America’s largest magnesium producer has ground to a halt. In September 2025, US Magnesium filed for Chapter 11 bankruptcy, exposing a deep industrial crisis. The company laid off roughly 186 workers – about 85% of its payroll – as international lithium and magnesium prices collapsed.

A November 2024 state notice cited “a dramatic decrease in lithium carbonate prices … largely due to oversupply from foreign producers,” and warned that plant operations could only resume once prices recovered.

The filing listed assets and debts in the $100–500 million range. In a statement, US Magnesium said the reorganization “provides a framework to preserve the value of our business, honor our commitments to employees and partners”.

Strategic Vulnerability

Magnesium is a critical metal for the U.S. military, yet the global market is dominated by rivals. Today, China (and Russia) produce roughly 85–90% of the world’s primary magnesium.

The Pentagon uses magnesium for missile casings, aircraft frames, rocket components, and defense electronics, valuing its strength-to-weight advantage.

With US Magnesium idled, military planners face unprecedented foreign dependence at a time of rising geopolitical tension. America has no other large-scale magnesium smelter to call on, leaving defense contractors scrambling for a secure supply as Chinese producers undercut prices.

Industrial Legacy

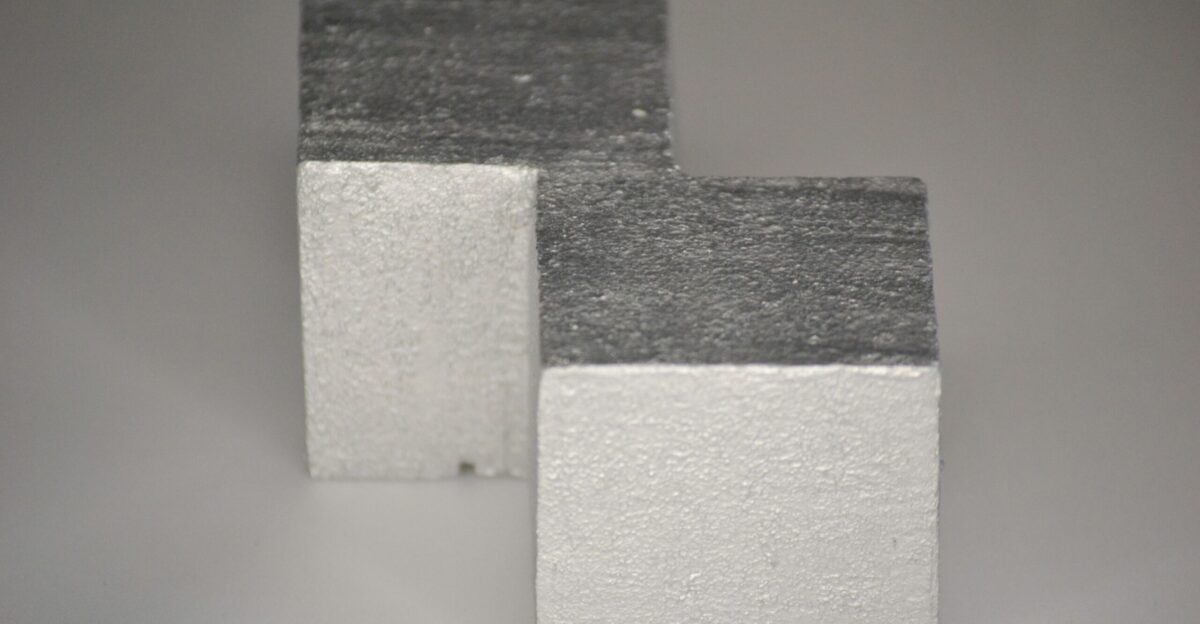

US Magnesium has been mining Utah’s Great Salt Lake brines since 1972 to produce pure magnesium metal. For decades, it turned brine into magnesium, magnesium alloys, and salts (and more recently, small amounts of lithium) to supply autos, electronics, and defense manufacturers.

As Utah’s largest magnesium supplier, its Rowley facility became the only domestic source of primary magnesium and a cornerstone of American industrial independence.

At its peak, the plant refined over 60,000 metric tons of magnesium annually. Even as it shifted toward lithium extraction recently, the company’s long history tied it deeply to U.S. manufacturing and national security.

Mounting Pressures

The plant had been beset by mounting troubles. Regulators in Salt Lake and Washington pinned major pollution on the plant: one study estimated its halogen emissions generated as much as 25% of Wasatch Front winter smog.

This led Utah officials to pursue lease terminations on environmental grounds. Meanwhile, production collapsed. An equipment failure in 2021 forced a pause in magnesium output, and by 2022, the plant had largely idled its furnaces.

Efforts to build a giant EPA-mandated barrier wall to contain toxic waste ponds also stalled amid funding disputes.

