Jack Daniel’s is making headlines with the return of its Old No. 7 Tennessee Whiskey in a massive 3-liter bottle, a size not seen in U.S. stores since before Prohibition. This bold move comes as the spirits industry faces shifting consumer habits and regulatory changes.

The 3-liter format, equivalent to four standard 750ml bottles, carries a suggested retail price of $79.99. The stakes are high for both the brand and the broader whiskey market as Jack Daniel’s tests consumer appetite for large-format spirits in a challenging sales environment.

Five States Say No

While the 3-liter bottle is launching nationwide, five states—Florida, Louisiana, Michigan, West Virginia, and Wisconsin—have immediately banned its sale. This regulatory split highlights ongoing tensions between federal and state alcohol laws, raising questions about market access and consumer choice.

The bans underscore the complex patchwork of alcohol regulations that distillers must navigate across the United States, where each state maintains independent authority over beverage alcohol sales and distribution within its borders.

Prohibition’s Long Shadow

Jack Daniel’s last sold a 3-liter bottle in the U.S. over a century ago, before the Prohibition Era began in 1920. The ban on alcohol sales during Prohibition forced distilleries to halt or drastically alter operations, shaping the American spirits landscape for generations.

The distillery, located in Lynchburg, Tennessee, survived the era through creative adaptation. Ironically, Moore County remains a dry county today, though the distillery operates as a major tourist attraction. The return of the 3-liter bottle marks a symbolic full-circle moment for the brand.

Regulatory Pressures Mount

Recent years have seen mounting pressure on U.S. distillers. With whiskey production booming but demand softening, brands are seeking new ways to stand out. Federal packaging laws, long seen as restrictive, have been a key barrier to innovation in bottle sizes and formats.

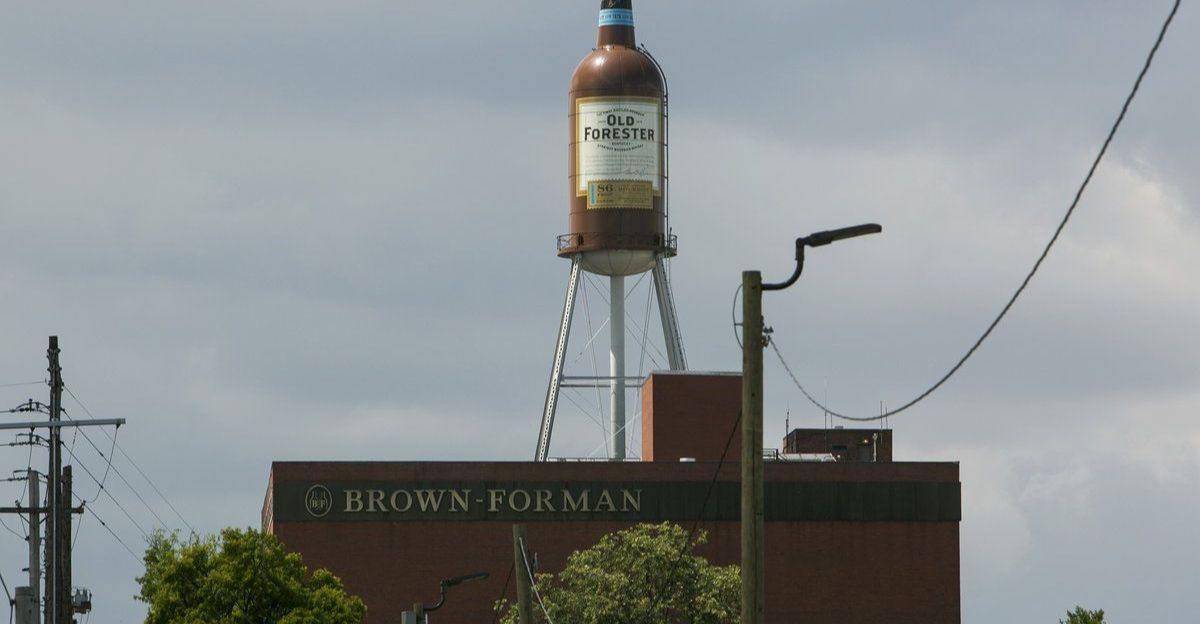

The American whiskey industry has faced headwinds including declining sales volumes, international trade tensions, and shifting consumer preferences. Brown-Forman, Jack Daniel’s parent company, reported fiscal 2025 net sales declines as the brand navigated a challenging consumer environment and increased competition.

