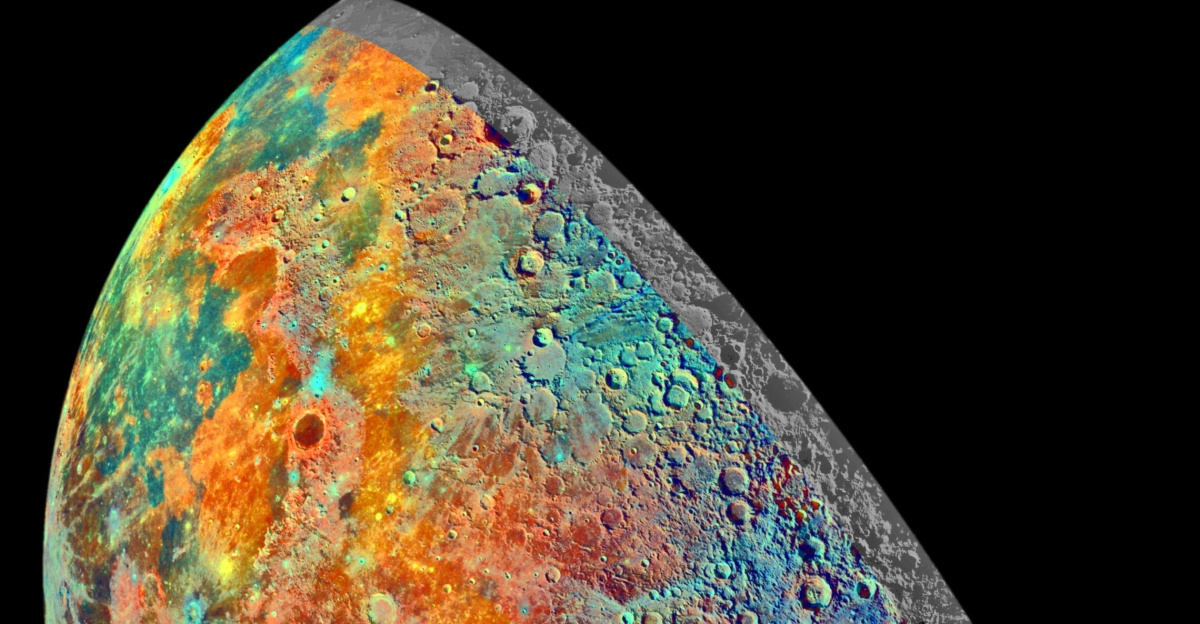

In April 2024, India’s ISRO announced that the Moon harbors far more exploitable water ice than previously known. Using Chandrayaan-2 radar data, scientists discovered subsurface ice deposits five to eight times larger than surface ice, located at depths of two meters, which is shallow enough to drill with existing technology.

This finding transforms lunar colonization from a speculative endeavor into an engineering problem-solving challenge. Humanity’s long-held dream of permanent lunar bases shifted from “if” to “when.” Implications rippled instantly across space agencies, private companies, and financial markets worldwide.

