On December 31, 2025, a bankruptcy petition hit the U.S. court system listing a stark imbalance: Motos America disclosed as little as $500,000 in assets against liabilities that could reach $50 million.

The filing pulled a 13-dealership network—selling BMW, Ducati, and Triumph motorcycles across multiple states—into Chapter 11 overnight. The collapse unfolded inside a market still growing, where demand never disappeared. What failed first wasn’t sales—but the money meant to keep them moving.

Rising Stakes

Court filings reveal just how narrow the margin became. Motos America reported only about $500,000 to $1 million in assets against liabilities ranging from $10 million to $50 million. That imbalance left little room to absorb shocks.

As borrowing costs climbed and lenders tightened terms across retail sectors, even modest disruptions became existential threats. For Motos America, leverage magnified pressure, turning a single failed financing event into a full-scale solvency crisis almost overnight.

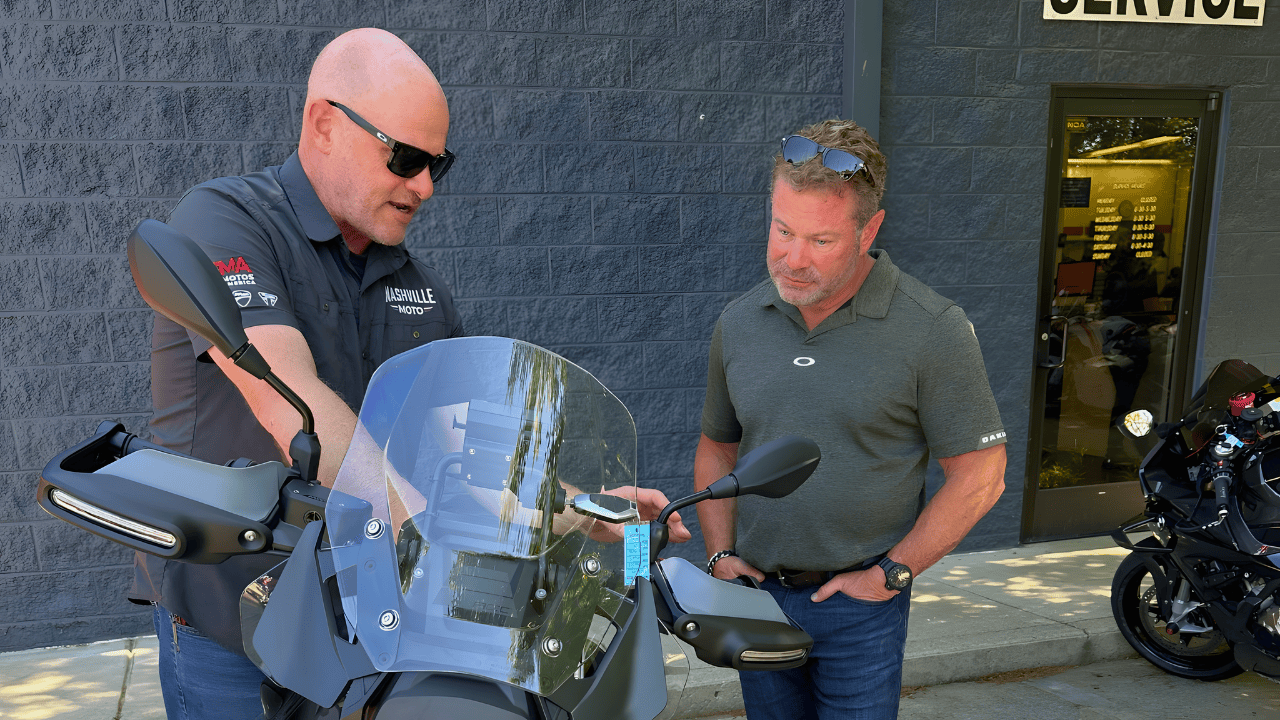

Premium Play

Motos America was built as a consolidation play. The company rolled up high-end European motorcycle dealerships under one corporate structure, betting that scale would unlock better manufacturer relationships, improved purchasing power, and access to larger credit facilities.

The strategy targeted affluent and aspirational riders in major U.S. markets. But consolidation cuts both ways. When financing frays, centralized debt means localized problems spread quickly across the entire dealership network.

Pressure Builds

From 2023 through 2025, rising U.S. interest rates steadily pushed up the cost of floorplan financing—the loans dealers use to carry inventory. High-priced European motorcycles often sit longer on showroom floors, especially models priced above $20,000.

Because most floorplan loans are variable-rate, carrying costs climbed even when unit sales held steady. Those rising interest expenses quietly drained cash, tightening liquidity long before bankruptcy became visible.

Fraud Trigger

The tipping point arrived with a sudden and costly shock. Motos America lost a $3 million deposit in an alleged fraud involving Prime Capital Ventures.

That loss wiped out confidence in a planned $15 million credit facility that management had counted on to stabilize cash flow. Without that liquidity, and facing mounting interest costs, the company filed for Chapter 11 in Utah on December 31, 2025.

Network at Risk

The bankruptcy matters far beyond a single corporate entity. Motos America’s footprint spans 13 dealerships across states including California, Florida, and Oregon—regions critical to premium motorcycle sales. These stores anchor local ecosystems for sales, service, parts, and rider communities.

The Chapter 11 outcome will determine whether the network stays intact, is broken up through asset sales, or sees stores transferred to new owners under manufacturer oversight.

Human Toll

Behind the balance sheet are real people. Employees work across Motos America’s dealerships, handling everything from sales and service to parts logistics and administration.

