Once the undisputed leader in semiconductor innovation, Intel now faces mounting pressure from fast-moving rivals expanding their dominance in markets ranging from AI to advanced chip manufacturing. Intel must prove it can execute on its ambitious plans or risk ceding control of its future to competitors.

The next year and a half will determine whether Intel can reclaim its leadership or be defined by the very rivals it once outpaced.

Under New Management

The appointment of Lip-Bu Tan as Intel’s new CEO marks a potential turning point for the company at this high-stakes moment. Known for his deep industry expertise as the former CEO of Cadence Design Systems and his reputation as a savvy investor in semiconductor startups, Tan brings technical insight and strategic vision to Intel’s leadership.

Under his leadership, Intel has a unique opportunity to reset its trajectory. Still, the window is narrow, and the industry will be watching closely to see if Tan can translate his track record into a bold new chapter for the company.

Billions at Risk

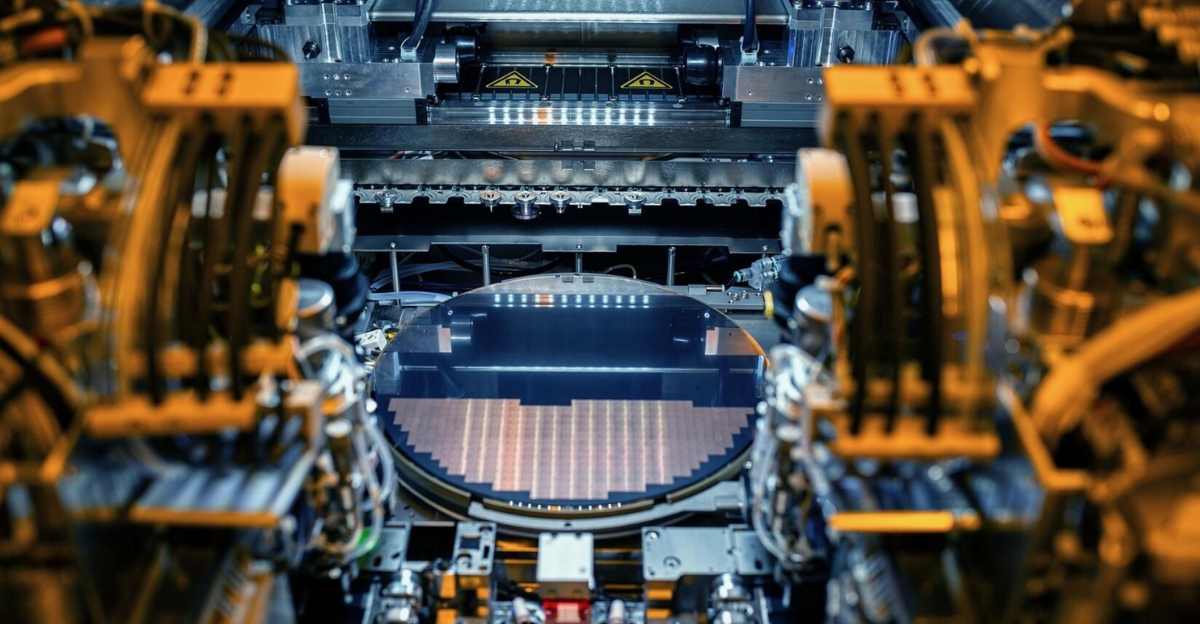

Intel poured billions into new fabs for the 18A process node, hoping to rival TSMC and Samsung. The company is gambling billions with their upcoming 18A process node, which is expected to be Intel’s first truly next-generation platform designed to compete head-on with TSMC’s and Samsung’s most advanced technologies.

If Intel can deliver 18A chips at scale, it could reestablish itself as a leader in both design and manufacturing while strengthening domestic chipmaking capacity. But if execution falters, the company will be burdened by monumental costs.

Product Deadlines

Slated to arrive just months after 14A, 18A is intended to showcase Intel’s leadership in advanced transistor architecture with RibbonFET and PowerVia, technologies designed to leap ahead of rivals in performance and efficiency. However, the timeline is incredibly tight, and any slippage could undermine confidence in Intel’s entire turnaround story.