Why Now? The Five-Year Data Accumulation

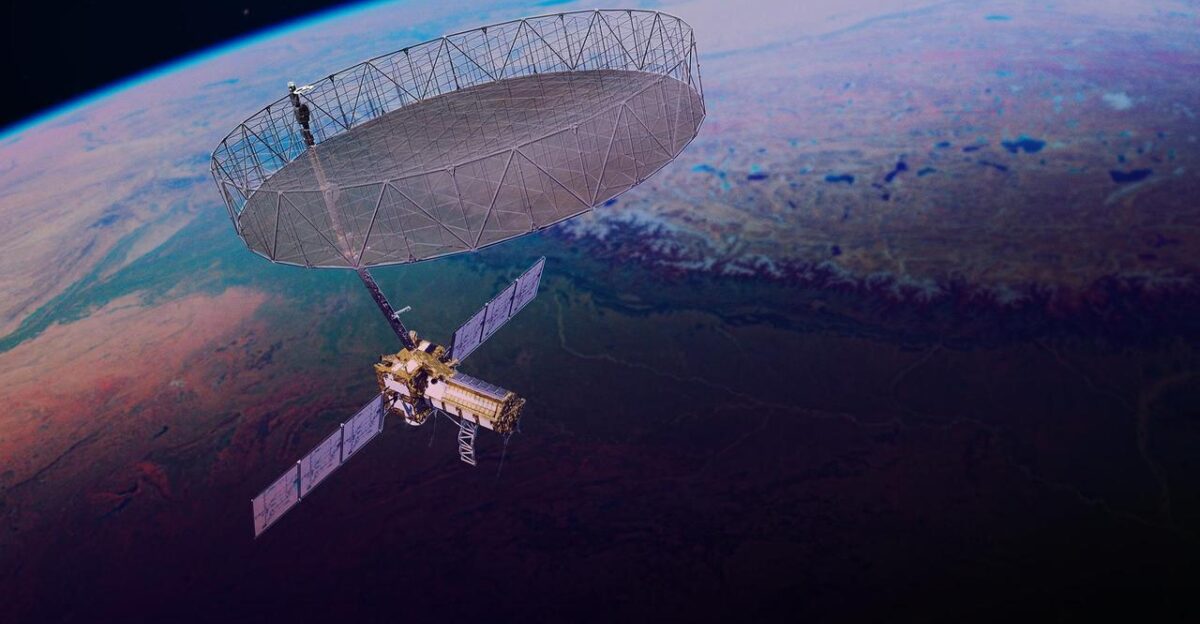

ISRO’s Space Applications Centre, collaborating with NASA’s JPL, IIT Kanpur, and USC, analyzed nearly 1,400 radar datasets collected over five years by Chandrayaan-2’s Dual Frequency Synthetic Aperture Radar (DFSAR). This unprecedented 25-meter-resolution mapping revealed subsurface patterns invisible to earlier missions.

Scientists traced the origins of ice to ancient volcanic outgassing 3.85–3.2 billion years ago, which deposited primordial water ice in permanently shadowed polar craters, where it remained untouched for eons. Accumulated data transformed theoretical models into concrete evidence.

The Polar Asymmetry Puzzle: Why North Holds Twice the Ice

The Moon’s northern polar region contains twice the water ice extent of the southern region, contradicting decades of assumptions that the two areas are symmetric. Scientists attribute this to localized volcanic patterns and crater geometry favoring northern ice preservation. This fundamentally reshaped mission planning.

NASA’s Artemis program, which aims to target the South Pole by 2026, has faced strategic recalculations. Future lunar bases will likely cluster near the north pole, requiring engineers to redesign landing sites, habitats, and extraction infrastructure. The discovery transformed assumptions into a reality of asymmetry.

NASA’s Role: Collaboration vs. Attribution

While ISRO’s Space Applications Centre led the investigation and authored the peer-reviewed publication, NASA’s Jet Propulsion Laboratory collaborated directly, providing crucial Lunar Reconnaissance Orbiter (LRO) data that integrated seven instruments: radar, laser, optical, neutron spectrometer, UV spectrometer, thermal radiometer, and sensors.

The headline attribution to “NASA” reflects this genuine partnership. NASA Administrator Jim Bridenstine previously called lunar water discoveries “a game changer” in 2019, but that statement referenced data from the 2009 LCROSS mission, creating temporal confusion in media narratives.

The “Billions of Tons” Claim: Historical Context

NASA’s estimate of “hundreds of billions of tons” was based on 2009 LCROSS impact data and subsequent modeling, not the 2024 ISRO study. The ISRO research quantified subsurface ice as 5–8 times surface deposits but provided no total tonnage estimate.

