Howard’s Appliance, a decades-old Southern California retailer, abruptly shut down all 17 of its stores and filed for Chapter 11 bankruptcy effective December 6, 2025. Employees were given just one day’s notice, while customers—many with Black Friday orders—received none.

The sudden collapse stunned local communities and left shoppers scrambling for refunds and replacement appliances, highlighting how fragile even long-established regional chains have become under mounting economic pressure.

Tariffs and Slumping Sales Trigger Collapse

The company’s legal representative said tariffs, weakening consumer spending, and broader macroeconomic challenges made continued operations impossible. Founded in 1946, Howard’s had weathered decades of retail cycles but struggled as costs rose and demand softened.

Court filings show the company entered bankruptcy with liabilities significantly outweighing assets. The timing, just after the peak holiday shopping period, intensified scrutiny over how quickly financial conditions deteriorated.

Holiday Shoppers Left in Limbo

Customers who placed orders during Black Friday promotions were blindsided when stores went dark days later. Deliveries were halted, customer service lines went silent, and the company website stopped functioning.

Many families expecting refrigerators, ranges, or washers for the holidays suddenly faced uncertainty. Refunds now depend on bankruptcy proceedings, forcing customers to file claims while urgently seeking replacements elsewhere at higher prices.

Employees Learn via One-Day Notice

Roughly 100 workers were informed of layoffs through a last-minute meeting the day before closures took effect. For many, the news came weeks after the busiest sales season, leaving little time to secure new employment before the holidays.

Management expressed gratitude for employee loyalty, but the abruptness of the shutdown underscored the human cost of sudden retail failures in a volatile economic environment.

A Regional Retail Gap Opens

With Howard’s gone, Southern California communities lost a familiar local appliance option. National chains and big-box retailers are positioned to absorb displaced demand, often through aggressive promotions. Smaller independent retailers, however, now face even stiffer competition.

The disappearance of all 17 locations at once reshapes local retail dynamics, particularly for customers who preferred regional service over national brands.

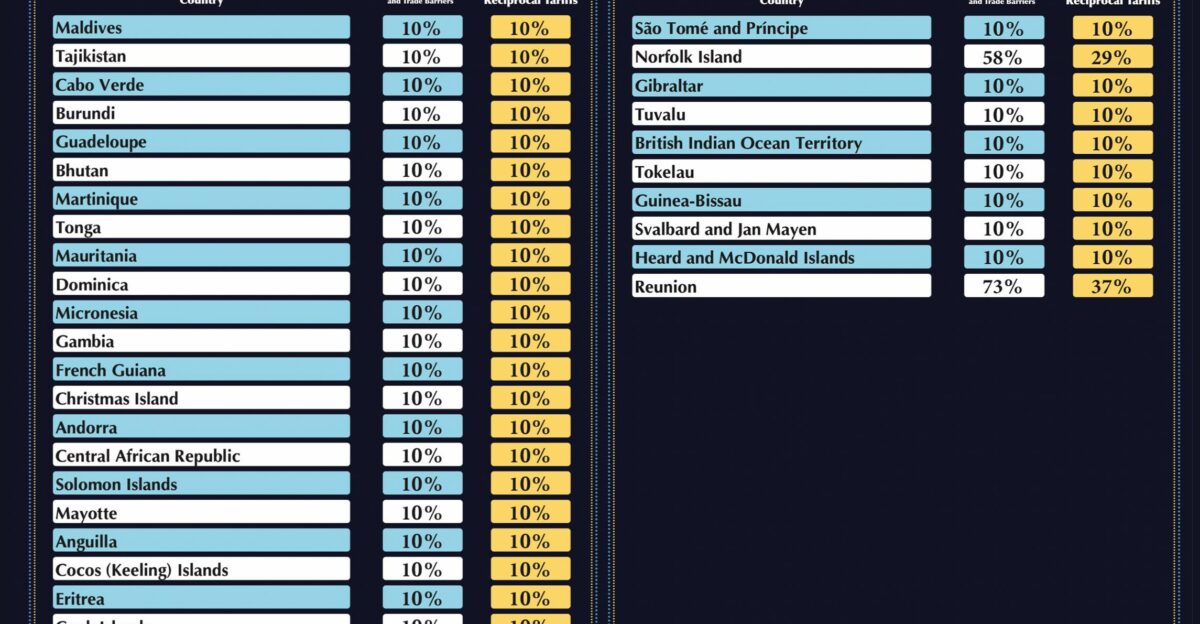

Tariffs Drive Up Appliance Costs

Recent U.S. tariffs on imported appliances and electronics significantly raised wholesale costs. Many products sold by Howard’s relied on global supply chains tied to Asia, making them especially vulnerable.