Panther Lake, set to debut the 18A node, is central to Intel’s rebirth. The critical launch date is the fourth quarter of 2025.

The 14A Ultimatum

In the foundry business, landing a marquee client can instantly validate a technology and attract a wider customer base. Without such an anchor, Intel risks pouring billions into 14A fabs with limited initial demand, putting immense strain on its balance sheet. Analysts warn that Intel must “land a hero customer on 14A” within 18 months or risk its newest fabs becoming obsolete.

Rising Competition

While Intel pushes forward with its ambitious turnaround, competition from AMD, Nvidia, and ARM-based challengers has never been fiercer. Nvidia dominates the AI wave, with its GPUs becoming the essential engines of machine learning and generative AI, leaving Intel scrambling to catch up with its accelerators.

Meanwhile, the global ARM ecosystem is thriving, as its flexible, energy-efficient architectures gain traction across mobile, cloud, and even enterprise computing, threatening Intel’s legacy x86 stronghold.

Strategic Shifts and Organizational Overhaul

In response to ongoing financial losses and underperforming manufacturing yields, Intel initiated substantial workforce reductions, reportedly trimming 15% of its global staff. This move, announced internally through a company-wide memo in May, aims to reduce overall operating expenses while sharpening focus on core product lines and strategic initiatives.

The company raced to build new fabs and upgrade existing ones, hoping that next-generation nodes like 18A would attract significant demand. But as CEO Lip-Bu Tan candidly shared with employees, “We invested too much, too soon, without adequate demand.” The refocused strategy is expected to save $1.5 billion over the next 16 months, allocating capital only to high-impact areas tied closely to Intel’s turnaround goals.

Microsoft and Apple Intensifying Pressure

As Microsoft and Apple deploy strategies that directly threaten Intel’s market dominance in PCs, the pressure has never been stronger to succeed in their goal. Apple’s decision to design its Arm-based silicon for Mac computers has paid off considerably—its market share has doubled over the past three years, eroding Intel’s monopoly on premium desktops and laptops.

Until recently, Microsoft’s partnership with Qualcomm was exclusive, ensuring that only Qualcomm-powered chips could run Windows-on-Arm. This exclusivity expired in 2024, opening the door to rival chip designers like Nvidia and AMD, racing to bring their Arm-based solutions to market.

SoftBank’s $2 Billion Lifeline

Global investment giant SoftBank has acquired a $2 billion stake in Intel, instantly becoming one of the company’s six largest shareholders. While the investment signals a belief in Intel’s deep technological reserves and leadership ambitions, SoftBank notably declined to take a seat on Intel’s board or make any direct commitments to purchase Intel chips.

Tan commented to employees and media, “SoftBank’s investment reinforces our strategic direction and belief in our capacity to lead—not just survive—in the next chapter of the chip industry.”

U.S. Government’s Strategic Stake

A proposal for the government to acquire a 10% equity stake in the company is under active review. This move would inject about $10 billion into Intel. This investment could be coupled with nearly $11 billion in federal grants dedicated to bolstering Intel’s manufacturing capacity and increasing domestic semiconductor output.

With Intel’s strategic importance as one of the last U.S.-based advanced chip manufacturers, federal authorities have grown increasingly concerned about America’s reliance on foreign foundries like TSMC in Taiwan and Samsung in South Korea. One official commented, “Our stake in Intel isn’t just about profits; it’s an investment in America’s long-term technological leadership.”

Securing the Semiconductor Supply Chain

The escalating rivalry with China, ongoing concerns about Taiwan’s political stability, and Europe’s desire for domestic chip manufacturing have reshaped policy, making Intel’s fate a matter of strategic interest at the highest level. One industry expert said, “Semiconductors are the oil of the digital age—whoever controls production wields enormous global influence.”

Ultimately, the intersection of global politics and chip manufacturing adds urgency to Intel’s 18-month sprint. Securing a resilient supply chain is now a corporate imperative and a strategic necessity for national security and economic sovereignty.

Financial Woes

The company posted a staggering $400 million loss in the last quarter, adding to a cumulative $18.8 billion loss for 2024. This cash hemorrhage stems from declining sales, costly investments in next-generation fabs, and operational inefficiencies. These financial pressures have forced Intel into aggressive cost-cutting mode.