Combining ISRO’s concentration findings with NASA’s historical volume estimates suggests potential reserves exceed 100 million to 1 billion metric tons per pole, supporting decades-long human habitation and fuel production. Different studies, employing various methodologies, yield different conclusions, yet all point toward the existence of accessible lunar water.

Immediate Impact: Lunar Mission Redesign

Within weeks, space agencies worldwide revised mission architectures. NASA’s Artemis program immediately incorporated water extraction scouting into its objectives. China’s Chang’e program announced accelerated missions targeting the north pole’s water-rich craters.

India is committed to the Chandrayaan-3 missions, incorporating new drilling and sampling objectives for subsurface ice collection. ESA and SpaceX have launched feasibility studies on extracting and processing lunar ice for use as propellant and in life support systems. Converting frozen water into hydrogen and oxygen fuel on-site, known as in-situ resource utilization, transforms spacecraft economics. Theory became operational.

Private Space Industry Awakens

Moon Express, Axiom Space, and iSpace immediately announced partnerships to develop ice-extraction equipment and in-situ resource utilization (ISRU) systems. SpaceX publicly committed to incorporating water-harvesting modules into Starship lunar lander designs. Within Q2 2024, venture capital inflows to lunar technology startups surged 40%.

One venture capitalist told reporters, “This changes the unit economics entirely.” For entrepreneurs, ISRO’s discovery provided proof that lunar resources existed in sufficient quantity and accessibility to justify billion-dollar investments in infrastructure.

Geopolitical Implications: The New Space Race

The discovery intensified great-power competition for lunar resources. China accelerated Chang’e-6 and -7 missions targeting the south pole’s water-rich regions. India announced follow-up Chandrayaan missions. Russia and the EU expressed renewed commitment to lunar exploration.

The UN Office for Outer Space Affairs faced urgent calls for clarified water-rights frameworks. Nations staked territorial claims not explicitly (banned by the 1967 Outer Space Treaty) but through concentrated missions to resource-rich poles, creating a de facto presence. Whoever extracted water first gained a technological advantage and, de facto, a territorial influence.

Policy & Regulation: Who Owns Moon Water?

The discovery forced urgent policy debates. The 1967 Outer Space Treaty prohibits national appropriation but permits the extraction of resources for peaceful purposes, including domestic use. Critical questions remained: Can commercial companies own extracted water? Who regulates drilling rights? The Artemis Accords, signed by 36 nations, were intended to establish frameworks for exploitation; however, China and Russia refused to join.

By mid-2024, the UN had drafted guidelines for space resources, with nations divided on whether lunar water constitutes a “common heritage of mankind” or an open-access resource. The answer determines trillions in future value.

Economic Ripple: Launch Costs Transform

Currently, launching water from Earth costs between $10,000 and $15,000 per kilogram. On-site lunar production, accounting for extraction, processing, liquefaction, and transportation, could reduce the delivered cost to $100–$500 per kilogram. This 20–100-fold advantage makes orbital fuel depots economically viable for Mars missions for the first time.

Aerospace companies have budgeted for orbital refueling infrastructure, a multibillion-dollar market shift that threatens traditional launch monopolies. One analyst commented, “This fundamentally rewrites space economics.” Established providers faced margin compression, while infrastructure companies saw their valuations soar. Cost advantage became existential to business models.