Bankruptcy Filing

On September 10, 2025, the company formally sought Chapter 11 protection in Delaware. The petition listed roughly $100–500 million in assets and a similar range of liabilities.

The Renco Group (Ira Rennert’s holding company) is the sole owner and moved quickly to lead the restructuring. Wells Fargo Bank agreed to provide fresh debtor-in-possession financing to keep the lights on during bankruptcy (reportedly $20M), but major debts remain.

US Magnesium’s lawyers say the goal is a reorganization sale: “The filing provides a framework to preserve the value of our business, honor our commitments to employees and partners,” the company explained.

Regional Impact

In Utah, the plant’s troubles reached beyond the plant gates. State officials have now taken court control of the 4,525-acre site after US Magnesium abruptly halted work on a massive EPA-required retaining wall.

That $37+ million underground barrier was meant to isolate highly acidic waste ponds from the Great Salt Lake. With construction stopped, regulators worried the ponds – covering over 400 acres – could leach contaminants.

A court-appointed receiver now monitors the site. Tests show soil and groundwater at the site are tainted: water in the ponds is said to be near “battery-acid” levels of acidity. Local communities fear that any spill or runoff would further damage the lake’s ecosystem.

Human Cost

The sudden shutdown hit workers hard. Most of US Magnesium’s roughly 220 Utah employees found themselves out of work. In late 2024, the company laid off 186 people, citing “deteriorating market conditions” for lithium.

In an official notice to the state’s workforce agency, management wrote: “We are hopeful that these layoffs will be temporary in nature, but we are unable to guarantee this”. Families that had relied on stable manufacturing jobs now face uncertain futures.

Many workers and retirees worry about lost pensions and benefits. Local officials, from mayors to chambers of commerce, have since been lobbying the bankruptcy court to protect jobs.

Market Dynamics

Worldwide, suppliers are scrambling to respond. Beyond China’s 85% share of output, no NATO ally currently has a major magnesium plant. A Silicon Valley start-up called Magrathea is racing to change that: backed by the U.S. Defense Department, it has opened a pilot facility in Oakland using seawater to produce magnesium.

The company says its electrolyzer is “the first new commercial-scale magnesium facility in the U.S. in the past 50 years”.

Magrathea CEO Alex Grant warns: “Magnesium is one of the most important critical materials, but NATO countries face a dire shortage of non-China supply.” Others are exploring smaller-scale recycling or alloy alternatives.

Supply Chain Crisis

Defense and high-tech sectors now face real pinch points. Magnesium’s unique lightness and strength make it irreplaceable for many missiles, aircraft, and precision bombs. The Tomahawk cruise missile and F-35 fighter jet both rely on magnesium alloys; even smart “jam” weapons and drones use magnesium structural parts.

In electric cars, magnesium components shave weight and extend range. Industry analysts warn that prolonged shortages could delay weapons production schedules and vehicle rollouts.

“No substitute can easily match magnesium’s combination of light weight and strength,” notes one military logistics official. With US Magnesium offline, contractors say they may have to retool designs or tap costly stockpiles, slowing development across multiple programs.

Critical Mineral Squeeze

China is now weaponizing the wider minerals market. In late 2024, Beijing restricted exports of seven rare-earth elements – and hinted it could curtail others – as leverage in geopolitical disputes. That move sent shockwaves through defense supply chains.

In this environment, American demand is acute: the U.S. already imports over 54% of its magnesium.

With domestic production evaporating, strategic dependence rises sharply. As one think-tank analyst bluntly observes, “By restricting access to critical minerals, China has the potential to do serious damage to the US defense industry.”

Environmental Standoff

The conflict has put Utah regulators and the military on a collision course. In recent months, the state sued to cancel US Magnesium’s lake leases, arguing violations of environmental agreements.

When asked if the move would end operations, Utah Lands Director Jamie Barnes was unambiguous: “We’re proceeding with an administrative hearing to cancel US Mag’s lease agreement,” Barnes said. “That means the company will no longer be able to operate on the Great Salt Lake.”.

Barnes pointed to the massive waste pond risk as justification. US Magnesium counters that halted magnesium production already stops the pollution. Now the bankruptcy judge and environmental courts must sort out whether EPA-mandated cleanups (including a federally-supervised Superfund plan) can be overridden by the need for national security.

Ownership Struggles

Much of the drama stems from Renco’s colorful history. Ira Rennert, age 90, and his private Renco Group now own US Magnesium. Rennert has previously faced courtroom blows: in 2015, he was ordered to pay $118 million for looting an earlier magnesium firm (MagCorp) to finance his Hamptons mansion.

His companies also operate a Peruvian lead mine embroiled in a mass poisoning lawsuit by 1,400 Peruvian children.

Observers note Rennert’s vast wealth – including a $425 million beachfront estate – even as environmental and legal debts mount. Utah’s regulators and injured parties in Peru see history repeating, warning that Renco could again use bankruptcy to shift obligations onto taxpayers and creditors.

