Hundreds of employees learned their roles were disappearing as 2026 began, even as trillions of dollars continued to move through the firm they worked for.

BlackRock confirmed it was cutting about 250 jobs worldwide—roughly 1 percent of its workforce—marking another round of reductions at the world’s largest asset manager.

The decision landed quietly but decisively, hitting investment and sales teams as markets reopened for the new year. And this was only the opening move in a much broader Wall Street shift.

A Weak Job Market Sets the Tone

By late 2025, U.S. unemployment had climbed to about 4.4 percent, hovering near a four-year high. Only around 584,000 jobs were added for the entire year, marking the weakest non-recession performance since 2003.

Forecasts for 2026 suggest monthly job gains could slow to just 40,000 to 60,000. For large financial firms, the message is clear: growth will be harder to come by.

The Rise of a Financial Giant

BlackRock did not become the world’s largest asset manager by standing still. Founded in 1988, the firm expanded aggressively through exchange-traded funds and its iShares platform, steadily absorbing market share.

Assets under management reached roughly $8.7 trillion in 2020 and climbed to about $13.5 trillion by late 2025. Size once meant stability. Now, it brings new pressures.

Post-Pandemic Reality Hits

After years of hiring fueled by pandemic-era growth, companies are now reassessing costs. Artificial intelligence, uneven rate expectations, and geopolitical uncertainty are forcing firms to operate leaner.

In 2025 alone, warehousing layoffs quadrupled compared with the prior year, while tech cuts accelerated. Finance, long insulated, is no longer immune. Efficiency has become the dominant theme across industries.

BlackRock Cuts 250 Jobs

The shift became unmistakable in early 2026. BlackRock confirmed it is cutting around 250 jobs, roughly 1 percent of its global workforce of about 24,600 employees.

Investment and sales teams were among the most affected. The firm said the move was part of its regular annual review process, designed to align resources with long-term client priorities.

A Global Workforce Feels It

The job reductions are not limited to one region. BlackRock’s operations in the United States, Europe, and Asia are all impacted, with New York absorbing a significant share.

The cuts arrive just as the firm reported assets under management of roughly $13.5 trillion at the end of September 2025, underscoring the contrast between record scale and shrinking headcount.

The Human Cost Inside the Firm

For employees, the announcement lands abruptly. Investment professionals and sales staff now face a tougher labor market, even as BlackRock continues to post industry-leading asset totals.

A company spokesperson said, “Improving BlackRock is a constant priority,” emphasizing that workforce decisions are revisited every year. For many workers, that reassurance offers little comfort.

Wall Street Isn’t Alone

BlackRock is far from the only firm cutting back. Citigroup confirmed roughly 1,000 job cuts in New York this week, part of a broader plan to eliminate about 20,000 roles by the end of 2026.

Meanwhile, UBS is preparing additional layoffs following its acquisition of Credit Suisse. The pattern is unmistakable.

A Broader Layoff Wave

Across the U.S. economy, layoffs surged about 65 percent in 2025 compared with the previous year. Government jobs were not spared, with hundreds of thousands eliminated through restructuring efforts in Washington, D.C.

Finance is now joining tech, retail, and logistics in pulling back. The cumulative effect is a labor market losing momentum on multiple fronts.

Third Straight Year of Cuts

This is not an isolated move for BlackRock. The 2026 layoffs mark the third consecutive year in which the firm has reduced its workforce by roughly 1 percent.

Similar cuts occurred in 2024 and 2025, even as assets under management continued to rise. The trend suggests a long-term structural shift rather than a temporary adjustment.

Tensions Beneath the Surface

Repeated workforce reductions have strained morale inside the firm. Some sales teams have questioned the strategic emphasis on alternatives and private markets over traditional public-market offerings.

Leadership argues that reallocating resources is essential for future growth, but internally, the tension between expansion ambitions and cost discipline is becoming harder to ignore.

