On January 8, 2026, Agriculture Secretary Brooke Rollins signed an order that sent shockwaves through Minnesota’s state government: immediate suspension of more than $129 million in federal funding. The decision froze all active USDA awards and blocked future financial assistance to Minnesota and Minneapolis indefinitely.

No warning period. No grace period. Just an immediate halt to federal money flowing into programs serving the state’s most vulnerable populations.

The Scope of Allegations

The funding freeze stems from what federal prosecutors have called “a staggering, industrial-scale fraud” that has plagued Minnesota’s social services programs for years. Secretary Rollins delivered her verdict in a pointed letter addressed directly to Governor Tim Walz and Minneapolis Mayor Jacob Frey, placing responsibility at the state’s highest levels.

The USDA demanded comprehensive documentation of all federal expenditures from January 20, 2025, forward within 30 days.

Why Minnesota Became Ground Zero

Minnesota has emerged as what the Trump administration characterizes as a “hub of fraudulent money laundering activity” involving multiple federal programs. The state’s fraud scandals span pandemic meal programs, housing assistance, childcare subsidies, and small business loans totaling hundreds of millions in stolen taxpayer dollars.

Federal authorities have charged 78 people across various schemes, with 57 already convicted, yet the stolen money continues flowing overseas beyond U.S. jurisdiction.

Nearly a Quarter Billion Dollars Vanished

The most notorious case involves Feeding Our Future, a nonprofit that allegedly orchestrated the theft of nearly $250 million in federal funds intended to feed hungry children during COVID-19. The organization claimed to operate 299 meal sites serving 90 million meals in less than two years—an impossible-sounding 120,000 meals per day.

FBI surveillance painted a drastically different picture: one site claiming to serve 6,000 daily meals actually averaged around 40 visitors.

Luxury Living on Children’s Meal Money

The remaining 97% of Feeding Our Future funds enriched individual conspirators who spent stolen money on luxury vehicles, high-end real estate, and lavish lifestyles. Some suspects transferred millions to banks in Kenya and China, placing assets beyond the reach of U.S. law enforcement. Despite 57 convictions, authorities have recovered just $75 million of the $250 million stolen—less than one-third.

The rest disappeared into overseas accounts, luxury purchases already sold, or expenses that left no recoverable assets.

How the Scheme Operated Undetected

Feeding Our Future exploited the USDA’s Child and Adult Care Food Program and Summer Food Service Program, which relaxed oversight during the pandemic to expedite meal distribution to children. The nonprofit served as a sponsor that approved sites to serve meals and receive federal reimbursement.

At its peak, Feeding Our Future sponsored sites claiming to serve more meals in Minnesota than the entire states of Texas and California combined.

Program Designed for Vulnerable Becomes Target

Minnesota’s Housing Stabilization Services Program, a Medicaid-funded initiative helping people with disabilities, mental illnesses, and substance-use disorders maintain housing, became another major fraud target. The program intentionally maintained “low barriers to entry” and minimal record-keeping requirements to ensure vulnerable populations could access help without bureaucratic obstacles.

Federal prosecutors charged 13 individuals with exploiting these protections, submitting fraudulent claims for services never rendered.

Fraud Tourism Exposes Systemic Weakness

Prosecutors revealed shocking cases of “fraud tourism”—individuals from Pennsylvania with no Minnesota connections who traveled specifically to commit fraud in the state’s vulnerable programs. These defendants allegedly flew to Minneapolis, recruited beneficiaries at shelters and Section 8 housing facilities, then submitted approximately $3.5 million in false Housing Stabilization Services claims for about 230 beneficiaries.

The organized, interstate nature of the fraud demonstrated that word had spread nationally: Minnesota’s programs were easy targets.

Attorney General Promises Court Battle

Minnesota Attorney General Keith Ellison issued a defiant response within hours of the funding suspension announcement. “I will not allow you to take from Minnesotans in need. I’ll see you in court,” Ellison declared, signaling immediate legal action.