Restructuring Strategy

Renco insists bankruptcy is meant to rescue, not ruin, the operation. Company representatives emphasize that much of their investment has been “sunk costs” – tens or even hundreds of millions pumped into Utah over decades to modernize equipment.

Renco spokesman Jim McCarthy told the court that the Chapter 11 case offers “a framework to preserve the value of our business, honor our commitments to employees and partners”.

The hope is to identify a buyer or investors who will reopen the plant with upgraded emissions controls, keeping magnesium flowing at home. But success hinges on resolving potentially $100–200 million in outstanding obligations – from creditor claims to environmental fines – and on persuading lenders and regulators of the plan’s viability.

Expert Skepticism

Many analysts remain doubtful. Market veterans note that underlying conditions – Chinese price dumping and tough U.S. environmental rules – have not changed. As one industry report observes, U.S. Magnesium “has been through a tough few years,” with magnesium prices collapsing due to global oversupply and heavy Chinese competition.

Environmental lawyers point out that a single RCRA violation or spill could upend any recovery plan. For now, experts say US Magnesium will likely need hefty government subsidies or tariff protections to make a comeback realistic.

Without them, bankers and engineers privately warn, America may simply buy its next warplane parts overseas.

Forward Uncertainty

The looming question: will US Magnesium’s collapse mark the end of America’s domestic magnesium industry or be the catalyst for renewal? In the next months, bankruptcy judge rulings and state hearings will reveal whether the plant can resume under new ownership or must be dismantled to protect the lake.

Critics fear surrendering this raw material channel cedes strategic ground to rivals. Supporters argue that if costly cleanup and emissions rules make domestic mining untenable, then America must find greener alternatives.

The nation’s response will test whether critical mineral policy rises above geopolitics or falls victim to it.

Policy Implications

By statute, magnesium is deemed a strategic mineral, which in theory unlocks emergency powers under the Defense Production Act. Yet to date, no significant U.S. stockpile has been built, nor have incentives been deployed to spur new smelters.

Now, Pentagon officials are quietly negotiating with NATO allies and friendly producers for magnesium purchases. On Capitol Hill, lawmakers from both parties are drafting emergency legislation. Proposals include using DPA authorities to guarantee loans or buy equity stakes in domestic projects, and reviving federal funding for metallurgy research.

The question is whether Congress will translate crisis into action — or simply watch U.S. capabilities dwindle.

International Ripples

America’s plight echoes globally. NATO countries face the same raw-material crunch: none besides the U.S. has a major primary magnesium producer. European automakers and aerospace firms have already reported alloy shortages as Chinese export curbs kick in.

Across Asia, manufacturers are stockpiling vital minerals. In Japan, electronics giants quietly hoarded magnesium and other metals after Beijing’s announcements.

The move has even prompted talk of a “critical minerals alliance” among Western nations to share scarce resources. In this way, China’s tightening export controls are forcing a new era of mineral diplomacy, testing the resolve of allies to collectively shore up supply chains.

Legal Ramifications

The courts are now the arbiter between competing priorities. On one side is environmental law: EPA’s 2021 settlement required US Magnesium to invest at least $37 million in cleanup and to contain a sprawling, acidic 400-acre waste pond.

On the other side is national security law: the military needs uninterrupted metal flow. Federal judges will have to weigh Utah’s claim that US Magnesium violated its air and water permits against Pentagon urgings to keep the plant alive.

Every ruling will be watched as precedent. A decision to enforce cleanup at the cost of supply may come at the price of readiness; conversely, easing regulations for mining could undermine future environmental enforcement.

Cultural Shift

Americans’ views on this trade-off are shifting. Nationwide, younger voters and environmental activists have generally cheered the prospect of decommissioning US Magnesium’s old refinery. In Utah’s urban corridor, many hailed the lease termination as a victory for cleaner air.

Piper Christian, an air-quality advocate, celebrated on local TV: “This is great news for Utahns,” she said. “US Magnesium has a long history of being a really bad neighbor to us on the Wasatch Front”.

Yet elsewhere – among defense contractors and trade associations – frustration is growing that strict U.S. rules leave Americans less secure. This cultural tug-of-war is emblematic of a larger debate: how to balance local environmental quality with global economic competition in an interconnected world.

Broader Reflection

US Magnesium’s bankruptcy crystallizes a larger national dilemma. Is America to rely on foreign geographies for the raw materials of power, or to maintain industrial bases that sometimes strain our environmental values?

The company’s fall underscores how globalized markets and domestic policies have outmatched one of our last mineral champions. Some experts warn that the collapse is a symptom of broader industrial decline.

Others say it could be a turning point: proof that the U.S. must invest in cleaner mining and processing if it hopes to break free from resource dependence. Ultimately, the saga forces a stark question: can the United States reconcile its economic security with environmental stewardship in an era of resource nationalism?