On August 11, 2025, gold futures reached all-time highs. Swiss refineries paused shipments to the US, and traders scrambled to make sense of a customs ruling that could disrupt global gold supply, according to Reuters.

Then President Trump posted on Truth Social: “Gold will not be Tariffed!” That single post instantly shifted market sentiment, calming panic.

The Customs Letter That Started Chaos

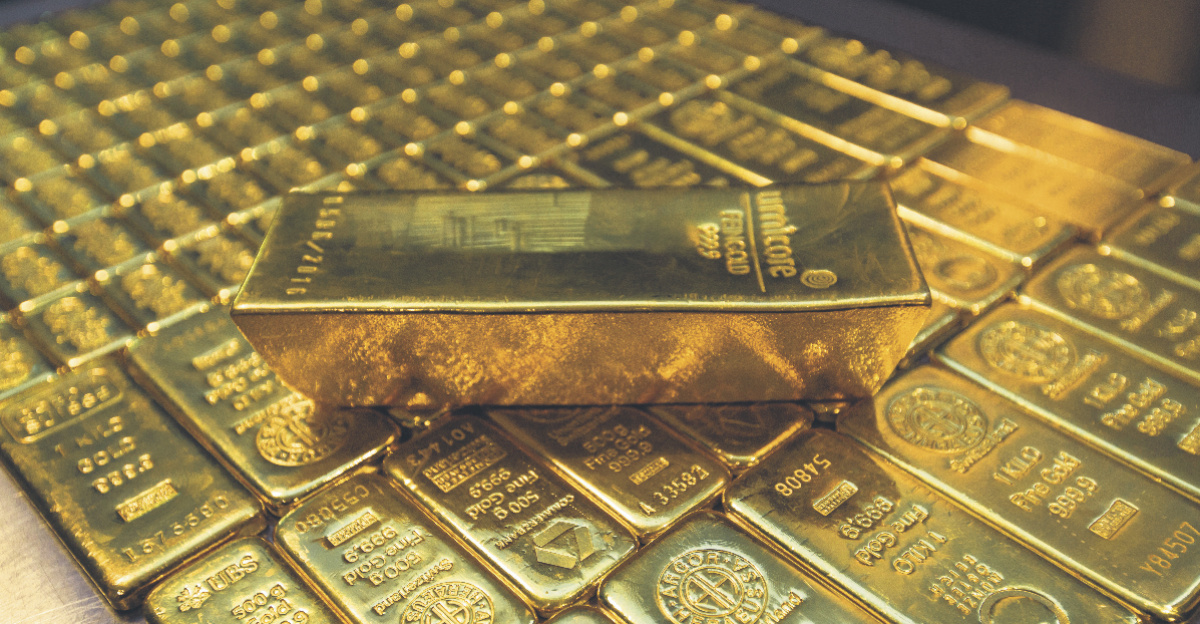

The turmoil began with a July 31 administrative letter. US Customs and Border Protection quietly classified 1-kilogram and 100-ounce gold bars under tariff-bearing codes, according to CNBC.

This letter contradicted assumptions that these products were exempt from Trump’s broader tariff policies. Its delayed public release on August 8 shocked markets and left traders scrambling. The ruling was intended as a response to a Swiss refinery query but ended up triggering widespread uncertainty in global gold trading.

Markets Woke to a Shocking Reality

When the CBP ruling became public on August 8, 2025, global bullion markets were blindsided, according to CNN and CNBC. Traders expected gold, held by central banks worldwide, to remain tariff-free.

The news that Swiss-refined gold bars could face a 39% duty created panic. Switzerland’s bars are the global standard, and the potential duty sent shockwaves through trading floors everywhere. Investors and traders had to quickly reassess risks, supply chains, and pricing for one of the world’s most stable commodities.

Prices Soar to Record Highs

Gold futures on the CME surged to $3,534.10 per ounce on August 8, according to Morningstar, Yahoo Finance, and Topstep. Investors scrambled to account for potential supply disruptions.

The widening spread between futures and spot prices reflected severe market stress. Traders rushed toward safe-haven assets as uncertainty gripped the market. Panic drove unprecedented premiums and highlighted just how fragile even a major commodity like gold can become when policy changes remain unclear.

Switzerland’s Gold Dominance

Switzerland refines about 70% of the world’s gold, according to the World Gold Council and Swiss government data. Major refineries like PAMP, Valcambi, and Argor-Heraeus serve as global quality gatekeepers.

Their “Swiss made” hallmarks guarantee purity for international markets. The tariff threat targeted the heart of global gold production, putting an enormous chunk of supply at risk. Any disruption from Swiss facilities could have caused ripple effects across trading floors and central banks worldwide.

Supply Chain Disruption Hits Hard

Swiss refineries suspended gold shipments to the US, wary of massive tariffs, according to Reuters. The suspension effectively froze the American gold supply.

This disruption threatened shortages in domestic markets and created ripple effects through global trading. The tight connection between mining operations and consumers meant even small delays could impact international flows. Traders watched closely, understanding that Switzerland’s dominance made the pause particularly dangerous.

