On the night of January 12–13, 2025, explosions and fire ripped through the Atlant Aero defense plant in Taganrog, Russia. Ukrainian-made missiles struck production buildings deep inside Russian territory, roughly 80–150 kilometers from Ukrainian-controlled areas. Satellite images and videos captured flames rising from industrial halls.

This was not a frontline attack—it was a direct strike on a key node powering Russia’s drone war, demonstrating Ukraine’s expanding ability to reach deep into enemy territory.

Multi-Oblast Operation

Taganrog was just one target. Ukrainian forces simultaneously struck three Russian air defense systems, a radar station, an ammunition depot, and multiple troop concentrations across Rostov Oblast and occupied Zaporizhzhia and Donetsk. This night showcased Ukraine’s growing deep-strike capability.

By synchronizing attacks on industrial, defensive, and military assets, Kyiv signaled both operational sophistication and an ability to impose simultaneous pressure on Russian forces far beyond active front lines.

Russia’s Drone Surge

Russia’s drone production has surged dramatically. In 2025, Moscow produced 3–4 million drones and roughly 2,500 missiles—more than double 2024 output. By September, over 34,000 strike drones and decoys had already been manufactured, nearly nine times the previous year’s pace.

Nightly drone barrages aim to overwhelm Ukrainian defenses by sheer volume. This industrial buildup highlights why Ukraine sees targeting production hubs as a strategic necessity to disrupt Russia’s high-tempo drone operations.

Supply Chain Vulnerabilities

Despite high output, Russian drone production depends on foreign components—batteries, processors, navigation systems, and communications hardware—largely sourced from China. Ukrainian strikes increasingly target these nodes: factories, warehouses, and logistics hubs.

Even modest disruptions can slow drone assembly, delay launches, and force costly rerouting. Understanding this supply chain is key: the threat to Russia isn’t just battlefield losses, but cumulative pressure on the industrial ecosystem that sustains its aerial campaigns.

The Taganrog Strike

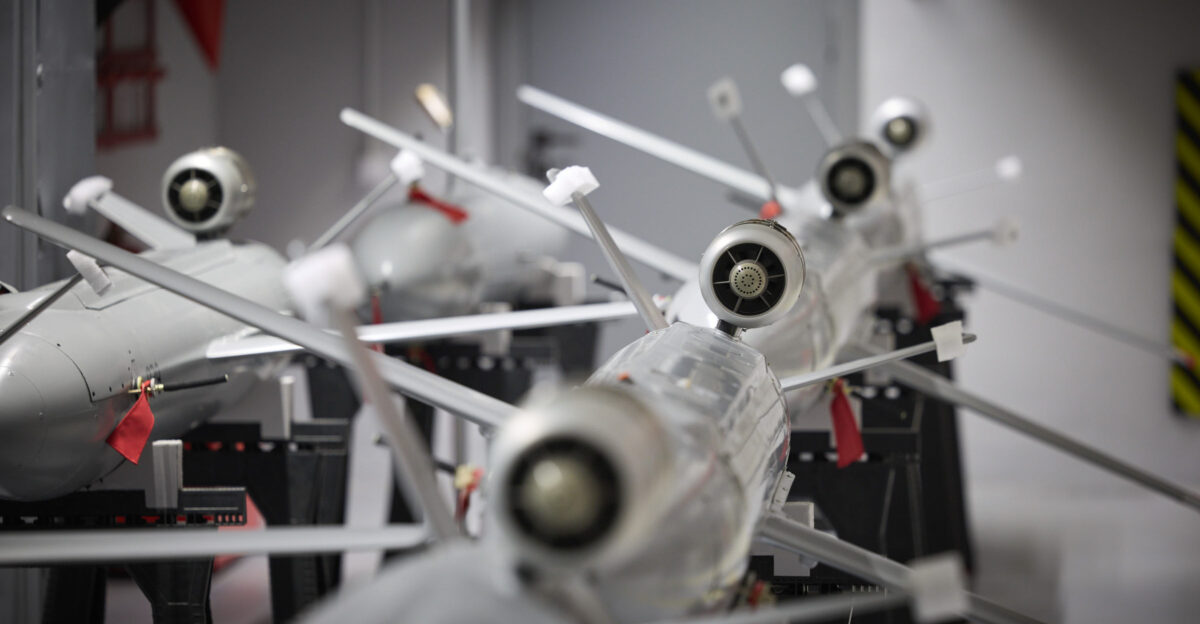

The Atlant Aero defense plant in Taganrog was hit by Ukrainian missiles on January 12–13. Explosions and fires were reported near production buildings. Atlant Aero produces Molniya-series fixed-wing FPV drones and components for Orion UAVs, which support Russian military operations against Ukrainian cities and infrastructure.

Though smaller than major hubs like Alabuga, the plant is a critical node in Russia’s drone network, illustrating Ukraine’s precision targeting deep inside enemy territory.

Production Impact

Atlant Aero specializes in FPV drones and UAV components rather than mass-produced Shahed systems. While the strike may cause temporary production disruption, its significance is symbolic and strategic: Ukraine demonstrated it can identify and strike key industrial nodes.

