Something big is brewing in the U.S., and it’s not beer. For the first time in nearly 90 years, fewer than six in ten Americans call themselves drinkers. Gallup’s 2025 poll puts the number at 54%, the lowest since the 1950s. That’s not just a dip, it’s a cultural reset.

Drinking, once woven into the fabric of American life, is losing its grip. Health fears, rising costs, and new lifestyle choices push people to rethink their habits. The real story isn’t just about what’s missing from the glass but what Americans choose instead.

A Pause Button on Old Habits

Drinking less doesn’t always mean quitting altogether. The data show even those who still drink are pulling back. Just one in four drinkers had a drink yesterday, while 40% said they hadn’t touched alcohol in more than a week. What’s telling is how people see the risk.

For the first time, a majority – 53% – say even one or two drinks a day can harm health, Gallup found. That’s a seismic shift in perception. For decades, moderation was sold as safe. Now the national mood leans cautious, skeptical, and, frankly, less impressed with alcohol’s old reputation.

1. Health Is Driving the Rebellion

The new drinking culture is fueled by a very modern obsession … health. Once, wine was pitched as heart-healthy. But medical research now shows even small amounts raise risks of cancer, liver disease, and heart trouble. The CDC’s Dr. Marissa Esser put it bluntly in 2024: “There is no completely safe level of drinking.”

That’s not fear-mongering, it’s science catching up with myth. For many, the decision isn’t about puritan restraint, but about staying sharp, living longer, and avoiding regrets. With health so front-and-center in American culture, alcohol increasingly feels like the odd one out.

2. Gen Z Is Changing the Script

If Millennials flirted with moderation, Gen Z is committing to it. In 2025, just half of 18 to 34-year-olds reported drinking, down from 59% two years earlier. That’s a generational cliff. Instead of hangovers, they’re opting for cannabis, gaming, fitness, or simply logging on.

Social media fuels the trend – TikTok’s #SoberCurious has millions of views, giving young people role models who openly say “no thanks” to alcohol.

As Stanford sociologist Jeremy Freese noted, Gen Z isn’t just cutting back; they’re redefining fun. Nights out don’t need alcohol at the center anymore, and that’s a massive cultural pivot.

3. The Wallet Says No

There’s also the practical truth that alcohol has become a budget buster. A night out can rival a grocery bill. With inflation still squeezing families, alcohol is moving from “must-have” to “maybe not.” People are trading down, splitting fewer bottles, or skipping bar tabs altogether. Industry insiders call it “premiumization” – drinking less, but better.

Behind the jargon is something simple: Americans don’t want to waste money on drinks that don’t feel worth it. When bills pile up and cocktails lose their charm. For millions, saying no to alcohol is as much about saving cash as saving health.

4. New Social Norms Around Sobriety

For decades, drinking meant sophistication, fun, and fitting in. That script is being rewritten. Alcohol-free bars are popping up in major cities, “mocktails” are regular menu items, and sobriety no longer carries the old stigma. Online communities like #SoberCurious turn personal choices into shared lifestyles.

Ruby Warrington, author of Sober Curious, said, “Not drinking used to be isolating; now it’s a lifestyle.” Younger generations aren’t embarrassed to skip a drink; they’re proud of it. Being the one with soda in hand is no longer odd; it’s becoming mainstream, and that’s a striking cultural shift.

5. Cannabis and the New Competition

Legal cannabis is rewriting the rules of relaxation. Nearly half of U.S. states allow recreational marijuana, and Pew Research shows more than 80% of Americans now live in areas with dispensaries. That convenience is siphoning occasions once reserved for alcohol. Younger people especially see cannabis as safer, cheaper, or simply more appealing.

Non-alcoholic cocktails and adaptogen-infused seltzers have exploded, offering flavorful ways to socialize without booze. “Cannabis is competing for the same occasions alcohol once dominated,” BDSA market researchers noted. Alcohol is no longer the default; it’s just one option in a crowded field.

6. The Pandemic’s Lingering Legacy

COVID-19 briefly sent alcohol sales soaring, but the long-term effect is very different. As life reopened, many Americans reassessed their habits. Drinking during lockdown often felt tied to stress, not joy. Routines changed, too, with less commuting, more home cooking, and more fitness. That recalibration stuck for some.

Another factor is that we’re socializing less. An American Time Use Survey found that under-25s now average just 10 hours a month of in-person hangouts, down from 30 hours two decades ago. Alcohol thrives in groups. With fewer gatherings, there are fewer occasions for drinking, which diminishes its role in daily life.