Many were hired during the group’s expansion phase between 2023 and 2025. While operations continue for now, uncertainty looms. Employees are watching court filings as closely as paychecks, knowing restructuring outcomes could determine whether their jobs survive the year.

Dealers Under Strain

Industry observers describe the filing as one of the largest premium European-brand dealership bankruptcies in recent years. It serves as a warning to other highly leveraged dealer groups operating on thin margins. Rising interest-rate resets are pressuring similar businesses nationwide.

While competitors may eye distressed acquisitions, they face the same macro conditions that helped bring Motos America down, making opportunistic expansion far from risk-free.

Growing Market, Shrinking Cushion

The irony is stark. The global motorcycle market continues to expand, with long-term growth forecasts pointing upward. U.S. motorcycle sales alone are projected to reach roughly $8.76 billion by 2032.

Yet Motos America shows how strong macro demand does not guarantee dealer survival. Debt-heavy operators can fail even in growing markets when financing structures leave no cushion for shocks.

Second Setback

The $3 million fraud loss was not the only blow. Reporting shows Motos America also failed to close a separate $12 million financing round, compounding its liquidity problems. With two major funding efforts collapsing back-to-back, options narrowed quickly.

Combined with rising floorplan costs, the failed raises left management with little alternative but court-supervised restructuring. For creditors, those missed deals likely reduced recovery expectations almost immediately.

Investor Frustration

Tensions with investors surfaced well before bankruptcy. In November 2024, the U.S. Securities and Exchange Commission revoked Motos America’s securities registration on November 18-19, 2024, for delinquent filings, effectively halting public trading of its stock.

Shareholders viewed the move as a serious blow to transparency and liquidity. Management, however, framed it as a cost-saving decision, arguing regulatory compliance no longer justified the expense.

Control at the Top

Leadership concentration shaped the company’s trajectory. Chief Executive Officer Vance Harrison controlled roughly 69 percent of Motos America’s voting power as of early 2023, giving him decisive influence over strategy and financing decisions.

That control now carries into bankruptcy negotiations. As a Chapter 11 plan takes shape, the balance between preserving equity control and attracting new capital will be one of the most delicate—and contentious—issues.

Staying Open

In early January 2026 statements, Harrison emphasized that dealership operations remain open and fully functional. Only the parent company is in Chapter 11; subsidiary dealerships have not filed bankruptcy.

Management says debtor-in-possession financing is in place to support day-to-day operations while a restructuring plan is developed. For customers and manufacturers, keeping showrooms open is critical to preserving brand confidence during the court process.

Creditor Reality

Bankruptcy filings paint a sobering picture for creditors. With assets capped near $1 million and liabilities reaching as high as $50 million, unsecured creditors face limited collateral.

Recovery will depend heavily on whether Motos America can reorganize as a going concern rather than liquidate. A successful restructuring could preserve value across the dealership network; failure could mean steep losses for lenders and vendors alike.

Uncertain Road Ahead

The Utah Chapter 11 process will decide Motos America’s fate. Key questions include whether all 13 dealerships remain under common ownership, how manufacturers respond to franchise risk, and whether new financing can be secured on sustainable terms.

For riders, employees, and suppliers, the case is a live test of whether a premium dealer network can survive a harsher credit environment without sacrificing long-term viability.

Policy Undercurrents

Motos America’s collapse highlights how monetary policy filters through niche retail sectors. As central banks raised rates to fight inflation in 2024 and 2025, floorplan-heavy businesses felt the impact immediately.

Variable-rate inventory loans turned rate hikes into direct operating costs. Analysts increasingly see dealership bankruptcies as an unintended consequence of tighter policy, especially for small and mid-sized operators with limited capital buffers.

Beyond U.S. Borders

Although Motos America operates in the U.S., its brands—BMW Motorrad, Triumph, Ducati, Royal Enfield, and Vespa—are global manufacturers. Disruption at a multi-state dealer group can ripple through regional sales targets, parts distribution, and brand presence.

OEMs closely monitor restructurings like this when deciding whether to support existing dealers or reassign territories.

Legal Fallout

The alleged fraud involving Prime Capital Ventures may extend beyond bankruptcy court. Any effort to recover the lost $3 million deposit could materially affect Motos America’s estate.

Separate litigation may determine responsibility for the collapsed $15 million credit facility. While outcomes remain uncertain, the episode underscores how a single disputed transaction can reshape the financial destiny of a highly leveraged retailer.

Culture of Risk

The case exposes the fragility of aggressive roll-up strategies in lifestyle industries. Consolidators like Motos America rely on cheap, plentiful credit to make scale work. When that assumption breaks, enthusiasm and brand prestige offer little protection.

The collapse challenges the belief that premium products guarantee stability, showing instead how leverage can turn passion-driven businesses into high-risk financial structures.

Signal to the Industry

Motos America’s Chapter 11—sparked by a $3 million fraud-linked loss and the disappearance of a $15 million lifeline—stands as a warning to the broader powersports industry. Growth alone cannot offset fragile financing.

For manufacturers, dealers, lenders, and riders, the case marks an early stress test of resilience in a higher-rate era—one where even iconic brands and strong demand may not be enough to keep the wheels turning.

Sources:

“Motos America Inc. Files for Chapter 11 Restructuring.” Yahoo Finance, 2 Jan 2026.

“Premium motorcycle dealer group files for Chapter 11.” PowerSports Business, 6 Jan 2026.

“Order Making Findings and Revoking Registration: Motos America, Inc.” U.S. Securities and Exchange Commission (Release No. 34-101650), 18 Nov 2024.

“Premium U.S. motorcycle brand files Chapter 11 bankruptcy.” TheStreet, 2 Jan 2026.