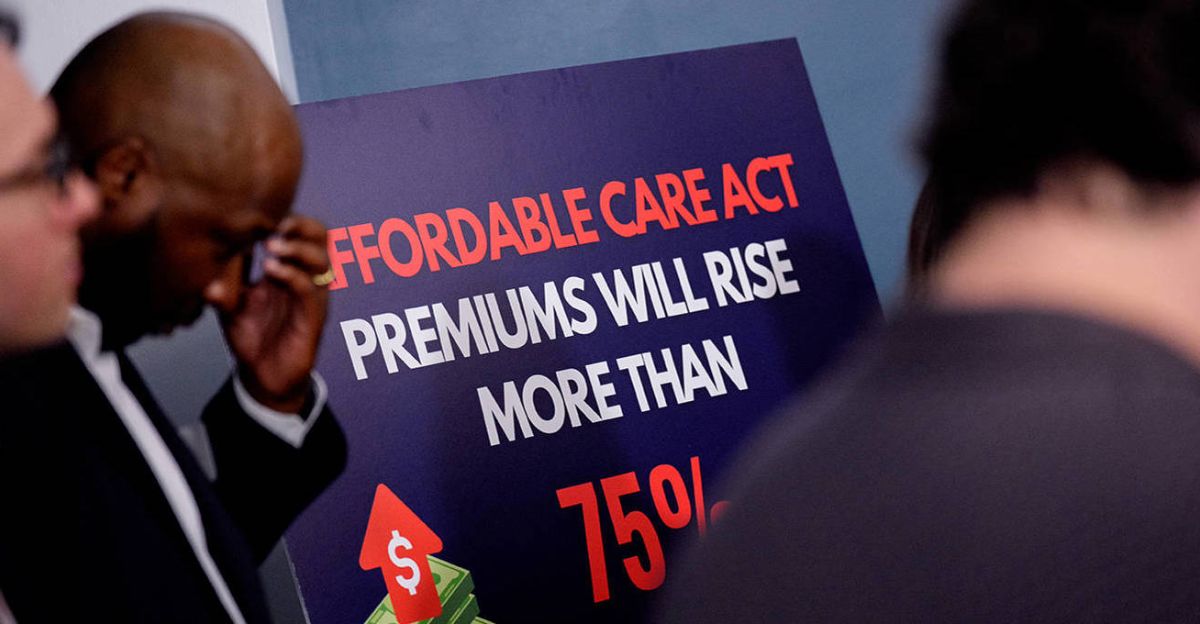

Open enrollment has begun amid the sharpest rise in Affordable Care Act premiums since the program’s inception. Rates for 2026 coverage are climbing 26% on average, and millions of Americans face losing vital subsidies that made health insurance affordable.

With Congress gridlocked and deadlines approaching fast, the clock is ticking for 22 million people who could see their costs double in a matter of weeks. Let’s see what’s driving this crisis.

What’s Going On?

ACA premiums are spiking nationwide, with average increases of 26% for 2026. Benchmark plans on Healthcare gov are up 30%, while state exchanges show 17% hikes. Unless Congress renews enhanced subsidies before year’s end, monthly payments for most enrollees will more than double.

The rise marks the steepest since 2018, and millions of Americans are now watching the calendar anxiously. But who exactly will feel the impact most?

Who Will Pay the Price?

About 22 million people enrolled in ACA plans currently receive enhanced subsidies that expire December 31. These families, small business owners, and self-employed workers will see their premiums more than double if Congress fails to extend the program.

Roughly 2 million higher-income enrollees already paying full price will still face the 26% base increase. But some age groups will feel it more sharply than others.

Older Adults Hit Hardest

Americans aged 50–64 make up a large share of ACA participants—about 5.4 million people. Early retirees not yet eligible for Medicare will face premium jumps of $10,000 to $14,000 in high-cost states.

As Justin Zimmerman, New Jersey’s insurance commissioner, warned on October 26, “Consumers will soon be confronted by startlingly higher prices for coverage.” And that’s before regional differences are factored in.

Where Premiums Are Soaring Most

Colorado and New Jersey are among the hardest-hit states. Colorado’s average increase is 101%, with 75,000 residents at risk of losing coverage. In New Jersey, premiums could spike up to 174%, wiping out subsidies for 60,000 people.

Other federal exchange states are also seeing steep hikes as insurers adjust for subsidy losses. Yet, for small business owners, the situation is even more precarious.

Small Business Strain

Around 4.2 million small business owners and self-employed workers rely on the ACA for health coverage. Without subsidies, many could face unaffordable premiums that undermine business stability.

These are entrepreneurs already operating in thin-margin environments. As costs rise, some may be forced to drop coverage altogether—raising broader questions about health security for America’s workforce.