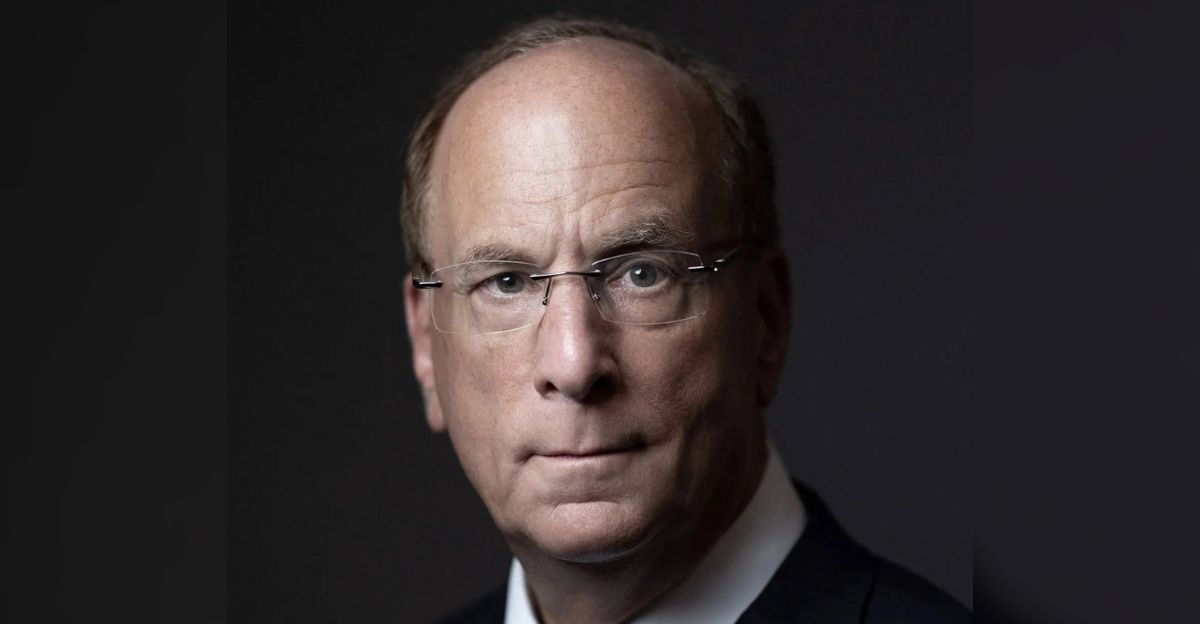

Larry Fink’s Strategic Pivot

Larry Fink has been steering BlackRock toward private credit and alternative investments. The firm’s $12 billion acquisition of HPS Investment Partners, completed in July 2025, marked its largest push into alternatives to date.

Integrating that business has reshaped priorities—and reinforced the rationale for trimming other parts of the organization.

Earnings Loom Large

BlackRock’s fourth-quarter earnings, scheduled for mid-January 2026, will provide the first detailed look at how these changes affect margins. Management has emphasized themes such as AI-driven investing, income products, and diversification.

The layoffs are framed as positioning the firm for volatile markets ahead, but investors will be watching closely for signs of strain.

Economists Urge Caution

Some economists argue the labor market is slowing, not collapsing. Others warn that persistent layoffs could weigh on consumer confidence.

Challenger, Gray & Christmas has cautioned that job cuts may remain elevated well into 2026. BlackRock’s actions reflect broader uncertainty about whether growth can resume without significant hiring.

Margins Versus Manpower

The central question now is whether efficiency gains will meaningfully lift profitability. BlackRock’s scale gives it room to absorb shocks, but its workforce reductions suggest management expects continued pressure.

Hiring plans remain restrained for 2026, even as new investment products roll out. For Wall Street workers, stability feels increasingly elusive.

Policy Uncertainty Adds Pressure

Federal Reserve officials have acknowledged that job growth data may overstate actual gains. Rate cuts aim to support markets, but trade tensions and immigration restrictions add new risks.

At the same time, government layoffs amplify private-sector pain. Policy uncertainty is becoming another factor in corporate retrenchment decisions.

Global Finance Feels the Shift

The pullback is not confined to the U.S. UBS’s restructuring in Switzerland and BlackRock’s global cuts highlight how interconnected financial labor markets have become.

AI adoption and cost discipline are reshaping employment across continents. What begins on Wall Street quickly echoes through Europe and Asia.

AI’s Growing Role

Artificial intelligence contributed to tens of thousands of job cuts across industries in 2025. At BlackRock, AI-focused investment products continue to grow, including ETFs managing billions in assets.

While no legal challenges have emerged from the layoffs, the accelerating shift toward automation raises long-term questions about workforce needs.

A Cultural Reckoning

For younger finance workers, repeated layoffs are reshaping expectations. Loyalty and long-term career paths are giving way to uncertainty and adaptability.

The idea that size guarantees security is fading fast. BlackRock’s experience reinforces a growing belief that even elite firms prioritize efficiency over permanence.

What BlackRock’s Cuts Signal

BlackRock’s decision to cut 250 jobs despite managing roughly $13.5 trillion underscores a stark reality: scale no longer guarantees stability.

As Wall Street’s 2026 layoff wave spreads, firms are choosing efficiency, AI, and alternatives over headcount. The broader signal is unsettling—growth may continue, but fewer workers will be along for the ride.

Sources:

“BlackRock to cut around 250 jobs in latest layoffs.” Reuters, 13 Jan 2026.

“The Employment Situation – December 2025.” U.S. Bureau of Labor Statistics, 9 Jan 2026.

“Citigroup set to cut about 1000 jobs this week, source says.” Reuters, 12 Jan 2026.

“CHALLENGER REPORT – December 2025 Job Cuts.” Challenger, Gray & Christmas, Inc., Jan 2026.