Tariff collections have hit historic highs. In July 2025, the U.S. collected over $29 billion in tariffs – the largest monthly haul yet.

Treasury Secretary Bessent says he will revise the year’s estimate well above the original $300 billion projection, reflecting this windfall.

Officials note this inflow is the highest in decades, offering new leeway for fiscal policy. Bessent and President Trump now highlight this “meaningful” revenue stream as a budget tool, a shift from earlier talks of rebates or relief payments.

Fiscal Reality

America’s debt trajectory continues its sharp climb. In August 2025, the national debt topped $37 trillion, years ahead of pre-COVID forecasts.

Roughly $1.9 trillion was added in the past 12 months amid massive spending.

Consequently, interest costs are soaring: around $1 trillion in FY2025, making interest payments the federal budget’s second-largest outlay (surpassing defense and Medicare).

Social Security remains the only larger expense. These figures underscore the pressure driving policymakers to find new revenue sources.

Trade War Origins

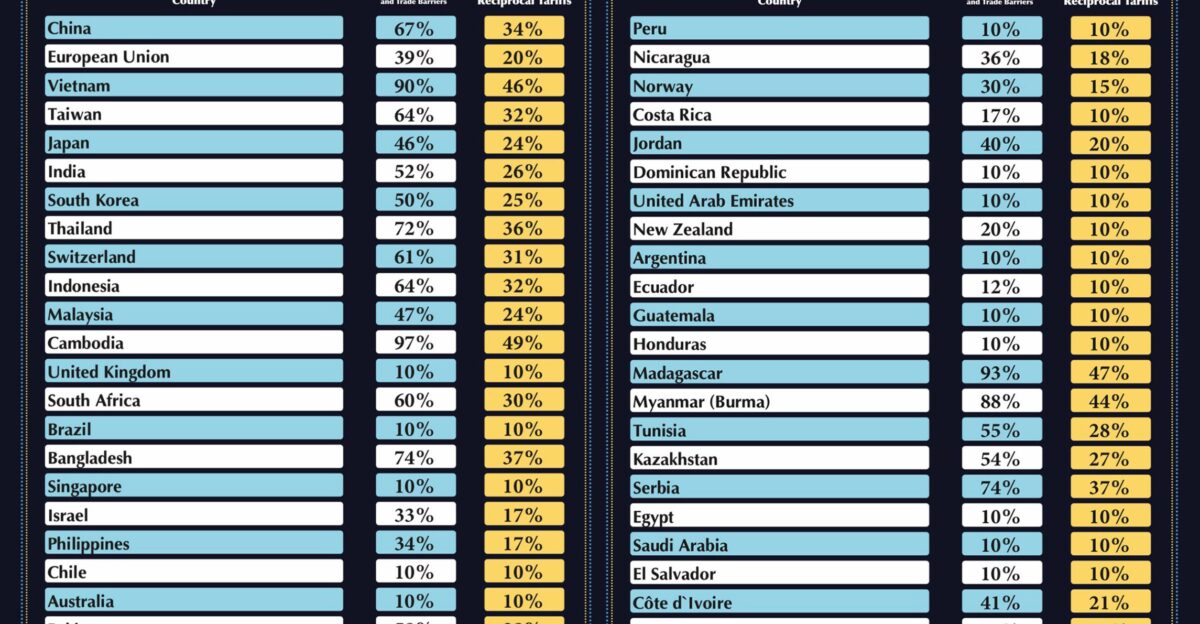

The modern tariff regime stems from Trump’s April 2, 2025, “Liberation Day” executive order.

It imposed a 10% baseline tariff on most imports, plus even higher “reciprocal” rates for trade partners with large deficits.

For example, China faces a 34% levy atop existing duties (temporarily trimmed to 10% in a May truce). This builds on prior Section 301 tariffs from 2018–19, which targeted roughly $550 billion in Chinese goods.

Analysts say this is the most sweeping U.S. tariff overhaul since the 1930s. The result: virtually all major imports now carry new duties, reshaping trade flows.

Economic Pressure

The tariff tit‐for‐tat has rattled markets. In April, the U.S. and China slapped sky-high duties on each other: China hiked tariffs on U.S. imports to an effective 84% range, while the U.S. boosted rates on Chinese goods toward 145%.

As a result, U.S. trade imbalances swung wildly.

The goods deficit hit a record $163.5 billion in March (per BEA), then narrowed to ~$85.9 billion by June as imports fell.

Firms raced to front-load shipments ahead of hikes: industry surveys note an “extraordinary burst of frontloading” in early Q2 as companies stockpiled inventory. This created volatility across supply chains and regions.

Debt Directive

On August 19, 2025, Bessent declared that the tariff bonanza will be used to reduce the federal debt instead of financing rebate checks.

He told CNBC that both he and President Trump are “laser-focused on paying down the debt”.

Indeed, Customs data showed more than $100 billion in tariff revenue from April through July, with July alone at ~$29 billion.