Why It’s Happening

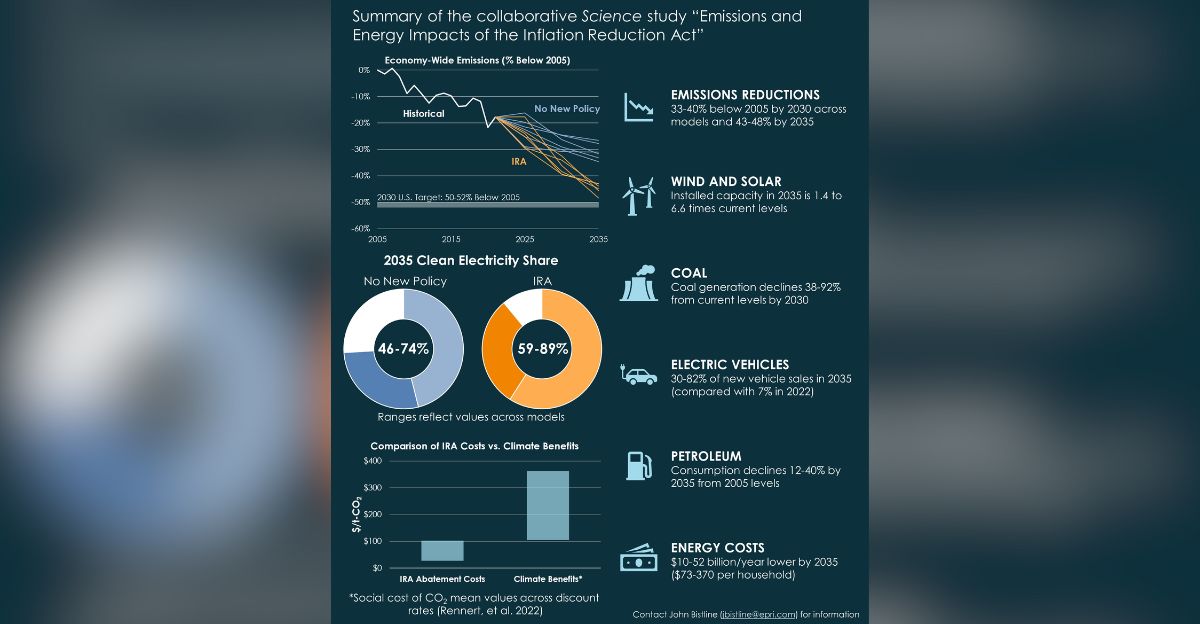

The surge traces directly to the expiration of enhanced subsidies introduced under the American Rescue Plan in 2021 and extended by the Inflation Reduction Act in 2022. These benefits capped premium costs and erased the so-called “subsidy cliff” for middle-income families.

With those provisions lapsing, millions are once again exposed to full market rates. But that’s not the only factor behind the increase.

Inflation and Health Costs Add Pressure

Hospital and drug prices continue climbing at record levels, while expensive new treatments strain insurers. Many regions also face reduced insurer competition, further driving up premiums.

According to HealthcareInsider on November 3, these pressures make 2026 a “perfect storm” for premium escalation. Still, political gridlock may prove the most immediate obstacle to relief.

Gridlock Freezes Congressional Action

A government shutdown that began October 1 has stalled budget talks and halted progress on renewing subsidies. Democrats support extending them, while Republicans call for budget cuts and stricter fraud oversight.

Without an agreement before December 31, subsidies expire automatically. That would trigger the full 114% premium surge projected for next year. What does that look like for families?

Real Costs for Real Families

A Denver family of four earning about $128,000 faces an annual premium increase exceeding $14,000 if subsidies lapse. Nationwide, the average subsidized enrollee would see monthly payments more than double.

For middle-class households already managing tight budgets, this change could erase health coverage entirely. But the story doesn’t end at the household level.

Ripple Effects on the Health System

Hospitals anticipate a wave of uncompensated care as more patients lose insurance. The Becker’s Payer Report on October 29 projected a $28 billion drop in hospital spending over the next decade.

That loss could deepen staffing shortages and burnout in already strained facilities. As coverage gaps widen, providers brace for what some call a “slow-motion collapse.”

Comparing to the 2018 Spike

The last major ACA premium surge came in 2018, when costs jumped 37% after cost-sharing subsidies were cut. But the 2026 increases are broader and potentially more damaging due to record enrollment.

This year’s 24.2 million marketplace participants far exceed 2018 levels—meaning more families stand to lose affordable coverage if Congress fails to act.

The Scale of Enrollment

ACA enrollment reached an all-time high in 2025, driven by pandemic-era policies and improved subsidies. Over 92% of enrollees—about 22.4 million people—currently receive some level of premium support.

Losing that aid would represent one of the largest affordability shocks in the program’s history. And the timing couldn’t be worse.

When the Changes Take Effect

Open enrollment for 2026 coverage began November 1, but the real test comes January 1, when new premiums take effect. If subsidies aren’t renewed by then, costs skyrocket overnight.

The deadline is fixed—no extensions or grace periods. Still, there’s growing debate over whether Congress can intervene in time.

The Political Standoff

Negotiations remain frozen as both parties tie ACA subsidies to larger budget demands. Democrats argue that extending the credits protects working families, while Republicans insist the cost—$350 billion over ten years—is unsustainable.

As Politico reported on November 4, the fight has become a symbol of deeper fiscal divisions. But those divisions carry human consequences.

Who Risks Losing Coverage

The Congressional Budget Office projects that 4.2 million more Americans will be uninsured by 2034 if subsidies lapse. Other analyses estimate total coverage losses approaching 14 million once Medicaid reductions are included.

That would reverse nearly a decade of ACA gains. Yet, for many small business owners and retirees, the fallout will come far sooner.

Impact on Work and Retirement

Half of all adults with ACA coverage under 65 either work for small businesses or are self-employed. Many early retirees also depend on these plans before qualifying for Medicare.

Premium spikes could force some back into the workforce or out of entrepreneurship altogether. But the damage may not be just financial.

Public Health at Risk

Uninsured Americans are less likely to seek preventive care or early treatment. That pattern could increase long-term healthcare costs and worsen chronic disease outcomes.

Experts warn this coverage shock could ripple into broader health crises over the next decade. Whether policymakers act in time may determine the scale of that impact.

A Looming Deadline

Unless Congress extends the subsidies before December 31, the largest premium hike in ACA history becomes reality on New Year’s Day. The outcome will shape not just affordability, but the very stability of the U.S. health insurance system.

The question now isn’t whether costs will rise—but how many Americans can still afford to stay covered.