The collector car market just delivered a shock few investors expected. Vehicles once promoted as inflation-proof assets are now posting brutal losses, puncturing years of speculative confidence. From rare American muscle to Italian exotics and modern performance icons, prices fell fast and hard. Data from 2024 confirms this was not isolated panic selling. It was a systemic reset. Here is how the bubble formed, why it burst, and which cars suffered most. Let’s look deeper.

A Boom Built On Fragile Assumptions

The modern collector car surge accelerated between 2015 and 2023, fueled by cheap money and pandemic-era spending shifts. Investors fled volatile equities and poured capital into tangible assets. Classic cars suddenly looked safe. Some segments climbed 30% annually. By summer 2023, prices peaked quietly. Few noticed the warning signs. However, year-end data would soon reveal how unstable those gains really were.

The Pandemic Fueled Demand Surge

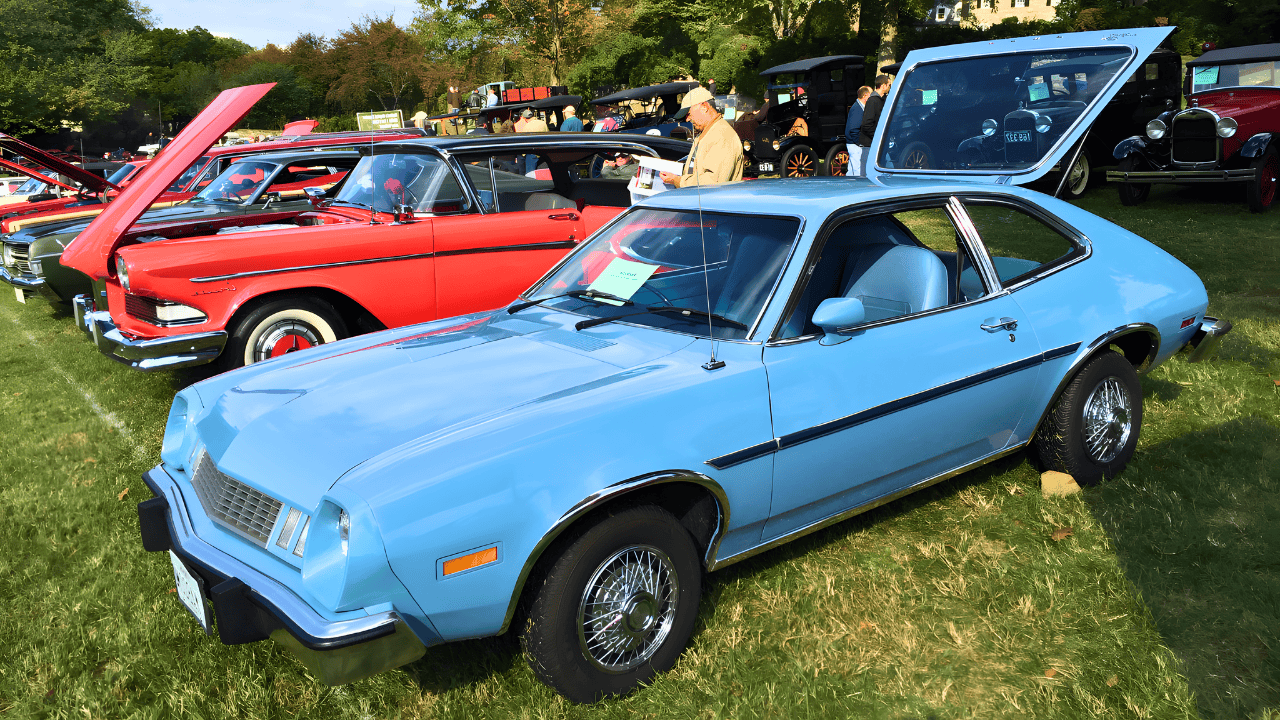

Lockdowns changed spending habits overnight. Travel paused, savings grew, and auctions went digital. Bidding wars became routine. Muscle cars, European classics, and JDM legends saw unprecedented attention. New buyers entered purely for returns, not passion. That influx inflated values beyond fundamentals. When normal economic pressures returned, demand softened fast. What looked like organic growth was actually momentum built on temporary conditions.

Baby Boomers Shifted The Supply Curve

Most premium collections were assembled by Baby Boomers decades earlier. By 2024, age, health, and estate planning forced many to sell simultaneously. Entire garages hit auctions at once. Analyst Greg Ingold observed, “Scarcity cultivated over generations evaporated instantly.” When supply spikes suddenly, buyers gain leverage. Prices adjust brutally. That demographic shift became a major accelerant in the correction.

Auctions Became Oversaturated Quickly

January 2024 exposed the imbalance. More than 20 Plymouth Superbirds appeared at auctions within weeks. Consignors accepted prices far below reserves. Limited production numbers lost meaning when cars clustered together. Ingold warned weakness at the top cascades downward. Once flagship models fall, confidence erodes everywhere. Collectors began reassessing value assumptions across all segments almost immediately.

Why These 12 Cars Matter

Hagerty’s December 2024 report highlighted 12 models with losses ranging from 10% to 26%. These were not fringe collectibles. They were considered blue-chip assets. Their declines signaled broader vulnerability. If these cars could not hold value, mid-market models faced even steeper risk. The psychological damage rivaled the financial losses, reshaping investor behavior rapidly.

When Icons Lost Their Shield

From million-dollar American legends to modern Porsche performance cars, each case told the same story. Scarcity alone does not guarantee protection. Liquidity, maintenance realities, and buyer demographics matter more during contractions. These failures dismantled the myth of automatic appreciation. The evidence became impossible to ignore. What followed was a rapid reassessment of what truly holds value.