As costs climbed, retailers either absorbed losses or passed increases on to consumers. For regional chains with thinner margins, the added pressure proved difficult to withstand, accelerating financial distress.

A 79-Year Retail Legacy Ends

Howard’s history stretched back to the post-war era, evolving from small electronics repairs into a full-scale appliance retailer. Longtime employees recall decades of community ties and repeat customers.

Despite efforts to modernize and adjust sourcing, the business struggled to compete in a high-cost, low-margin environment. The closure marked the end of a nearly eight-decade presence in Southern California retail.

Tariffs Spark Policy Debate

Supporters of tariffs argue they protect domestic manufacturing, while critics point to collateral damage among retailers dependent on imports.

Howard’s collapse has renewed debate among policymakers, particularly in regions heavily reliant on imported consumer goods. Calls for exemptions or relief have grown louder, as lawmakers weigh the balance between trade protection and the survival of local businesses.

Inflation Pressures Consumers

Rising appliance prices, driven in part by tariffs, hit consumers already strained by inflation and higher interest rates.

With fewer home moves and renovations, appliance purchases increasingly center on replacements rather than upgrades. Retailers face pressure to discount, but higher costs limit flexibility. The result is a tighter market where both sellers and buyers feel squeezed.

Shoppers Delay Big Purchases

Faced with higher prices and economic uncertainty, many households are postponing non-essential appliance upgrades. Repairs and extended use have become more common.

Howard’s sudden closure reflects a broader shift in consumer behavior, where necessity outweighs discretionary spending. This change has ripple effects across the retail sector, particularly for stores reliant on big-ticket purchases.

Community Loss Beyond Commerce

The shutdown wasn’t just a business failure—it was a cultural loss for many neighborhoods. Longstanding local retailers often serve as community fixtures, employing local residents and building generational relationships.

Howard’s disappearance sparked nostalgia and frustration, reinforcing concerns about the erosion of regional brands in favor of national chains and online giants.

Global Supply Chains Adjust

The impact of U.S. tariffs extends beyond domestic borders. Manufacturers are increasingly diversifying production away from heavily taxed regions, shifting supply chains toward alternative countries.

While these adjustments may ease future costs, transitions take time. In the interim, retailers like Howard’s bore the brunt of higher prices without the scale needed to adapt quickly.

Winners and Losers Emerge

National retailers and online platforms are poised to benefit from displaced demand in Southern California. Smaller appliances and value-oriented brands show steadier sales.

Meanwhile, suppliers and service partners tied to Howard’s face losses from unpaid invoices. The bankruptcy reshuffles the local appliance market, redistributing both opportunity and risk.

What Consumers Can Do Now

Customers affected by the closure must act quickly, filing claims through bankruptcy proceedings and monitoring credit card protections.

Shoppers elsewhere are advised to compare prices carefully, watch for promotions, and consider products less exposed to tariff costs. Strategic timing and flexibility have become essential in navigating today’s appliance market.

A Warning Sign for Retail

Howard’s sudden collapse signals broader vulnerability across legacy retail. Even long-established chains can unravel quickly when tariffs, inflation, and weak consumer spending converge.

As courts process the bankruptcy and assets move toward liquidation, the case stands as a stark reminder: history alone no longer guarantees survival in a rapidly shifting economic landscape.

Sources:

TWICE (Dec 2025)

Article: “Appliance Brand Shuts 17 Stores Overnight as Tariffs Hammer Decades-Old Chain” (Slide 1); additional coverage on customer impacts and closure ripples (Slides 3, 7, 15).

The Independent (Dec 2025)

Article: Coverage on tariffs, slumping sales, and employee layoffs (Slide 2, 4).

Strata-gee (Dec 2025)

Article: Coverage on employee stories, layoffs, winners/losers, and future reckoning (Slides 4, 7, 11, 13, 15).

OpenBrand (2025)

Article: Insights on rivals, inflation ripples, lifestyle shifts, and market winners (Slides 5, 9, 10, 13).

eFulfillment Service (Apr 2025)

Article: “U.S. Tariffs Hit Appliance Imports from China, Asia” (Slide 6); tariff policy analysis (Slide 8, 12).