Cracker Barrel Old Country Store, founded in 1969, has long been a beloved symbol of Southern comfort food and nostalgia.

With over 660 locations today, the chain built its success on kitschy country-store decor and menus of buttermilk biscuits and chicken ‘n’ dumplings.

Lately, however, Cracker Barrel’s image and finances have faltered. In late 2025, the company grappled with fierce backlash over abrupt brand changes and slowing sales. Once celebrated for its heritage, the company now finds its “bottom line” and reputation on shaky ground.

Backlash Grows Loud

In August 2025, Cracker Barrel rolled out a sleek, modern logo that dropped its iconic “Uncle Herschel” figure.

The reaction was immediate and viral: customers erupted in social media outrage, and conservative influencers (including Donald Trump Jr.) led the call to abandon the change.

Within days, Cracker Barrel’s stock value plunged – the chain “found itself at odds with its fans” and saw its share price sink sharply after unveiling the new text-only design. The market reaction and online fury made clear that longtime fans would not take the redesign lightly.

Maple Street’s Fast Start

In parallel, Cracker Barrel had spent recent years pursuing growth through its 2019 acquisition of Maple Street Biscuit Company. The $36 million deal gave Cracker Barrel a trendy fast-casual chain serving biscuit sandwiches and brunch.

Maple Street quickly expanded from 28 stores (and five franchises) in seven states to nearly 70 locations by the end of 2024.

Early store openings attracted crowds hungry for the biscuits-and-fried-chicken concept. By tapping this niche, Cracker Barrel sought to capture younger breakfast lovers while diversifying beyond its old-time country format.

Pressures Mount

But the momentum hit headwinds. In 2024–25 Cracker Barrel warned of macro pressures: inflation and rising menu prices were forcing many diners to cut back on eating out.

As Reuters noted, consumers were “tempering spending on dining out due to high menu prices and sticky inflation”. Meanwhile labor costs remained elevated and competitors pushed into breakfast niches.

These factors dampened Cracker Barrel’s same-store sales. Executives began to pull back aggressive expansion plans and warned that both the legacy chain and its Maple Street offshoot needed steadier footing.

14 Maple Street Closures

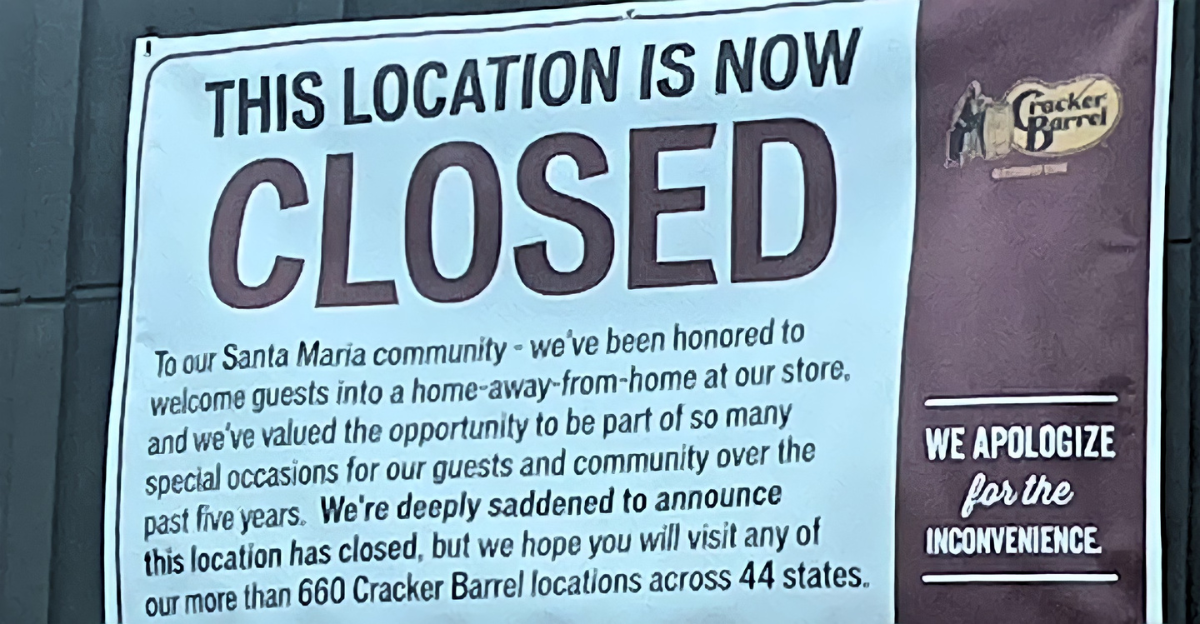

That caution culminated in a sweeping retreat: in September 2025 Cracker Barrel confirmed it will close 14 Maple Street Biscuit Company outlets in fiscal year 2026. That represents roughly one in five of Maple Street’s locations.

