Peet’s Coffee, the Berkeley-born café chain that helped launch a coffee revolution and even mentored Starbucks, is vanishing from San Francisco neighborhoods where it thrived for decades.

Once a symbol of craft coffee culture in the Bay Area, the brand operated more than 465 locations across the U.S., China, and the Middle East. Yet by month’s end, that footprint will shrink dramatically as part of a massive corporate restructuring.

The Pressure Mounts

The coffeehouse sector faces unprecedented headwinds. Record-high coffee bean prices, combined with Americans’ shift toward home brewing post-pandemic, have squeezed profit margins across the industry.

Starbucks itself closed hundreds of shops in 2025 and laid off 900 employees as part of a $1 billion restructuring. For Peet’s, already operating with 1.2 percent fewer stores than 2023, further contraction seemed inevitable.

A Legacy Under Pressure

Founded in 1966 in Berkeley, Peet’s became the intellectual godfather to specialty coffee in America. The brand’s founder, Alfred Peet, moved to San Francisco dismayed by inferior American coffee, then revolutionized the market.

For six decades, Peet’s stores anchored neighborhoods from the Marina to the Castro, serving as community hubs where locals camped for hours over espresso and pastries. That heritage suddenly feels fragile.

The Acquisition Enters the Picture

On January 15, 2026, Keurig Dr Pepper, the U.S. soft-drink and beverage giant, launched a $18 billion all-cash takeover bid for JDE Peet’s, the Amsterdam-based parent company that owns the Peet’s brand.

Keurig offered 31.85 euros per share, a bid backed by JDE Peet’s board and major shareholders. The deal is expected to close in the second quarter of 2026, setting the stage for dramatic restructuring of the coffee empire.

Thirty Shops Close This Month

By the end of January 2026, Peet’s Coffee will close 30 Bay Area locations, including three beloved San Francisco cafés: the 32-year-old flagship at 2139 Polk Street in Polk Gulch, the neighborhood anchor at 919 Cole Street in Cole Valley, and the Castro gathering spot at 2257 Market Street.

The company confirmed the closures on January 20, citing alignment with “long-term growth priorities and current market conditions.” This represents the first major wave of restructuring under the looming Keurig acquisition.

San Francisco’s Shrinking Coffee Map

The Bay Area alone hosts more than 20 Peet’s locations, yet this closure wave will remove at least three iconic sites from San Francisco’s retail fabric. The Polk Street flagship, open since 1994, was a destination for coffee aficionados willing to pay premium prices for precise espresso technique.

Cole Valley’s café served as a neighborhood third place; the Castro location was equally embedded in local culture. Their simultaneous closure signals a coordinated retreat.

