A seismic shift is underway in the global iron ore market, with a massive new mine in Guinea preparing to challenge Australia’s Pilbara dominance. This $23 billion venture, called Simandou, holds the world’s largest untapped deposit of iron ore—at least 3 billion tons of high-quality ore. The project, a monumental 27-year-long development, is set to export its first cargo by the end of 2025.

This game-changing mine could forever alter global supply dynamics, especially as China—already the largest consumer of seaborne iron ore—takes control of a significant portion.

Price Collapse Looms

Iron ore prices have already dropped sharply from their 2021 peak of $200 per ton to just over $100 in November 2025. With the influx of new supplies from Simandou, prices are expected to decline even further. Mining giants like BHP, Rio Tinto, and Vale are preparing for a potential drop to $85 per ton by 2028.

This downturn is largely driven by weakening demand from China’s steel sector, coupled with the vast increase in iron ore supply from Guinea.

Colonial Roots

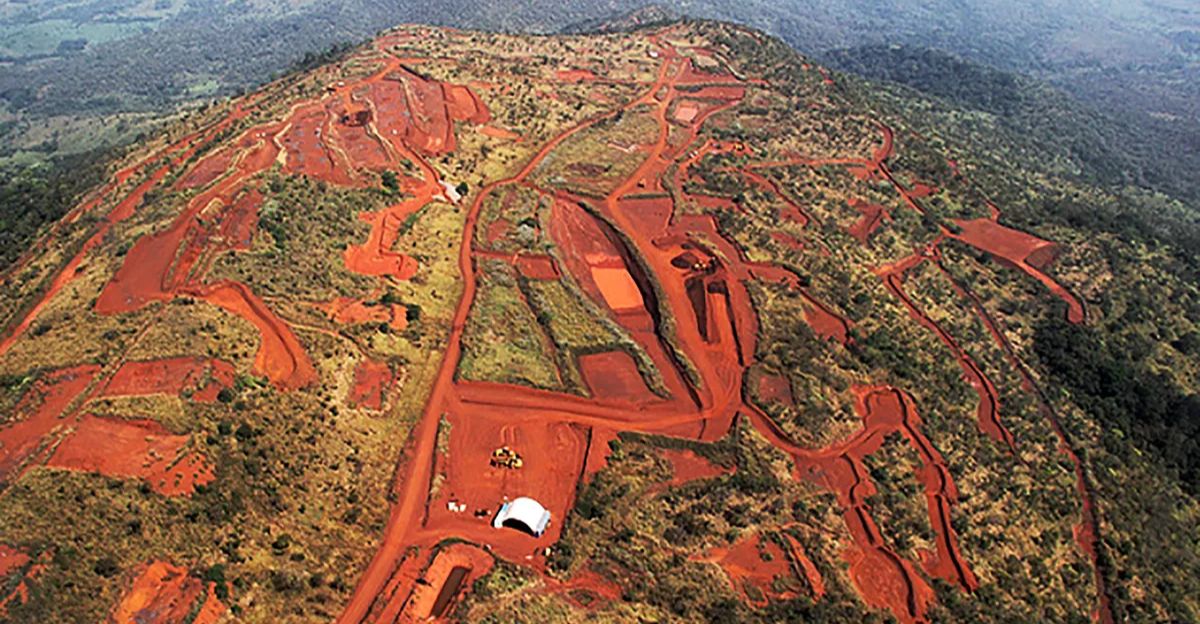

Simandou’s vast iron ore reserves were first discovered in the 1950s under French colonial rule. Rio Tinto began exploring the deposit in 1998, sending geologist Sidiki Koné on an arduous trek through Guinea’s dense forests. Despite confirming vast ore reserves, the project faced numerous obstacles: military coups, corruption scandals, and logistical challenges that kept it dormant for decades.

However, in the 21st century, the deposit’s remoteness has become less of a barrier due to advances in modern mining technology.

Ownership Battles

Rio Tinto initially controlled the Simandou project but lost half of its stake in 2008 when Guinea’s president seized the company’s licenses and handed them over to diamond billionaire Beny Steinmetz. Steinmetz was later convicted of bribing Guinean officials, and Vale, which had invested $2.5 billion, found itself a victim of deception.

By 2019, Chinese and Singaporean firms secured the rights to the forfeited blocks, significantly altering the project’s ownership landscape and signaling China’s growing influence.

Simandou Awakens

Simandou’s operations officially kicked off on November 11, 2025, marking a new chapter in global mining. This deposit, with reserves exceeding 3 billion tons of iron ore, is controlled primarily by Chinese state-owned enterprises, which own approximately 75% of the project. The first shipment, totaling 9,850 tons, left the newly built port in Guinea, with subsequent shipments set to follow before the end of the year.

This marks the beginning of what could be one of the most significant shifts in global iron ore supply chains.

Guinea’s Gamble

Simandou promises to transform Guinea’s economy, boosting its GDP by more than 25% by the early 2030s. However, the project’s massive scale comes with significant human and environmental costs. Over 450 localities face potential impacts, and workers have tragically died during construction.

Additionally, the project threatens the habitat of the critically endangered West African chimpanzee. The geopolitical stakes are high, as Guinea’s government—led by military junta President Mamady Doumbouya—seeks to balance development with its international obligations.

Local Workforce

The local workforce at Simandou, many of whom are illiterate, is tasked with operating machinery in one of Africa’s largest-ever mining projects. The transition from a subsistence economy to an industrialized operation has been swift, with many locals now working in an advanced industrial environment for the first time.

