The air buzzes with tension as GM’s senior executives stand in a conference room, watching a video of their supply chain crumbling. Thousands of suppliers scramble to eliminate China from their operations by 2027—an order so bold it could reshape the entire automotive industry. In the coming months, hundreds of contracts are at risk, with countless parts and materials at stake.

GM’s directive is clear: cut ties with China. But can this sweeping change truly happen in just two years?

Why GM is Making the Change

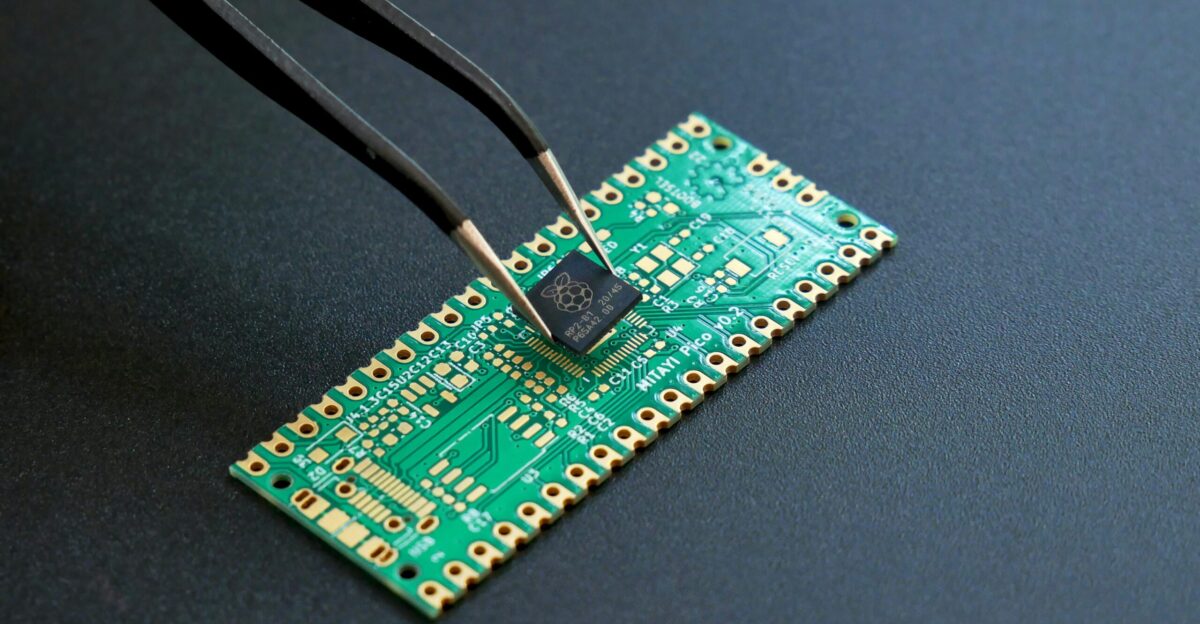

The U.S.-China trade war has triggered a reevaluation of global supply chains, and GM is at the forefront of this change. China dominates rare earth material production and semiconductors, vital components for modern vehicles.

The recent export restrictions on critical materials by China have escalated supply chain risks, prompting GM’s dramatic response to secure its future manufacturing needs.

Immediate Disruptions to the Supply Chain

As GM works to meet its 2027 deadline, thousands of suppliers are scrambling to identify non-China alternatives. The supply chain that has been developed over the past 30 years faces disruption, particularly in the areas of microchips and rare earth materials.

The short two-year timeframe presents a monumental challenge, and many industry experts are questioning whether this can be realistically achieved.

China’s Rare Earth Monopoly

China controls the lion’s share of global rare earth production, which is essential for electric vehicle motors, smartphones, and other technologies. In the automotive sector alone, each electric vehicle requires 1-2 kilograms of rare earth magnets.

With over 11.5 million new energy vehicles produced annually, the global reliance on Chinese rare earths is staggering, and GM’s move could reshape the supply landscape.

Production Shutdowns: The Risks of Disruption

GM’s directive comes with significant risks. If the supply chain is not quickly redirected, production could be halted.

For instance, recent disruptions due to China’s temporary ban on Nexperia chips highlighted just how vulnerable the automotive sector is to Chinese export policies. A similar situation could trigger widespread factory shutdowns and severely impact U.S. car production.