The Big Reveal

On November 3, 2025, Jack Daniel’s announced the permanent return of its 3-liter Old No. 7 Tennessee Whiskey to U.S. retail shelves. This marks the first domestic release of this size since 1920, enabled by a federal rule change effective January 10, 2025 that now allows larger spirit bottles.

The Alcohol and Tobacco Tax and Trade Bureau (TTB) expanded regulations, adding 15 new container sizes for distilled spirits ranging from 187ml to 3.75 liters. This provides distillers with unprecedented flexibility and aligns U.S. regulations with international norms for beverage alcohol container sizes.

State Bans Create Patchwork

Despite federal approval, Florida, Louisiana, Michigan, West Virginia, and Wisconsin have blocked the sale of the 3-liter bottle. These bans mean that, at launch, consumers in those states will not have access to the new format, underscoring the fragmented nature of U.S. alcohol regulation.

Each state maintains its own beverage alcohol control system. The five states that banned the 3-liter format cite concerns from public health considerations to existing container size limitations, creating competitive disadvantages for retailers in banned states compared to neighboring jurisdictions.

Fans React to the News

Whiskey enthusiasts nationwide have expressed excitement about the new release, with some lamenting their inability to purchase the bottle in banned states. Jack Daniel’s master distiller Chris Fletcher said, “We hope this bold new take will help create timeless holiday memories that last long after the bottle is gone.”

The brand is marketing the 3-liter bottle as ideal for holiday gatherings and gift-giving occasions. Social media reactions have been largely positive, with collectors particularly interested in the nostalgia factor and bars seeking value-oriented purchasing options for high-volume establishments.

Competitors Eye the Trend

Other major whiskey brands are closely watching Jack Daniel’s move. The new federal rules allow all distillers to offer larger bottles, potentially sparking a wave of similar releases as brands seek to capture value-conscious consumers and stand out on crowded shelves.

Industry observers anticipate that competing Tennessee whiskey and bourbon producers may follow suit with their own large-format offerings. The TTB’s expanded regulations opened the door for innovation, with some brands already exploring 1.5-liter and 2-liter formats while warehouse clubs express strong interest in larger bottles.

Industry Faces Surplus

The American whiskey industry is grappling with a supply glut. Kentucky alone has 16.1 million aging barrels as of January 2025, representing a record high inventory level. Production from January to April 2025 dropped 28% compared to the same period in 2024.

Larger bottles may help distillers move inventory, but the long-term impact remains uncertain. The combination of overproduction during the bourbon boom and softening demand has created pressure to find creative solutions. Exports have also declined, with American whiskey shipments falling more than 13% through mid-2025.

Mini-Nugget: Permanent Addition

Unlike previous limited releases, the 3-liter bottle is joining Jack Daniel’s permanent U.S. lineup. This strategic shift signals the brand’s confidence in sustained demand for larger formats, not just seasonal or novelty appeal.

Jack Daniel’s Old No. 7 is now available domestically in eight sizes: 50ml, 100ml, 200ml, 375ml, 750ml, 1 liter, 1.75 liters, and 3 liters. The whiskey maintains its 80 proof specification across all formats, with a mash bill of 80% corn, 12% malted barley, and 8% rye.

Retailers Face Dilemmas

Retailers in the five banned states must navigate the regulatory landscape as the new bottle format launches in other states, putting them at a competitive disadvantage compared to stores in neighboring states where the product is available.

Store owners near state borders face particular challenges, as customers may cross into adjacent states to purchase the 3-liter bottles, creating potential revenue losses. Some retailers have expressed frustration with the inconsistent state-by-state approach, arguing that federal approval should suffice nationwide.

Brown-Forman’s Calculated Bet

Jack Daniel’s parent company, Brown-Forman, is betting that the 3-liter format will boost sales and brand visibility. The move comes amid broader efforts to adapt to changing consumer preferences and regulatory landscapes.