#1 Chevrolet Corvette L88

Despite only 20 examples existing, the 1967 Chevrolet Corvette L88 fell 19%, settling between $2.1 million and $2.35 million. Ultra-wealthy buyers pulled back sharply in 2024. Even extreme rarity could not offset reduced liquidity. When discretionary spending tightens, exclusivity matters less than cash flexibility. That reality reshaped expectations at the very top.

#2 Alfa Romeo Spider

The Alfa Romeo Spider declined 14%, pushing $25,000 examples toward $21,500. Maintenance issues, corrosion, and electrical problems resurfaced as deterrents. Baby Boomer owners are selling, while younger buyers favor reliable Japanese alternatives. Romantic design alone could not sustain prices. Sentiment faded quickly once ownership costs reentered the conversation.

#3 Ford Thunderbird

The 1972 to 1976 Ford Thunderbird dropped 24%, stabilizing near $13,700. Nostalgia spikes in 2023 proved short-lived. Poor fuel efficiency, limited performance, and average build quality capped demand. Unlike true rarities, the Thunderbird offered little differentiation. Its fall reflected pragmatic repricing rather than speculative collapse. Reality eventually overtook sentiment.

#4 Plymouth Road Runner Superbird

The 1970 Plymouth Road Runner Superbird symbolized the correction. Once selling for $1.65 million, examples now trade between $242,000 and $605,000. Although only 1,935 were built, more than 30 appeared at auctions in 2024. Concentrated supply crushed prices. Peak buyers absorbed devastating losses almost overnight.

#5 Porsche 911 991.2 Carrera

The Porsche 911 991.2 Carrera slipped 10%, trading between $95,000 and $110,000. This decline was modest but revealing. Entry-level models proved more resilient than higher trims. Buyers remained active at accessible price points. Wealthier collectors exited sooner. That split highlighted how capital reallocation hit premium variants first.

#6 Mini Cooper S

The 2002 to 2006 Mini Cooper S plunged 26% after exceeding $13,300 in 2023. Massive production volumes overwhelmed demand. Rising insurance and maintenance costs discouraged younger buyers. The car never reached true nostalgic status. Recency alone could not justify collectible pricing. That realization arrived abruptly as listings piled up.

#7 Maserati Sebring

The Maserati Sebring fell 24%, dropping toward $207,500 after years above $300,000. Brand instability hurt confidence. Younger collectors increasingly favor German and Japanese alternatives. Historical significance was not enough. The Sebring’s decline signaled fading enthusiasm for 1960s Italian grand tourers despite craftsmanship and pedigree.

#8 Acura Honda Integra Type R

The Acura Honda Integra Type R declined 13%, retreating from $150,000 peaks into the $100,000 to $150,000 range. Ownership costs tempered excitement. Supply finally caught up with demand. Once the cornerstone of JDM collecting, it showed early signs of saturation. Momentum cooled as practical realities set in.

#9 Mercedes-Benz W126

The Mercedes-Benz W126 dropped 16%, settling between $5,500 and $18,000. Aging electronics and service complexity discouraged younger buyers. Prestige alone could not overcome maintenance frustrations. As reliability narratives weakened, confidence slipped. The decline raised uncomfortable questions about long-held assumptions surrounding brand durability and long-term ownership appeal.

#10 Lamborghini Espada

The Lamborghini Espada suffered a 26% decline, falling from nearly $159,000 to $50,000–$100,000 in 2024. Once swept up in exotic enthusiasm, it lost favor quickly. Positioned awkwardly between accessible classics and trophy cars, demand evaporated. Buyers simply moved on when excitement cooled.

#11 Volvo 122

The Volvo 122 fell 24%, sliding from low $40,000s to low $30,000s for top examples. Known for durability and sensible appreciation, it still could not escape the downturn. European demand weakened throughout 2024. The correction proved global. Even conservative collectibles were not immune.

#12 Porsche 911 991.2 Carrera S

The Porsche 911 991.2 Carrera S declined 15%, equal to roughly $18,000 per car in one year. Values now range from $110,000 to $135,000. Performance-focused investors exited early. Speculative premiums vanished quickly. Even Porsche felt pressure once excitement faded across the broader market.

What Investors Should Take Away

These 12 cars erased over $100 million in owner value within 12 months. Yet transaction rates improved from 67% in 2023 to 68% in 2024. Hagerty reports values stabilized by autumn. The panic phase passed. Whether opportunity has replaced fear remains the critical question ahead.

The Market Reset, Not Collapse

Collector cars did not disappear. Prices realigned with fundamentals. Baby Boomer selling continues, expanding supply. Younger buyers favor Japanese performance and modern usability. Ownership is shifting back toward passion, not hedging. Timing now matters more than hype. The choice is simple: wait patiently, or buy with discipline.

Sources:

These 5 Cars Lost the Most Value in the Beginning of 2024. Hagerty Media, April 2024.

The Biggest Winners and Losers of the Collector Car Market in 2024. Hagerty Media, December 2024.

Was This Plymouth’s Plummet from $1.65M to $418K a Reality Check? Hagerty Insider, May 2025.

Your Handy 1983–90 Alfa Romeo Spider Buyer’s Guide. Hagerty Media, October 2024.

2024 Classic Car Market Analysis: Real Auction Results & Price Trends. WC Shipping Blog, March 2025.

By the Numbers: The Collector-Car Market in 2024. Hagerty Media, December 2024.