7. Boomers Age Out, Wine Loses Anchor

Baby Boomers once drove America’s beer and wine boom. But age brings health issues, medications, and lifestyle changes that make drinking less appealing. As Boomers scale back, younger generations aren’t filling the gap. Rabobank analysts warned in 2024 that the wine industry faces a “demand reset.”

The numbers prove that consumption among 30 to 45-year-olds has slumped, leaving a hole producers can’t easily patch. This isn’t a temporary dip; it’s a demographic reality. Without a new generation to champion wine or beer, these markets face long-term decline, reshaping America’s drinking landscape.

8. Choice Overload, Loyalty Lost

Paradoxically, too much variety is hurting the alcohol industry. Consumers have endless options for craft beers, flavored seltzers, ready-to-drink cocktails, and imported spirits. Instead of boosting loyalty, the flood of products dilutes it. People sample something new but rarely stick with it.

IWSR Drinks Market Analysis reported in 2023, “The sheer abundance of choice has fragmented consumption.” Even once-hot trends like hard seltzers are cooling. What used to be a market built on brand loyalty is now driven by novelty, and novelty wears off fast. That churn leaves traditional players fighting to keep attention.

Beer’s Fall from the American Table

Beer was once the drink for nearly every occasion, from ballgames to backyard cookouts. However, shipments dipped below 200 million barrels in 2023, the lowest since 1999. Bud Light’s decline grabbed headlines, but the struggle runs deeper. Domestic lagers are losing fans, and even craft brews have plateaued.

Younger Americans see beer as heavy, bloating, and less exciting than cocktails or seltzers. Even stadiums now market alcohol-free options alongside beer. It hasn’t disappeared, but beer no longer feels like the default. Its cultural dominance is slipping, replaced by lighter and trendier alternatives.

Why Beer Isn’t Clicking Anymore

Calories, cost, and culture are all working against beer. Health-conscious drinkers prefer lighter options. Budget-conscious buyers see better value in a single cocktail. And culturally, beer doesn’t carry the same cool factor for Gen Z.

“Beer loyalty isn’t inherited anymore,” said Bart Watson of the Brewers Association in 2024. That’s critical, because beer once thrived on tradition, passed from parents to kids. Now, drink choices are fluid, tied to identity and occasion rather than family ritual. Without that handoff, beer is struggling to reinvent itself in a world where brand loyalty barely exists.

Wine’s Prolonged Slump

Wine is also feeling the pressure as U.S. sales fell 6% in 2023, with the steepest declines among 30 to 45-year-olds. Once buoyed by its heart-health reputation, wine has lost that halo. Younger generations see it as expensive, elitist, or simply unappealing.

Silicon Valley Bank’s 2024 State of the Wine Industry report described it as “the most challenging period in modern history.” With Boomers aging out and Millennials and Gen Z uninterested, the pipeline of new drinkers looks thin. For a product that built its image on tradition, wine now faces an uncertain and sobering future.

Why Younger Generations Don’t Buy Wine

For many young adults, wine feels more like homework than fun. The jargon – terroir, vintages, appellations, intimidates rather than invites. Costs are another barrier. A decent bottle can run $20 or more, compared with cheaper, more accessible drinks. Add a cultural shift away from alcohol, and wine becomes an easy skip.

Premium collectors and luxury bottles still have their audience, but everyday table wine is struggling. Wine economist Rob McMillan said, “There’s a cultural mismatch.” Younger generations aren’t chasing exclusivity – they’re chasing accessibility, and wine hasn’t delivered.

Spirits Lose Some Spark

Spirits were supposed to be the bright spot. In 2022, they surpassed beer in revenue for the first time. But even here, cracks are forming. Whiskey, tequila, and gin enjoyed a “cocktail renaissance,” yet the momentum isn’t holding. California sales fell in 2023, particularly among younger drinkers.

Analysts point to cannabis, non-alcoholic cocktails, and trend fatigue. New flavors and infusions grab attention, but not lasting loyalty. What looked like the category poised to carry alcohol forward is now slowing, showing that no corner of the industry is immune to America’s drinking reset.

The Rise of Zero-Proof Living

The most visible sign of change is the boom in non-alcoholic alternatives. Once niche, these drinks are now mainstream. Sales of zero-proof beer, wine, and spirits surged in the past two years, fueled by consumers who want flavor without the hangover. Younger adults are leading the charge, but health-conscious parents and professionals are on board too.

Bars and grocery stores have expanded their non-alcoholic shelves, and brands are investing in innovation. This isn’t a fad; it’s a full-blown category. And it’s one cutting into alcohol’s traditional stronghold with surprising speed.