Analyst commentary said, “Intel’s negative cash flow shows how difficult it is to recover market share when you’re behind in technology and facing aggressive competitors with more efficient manufacturing.”

Why a Hero Customer Is Critical

In semiconductor manufacturing, a hero customer refers to a major client that commits to significant orders on a new node, thereby validating the technology and giving confidence to other potential customers and investors. “Without a major external client, the future of advanced manufacturing is bleak,” said Intel executives.

If Intel fails to secure this kind of commercial anchor for its advanced nodes, the consequences could be severe, and the company might have to abandon its latest generation of manufacturing technology.

Yield Challenges and Manufacturing Bottlenecks

The percentage of manufactured chips that meet strict quality and performance standards is the most critical metric for profitability in semiconductor foundries. Troublingly, “only a small percentage of Panther Lake chips produced using the 18A process have been good enough to supply to customers,” according to industry reporting.

To be commercially viable, yield rates on a new node like 18A must typically exceed 70–80%. Intel’s numbers are falling “well short of industry standards,” raising serious questions about whether the process can achieve sufficient efficiency.

What Rivals Are Doing

Qualcomm, long dominant in mobile chips, has pivoted aggressively toward laptops and PCs, partnering with Microsoft and leveraging its Arm architecture expertise. A new generation of flagship Arm chips is expected to power high-end Windows devices, highlighting Qualcomm’s ambition to dethrone Intel from its position atop the PC processor hierarchy.

The strategic moves by Qualcomm, Nvidia, and AMD signal that competition is no longer limited to incremental improvements among x86 CPUs. A senior executive summarized the risk: “Joining Qualcomm in the race for PC supremacy, Nvidia and AMD could change the rules overnight if Intel doesn’t reclaim its technical leadership.”

Political Pressures Mount

President Trump’s involvement shows just how politically charged Intel’s fate has become. Initially, Trump called for the resignation of CEO Lip-Bu Tan amid growing frustration over Intel’s persistent losses, missed technical milestones, and rapidly rising competition from Asia. However, following a high-profile meeting at the White House, Trump reversed his position, publicly voicing support for Tan and Intel’s ongoing turnaround efforts.

According to Bloomberg, the discussion led to assurances that the government would expedite regulatory reviews for nearly $11 billion in grants Intel has pursued to expand manufacturing capacity and accelerate advanced chip development.

Risk of Foundry Exit

According to recent remarks from CEO Lip-Bu Tan, the company may be forced to “exit the contract manufacturing sector ” without a breakthrough in attracting external clients for its advanced 14A process node. Intel operated as an integrated device manufacturer (IDM), designing and producing its own chips. The shift to the IDM 2.0 model was intended to restore its relevance and profitability in a world increasingly dominated by foundry specialists.

“Without external validation and volume, continuing foundry operations puts Intel in a losing race—costs escalate, returns diminish, and the business case fades,” said one analyst.

The ‘IDM 2.0’ Vision

IDM 2.0 is about restoring trust in Intel’s manufacturing prowess. This means building the most sophisticated process nodes and reliably delivering high yields and on-time launches that attract new customers. “By integrating design and manufacturing, and opening our fabs to outside clients, we aim to redefine leadership in the semiconductor industry,” said Tan.

Intel’s IDM 2.0 aligns perfectly with U.S. government priorities for “reshoring” semiconductor fabrication, and it’s why the company is a beneficiary of proposed public-private investment.

Timeline and Milestones

Intel’s leadership team, analysts, and investors are closely tracking a handful of key milestones that will determine whether Intel can reclaim its manufacturing and technology leadership or sink further behind global competitors. Bernstein’s Stacy Rasgon warns, “This countdown cannot continue indefinitely.” If Intel fails to demonstrate tangible progress on these time-sensitive goals, it could lose its place as a leader in design and manufacturing.

Intel at the Crossroads

The company stands at a crossroads between resurgence and irrelevance, with outcomes hinging on the delivery of breakthrough products. Industry experts have been blunt about what Intel must do to remain relevant: “Only great products, delivered on time, will keep Intel competitive in the new era,” echoed analysts tracking the company’s progress. Execution, not intent, will define Intel’s survival.