This decision reversed earlier forecasts – executives had expected to open four new Maple Street stores in FY2025 but now plan none.

CFO Craig Pommells said leadership is reallocating capital toward Cracker Barrel’s core business, noting that Maple Street’s growth was being “slowed” while the parent brand was being strengthened. The closure count – the chain’s sharpest contraction ever – signals a dramatic scaling back of the fast-casual push.

Regional Ripple

Most Maple Street Biscuit Company cafes are clustered in the Southeast – Florida, Tennessee, the Carolinas and Georgia – reflecting the chain’s Southern roots. In those communities, the closures are being felt by employees and patrons alike.

Local diners lament losing one of their favorite breakfast spots, and dozens of workers face an uncertain future. Franchise partners in several states must now adjust plans.

While Cracker Barrel reassures that Uncle Herschel and other traditions remain intact, the loss of familiar Maple Street restaurants has left a tangible void in neighborhoods from Atlanta to Orlando.

Real Customer Voices

Customers made their feelings known. In Naples, Florida, retiree Jack Graeve told local media, “I don’t like it. I wish that they would keep it the way that it is… the whole time it was meant to be this old country store, and now that’s changing”. Such comments reflect a deep emotional attachment to Cracker Barrel’s vintage image.

Hearing this outcry, CEO Julie Felss Masino moved quickly to apologize. On a recent investor call, she acknowledged Cracker Barrel had underestimated “the deep connection customers feel toward the company’s nostalgic imagery”.

The chain then issued an emphatic statement to customers: “We thank [our] guests for sharing their voices and love for Cracker Barrel… Our new logo is going away, and our ‘Old Timer’ will remain”.

Industry Peers Watch Closely

Cracker Barrel’s missteps have not gone unnoticed by rivals. In the breakfast and comfort-food space, chains like First Watch, Biscuitville, and local country diners see openings in Cracker Barrel’s turmoil.

Investors in peer brands note that vacating one’s core identity can invite competition. For now, Cracker Barrel’s peers are largely silent, avoiding any gloating as media cameras scrutinize the unfolding crisis.

But analysts point out that any loss of customer loyalty is an opportunity: “Some of Cracker Barrel’s customers may sample alternatives,” says one industry watcher.

Restaurant Industry at Crossroads

Cracker Barrel’s saga is emblematic of broader restaurant-industry challenges. Chains across America – especially mid-sized family dining brands – are wrestling with fickle tastes, labor shortages, and inflationary pressure.

Many have experimented with sleeker looks and updated menus to attract younger diners. Marketing professor Gina Tran observed that companies often “have a lot of emotional attachment [to logos]… in an effort to reach a younger audience… they went with a sleeker, modern design”.

Yet she warned that such moves risk backlash if done too abruptly. In Cracker Barrel’s case, the attempt to modernize collided with deep customer nostalgia.

Multi-Million Dollar Hit

The Maple Street pullback also hit Cracker Barrel’s finances. In the fourth quarter of fiscal 2025, the company took a $16.2 million impairment charge for underperforming Maple Street units.

This non-cash write-down reflects lost goodwill as executives admitted to overestimating the brand’s potential. The charges came on top of earlier write-downs and a pause in new store openings, amplifying investor concern.

Meanwhile, Cracker Barrel’s core restaurants softened: same-store sales growth slowed and traffic dipped. The combined effect was a material drag on quarterly earnings, far worse than the company had forecast just months before.

Tension at the Top

Unsurprisingly, shareholders voiced outrage. Veteran Cracker Barrel investors publicly lambasted management for the upheaval.

Activist investor Sardar Biglari – a longtime shareholder – launched a new proxy fight, calling CEO Masino’s strategy “worse than mediocre” and arguing the branding changes had “betrayed the company’s heritage, alienated loyal customers, and undermined investor confidence”.

In boardroom discussions and industry circles, other investors echoed similar themes: they questioned why leadership seemed bent on abandoning proven formulas in favor of untested trends.

Leadership on Defense

Faced with mounting criticism, CEO Julie Felss Masino went on the defensive. Just months into her tenure (she took the helm in early 2024), Masino had championed Maple Street and a brand refresh, only to see both plans blow up.

In interviews and on the September earnings call, she acknowledged missteps. As Fox News’ Sophia Compton reported, Masino said the chain “underestimated the deep connection customers feel” toward its old-time imagery and vowed to “pivot quickly” back to tradition.

Internally, the board held emergency meetings to restore confidence.

Refocusing Strategy

Cracker Barrel executives say the store closures and rebranding retreats are all part of refocusing on the core business. CFO Craig Pommells has emphasized that “our top capital allocation priority is investing in the core Cracker Barrel business”.

