The second a new luxury sedan or electric SUV leaves the dealership, its value can plunge faster than many buyers expect. An iSeeCars analysis of more than 800,000 used car listings for 2020 model-year vehicles, reviewed between March 2024 and February 2025, shows some high-end models losing up to $20,000 almost immediately and more than 60% of their value within 5 years.

For households stretching budgets to afford premium cars, depreciation often becomes the most expensive surprise of ownership. Here is what the data reveal about why those losses happen so quickly, and which vehicles are hit the hardest.

When Value Vanishes Instantly

All new vehicles depreciate the moment ownership changes, but luxury models fall faster. Mainstream cars typically lose about 10–15% of their sticker price immediately after purchase. Luxury vehicles often drop 10–20%, meaning a $70,000 sedan can shed $7,000–$14,000 before its first drive home.

Electric vehicles face an added disadvantage tied to incentives. Federal clean-vehicle tax credits apply only to the original buyer and cannot be transferred after the vehicle is titled, according to IRS guidance on clean vehicle credits. That policy effectively lowers the real cost of a new EV while offering no support for a nearly identical used model.

As a result, the market quickly discounts recently purchased luxury and electric vehicles. Buyers who financed their purchase can find themselves owing more than the car is worth within weeks, setting the stage for deeper losses over time.

Why Luxury Cars Struggle on Resale

Long-term depreciation patterns are especially harsh for premium brands. The iSeeCars data show German luxury marques such as BMW, Audi, and Mercedes dominating the list of steepest 5-year value declines. High starting prices, advanced technology, and expensive maintenance all weigh heavily on resale values.

Buyer behavior reinforces the trend. Once a luxury vehicle becomes used, it must appeal to shoppers who want a premium badge and are comfortable with repair costs that can reach thousands of dollars annually after warranties expire. That narrower buyer pool reduces demand.

Dealers also factor depreciation into pricing. Knowing that part of the sticker price will evaporate quickly, manufacturers and retailers often build higher margins into new luxury vehicles. When resale reality catches up, the market corrects sharply, pushing used values down even faster.

Electric Vehicles and Incentive Shifts

Depreciation is most pronounced among electric vehicles. The iSeeCars study found EVs lose an average of 58.8% of their value over 5 years, compared with 45.6% for the average vehicle. Early-generation EVs now face concerns about range, battery aging, and rapid technological progress that makes older models feel obsolete.

Incentive policy amplifies the issue. When tax credits apply to new purchases but not to used vehicles, new EVs gain an artificial price advantage. Once incentives shrink or expire, resale values can fall quickly, particularly for high-priced models.

Premium EVs such as the Tesla Model S, Model X, and Jaguar I-Pace illustrate this dynamic. Frequent price cuts, new features, and shifting incentives leave buyers questioning whether paying full price upfront delivers enough long-term value compared with waiting for steeply discounted used options.

The Five-Year Financial Hit

Over a 5-year period, depreciation becomes the largest ownership cost for many high-end vehicles. The iSeeCars analysis shows the worst-performing 2020 models lost between 60% and 72% of their original value. On a $70,000 purchase, that equals $42,000–$50,000 erased, with some individual cases exceeding $50,000.

Losses accumulate quickly. After an immediate double-digit drop at purchase, many luxury sedans and SUVs lose another 15–25% within the first year. Owners can end year 1 owing far more on their loans than the vehicle is worth.

By year 5, depreciation often outweighs fuel, insurance, and maintenance combined. For some households, the decline rivals or exceeds a full year of income, turning what seemed like a status purchase into a long-term financial burden.