The Louisville-based spirits company acquired Jack Daniel’s in 1956 for $20 million, agreeing to maintain production exclusively in Lynchburg. The 3-liter launch represents one element of a broader strategy to reinvigorate Jack Daniel’s Tennessee Whiskey sales amid recent headwinds.

Marketing the Comeback

Jack Daniel’s is leveraging the nostalgia of its Prohibition-era legacy in marketing campaigns, emphasizing both tradition and innovation. The company hopes the new bottle will appeal to collectors, party hosts, and loyal fans alike.

Marketing materials highlight the historical significance of bringing back a pre-Prohibition bottle size while positioning the format as practical for modern entertaining. The value proposition compared to four separate 750ml bottles is emphasized, with the November launch strategically timed for the holiday shopping season.

Market Response

The success of this launch could influence future packaging trends across the spirits sector, as the industry watches to see whether consumers embrace the larger format long-term in response to market oversupply.

Early indications suggest strong interest from warehouse retailers and value-oriented consumers. However, questions remain about whether the format will gain traction in traditional liquor stores with limited shelf space. The spirits industry has seen mixed results with non-standard sizes, making this a closely watched test case.

What’s Next for Big Bottles?

Will other states follow suit in banning or embracing larger bottles? The coming months will test whether Jack Daniel’s gamble pays off and if the 3-liter format becomes a new industry standard or a passing fad.

Several major bourbon and Tennessee whiskey producers are evaluating their own large-format strategies, waiting to assess Jack Daniel’s performance before committing resources. Trade associations are monitoring state legislative activity while consumer purchasing patterns through the 2025-2026 holiday season will provide critical data points.

Political Implications

The state-level bans highlight ongoing debates over alcohol regulation and states’ rights. Lawmakers in the banned states cite public health and safety concerns, while industry advocates argue for consumer freedom and regulatory consistency.

The tension between federal and state authority over alcohol regulation dates back to the post-Prohibition period and the Twenty-first Amendment. Some public health advocates argue that larger bottles may encourage excessive consumption, while opponents counter that adults should have freedom to purchase legal products in various formats.

Global Perspective

Internationally, larger spirit bottles are common. Jack Daniel’s has sold 3-liter bottles abroad for years, including in duty-free stores and travel retail channels. The brand’s international presence has long included large-format offerings that were unavailable domestically.

The U.S. move aligns domestic offerings with global norms, potentially boosting brand prestige. European, Asian, and Latin American markets have embraced large-format spirits for decades, particularly in duty-free environments. By harmonizing domestic and international offerings, Jack Daniel’s can achieve greater production efficiencies and present a consistent global brand image.

Legal and Compliance Hurdles

Navigating the patchwork of state and federal laws remains a challenge for distillers. Compliance teams must monitor evolving regulations, while legal experts warn that further changes could reshape the market yet again.

Alcohol compliance professionals must track regulations across all 50 states plus the District of Columbia, each with unique requirements. The cost of regulatory compliance represents a significant burden, particularly for smaller craft distillers. Legal teams at major producers maintain constant vigilance over legislative developments affecting packaging and market access.

Cultural Shifts in Drinking

The rise of larger bottles reflects changing attitudes toward alcohol consumption, gatherings, and value, with the format potentially appealing to those hosting communal celebrations. The move mirrors broader cultural shifts in drinking norms.

Contemporary drinking culture increasingly emphasizes social occasions over solitary consumption. The craft spirits movement has elevated whiskey’s status as a sophisticated beverage for sharing. Simultaneously, economic pressures have made value-conscious purchasing more attractive, with the 3-liter bottle straddling both premium positioning and practical economics.

Why It Matters Now

Jack Daniel’s 3-liter comeback is more than a product launch—it’s a signal of how tradition, regulation, and consumer trends intersect in today’s spirits industry. As the dust settles, the story will shape how Americans buy, share, and think about whiskey for years to come.

The launch represents a convergence of regulatory reform, market adaptation, and brand heritage. For an industry facing inventory challenges and shifting demographics, the success or failure of large-format offerings could influence strategic decisions across multiple brands and categories, potentially bridging a long-standing gap in the global spirits marketplace.