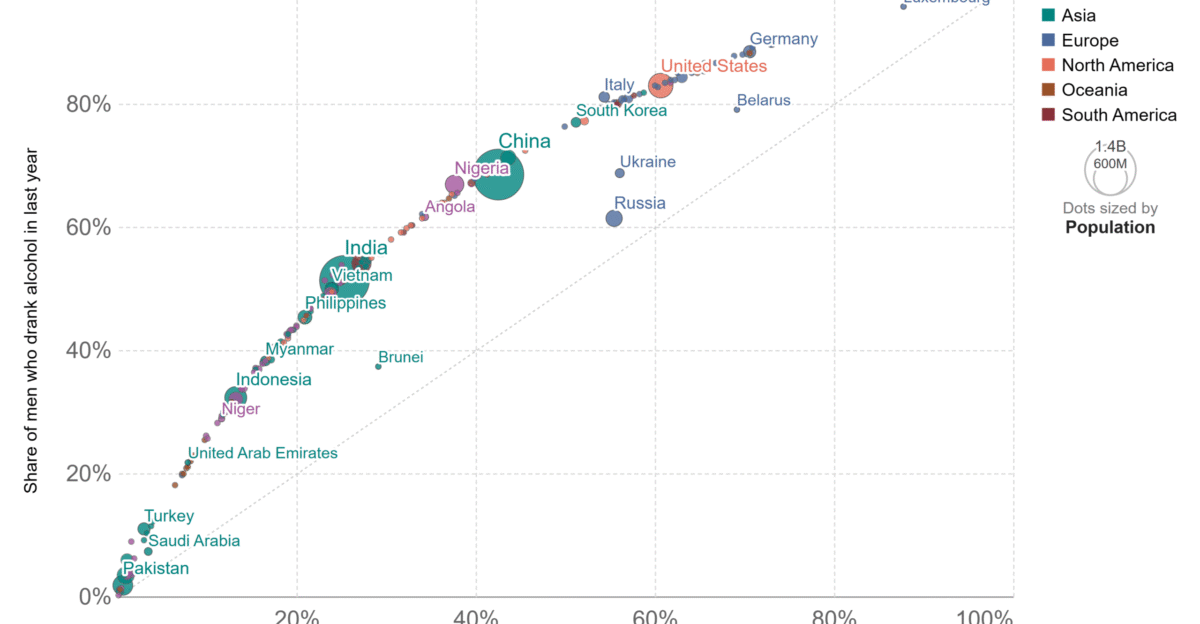

Who Drinks What and Where

Not all shifts look the same. Men still favor beer more than women, while women lean toward wine or spirits, though both drift toward non-alcoholic choices. Geography matters, too. Northeastern states continue to drink the most, while conservative regions like Utah report the lowest rates.

These micro-trends show the U.S. isn’t uniform in its habits. However, the direction of travel is clear: Overall, drinking is down across age, gender, and region. Alcohol is becoming less of a national pastime and more of an occasional choice.

A Reset, Not a Rejection

This isn’t prohibition 2.0. Alcohol isn’t vanishing; it’s being redefined. Instead of frequent, automatic drinking, many Americans now drink with more intention, choosing special occasions, lighter products, or skipping entirely. Brands are adapting with low-ABV and non-alcoholic options.

The backdrop is unmistakable, and wellness-driven consumers, generational turnover, and new competitors like cannabis are all reshaping the landscape. Whether this decline flattens or continues is uncertain, but one thing is clear. The old status quo of alcohol as the centerpiece of American life isn’t coming back anytime soon.

How the Industry Is Fighting Back

Alcohol makers aren’t sitting idle. Wineries are trying canned and flavored wines to draw in new buyers. Breweries are experimenting with lower-calorie beers and collaborations. Distillers are crafting low-ABV spirits to meet wellness demand. But experts agree the industry can no longer rely on nostalgia or health claims.

Rob McMillan said, “You can’t market wine as medicine when consumers know better.” To survive, brands must lean into authenticity, sustainability, and innovation, meeting consumers where they are, not where tradition says they should be.

The New Era of Mindful Drinking

Drinking rates at record lows reflect not rejection but a recalibration as people want control, clarity, and balance. They want social connection without regret the next morning. This “sober-curious” era is less about abstinence and more about choice.

It reflects broader cultural shifts in many ways – prioritizing health, demanding meaning, and rejecting habits that no longer serve. Alcohol isn’t gone, but its role is different. What’s in the glass matters less than who you’re with, and that’s the story Americans seem ready to write.