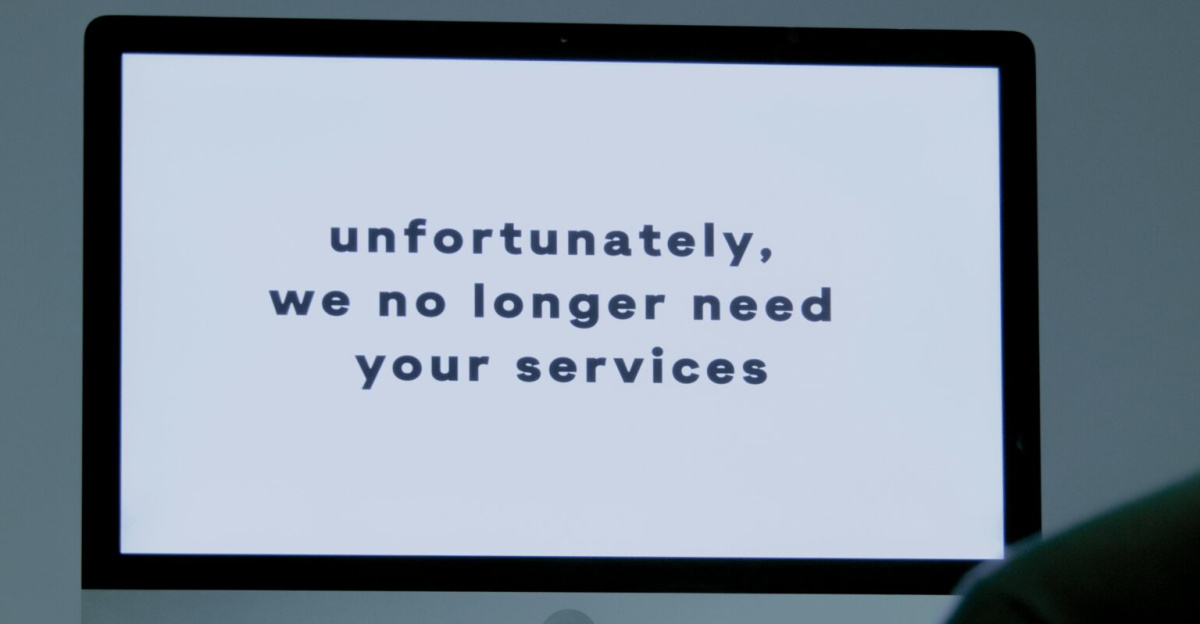

Workers Face Uncertain Futures

The three San Francisco closures alone are estimated to impact 45 to 75 direct employees, according to early reports. Beyond wages, staffers lose stable employment that many described as part of a quality-focused community.

Peet’s leadership offered only a bland statement: “We are deeply grateful to our incredible employees and loyal customers for their continued commitment to the brand,” said Stephanie O’Brien, a Peet’s spokesperson. For hourly baristas and café managers, the gratitude rang hollow.

Competitors Smell Blood

Starbucks, which Peet’s cofounders once advised, now dominates craft-coffee retail. But independent cafés and mid-tier chains like Blue Bottle itself now owned by Nestlé are eyeing Peet’s abandoned corners as expansion opportunities.

The closures also free up prime real estate in San Francisco’s hottest neighborhoods, potentially inviting new concepts or, more likely, higher-margin retail and residential conversion.

A Decade of Decline

Peet’s store count tells a stark story. At the end of 2019, before the pandemic, the chain operated nearly 400 U.S. locations. By the end of 2024, that number had fallen to 255 stores.

The $18 billion KDP deal doesn’t cause this erosion but it accelerates Peet’s management’s willingness to shed underperforming properties. Each closure cuts debt and overhead as the combined entity prepares for its post-deal split into two public companies.

Keurig’s Breakup Plan

Here’s the collateral consequence most observers miss: After the JDE Peet’s acquisition closes in Q2 2026, Keurig Dr Pepper will split into two separate, publicly traded companies.

One will focus on North American beverages (sodas, Dr Pepper, etc.); the other “Global Coffee Co.” will become the world’s largest pure-play coffee business, rivaling Nestlé itself. Peet’s closures aren’t just pruning; they’re reshaping the portfolio for a massive corporate divorce.

Inside Peet’s Strategic Tension

Peet’s leadership faces a harsh reality: the brand is heritage-rich but operationally expensive. Flagship stores require skilled baristas, higher rent, and meticulous training. Meanwhile, Keurig’s acquisition mandate demands cost synergies and margin expansion.

The company’s press releases invoke “long-term growth,” but the subtext is clear selective closures maximize profit per remaining store and prepare the brand for its rebirth under a global coffee giant’s umbrella.

Who Decides? The KDP Corporate Hierarchy

KDP, led by executives oriented toward shareholder returns and operational efficiency, is not sentimental about heritage brands. The company’s press release referenced “KDP’s disruptive legacy” and “cost synergies” corporate language for relentless cuts.

Yet JDE Peet’s board, which endorsed the takeover, approved this playbook. For Peet’s employees and customers, the decision feels both distant and inevitable.