His statement frames the dispute as federal overreach that punishes innocent, vulnerable residents for crimes committed by fraudsters. The state maintains it has actively prosecuted fraud cases and cooperated fully with federal investigations, arguing the funding freeze is both illegal and counterproductive.

Minneapolis Alleges Political Retaliation

Minneapolis city officials characterized the federal action as politically motivated targeting of a Democratic stronghold. “Minneapolis is the latest target of the Trump administration—willing to harm Americans in service to its perceived political gain,” a city spokesperson stated.

Officials emphasized their cooperation with fraud investigations while maintaining that blanket funding cuts harm legitimate program beneficiaries who had nothing to do with criminal schemes.

Governor Walz Exits Political Stage

Governor Tim Walz announced on January 6, 2026—just two days before the USDA funding freeze—that he would not seek a third term in office. The timing followed weeks of intense national scrutiny over fraud scandals that occurred during his tenure, though Walz himself faces no criminal allegations.

In December, Walz stated: “You commit fraud in Minnesota, you’re going to prison. I don’t care what color you are, what religion you are.”

New IRS Task Force Targets Tax-Exempt Status

Treasury Secretary Scott Bessent announced comprehensive anti-fraud initiatives during a January 8, 2026 visit to Minnesota, deploying federal resources on an unprecedented scale. “Minnesota is going to be the protocols, procedures and investigative techniques and collaboration.

Minnesota is going to be the genesis for a national rollout,” Bessent declared. The measures include forming a new IRS task force to investigate fraud involving pandemic-era tax incentives and potential misuse of 501(c)(3) tax-exempt status by organizations implicated in fraud schemes.

Banks Face Audits and Reporting Requirements

Treasury investigators implemented a “geographic targeting order” requiring banks and money transmitters in Hennepin and Ramsey counties to report any overseas transfer of $3,000 or more. Four money services businesses in Minnesota received notices of investigation under the Bank Secrecy Act for their potential roles in facilitating fraud and money laundering.

Financial institutions that processed transactions for fraudulent organizations now face audits to determine if they enabled criminal activity.

Terrorist Funding Investigation Adds Urgency

Secretary Bessent revealed that Treasury investigations are examining whether Minnesota tax dollars may have been filtered to al-Shabab, the Somalia-based terrorist organization designated by the U.S. as a foreign terrorist organization. The allegation adds national security dimensions to what began as social services fraud cases.

Bessent characterized Governor Walz as having been “negligent in his fiduciary duties as a chief executive of the state of Minnesota” regarding oversight.