Bessent said this windfall “generally [offsets] weaker fiscal outcomes” from recent tax-and-spending legislation. This marks a clear break from earlier talk of giving consumers a chunk of the revenues. Instead, the White House aims the tariff proceeds at shrinking the deficits.

Regional Impact

Tariffs are reshaping the geography of gains and pains. Customs duties surged in 2025: roughly $17–$18 billion in April, leaping to $29.6 billion by July. Most of these funds flow through port-heavy states.

California, New York and Texas – home to major shipping hubs – have seen outsized revenue inflows from customs duties.

In turn, those regions benefit from the tariffs: jobs and investment in manufacturing and logistics have ticked up where goods are handled. However, consumers have felt higher costs.

Goods tied to imports, from electronics to auto parts, have become pricier nationwide. State officials and economists note that import-dependent areas (including some agricultural and retail regions) now face headwinds. Overall, the tariff strategy has boosted investment in factory areas, even as it pushes up living costs elsewhere.

Business Response

President Trump briefly floated rebates for Americans, saying in late July: “We have so much money coming in. We’re thinking about a little rebate”.

Prompted by that, Senator Josh Hawley introduced the American Worker Rebate Act, proposing $600 checks per adult (and child) funded by tariff proceeds.

Hawley argued that “Americans deserve a tax rebate… my legislation would allow hard-working Americans to benefit from the wealth that Trump’s tariffs are returning”. But most business leaders have been cautious.

The U.S. Chamber of Commerce warns that unprecedented tariffs will raise prices for consumers: “price increases that will inevitably follow these unprecedented tariff levels” will hike living costs.

Corporate Adaptation

Companies are scrambling to adapt. Many multinationals are retooling supply chains to avoid tariffs: electronics firms are shifting production or stockpiling parts, while apparel manufacturers seek new sourcing countries.

Retailers report a build-up of inventory ahead of looming rate hikes. Shipping lines have added surcharges, and ports are handling surges in containers (one survey notes import volumes jumped ~18% in July vs June).

Even the aerospace industry has reacted: GE Aerospace CEO Larry Culp said he pressed the White House to exempt aircraft parts from the trade war, noting a zero-duty regime once enabled a $75 billion annual surplus for U.S. aerospace.

Global Implications

Internationally, the trade war’s ramifications are profound.

The nonpartisan Congressional Budget Office estimated that these tariffs could shrink the deficit by about $2.8 trillion over the next decade, thanks to the revenue, and only slightly lift inflation (roughly 0.4 percentage points in 2025-26).

But the higher duties are already rerouting trade flows. New supply chains in Asia and Latin America are emerging as firms sidestep heavy U.S. import tariffs.

Meanwhile, global institutions warn of danger: WTO Director-General Okonjo-Iweala cautioned that tit-for-tat duties could cut bilateral trade by “as much as 80%”. She also warned of a split into opposing economic blocs, which could shave 7% off global GDP.

Credit Boost

In a historic first, rating agencies have already factored tariffs into sovereign credit. On August 18, S&P Global affirmed the U.S.’s AA+ rating, explicitly citing tariff proceeds as a fiscal offset.

The agency noted that the surge in import taxes could “generally offset weaker fiscal outcomes” in the recent $4.1 trillion budget legislation.

It said that “meaningful tariff revenue has the potential to offset the deficit-raising aspects” of current spending. Wall Street analysts agreed this was unprecedented. D.A.

Davidson’s James Ragan commented that the high tariffs are indeed “all good revenue (coming) in, but that’s also a drag on the economy, so…we don’t know the impact…going forward”.

Congressional Tension

The tariff windfall has roiled GOP ranks. Some conservative senators (like James Lankford and Ron Johnson) have insisted that any new revenue go to debt reduction, not giveaways.

By contrast, populist Republicans (led by Hawley and a few House allies) have pressed for immediate cash rebates.

This split mirrors broader debates. Even within Trump’s party, fiscal hawks argue against siphoning off tens of billions for short-term relief. The American Worker Rebate Act faces long odds in this climate.

Rank-and-file Republicans privately acknowledge the optics of debt paydown are solid, but they worry about alienating voters who were promised a piece of the tariff bounty.

Leadership Focus

Treasury Secretary Bessent has become the administration’s point man on trade policy. A former hedge-fund manager, he frequently appears on financial news shows to defend the strategy.

Bessent emphasizes the long-term calculus: as a market veteran, he notes that tariff revenue could climb even higher – on the order of $40–50 billion per month if rates stay elevated (implying nearly $500–600 billion annually).

His Wall Street background lends weight to the debt-reduction arguments.

Bessent’s clear message is that the real payoff comes from fiscal strength: he has called the tariff windfall a tool to “bring down the deficit-to-GDP”, underscoring his focus on the big picture beyond short-term checks.

Strategic Pivot

The White House’s trade narrative has quietly shifted. Early on, administration spokesmen promised “90 deals in 90 days” to replace tariffs with reciprocal agreements. In practice, that rapid round of accords never materialized.