In other words, the company will slow down Maple Street growth while shoring up its legacy chain. Masino echoed this stance, noting that the team is “insanely focused on Cracker Barrel and working very, very hard on the strategic transformation”.

Moving forward, Cracker Barrel has announced no new Maple Street openings for now, and the write-downs allowed more funds for menu improvement, marketing and labor at its traditional restaurants.

Sober Analyst Outlook

Despite these remedies, analysts remain cautious. Cracker Barrel’s own forecasts now assume traffic headwinds: the finance chief said comparable store traffic is expected to drop 7–8% in the current quarter.

Morningstar analysts also note that full-year comparable traffic could decline as much as 4–7% in fiscal 2026. Such steep contractions are a red flag.

Industry observers warn that even after any logo reset, reviving foot traffic will require more than nostalgia alone. “We’ve factored all of this into our guidance,” Pommells told investors, but unnamed analysts suggest comparable sales could fall by mid-single-digits next year absent a significant strategy shift.

Looking Forward

The key question now is how far Cracker Barrel must go to turn the tide. Can simply recommitting to its Southern-charm roots be enough, or are deeper changes still needed? Masino insists the goal was always to “freshen things… in such a way as to be noticeable and attractive but still feel like Cracker Barrel”.

Management now touts customer favorites (like Uncle Herschel’s Breakfast and early-bird specials) and new grassroots marketing, hoping to rebuild trust. At the same time, competitors may double down on innovations.

Whether the chain’s renewed emphasis on tradition will regain momentum remains uncertain. The outcome will shape not just Cracker Barrel’s future, but perhaps offer lessons for any brand balancing heritage with innovation.

Political Undercurrents

The Cracker Barrel controversy even took on political overtones. On social media, former President Donald Trump waded into the debate, posting a satirical video of himself dancing with Uncle Herschel and urging the chain to “go back to the old logo”.

Trump’s active commentary (including a Truth Social post) amplified the story beyond food industry pages into national news.

At one point, a White House aide shared a mocked-up “Go woke, go broke” Cracker Barrel image in response to the uproar. While the company sought to keep the focus on customers, the saga became a talking point in conservative circles about corporate branding and cultural values.

National Impact

The fallout has rippled far beyond any single market. With nearly 660 Cracker Barrel restaurants spread across the South and Midwest, and Maple Street’s 69 outlets in seven states, the strategy shift affected multiple regions.

Franchise partners and suppliers have had to adapt plans or absorb cutbacks. For example, companies that supplied baking ingredients, chicken, and produce to Maple Street locations will see reduced volume.

Local franchised Maple Street stores (there were five franchises) must now chart a new course as the chain cuts corporate support. The lesson has resonated in restaurant boards nationwide: even a minor regional chain’s misstep can cause headaches for employees, vendors, and communities from Texas to Ohio.

Legal and Financial Fallout

Cracker Barrel’s misadventures have had real financial costs and legal scrutiny. In one month in August–September 2025, the stock lost roughly 16% of its value (amounting to well over $100 million in market cap) amid sliding sales. By year-end, shares were down over 10% from the start of 2025.

Investors have questioned management’s fiduciary responsibility. The Maple Street write-downs alone ($16.2M impairment) were sizeable for a $3+ billion company.

Activists like Biglari are publicly criticizing the board: he is urging shareholders to withhold votes for the CEO and others, claiming they failed in stewardship. Behind the scenes, lawyers for investors may even review whether any proxy disclosures or governance standards were breached.

Changing Tastes

Industry analysts say the episode serves as a cautionary tale. Branding experts note that Cracker Barrel’s attempt to modernize “went against their brand story,” replacing a logo with “genuine symbolic currency” with a “very generic looking logo that doesn’t tell a story”.

One consultant observed that the original imagery was a “throwback to a simpler time” – exactly the quality that made customers feel at home.

Had Cracker Barrel managed tastes differently – for example, by gradual test markets or clearer storytelling – the outrage might have been tempered. As one branding professor put it, the most successful rebrands are those that evolve slowly to give customers time to adjust.

The Road Ahead

The Cracker Barrel saga highlights how tricky balancing tradition and innovation can be – but also hints at opportunity. Some experts praise the chain’s swift retreat as a “positive course correction” that can reinforce its heritage.

With its core identity back in place, Cracker Barrel has a chance to win back wavering fans and attract new ones in a crowded market. As CEO Masino put it in early 2024, the aim was “to freshen things… but still feel like Cracker Barrel”.

Going forward, the company’s real test will be whether it can draw from this blow-up to carefully update its image and menu without losing the soul that long defined it. For brands everywhere, Cracker Barrel’s experience is a reminder: bold change can be perilous, but thoughtful adaptation – grounded in listening to customers – can ultimately create a stronger, more resilient business.