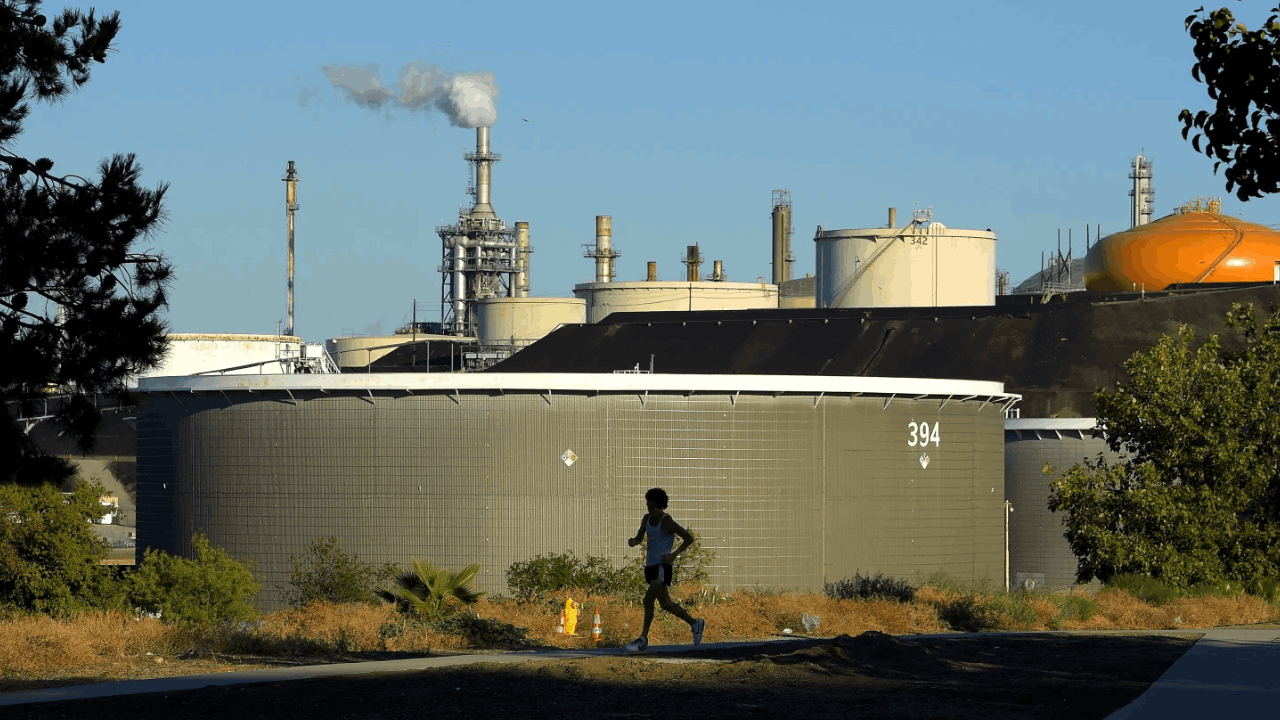

California’s Phillips 66 Los Angeles refinery is scheduled to cease operations in October 2025, resulting in a daily reduction of 139,000 barrels (approximately 8% of the state’s capacity). While officials dispute predictions, UC Berkeley’s Borenstein warns of “severe gasoline shortage and unprecedented price increase.”

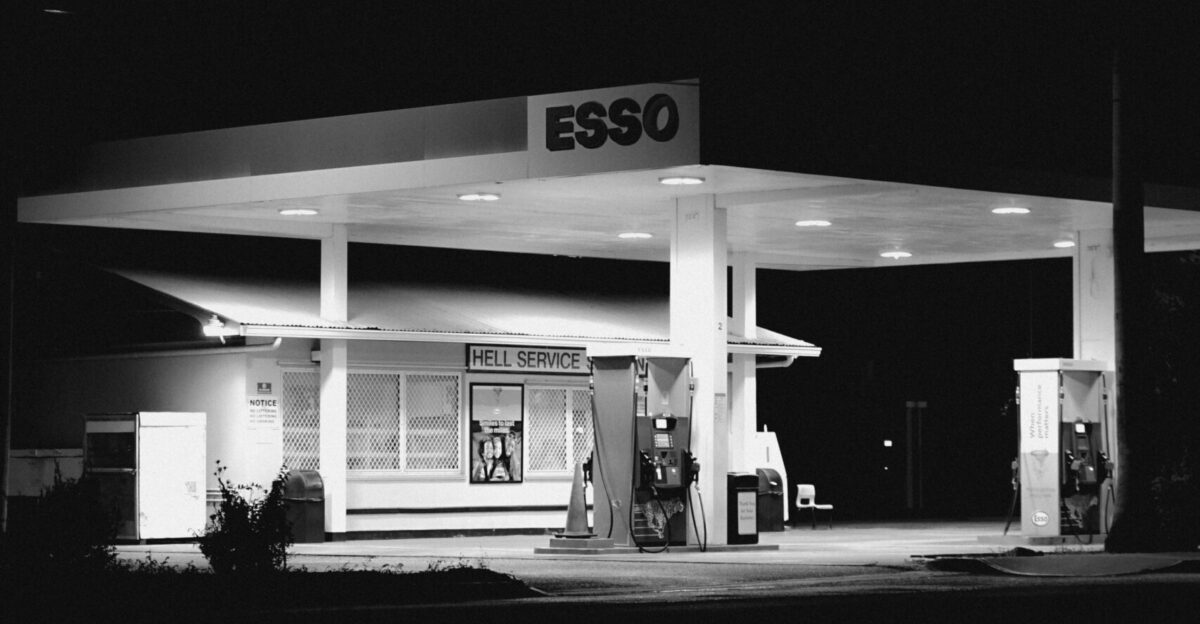

According to AAA, the current average gas price is $4.66 per gallon. The relationship between capacity loss and demand can lead to potential price spikes.