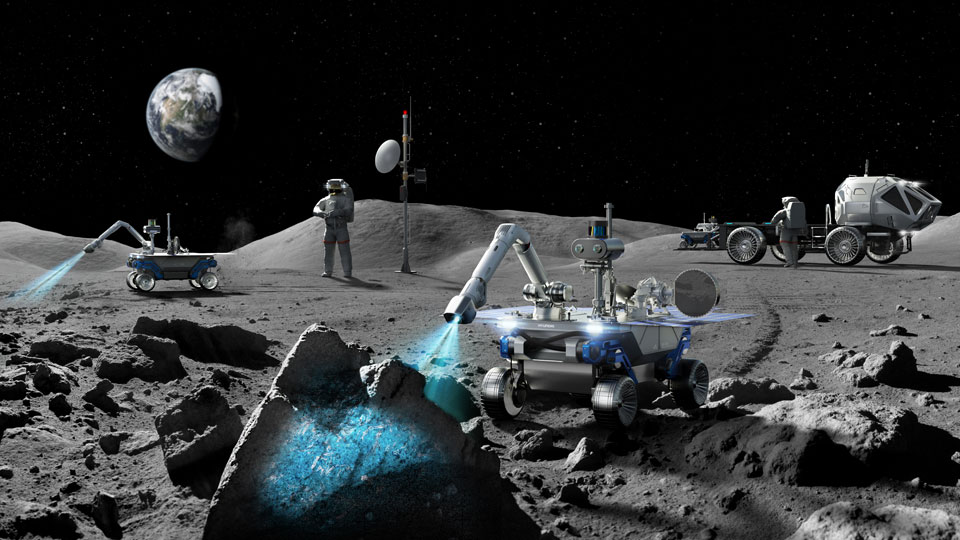

Industry Response: New Equipment Frontiers

Roboticists and mining-equipment manufacturers pivoted toward lunar drills and water-processing concepts. Caterpillar, Epiroc, and specialized firms designed radiation-hardened, vacuum-rated drilling rigs for lunar conditions. Water-extraction companies studied sublimation and regolith-heating techniques.

3D-printing firms explored constructing water-storage tanks from lunar regolith. Equipment manufacturers faced 5–10 year development timelines with uncertain ROI, yet venture-backed startups attracted over $200 million in funding. Engineers specializing in Earth mining suddenly designed equipment for an alien environment where pressure, temperature, radiation, and vacuum required fundamental rethinking.

Defense Implications: Strategic Asset Recognition

Military strategists worldwide classified lunar water as critical infrastructure. The U.S. Space Force integrated lunar resource mapping into space dominance doctrine. China’s military acknowledged the strategic significance of water-secured bases. Russia positioned itself as a “neutral” supplier of advanced drilling technology.

Nations classified aspects of lunar exploration as sensitive security matters, restricting information sharing on ice deposits and drilling capabilities. Space-based military concepts, such as fuel depots, power stations, and forward operating bases, have moved from science fiction into official DoD planning documents, incorporating realistic resource assumptions. Water became a weapon system.

Environmental & Planetary Science Impact

The discovery reinvigorated planetary science funding while sparking concerns about conservation. Universities proposed new lunar research programs focused on water extraction and geological mapping. Mars mission planners incorporated lunar water into trajectory optimization.

However, scientists warned that extracting subsurface ice risks destroying pristine geological records that are 3 billion years old or more, a scientifically irreplaceable solar system archive. Conservation advocates called for designated “lunar preserves” protecting valuable craters from mining. ESA proposed “polar research zones” separating commercial extraction from protected scientific study. Environmental ethics extended beyond Earth for the first time.

Consumer Impact: Future Space Tourism Roadmap

Tourism firms marketed lunar base vacations as realistic near-term experiences. Axiom Space announced that pressurized lunar habitats with water-derived oxygen and hydrogen amenities will be operational by 2030. Companies projected $1–5 million lunar stay costs as expensive but achievable for ultra-high-net-worth individuals.

Media coverage shifted from “impossible dream” to “future adventure reservation now available.” Consumer space-related investments surged, with space tourism stocks rising 30–50%. Realistic timelines remain 10–20 years away, tempering immediate expectations while planting aspirational narratives driving retail investment. The Moon suddenly felt accessible.

Climate & Sustainability Narratives Shift

Climate advocates seized on lunar water as validation of space-based climate solutions. Some proposed cosmic-scale solar panels and asteroid mining as alternatives to terrestrial decarbonization. Others cautioned that space optimism distracted from the urgent need for climate action on Earth.