Sidiki Koné, who first explored the area in 1998, recalls the daunting challenges of the terrain: “It was forest to the left and forest to the right,” he said, reflecting on the project’s formidable history.

Australia Braces

Australia’s dominant role in global iron ore supply is facing its most serious challenge in decades. While Simandou’s reserves are much smaller than Australia’s Pilbara deposits—Simandou holds 3 billion tons compared to Pilbara’s substantially larger reserves—the quality of Simandou’s ore is a significant advantage.

Averaging above 65% iron content, it outperforms Pilbara’s typical 55-62% grades. This, coupled with strategic Chinese ownership, means Simandou’s impact on global pricing and market power could be transformative.

Steel Demand Peaks

China’s steel sector, which consumes over half of the world’s iron ore, has likely reached its peak production. With the property sector in decline and government crackdowns on industrial overcapacity, demand for steel is expected to slow.

This is a troubling sign for traditional suppliers like BHP and Rio Tinto, especially as Simandou’s new supply enters the market. The timing couldn’t be worse: global demand growth for iron ore is stagnant, and now China controls both supply and demand.

CMRG’s Rise

In just three years, China Mineral Resources Group (CMRG) has become the world’s largest iron ore buyer. Representing over half of China’s steelmakers, CMRG consolidates power in negotiations with suppliers. The state-backed entity now wields significant influence over the global iron ore market.

As Simandou ramps up production, CMRG’s ability to control both purchasing and supply gives China an unprecedented level of leverage over pricing and market dynamics.

Infrastructure Marvel

The infrastructure behind Simandou is nothing short of extraordinary. More than 140 locomotives have been ordered from Wabtec Corp. to haul iron ore across a 600-kilometer railway that includes over 200 bridges. The journey from the mine to the port takes 30 hours, but this rail route is among the most advanced in the world, drawing on high-speed rail designs from China.

The sheer scale of the project reflects China’s commitment to transforming Guinea into a global mining powerhouse.

Rio’s Retreat

Rio Tinto’s involvement in Simandou has shrunk drastically. Once the majority owner, it now holds just 25% of the project through a joint venture with Chinalco. Rio’s largest shareholder, Aluminum Corp of China (Chinalco), also owns a significant stake in Simfer, signaling a major shift in the project’s control.

Over the years, Rio Tinto faced controversies and setbacks related to its Simandou interests, including a $10.5 million payment to a consultant investigated for bribery in 2016.

Comeback Strategy

Despite its reduced stake, Rio Tinto is pushing forward with plans to ramp up production at Simandou. The company aims to reach 60 million tons per year within 30 months, aligning with Winning Consortium Simandou’s target of 120 million tons annually.

Rio Tinto’s stockpiled ore, combined with its aggressive expansion plans, signals that the company is not ready to cede the iron ore market to its competitors without a fight.

Analyst Doubts

Not all analysts believe Simandou will cause a market crash. Vale’s CEO has expressed doubts, suggesting that the African mine “won’t be a game-changer” for China’s pricing power. While this view is in the minority, it highlights the uncertainty surrounding Simandou’s true impact on global supply.

With a projected 120 million tons in annual exports by 2028, Simandou could flood the market, but whether this leads to price volatility remains to be seen.

Power Question

For the first time in history, China holds the reins to both the world’s largest iron ore supply and the largest iron ore demand. “Never before has China held this level of pricing power,” says Tom Price, Head of Commodities Strategy at Panmure Liberum.

This raises a critical question: what leverage do traditional mining giants have left? With China controlling both ends of the market, it may soon dictate the terms of global iron ore trade.

Geopolitical Chess

The U.S. embassy in Guinea has lobbied to keep Western firms involved in the Simandou project, citing the strategic importance of balancing Chinese dominance. Meanwhile, Guinea’s military junta has taken steps to secure the country’s first sovereign credit rating, hiring KPMG and Rothschild & Co. to advise on investment strategies.

Simandou’s success could determine Guinea’s future as a global mining power—and its place in the geopolitical landscape.

Belt and Road Blueprint

The construction of Simandou reflects China’s Belt and Road Initiative, with infrastructure built using standardized designs from major projects across the globe. The rail bridge, completed in just one month, exemplifies the speed and efficiency possible when state-backed financing meets standardized designs.

This method has already proven successful in northern Guinea, where Chinese companies helped make the country the world’s top bauxite supplier.

Environmental Cost

Simandou’s environmental toll is significant. Located in one of the most biologically diverse regions on Earth, the project threatens the habitat of critically endangered West African chimpanzees. Iron ore extraction generates heavy metal runoff, which could damage nearby watersheds.

In response, Guinea’s government has mandated that both consortiums involved in Simandou complete a feasibility study for building a domestic steel plant, aiming to capture additional value beyond raw ore exports.

Resource Curse Risk

Guinea’s leadership is keen to avoid the “resource curse” that has plagued many African nations. The government’s “Simandou 2040” development roadmap promises to transform the country into a mineral powerhouse, but it remains to be seen whether the wealth from Simandou will be used to develop other sectors of the economy.

Critics fear that without a diversified economy, Guinea could become another oil-rich nation that fails to capitalize on its newfound wealth.

Market Reality

Simandou’s awakening signals the dawn of a new era for the global iron ore market. With China controlling both supply and demand, the market will face unprecedented challenges. For Guinea, the transformation from one of the world’s poorest countries to a mineral powerhouse is unfolding in real time.

However, the full implications for the market, Guinea, and the global economy are still being written. The world is watching closely as this $23 billion mega-project reshapes global iron ore dynamics.