Peet’s Pushback and Adaptation

Behind closed doors, Peet’s management is reportedly exploring ways to retain brand prestige while cutting costs. Some shuttered locations may reopen as smaller, minimalist kiosks in less expensive neighborhoods or inside grocery chains.

The company has not publicly announced a recovery plan, but industry observers expect selective reopenings in high-traffic, lower-rent settings as KDP integrates the business post-closing.

Expert Skepticism on Revival

Coffee-industry analysts doubt Peet’s can reclaim its cachet after mass closures and a corporate conglomerate’s acquisition. “Once you close flagship locations and centralize operations, the craft narrative breaks,” said one beverage analyst tracking the deal.

Peet’s premium positioning depends on perceived artisanal care hard to maintain if stores shutter and staffing shrinks. The brand may survive; its soul is another matter.

What Comes Next for San Francisco?

The question now: who fills the void? The Polk Street and Castro locations are prime real estate in expensive neighborhoods.

Will new cafés or restaurants move in, or will landlords lean into higher-margin retail and housing? For San Francisco’s identity as a coffee-culture capital, the loss of Peet’s flagships signals a broader shift away from local, independent institutions toward corporate chains and tech-driven quick-service models.

The Bigger Picture: Consolidation in Coffee

Peet’s retreat reflects a seismic shift in the global coffee industry. Nestlé dominates retail coffee worldwide; Starbucks controls American café culture; now KDP is assembling a worldwide pure-play coffee powerhouse that will dwarf traditional roasters.

Independent coffee shops and heritage brands like Peet’s are increasingly caught between hobbyist home-brewing on one end and mega-conglomerate consolidation on the other. The middle ground is vanishing.

International Ripples

JDE Peet’s operates across Europe, Asia, and the Middle East under various coffee and tea banners. The KDP takeover will likely trigger similar closures in underperforming international markets.

Amsterdam-based JDE Peet’s, once an independent force, will now answer to Kansas City–based Keurig, shifting strategic decisions from Europe to the American heartland. International employees and retailers face the same uncertainty as San Francisco baristas.

Labor and Community Advocacy

Bay Area labor organizations and neighborhood advocates have begun pushing back. A coalition of San Francisco supervisors and café workers’ groups are calling for Keurig to preserve jobs and offer relocation assistance.

However, without legal leverage, their appeals remain symbolic. The acquisition machinery approvals, antitrust clearance, synergy targets moves faster than civic sentiment can counter.

The Generational Reckoning

For older San Francisco residents, Peet’s closures sting as another erosion of the city’s character. The brand embodied a pre-tech-boom café culture a place where you lingered, debated ideas, and belonged to a community.

Younger tech workers, meanwhile, prioritize convenience and customization, often opting for delivery or office espresso machines. Peet’s belonged to a vanishing era; its closures are a symptom, not a cause.

What Peet’s Closure Really Signals

Peet’s Coffee closures are not an anomaly but a harbinger. As coffee commoditizes, rents spike, and corporate consolidation accelerates, even storied independent chains cannot survive without mega-conglomerate backing.

The $18 billion Keurig acquisition is a rational business move but it’s also a funeral rite for the era when Peet’s could stand alone. What replaces it will be bigger, leaner, and less tethered to place. The coffee may taste fine; the soul, though, is gone.

Sources:

SF Gate “Peet’s Coffee Close Multiple SF Locations Amid $18B Takeover”

SF Chronicle “Peet’s Coffee Is Closing Numerous Shops Across the Bay Area”

SFist “Berkeley-Born Peet’s Coffee Closing 30 Bay Area Locations”

Reuters “Keurig Dr Pepper Launches $18 Billion Takeover Bid for JDE Peet’s”

Yahoo Finance “Popular Coffee-Chain to Close 30 Locations Next Week Amid $18B Acquisition”

TheStreet “Starbucks Rival Coffee Chain Peet’s Coffee Closes Dozens Locations Permanently”