White House Scrambles

The White House responded on August 8, 2025, with damage control statements, promising an executive order to clarify “misinformation” about gold tariffs, according to CNN.

Officials admitted the routine customs classification had unexpectedly destabilized global markets. While intended as a bureaucratic clarification, the lack of immediate presidential guidance left traders and industry leaders uneasy, prolonging market stress.

Traders Demand Action

Despite assurances, markets stayed tense over the weekend, with prices near record highs, according to Reuters. Traders wanted clear presidential guidance, not just administrative statements.

Swiss industry leaders publicly requested formal, binding clarification before resuming shipments. The ongoing uncertainty showed that markets would not calm without a decisive, public intervention from the president.

The Words That Moved Billions

On August 11, Trump posted on Truth Social: “Gold will not be Tariffed!” Reports from Reuters, Economic Times, and Newsweek confirmed the post.

No explanation was given, but the statement was clear enough to instantly shift sentiment. Traders quickly realized presidential authority outweighed bureaucratic uncertainty, ending days of anxiety and setting the stage for market correction.

Gold Prices Begin to Correct

Markets responded immediately. US gold futures dropped 2.4% to $3,407 per ounce, and spot gold fell 1.2% to $3,357, according to Reuters citing Bloomberg and LBMA data.

The abnormal futures-spot gap narrowed, and investors unwound panic-driven positions. The market began functioning normally again as the presidential statement removed the supply disruption fear that had dominated trading floors for days.

Mining Stocks React

Gold mining stocks fell after the announcement. Barrick Mining dropped 2.8%, and Newmont declined to $68.87.

Investors had priced in supply disruptions and higher gold prices. With the risk premium gone, stocks corrected. The move highlighted how dependent mining valuations are on perceived scarcity and geopolitical risk rather than actual production issues.

Industry Breathes a Sigh of Relief

Analyst Ross Norman told Reuters: “Delighted to hear the crisis has been averted. It will come as an enormous relief to the bullion markets.”

Swiss leaders remained cautious. ASFCMP president Christoph Wild said formal and binding clarification is still needed. The statement encourages trade stability, but only official implementation guarantees certainty for the gold sector and its partners.

Why Gold Is Special

Gold has a unique dual role as a commodity and monetary asset. It underpins central bank reserves, inflation hedging, and trade settlement.

Its systemic importance makes tariffs dangerous. Central bank gold holdings reduce credit risk and stabilize markets during crises. Disrupting this essential asset could have far-reaching consequences for the global financial system, which explains why gold earned a special exemption from US tariffs.

Policy Uncertainty Moves Fast

The episode revealed how modern markets amplify policy uncertainty. A routine customs classification quickly triggered global chaos.

The speed of information flow now forces presidents to intervene personally. Decisions that might have been bureaucratic in previous eras can instantly affect global trading and commodity flows, creating the need for immediate, decisive action.

Crisis Management in the Social Media Age

Trump’s Truth Social post solved a multi-billion-dollar crisis in seconds. Five words: “Gold will not be Tariffed!”, stabilized markets instantly.

The approach shows how presidential communication has evolved to match market speed. Rather than complex policy statements, a clear, public message prevented panic. The episode may set a precedent for future market interventions, demonstrating the power of rapid social media communication in global finance.

Market Memory and Vigilance

Traders learned that even assumed exemptions can be questioned. Markets are now hypersensitive to regulatory signals.

The precedent of presidential intervention via social media raises expectations for rapid responses to future policy confusion. This could increase market volatility if clarity isn’t immediate. Investors remain cautious, remembering how quickly chaos escalated this August.

Central Banks Take Note

Central banks’ gold holdings are rising rapidly, with over 1,000 tonnes accumulated annually for three years, triple the previous decade’s pace, according to the World Gold Council.

Any disruption affects global monetary stability. The episode highlighted gold’s growing importance as a hedge and diversification tool, reinforcing why institutions treat it as a core component of reserves outside US dollar assets.

Geopolitical Ripples

The tariff scare showed US leverage over global gold flows. Switzerland, neutral and economically stable, suddenly faced vulnerability to US trade policy, refining roughly 70% of world gold, according to industry sources.

This illustrates how economic nationalism can unintentionally weaponize commodities. Other nations may accelerate alternative trading and refining networks to reduce dependence on US policy decisions, reshaping global gold flows in the long term.

Regulatory Lessons

A customs ruling on July 31 almost destabilized a market crucial to global finance. MTB Metals’ query on 1-kilogram and 100-ounce bars highlighted gaps in coordination between trade policy and financial stability.

Future administrations will need mechanisms to anticipate systemic risks of administrative decisions. Gold’s role as a monetary asset means even minor regulatory changes can have outsized effects, demanding proactive policy planning to protect international markets.

Presidential Authority Meets Market Reality

Trump’s gold exemption revealed the power of decisive executive communication. Five words posted on social media moved billions in assets and restored stability.

The crisis showed how fragile global systems can be when administrative actions lack coordination with policy.

As markets become instantaneous and interconnected, presidential clarity has become crucial for maintaining stability, signaling a new era in crisis management where rapid intervention is sometimes more effective than traditional policy processes.