The Impact on Vehicle Manufacturing

Critical vehicle components like electric motors, anti-lock braking systems, and windshield wipers are also at risk due to shortages in rare earth magnets and other materials sourced from China.

The ripple effect could force manufacturers to halt production lines, causing delays and potential shutdowns of plants across the U.S.

The Rising Cost of Vehicles

As GM accelerates its efforts to shift away from China, vehicle prices are expected to rise.

The cost of securing alternative sources for parts, along with the tariffs GM has already incurred, will likely increase vehicle prices significantly. Some analysts suggest that without adequate sourcing alternatives, cars could cost up to $10,000 more.

The Strain on Global Markets

The global demand for non-China parts is intensifying as other automakers try to secure alternative sources.

The scramble for rare earth materials and semiconductors is already causing price increases. Suppliers are facing heightened competition, leading to price volatility and putting pressure on the entire automotive industry.

Suppliers Under Pressure

The clock is ticking for GM’s suppliers to adapt to new sourcing requirements. Industry leaders are voicing concerns that restructuring a supply chain built over decades in just two years is unrealistic.

Small to mid-sized suppliers, heavily reliant on China, are particularly vulnerable to the risks posed by GM’s directive.

The Labor Market: U.S. Auto Jobs at Risk

The ongoing supply chain disruptions could put hundreds of thousands of U.S. auto jobs at risk. As manufacturers face supply shortages, potential layoffs could follow, particularly among factory workers.

This is compounded by a skills gap in the automotive industry, with thousands of technician jobs left unfilled due to insufficient training programs.

The Challenge of Reshoring Production

Efforts to reshore production to the U.S. face significant labor shortages. The country currently lacks enough skilled workers to execute a rapid reshoring of the automotive supply chain.

This shortage is compounded by the absence of a robust pipeline for training the next generation of automotive technicians.

GM’s U.S. Sourcing Strategy

GM is taking steps to mitigate these risks by ramping up domestic sourcing efforts. The company has invested $4 billion into U.S. mining projects for rare earth elements and critical materials.

While these efforts are promising, industry experts caution that these initiatives will take time to scale up to meet GM’s needs.

Political Support for Reshoring

In response to GM’s actions, U.S. lawmakers are offering subsidies and incentives to encourage reshoring critical supply chains.

Bipartisan support for reducing reliance on China has led to increased calls for investments in domestic mining and manufacturing, particularly for semiconductors and rare earth elements.

Consumer Impacts: Price Increases and Delays

Consumers can expect to face higher vehicle prices and longer wait times if GM is unable to secure non-China sources in time.

As production timelines stretch, some models may become harder to find. Buyers might also choose to hold onto older vehicles longer, contributing to a potential slowdown in new car sales.

Technological Innovation: Seeking Alternatives

The automotive industry is investing heavily in innovation to overcome its reliance on China. Efforts are underway to develop alternative materials and technologies, such as new electric motor designs and increased recycling of critical materials.

However, many of these solutions are still in their infancy and are years away from large-scale deployment.

Global Implications: A Domino Effect

The ripple effects of GM’s China exit could extend beyond the automotive industry. Other sectors, including electronics, defense, and renewable energy, also rely on Chinese rare earths and semiconductors.

As the global supply chain adjusts to these disruptions, price volatility and shortages may affect industries worldwide.

Inflationary Pressures

The shortage of critical materials and the rising cost of rare earths, semiconductors, and lithium are likely to push inflation higher in industries like automotive, electronics, and industrial manufacturing.

Central banks will be watching closely as these supply chain challenges create upward pressure on prices.

Winners and Losers

In the wake of GM’s supply chain shift, some companies stand to benefit, including U.S. rare-earth miners, domestic chipmakers, and alternative materials firms.

On the other hand, China-linked suppliers, traditional automakers, and factory workers vulnerable to layoffs could suffer as the industry undergoes a significant transition.

Consumer Advice: Act Quickly

For consumers considering new vehicle purchases, acting sooner rather than later may be wise.

Prices are likely to rise, and availability could be affected as the automotive industry works to secure non-China alternatives. Buyers might also want to plan for longer delivery times as the supply chain rewiring continues.

The Road Ahead: Strategic Implications

GM’s 2027 deadline marks a monumental shift in globalization strategy for the automotive industry.

As the company moves away from decades of “just-in-time” global sourcing toward decoupling and reshoring, it could reshape manufacturing strategies, geopolitical relations, and the global economy for years to come.