UPS’s sweeping decision to cut 48,000 jobs—nearly 10% of its U.S. workforce—has sent shockwaves through the logistics sector. Announced as part of what CEO Carol Tomé described as “the most significant strategic transformation in our company’s history,” the layoffs mark a pivotal moment for the shipping giant. Behind the headlines of automation and stock surges lies a complex story of cost-cutting, operational overhaul, and far-reaching human impact.

Strategic Overhaul and Workforce Reductions

UPS’s restructuring, unveiled in late October 2025, was framed by CEO Carol Tomé as a necessary step to ensure long-term efficiency and value for stakeholders. The company’s pivot away from heavy reliance on Amazon, its largest customer, signaled a deliberate shift in operational strategy. Of the 48,000 jobs eliminated, 34,000 were operational roles—primarily drivers and warehouse staff—whose annual compensation ranged from $45,000 for part-time workers to $170,000 for full-time drivers. These cuts disproportionately affected union-represented employees, reflecting a targeted approach to reducing labor costs.

Management and corporate positions were not spared. UPS trimmed 14,000 administrative and mid-level management jobs, representing 30% of the total reductions. While automation and artificial intelligence played a role in these corporate cuts, the company’s approach blended technological investment with traditional cost discipline. Voluntary buyouts, offered to full-time drivers at a cost of $175 million, were accepted by 90% of eligible employees by the end of August 2025. However, many departures were effectively compelled by facility closures and restructuring, blurring the line between voluntary exits and layoffs.

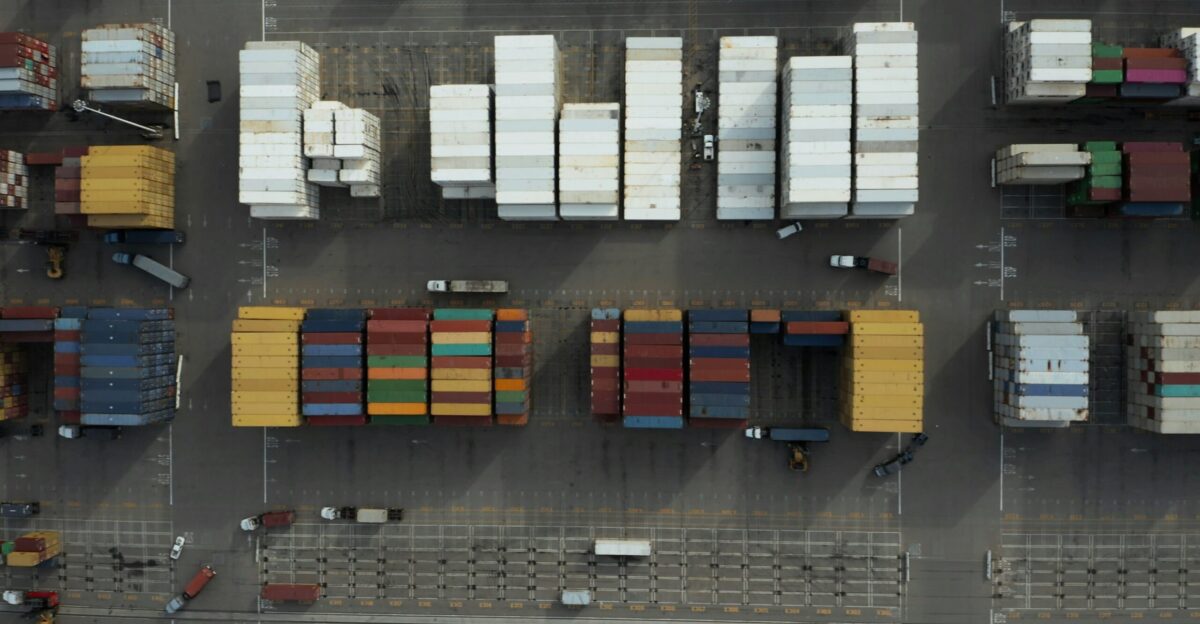

Facility Closures and Operational Consolidation

A key driver of the workforce reduction was the closure of 93 UPS facilities by September 2025, surpassing initial projections. This consolidation concentrated operations in fewer, more technologically advanced hubs, laying the groundwork for large-scale job cuts and reducing the company’s dependence on manual labor. The ripple effects extended beyond UPS’s own workforce, disrupting regional economies and affecting small businesses and logistics partners that relied on the company’s network.

The company’s deliberate reduction in Amazon package volume—expected to be halved by mid-2026—further decreased labor demand. In the third quarter of 2025 alone, UPS reported a 21.2% year-over-year drop in Amazon-related volumes. CEO Tomé emphasized that this was a proactive move by UPS to “take control of our destiny,” prioritizing higher-margin business over unprofitable volume.

Financial Discipline and Automation’s Measured Role

UPS reported $3.5 billion in year-over-year cost savings, achieved through a combination of workforce reductions, facility closures, seasonal hiring cuts, and automation. Payroll savings accounted for the majority of this figure, but the company clarified that the total reflected aggregate cost discipline rather than being solely attributable to job cuts. Contrary to some media narratives, most operational layoffs resulted from facility closures rather than direct replacement by automation or robotics. By the end of 2025, 400 facilities had deployed new automation systems, handling 66% of fourth-quarter package volumes. In the corporate sphere, artificial intelligence contributed to some of the 14,000 job reductions, but technology was not the primary driver of the overall restructuring.

Market Response and Industry Impact

Despite reporting lower net income ($1.3 billion) and revenue ($21.4 billion) compared to the previous year, UPS’s stock surged following the restructuring announcement. Investors rewarded the company’s financial discipline, with shares rising 7–9% in afternoon trading and up to 16% in premarket activity. The market’s reaction underscored a preference for cost-cutting and margin preservation over pure growth.

The effects of UPS’s transformation rippled across the logistics industry. Competitors such as DHL and FedEx responded with their own layoffs and rate adjustments. The closure of 93 UPS hubs disrupted supply chains for small businesses and regional partners, while consumers faced higher shipping costs due to a 5.9% rate increase and expanded surcharges. Amazon third-party sellers, in particular, passed these costs on to buyers, and service reliability became a concern in areas affected by facility closures.

Broader Implications and the Road Ahead

The scale of UPS’s restructuring has had significant consequences for local economies, especially in logistics hubs like Louisville, Memphis, Indianapolis, and Northern California. Municipal revenues and retail activity declined as thousands of workers lost income, affecting schools, healthcare, and community services. The layoffs also accelerated the adoption of automation across the industry, with warehouse roles facing increasing risk of replacement by robotic systems in the coming years.

UPS’s strategic pivot—combining voluntary buyouts, facility closures, reduced Amazon volume, and selective automation—delivered substantial savings and reassured investors. Yet, the human cost remains extensive, raising questions about the balance between operational efficiency and societal impact. As the logistics sector continues to evolve, the stakes for workers, communities, and industry partners remain high, with the future shaped by ongoing economic pressures and the relentless advance of technology.