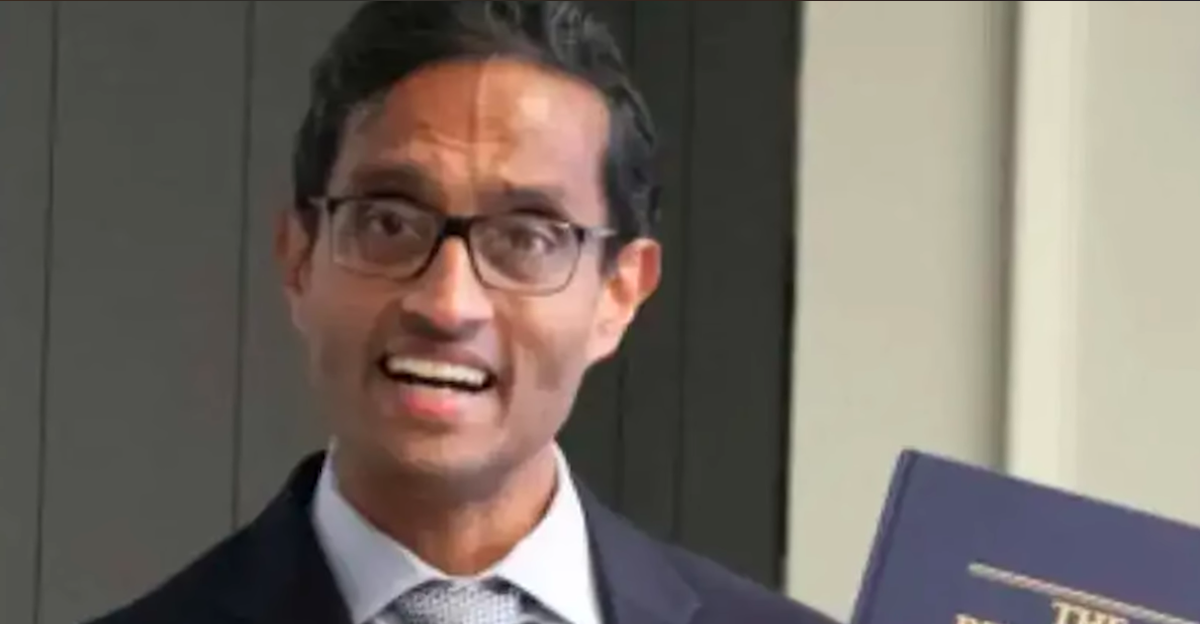

Federal Judge Blocks Related Funding Freeze

U.S. District Judge Arun Subramanian temporarily blocked a separate Department of Health and Human Services funding freeze on January 10, 2026, granting a 14-day restraining order. The HHS had frozen approximately $10 billion in childcare grant programs across five Democratic-led states—Minnesota, California, New York, Illinois, and Colorado.

The affected states sued, arguing the freeze was illegal, unconstitutional, and served as a “pretext” to punish Democratic states.

Justice Department Deploys Prosecution Team

Attorney General Pam Bondi announced the Justice Department is sending a team of federal prosecutors to Minnesota to strengthen fraud investigations and prosecutions. The team will “reinforce our U.S. Attorney’s Office and put perpetrators of this widespread fraud behind bars,” Bondi stated.

This deployment treats Minnesota as a test case for aggressive federal prosecution of social services fraud, with techniques and strategies developed here potentially applied nationwide.

The National Fraud Picture Emerges

The USDA estimated in November that an average of $24 million in federal funds is lost daily to fraud and errors that remain undetected by states, based on records from 28 states. The agency anticipates this figure will rise as more states submit data, suggesting potential savings of approximately $9 billion or more annually if such losses could be reduced.

These staggering numbers explain why the Trump administration has made fraud prevention a central priority. Minnesota’s visibility makes it the obvious starting point for nationwide reform.

What This Means for Other States

Minnesota serves as the Trump administration’s pilot program for anti-fraud protocols that will be rolled out nationwide across federal programs. Treasury Secretary Bessent explicitly stated that investigative techniques, collaboration methods, and enforcement procedures developed for Minnesota cases will serve as templates.

States watching Minnesota’s experience are already reviewing their own programs, anticipating similar federal scrutiny.

The Human Cost of Fraud and Enforcement

While federal authorities pursue fraud prevention and prosecution, vulnerable populations face service disruptions that advocates warn could create humanitarian crises. The suspension of Housing Stabilization Services eliminated assistance for people with disabilities, mental illnesses, and substance-use disorders who had no involvement in fraud.

The USDA funding freeze threatens meal programs, agricultural support, and rural development initiatives serving legitimate beneficiaries.

Where Minnesota Goes From Here

The state faces a 30-day deadline to provide the USDA with comprehensive documentation justifying all federal expenditures since January 20, 2025. Meeting this requirement while simultaneously challenging the funding suspension in court presents enormous administrative and legal challenges.

Minnesota officials must balance cooperation with federal investigators against defending the state’s interests and protecting vulnerable residents. The outcome will determine not just Minnesota’s future relationship with federal programs, but establish precedent affecting all states.

Sources:

“USDA Suspends Nearly $130 Million in Federal Funds to Minnesota Over Fraud Concerns.” CBS News, 2026.

“Trump Administration Freezes Food Stamps in Minnesota.” New York Times, 2026.

“Secretary Bessent Announces Initiatives to Combat Rampant Fraud in Minnesota.” U.S. Treasury Department Press Release, 2025.

“Federal Jury Finds Feeding Our Future Mastermind and Co-Defendant Guilty.” U.S. Department of Justice, 2025.