This sends a strong message that Russian facilities are vulnerable even far from frontlines, increasing operational uncertainty and forcing Moscow to allocate resources for defense and repair, rather than purely offensive operations.

Air Defense Losses

Simultaneously, Ukrainian forces struck three Russian air defense systems—two Tor units and one Tunguska—as well as a P-18-2 Prima radar. These losses reduce coverage over critical industrial and military sites.

By degrading the layered air defense network, Ukraine creates temporary windows for future strikes. The coordinated targeting of production and defense assets demonstrates sophisticated intelligence and planning, increasing pressure on Russia’s ability to protect its rear-area infrastructure.

Ammunition and Troop Targets

In occupied Donetsk and Zaporizhzhia, Ukrainian strikes destroyed an ammunition depot and multiple troop concentrations. Ammunition depot losses can remove hundreds of tons of ordnance, disrupting frontline logistics.

Troop cluster strikes further weaken operational readiness. The January 12–13 operation exemplifies a multi-layered strategy: hitting production, defense, and battlefield nodes simultaneously, maximizing both material and psychological impact on Russian forces.

Scale and Saturation

Despite these strikes, Russia’s drone production remains resilient. January 2025 saw 2,599 long-range drone launches, peaking at 6,297 in July, then stabilizing around 5,300–5,500 units monthly.

The campaign emphasizes saturation: launching hundreds of drones per night to overwhelm defenses. Ukraine’s strategy focuses on both disrupting production and targeting vulnerable components, rather than halting drone attacks entirely. Each strike increases operational friction for Moscow, even if overall output remains high.

Ukraine’s Counteroffensive Logic

Individual strikes may not stop Russia’s drone production, but they impose financial, operational, and psychological costs. Targeting facilities like Taganrog signals reach and capability, forcing Moscow to disperse production, redeploy air defenses, and repair infrastructure.

Over time, cumulative pressure may degrade Russia’s ability to sustain high-tempo drone campaigns, while enhancing Ukrainian morale and credibility both domestically and internationally.

Western Support and Indigenous Capability

Taganrog underscores Ukraine’s growing indigenous missile capability, reducing reliance on Western systems. Still, Western aid—particularly for air defenses and drones—remains essential. Joint initiatives with the U.S., UK, Denmark, and the Netherlands bolster capabilities, but political uncertainty and procurement delays create limits.

Ukraine’s ability to sustain strikes depends on combining domestic production with external support, while facing Russia’s massive industrial scale and accelerating output.

Labor and Industrial Challenges

Russia’s drone surge relies heavily on labor. Alabuga and other zones have expanded, recruiting foreign workers under reported coercive conditions from Africa, Latin America, and Asia. Training initiatives aim to create 1.5 million drone operators by 2030.

While this labor expansion increases production, it also creates vulnerabilities—discontent, scrutiny, and operational risk—complicating Moscow’s ability to maintain uninterrupted drone output over time.

Sustainability Questions

Russian drone launches have plateaued around 5,300–5,500 units monthly since mid-2025. Analysts debate whether this reflects production limits or component shortages. Ukrainian strikes on facilities like Taganrog, combined with sanctions on drone technologies, may gradually tighten supply chains.

Moscow has repeatedly adapted, but sustained disruption could eventually erode operational tempo, making strikes on industrial and supply nodes a central element of Ukraine’s long-term strategy.

The Long Game

The Taganrog strike highlights a strategic shift: the war increasingly resembles an industrial contest. Ukraine targets production facilities, air defenses, and supply chains to raise Russia’s operational costs and degrade its drone capabilities.

Russia’s distributed manufacturing network and access to Chinese components provide resilience, but the pace and reach of Ukrainian strikes will test whether Moscow can rebuild faster than Kyiv can dismantle critical nodes.

Deep Strike Implications

Striking Taganrog, deep inside Russian territory, demonstrates Ukraine’s precision and reach. Losses of air defenses, radar, and drone factories challenge assumptions that rear-area assets are secure.

Each successful strike forces Russia to defend infrastructure instead of focusing solely on operations. The ongoing battle is as much about industrial capacity and supply chains as battlefield tactics. How quickly Ukraine can sustain this pressure may determine the conflict’s trajectory and Moscow’s ability to wage its drone war effectively.

Sources:

Ukraine’s General Staff via Ukrinform, Drones attack military and aircraft repair plants in Taganrog Russia, January 13, 2026

United24 Media, Drone Strike Hits Atlant Aero Facility Linked to Molniya and Orion UAV Production in Russia, January 12, 2026

New Eastern Europe, Kremlin’s drone surge in 2025 and its hybrid threat to Ukraine and Europe, October 16, 2025

ISIS-Online, Monthly Analysis of Russian Shahed-136 Deployment Against Ukraine, November 2025

CSIS, Drone Saturation: Russia’s Shahed Campaign, 2025

Institute for the Study of War (Understanding War), Russian Offensive Campaign Assessment January 13, 2026