Models With the Steepest Declines

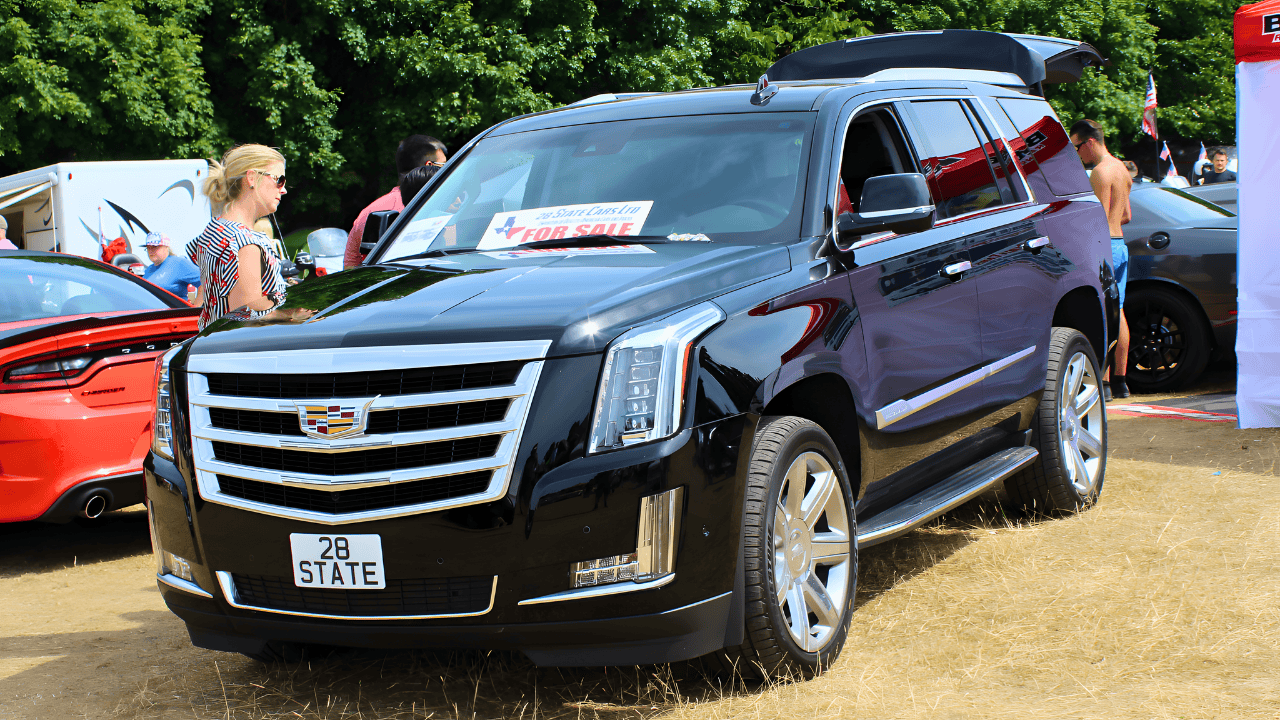

Among vehicles tracked through February 2025, 12 stand out for losing more than 60% of their value in 5 years. Large luxury SUVs such as the Cadillac Escalade ESV, at 58.5% depreciation or about $63,885, and the Infiniti QX80 at 65% show dollar losses that can top $50,000.

Mainstream-based but high-priced models also struggle. The Ford Expedition MAX loses about 60%, as used buyers often favor competitors with stronger reliability records. In the EV category, steep decliners include the Tesla Model Y at 60.4%, Model S at 65.2%, Model X at 63.4%, Nissan Leaf at 64.1%, and Jaguar I-Pace at 72.2%.

Ultra-luxury sedans and performance models such as the BMW 7 Series at 67.1%, BMW 5 Series Hybrid at 64.7%, and Maserati Ghibli at 64.7% round out the list, reflecting high ownership costs and limited second-owner demand.

What the Data Mean for Buyers

Taken together, the findings highlight a clear pattern. Luxury and electric vehicles face the steepest depreciation due to high starting prices, rapid technology changes, and ongoing ownership costs. For buyers, timing and purchase strategy matter as much as the badge on the hood.

Leasing can limit exposure by shifting residual-value risk to the leasing company, an approach that can make sense for fast-evolving EVs. Buyers who prefer ownership often find better value in certified pre-owned vehicles that are 2 or 3 years old, after the sharpest depreciation has already occurred.

Shoppers focused on long-term value frequently gravitate toward brands with strong reliability records and lower entry prices, including Toyota, Lexus, Honda, and Acura. As incentives evolve and technology advances, future model years will reveal whether luxury and electric vehicles can better protect their value, or if rapid depreciation remains the price of innovation.

Sources:

“These Cars Lose The Most Resale Value Over Five Years, Data Shows.” Forbes, March 26, 2025.

“New Study Reveals Fastest and Slowest Depreciating 5-Year-Old Vehicles.” Guide Auto Web, March 25, 2025.

“Losing Value Fast! The Top 5 Fastest Depreciating Cars.” Motor Easy Magazine, December 6, 2025.

“The EV Depreciation Shock: Why Electric Vehicle Values Are Plummeting Faster Than Ever.” Auto Value Professionals, October 26, 2025.

“Luxury Car Depreciation: When to Sell Your Used Luxury Car.” Motozite, August 20, 2025.