Environmental groups split: pragmatists welcomed the reduced launch cost benefits for Earth-orbit climate monitoring, while purists opposed resource exploitation beyond Earth. One Sierra Club analyst remarked, “We should solve Earth’s problems before mining the Moon.” The discovery deepened philosophical tension between “fix Earth first” and “expand humanity’s resource base,” a cultural debate with educational, political, and investment implications.

Unexpected Winners: Lunar Tech Startups & Niche Sectors

Companies positioned for lunar infrastructure, including vacuum-sealing technology, radiation-hardened electronics, regolith simulants, and ice-detection sensors, experienced stock surges and funding explosions. Smaller aerospace contractors won government awards. Traditional Earth-launch monopolies faced margin pressure as customers deferred launches pending the viability of orbital refueling.

Remote-sensing companies profited from demand for detailed polar mapping. Luxembourg, the UAE, and smaller nations with space ambitions experienced a surge in economic interest. Luxembourg’s space-tech industry saw a 15% increase in valuations during 2024. Smaller nations discovered a niche: lunar operations support infrastructure could serve as a cornerstone for economic development strategies.

Financial Markets React: Space Stocks Surge

Wall Street responded with exuberance. Aerospace ETFs surged 12–18% following the ISRO announcement. SpaceX, Blue Origin, and Axiom Space valuations jumped. Boeing and Lockheed Martin gained on Artemis contract expectations. Traditional telecommunications satellite operators and Earth-launch providers faced pressure on their valuations.

Investors debated whether gains from the space economy offset the risks of regulatory delays, technology failures, and geopolitical disruptions. By mid-2025, space-focused investment funds managed over $40 billion, triple the 2023 levels. One Bloomberg commentator observed, “This sector attracts capital based on hope more than proven returns.” Markets moved faster than fundamentals.

Consumer Takeaways: What Lunar Water Means for You

Most consumers won’t reach the Moon, but benefits trickle down through interconnected systems. Reduced satellite launch costs improve global broadband and weather monitoring. Space-based solar power becomes feasible if the expenses of orbital refueling drop dramatically. Technological spillovers advance terrestrial industries in materials, robotics, and sensors.

Investment-cautious consumers should expect space-sector volatility. For enthusiasts, lunar water lends credibility to long-term human expansion through engineering. Support STEM education, monitor space-tech stocks cautiously, and recognize that this discovery justifies the half-century investment in unmanned probes that forms the foundation for future crewed missions.

The Larger Context: From Speculation to Infrastructure

Five years ago, lunar water was scientifically confirmed but economically distant. Today it’s mapped with precision, quantified with confidence, and economically relevant to mission planning. The ISRO/NASA collaboration demonstrated how international science transcends political divides. Japanese instruments, ESA expertise, and data from private firms contributed to the synthesis. Yet the discovery triggered territorial anxieties and regulatory chaos.

The next decade will determine whether lunar resources become a global commons, commercial commodities, or geopolitical prizes. Precedents set now through policy decisions, technology priorities, and corporate positioning will shape decades of space activity, influencing Mars missions and humanity’s footprint beyond Earth.

Synthesis: One Discovery, Infinite Ripples

The April 2024 ISRO discovery transformed space exploration from aspiration to reality through engineering. Immediate ripples cascaded: mission redesigns, commercial pivots, geopolitical maneuvering, regulatory scrambles, and financial speculation. More profound ripples penetrated climate discourse, national security doctrine, industrial priorities, and cultural imagination. Winners emerged among lunar-tech startups; losers faced margin compression.

Financial markets boomed. Consumers gained insight into realistic pathways for accessing space resources and infrastructure. The discovery validates half a century of planetary science investment, signaling that human expansion beyond Earth is transitioning from aspiration to logistics. The next 20 years will determine whether lunar water becomes humanity’s stepping stone to Mars or a geopolitical flashpoint.