The U.S. job market had its hardest year since the COVID-19 pandemic in 2025. Employers announced around 1.17 million layoffs through November, a 54 percent jump from 2024. This made it the fifth-highest total of job cuts since 1993. Several factors caused the wave of layoffs, advances in artificial intelligence, government downsizing, slower economic growth, and global trade pressures. Despite all the job cuts, the official unemployment rate stayed relatively moderate at 4.6 percent.

What made 2025 unusual was that no single crisis dominated. Instead, several smaller pressures collided. The Department of Government Efficiency led the way, cutting nearly 294,000 federal jobs, about a quarter of all layoffs. Artificial intelligence played an increasing role, directly eliminating around 55,000 positions and indirectly affecting thousands more through automation. Economic uncertainty and trade disputes added roughly 245,000 more job losses. Struggles in the electric vehicle industry also contributed to a tough climate for both manufacturers and their suppliers.

Tech and Retail Take the Hardest Hits

Technology companies were among the first and hardest hit. The sector announced over 153,000 layoffs through November, a 17 percent increase compared to the year before. Amazon cut 14,000 corporate jobs in October, pointing to efficiency gains from AI tools. Microsoft eliminated 15,000 positions, while Intel planned to lay off the same number even after receiving $8.5 billion in government funding. Salesforce let go of 4,000 workers as it shifted more operations to AI automation. Many of these cuts rippled into the retail industry, affecting warehouse operations and logistics.

Retailers faced a similarly difficult year. With nearly 92,000 layoffs, up 139 percent from 2024, the sector struggled with weak consumer demand and changes in shopping behavior. Target cut 1,800 corporate jobs, while overall seasonal hiring fell sharply. The National Retail Federation reported that only 372,520 temporary positions were added for the holidays, the fewest since 2009 and down 44 percent from the previous year. The slowdown stretched into manufacturing, especially among companies tied to the stalled rollout of electric vehicles.

Government Cuts and Manufacturing Setbacks

The federal government saw major job losses in 2025, shedding 271,000 jobs between January and November, the steepest non-war drop ever recorded. Nonprofits and government contractors also lost nearly 21,000 positions because of funding cuts. The manufacturing sector faced similar pain. General Motors began laying off over 1,100 workers at its Detroit Factory Zero plant starting January 2026. Ford announced it would close its $5.8 billion BlueOval SK battery plant in Kentucky after just 11 months, cutting 1,500 jobs by mid-February 2026 as electric vehicle demand slowed. Nissan planned 11,000 global layoffs, while UPS eliminated 48,000 roles as it increased its reliance on automation and robotics. Verizon also cut 13,000 workers in November, converting many of its stores into franchises and setting aside $20 million for retraining programs.

October was the worst month of the year for layoffs, with job cut announcements surging 183 percent to more than 153,000, a record for any October since 2003. Major contributors included Amazon, Intel, and Verizon. Telecommunications saw a spike in cuts, up 268 percent to 38,000, while food and beverage companies lost 34,000 jobs. Media organizations reported 17,000 cuts, and nonprofits endured a 409 percent jump to nearly 29,000. Manufacturing lost about 42,000 jobs since April.

Signs of Deeper Trouble Ahead

Although unemployment was officially 4.6 percent in November, the overall picture was less reassuring. Long-term unemployment, the share of people jobless for more than six months, made up nearly a quarter of the total unemployed. Hiring levels fell to their lowest since 2013, even as more people entered the labor force, with participation climbing to 62.5 percent.

Trade tensions also had a direct impact. Tariffs prompted nearly 8,000 job cuts and caused an estimated $34 billion in lost sales, according to Reuters. Procter & Gamble alone expected a $600 million financial hit, leading to plans for 7,000 layoffs over two years. Smaller companies were especially vulnerable, with those employing 50 or fewer people cutting 32,000 jobs in November. These “forever layoffs” have become more common, small business job cuts made up 51 percent of all notices in 2025, up from 38 percent a decade ago, shaking worker confidence nationwide.

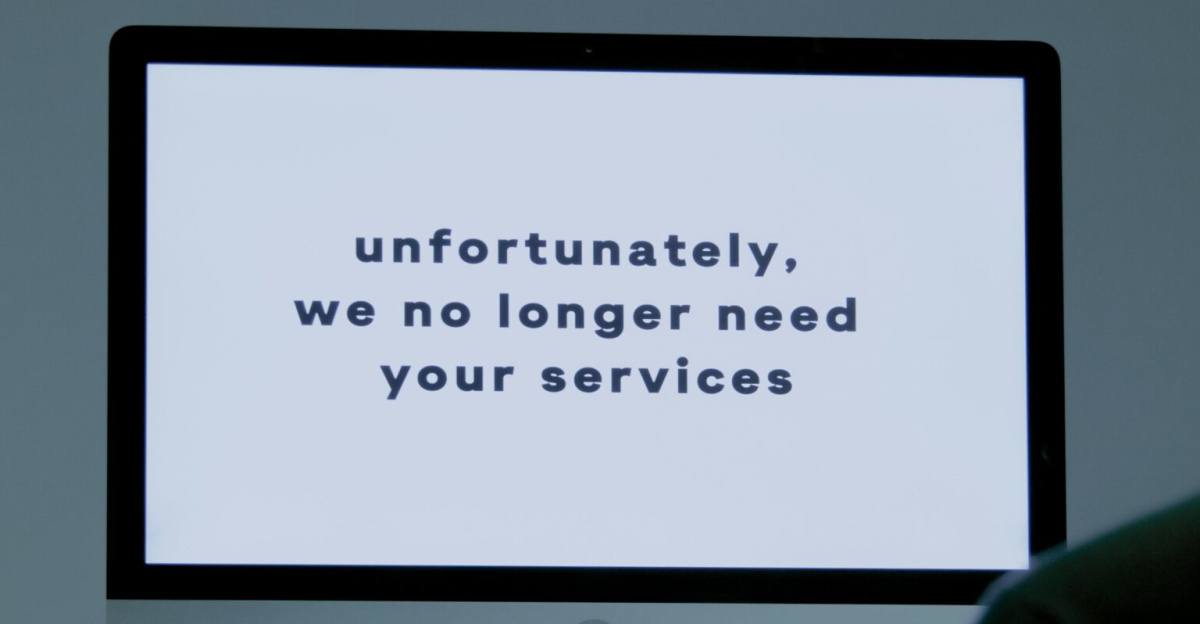

Looking toward 2026, the job market faces more uncertainty. Many announced layoffs from 2025, such as those at GM and Ford, will take effect in the coming months. Federal Reserve Chair Jerome Powell warned of significant downside risks for the economy, projecting unemployment at 4.4 percent by the end of 2026. Some analysts predict even higher, up to 6 percent, if automation continues to accelerate. The economy also remains deeply split: wealthier households maintain their spending power, while middle- and lower-income families are running out of savings. With inflation steady around 2.7 percent, rising stress and workplace fatigue are growing problems, showing up in more employee reviews that mention disconnection and misalignment. Communities across the country face shrinking safety nets, weaker small businesses, and difficult questions about balancing corporate progress with human stability.

Sources:

Challenger, Gray & Christmas. Monthly Layoff Report, December 4, 2025

U.S. Bureau of Labor Statistics. Employment Situation Summary – November 2025, December 16, 2025

Federal Reserve. Federal Reserve Statement, December 24, 2025

Reuters. Global Trade Analysis and Tariff Impact Assessment, June 2025