Capacity Crisis Scale

Phillips 66’s closure represents 8% of California’s refining capacity. If Valero Benicia closes as well, the total loss would exceed 17%.

The U.S. Energy Information Administration states this will have “outsized impact” because “the supply shortfall cannot be easily filled by other refineries elsewhere in the country.”

Expert Warnings vs. State Dismissals

UC Berkeley’s Severin Borenstein warns refinery closures “would reduce total production faster than consumption will decline, resulting in severe gasoline shortage and unprecedented price increase.”

Governor Newsom’s office has dismissed the $8 predictions as “FALSE,” while Stanford economists anticipate a more modest 15-cent increase. The debate centers on the extent of the increases, not their likelihood.

USC Professor’s $8 Analysis

USC Professor Michael Mische’s 40-year analysis predicts that gasoline prices could rise to $6.43-$6.45 per gallon after the closure of Phillips 66, and potentially reach $8.43-$8.44 after a second closure, marking a 75% increase.

His research shows a strong correlation of 0.641 between changes in California’s GDP and gasoline consumption.

California’s “Island Effect” Amplifies Impact

California’s unique fuel specifications and lack of pipeline connections to other U.S. regions create an “island” market.

This geographic isolation hinders prompt responses to supply disruptions, often resulting in significant price spikes that exceed normal fluctuations in supply and demand.

Historical Precedent for Extreme Spikes

The 2015 Torrance refinery fire caused prolonged price increases for over a year.

In February 2025, a fire at the Martinez refinery resulted in a 42-cent increase in Northern California gasoline prices over just two weeks. The October 2025 fire at Chevron’s El Segundo facility further underscores the vulnerability of refinery operations.

Regulatory Costs Compound Crisis

State taxes, cap-and-trade, and low-carbon fuel standards add $1.25 to the price of each gallon of gas, which is about twenty-seven percent of what you pay at the pump, according to an analysis by the Independent Institute.

These costs remain the same regardless of the supply situation, making price increases due to demand even higher for consumers.

Limited Import Relief Options

California’s fuel rules limit options for finding substitutes during shortages. Relying more heavily on imports from Asia and the Gulf Coast increases supply chain risks and transportation costs.

Fluctuations in global crude prices make it even harder to find affordable replacement supplies during domestic shortages.

Policy Response Insufficient

Governor Newsom’s approval of E15 ethanol offers only limited help compared to the significant loss in capacity. It also requires substantial investment in infrastructure.

While strategic reserves can provide temporary relief, they do not address the underlying issue of reduced capacity. Furthermore, the growth of electric vehicles cannot quickly solve current supply issues.

Economic Stakes

California has a “mystery gasoline surcharge” that costs $20 million every day, according to economists at UC Berkeley. This has been happening since 2015.

It shows that the market can set higher gasoline prices, even when we can’t explain the reasons. This raises concerns that prices could rise even further during actual shortages.

Workforce Paradox

Refinery closures eliminate 900 direct jobs while creating supply shortages—job losses coinciding with increased import dependence.

This highlights California’s challenging transition between environmental goals and energy security, with economic and social costs concentrated on working families.

Market Vulnerability Demonstrated

Recent incidents highlight California’s supply fragility, as seen in the Martinez fire (resulting in a 42-cent increase), the Chevron fire (immediate regional impact), and seasonal maintenance (leading to price spikes).

Single incidents already cause significant increases; their effects will magnify dramatically after a 17% reduction in capacity.

Progressive Price Timeline

Industry analysis projects staged increases: the current $4.66 could reach $6.43-$6.45 after Phillips 66 closure, potentially climbing toward $8.43-$8.44 with additional capacity loss.

Projections assume stable crude prices; however, volatility could drive prices higher during periods of supply constraints.

Economic Ripple Effects

Transportation cost increases ripple through California’s entire economy, affecting goods movement and consumer spending. Small businesses face disproportionate pressure as fuel expenses compound existing regulatory costs.

The oil and gas industry supports over 536,000 jobs and $166 billion in economic activity statewide.

Mathematical Reality vs. Political Rhetoric

Multiple independent experts—UC Berkeley’s Borenstein, EIA analysis, USC research—confirm unprecedented supply risks.

The combination of 17% capacity loss, geographic isolation, import limitations, and historical precedent creates conditions where $8 gas becomes mathematically plausible rather than alarmist speculation. Monitoring refinery utilization will help determine whether there are gradual increases or sudden shocks.