On December 31, 2025, Motos America, operator of 13 premium motorcycle dealerships across states like California, Florida, and Oregon, filed for Chapter 11 bankruptcy in Utah. The filing exposed assets of $500,000 to $1 million against liabilities of $10 million to $50 million, thrusting a key player in the BMW, Ducati, Triumph, Royal Enfield, and Vespa sales network into uncertainty amid a robust U.S. motorcycle market.

Rising Stakes

Court documents highlight the company’s razor-thin financial margin. High leverage amplified vulnerabilities as borrowing costs surged and lenders imposed stricter terms on retail operations. A single financing setback escalated into a solvency crisis, despite steady demand for high-end bikes.

The dealership group had pursued a consolidation strategy, acquiring premium European-brand outlets to gain scale, stronger manufacturer ties, and larger credit lines. This approach served affluent riders in major markets but centralized debt, allowing local issues to ripple network-wide when credit dried up.

Pressure Builds

From 2023 to 2025, U.S. interest rate hikes drove up floorplan financing costs—the variable-rate loans dealers use for inventory. Premium motorcycles, often priced over $20,000, lingered longer on lots, inflating carrying expenses even as sales volumes stabilized. These hidden drains eroded liquidity gradually.

The crisis peaked with a $3 million deposit lost in an alleged fraud tied to Prime Capital Ventures. This blow derailed a planned $15 million credit facility essential for cash flow. Compounding the damage, a separate $12 million financing round also collapsed, leaving management no viable path outside court protection.

Network at Risk

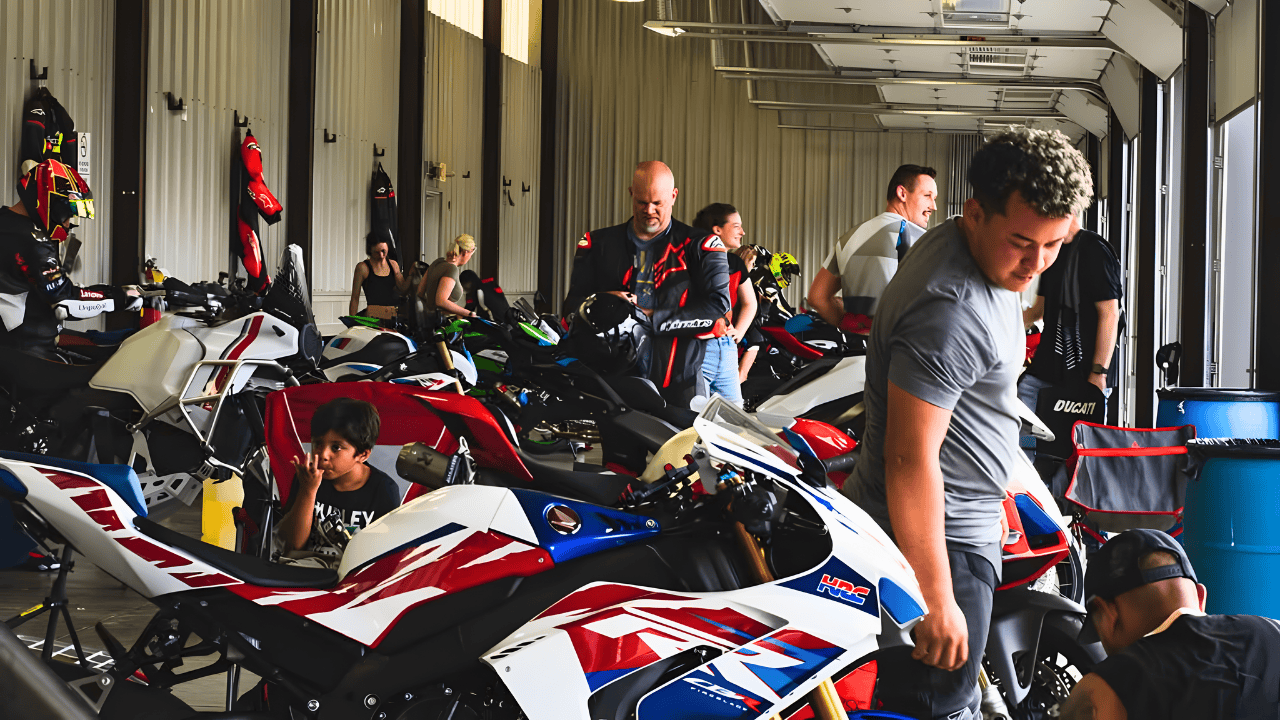

The 13 locations form vital hubs for sales, service, parts, and rider communities in high-volume regions. Chapter 11 proceedings will decide if the network endures intact, fragments via asset sales, or shifts to new owners under manufacturer guidance. Operations continue under debtor-in-possession financing, with CEO Vance Harrison, who holds 69 percent voting control as of early 2023, stressing that only the parent filed—subsidiaries remain operational.

Employees, many onboarded during 2023-2025 expansion, face looming uncertainty. Restructuring could preserve jobs or trigger layoffs, as they monitor filings alongside paychecks.

Human and Industry Toll

Creditors confront stark realities: limited collateral for unsecured claims means recoveries hinge on reorganization success over liquidation. Earlier, in November 2024, the U.S. Securities and Exchange Commission revoked the company’s securities registration due to delinquent filings, curbing stock trading. Management called it a cost-saving move, though investors decried lost transparency.

This marks one of the largest recent bankruptcies for premium European motorcycle dealers, signaling risks for other leveraged groups on slim margins. Competitors eyeing acquisitions grapple with identical headwinds like rate resets.

Uncertain Road Ahead

Despite global motorcycle market growth—U.S. sales projected at $8.76 billion by 2032—Motors America’s fall underscores how debt-laden models falter without buffers for shocks. Potential fraud recovery litigation and OEM responses to franchise threats could reshape outcomes. For manufacturers, the case tests territory reassignments; for suppliers, employees, and riders, it gauges endurance in a tighter credit landscape where policy-driven rate hikes hit inventory-reliant niches hardest. The proceedings will reveal if premium networks can restructure sustainably or if higher rates demand leaner models industry-wide.

Sources:

“Motos America Inc. Files for Chapter 11 Restructuring.” Yahoo Finance, 2 Jan 2026.

“Premium motorcycle dealer group files for Chapter 11.” PowerSports Business, 6 Jan 2026.

“Order Making Findings and Revoking Registration: Motos America, Inc.” U.S. Securities and Exchange Commission (Release No. 34-101650), 18 Nov 2024.

“Premium U.S. motorcycle brand files Chapter 11 bankruptcy.” TheStreet, 2 Jan 2026.