Instead, by mid-2025 officials were effectively accepting that most countries will simply pay the designated rates.

Even so, limited deals are being made at the edges – for example, Trump announced a July agreement with Indonesia cutting its tariff rate to 19% (down from 32%) as part of a trade package.

Similarly, negotiations with China have yielded temporary truces and partial rollbacks, but no sweeping new framework. In effect, policy has pivoted away from grand bargains toward extracting revenue where possible.

Market Skepticism

Not all experts are convinced the high-rate strategy can last. Many economists warn that excessively steep tariffs may backfire by suppressing imports so that revenue falls.

In particular, analysts at the Tax Foundation have noted that duties as high as 125% on Chinese goods could choke off trade flows, undermining the intended yield.

Other forecasters project more modest outcomes – believing firms will restructure or pass costs to consumers to keep trade moving. Investors and analysts are watching closely: if import volumes collapse, the $2–3 trillion revenue windfall might never materialize.

For now, markets have taken heart in the credit upgrade (slide 10), but uncertainties remain about consumer behavior and inflation.

Future Questions

Key unknowns loom. Will soaring tariff rates eventually throttle trade enough to curtail revenues? If import volumes drop sharply, the projections underpinning this strategy could be jeopardized.

At home, political tolerance for higher prices is fragile: consumer groups and Democrats warn that sustained inflation will become a liability.

The 2026 midterms will effectively become a referendum on these policies – forcing lawmakers to weigh the debt payoff against any economic drag.

Internationally, legal challenges over presidential tariff powers (through IEEPA) continue to wind through the courts, and allied nations are ratcheting up pressure for negotiation.

Political Calculations

Choosing debt reduction over instant relief was a carefully timed political choice. By announcing the debt focus immediately after S&P’s credit call (slide 10), the administration framed it as a prudent fiscal move, not a payout denial.

Fiscal conservatives applaud the approach, but Trump’s populist base is mixed.

Some supporters are bristling that the promised “American Worker” checks may never come, even as interest groups emphasize the safety of holding debt. Capitol Hill Republicans feel the crunch: publicly, they praise borrowing less, but privately, some fear losing votes.

Meanwhile, Democrats and many economists criticize the trade policy’s hit on working families. In effect, the debate has split along familiar lines: conservative debt hawks and centrists versus grass-roots populists and moderate Democrats worried about pocketbook politics.

International Reactions

The global backlash is significant. On April 10, 2025, both governments had tariffs of over 100% on each other’s goods, effectively a “mirror” trade war.

Major U.S. allies in Europe have voiced skepticism – even as the EU briefly stood down its own proposed counter-tariffs for negotiations. Developing countries that initially got exemptions (e.g. some ASEAN nations) are now seeking either similar treatment or the chance to negotiate deals.

The WTO Director-General warned that this spiral risks splitting the world economy. Okonjo-Iweala cautioned that U.S.-China trade could fall by 80%, and warned against fracturing global markets into rival blocs.

Many fear a retreat from decades of trade integration, as geopolitical lines harden under the weight of tariffs.

Legal Challenges

The tariff policy’s legality is under fire. Opponents have sued, arguing that the International Emergency Economic Powers Act (IEEPA) doesn’t authorize sweeping trade duties.

Federal courts have issued mixed rulings: some judges have enjoined parts of the tariff regime while litigation proceeds (for example, blocking new tariffs on certain countries). Others have allowed higher duties to remain temporarily.

The matter is headed toward the Supreme Court for a final decision on presidential trade authority.

If courts curtail IEEPA’s reach, it could imperil the revenue stream and force a legislative fix. Thus, legal uncertainty casts a shadow over how durable and enforceable the new tariff regime will be.

Cultural Shift

These tariffs have transformed the political conversation on trade. Traditional free-market Republicans have embraced protectionism, while some Democrats express genuine concern about the cost burden on consumers and low-income families.

Among voters, reactions are mixed: younger Americans and swing voters who want “Made in America” jobs may support tariffs, but many also worry about rising living costs.

Commentators note that the language around trade has shifted – talk of globalization and multilateralism has largely given way to an economic nationalism that prizes debt reduction and U.S. production.

This debate reflects a broader move away from the post-Cold War consensus: both parties are now reassessing long-held assumptions about free trade in light of modern geopolitical and fiscal challenges.

Historical Pivot

Treasury’s debt-first strategy harks back to the vision of Alexander Hamilton, who used tariffs as a nation-building revenue source in the 1790s. It also recalls the 1930s, when tariffs became central to economic policy debates.

Today’s moment is similarly pivotal: as Hamilton noted, import duties can finance governments and protect industry, but must be managed carefully.

Whether the tariff windfall can meaningfully dent a $37+ trillion debt remains to be seen. If successful, it would represent a dramatic test of tariffs as fiscal medicine; if not, it would underscore the limits of trade policy as a cure for larger budgetary challenges.

The outcome will likely shape U.S. trade policy (and its politics) for years to come.