A master’s degree holder earning $120,000 annually checks her bank account on the 25th and feels a sense of panic. Avery White, a former financial analyst, spent years observing this exact moment repeated across income brackets. Her December 2025 analysis reveals something counterintuitive: intelligence and financial freedom operate independently.

The most accomplished professionals mysteriously find themselves broke before the month’s end, trapped in cycles conventional wisdom says shouldn’t exist.

The Uncomfortable Truth

Sixty-seven percent of Americans reported living paycheck to paycheck in 2025. The real shock sits deeper: someone making $150,000 feels as financially trapped as someone making $50,000. White’s research identifies a troubling pattern: intelligent people haven’t solved their money problems; they’ve perfected sophisticated rationalizations for poor financial habits.

Bright minds create intelligent-sounding justifications for unintelligent decisions.

Every Raise Disappears Into Thin Air

The promotion arrives—a twenty percent salary increase. Weeks of anticipation for breathing room, security, and finally getting ahead. Then six months pass—new apartment, reliable car, restaurants where entrees cost more. The raise vanishes into lifestyle upgrades.

This isn’t individual failure—lifestyle inflation affects nearly everyone regardless of income level. Economists classify it as predictable human behavior rather than personal weakness.

The Spending Trap Nobody Discusses

Behavioral research on payment methods reveals that people spend more when using credit cards than when paying with cash, with studies documenting double-digit percentage gaps. For middle-income earners, that extra percentage adds thousands of dollars to their annual income.

Swiping plastic doesn’t register loss the same way cash does. There’s a psychological distance between the pleasure of purchase and the pain of payment that keeps people unaware of true spending.

A Blind Spot Nobody’s Talking About

PhDs and MBAs nervously check account balances despite impressive credentials. Lawyers and doctors work 60-hour weeks yet feel financially powerless. Executives with sophisticated strategic minds often make irrational, emotional financial decisions.

White’s observation challenges comfortable assumptions: sometimes intelligence becomes a disadvantage. The brighter the person, the more elaborate their rationalizations for poor financial habits become.

One Simple Truth Changes Everything

Financial success isn’t a matter of intelligence. It’s a behavior test. This reframe explains why some people build wealth on modest incomes while others struggle despite high earnings. The eight habits in this analysis operate invisibly, so sophisticated that they masquerade as smart decisions.

Understanding why you make these choices is the first step toward making different ones.

1. Believing Your Next Raise Will Fix Everything

The mythology around raises runs deep. Twenty percent more income equals finally breathing, finally secure. But human behavior works differently than salary calculators suggest. Expenses mysteriously grow to match new earnings. Lifestyle inflation operates almost automatically, affecting nearly everyone regardless of bracket.

People making six figures experience identical stress as those making five figures. Every increase vanishes into upgrades before reaching savings.

2. Hemorrhaging Thousands

Intelligent people optimize the wrong expenses. Hours spent researching the cheapest coffee while massive leaks persist unaddressed. Housing, transportation, and food consume the most significant portion of budgets. Yet people spend minimal time reviewing mortgages they’ll pay for 30 years. A 0.5 percent rate reduction on a $300,000 loan saves roughly $90 monthly and thousands over the life of the loan.

Misplaced focus creates an illusion of responsibility while substantial money disappears elsewhere.

3. Using Credit Cards as a Salary Extension

When credit cards function as a fourth paycheck, problems compound silently. Psychological distance between swiping and paying creates dangerous illusions about the actual cost. The brain registers cash loss immediately. Credit cards remove that “pain of paying.” Behavioral economists describe a happiness gap: spending feels rewarding while bills remain abstract.

Over time, that extra spending layer quietly expands monthly outflows beyond what income alone would suggest.

4. Waiting for Perfect Timing That Never Arrives

Analysis paralysis masquerades as prudent caution. People often delay investing until markets stabilize, their income increases, and circumstances improve—perfect conditions rarely materialize. Yet, history proves clear: investors who bought small amounts during the 2008 crisis outperformed those who timed the market perfectly.

Someone investing $50 monthly came out far ahead of someone waiting for ideal conditions. Millions wait while compound interest passes them by. Imperfection compounds faster than perfect inaction.

5. Confusing Exhaustion With Financial Progress

Working 60 hours weekly doesn’t create financial progress—it creates exhaustion too complete for planning. White observed people drained by work schedules who never spend two hours a month reviewing their finances.

Productivity research shows hours worked correlate minimally with output beyond five or six hours daily. Yet a simple monthly money date—two hours reviewing accounts—transforms trajectories more than any raise ever could.

6. Turning Shopping Into Intellectual Entertainment

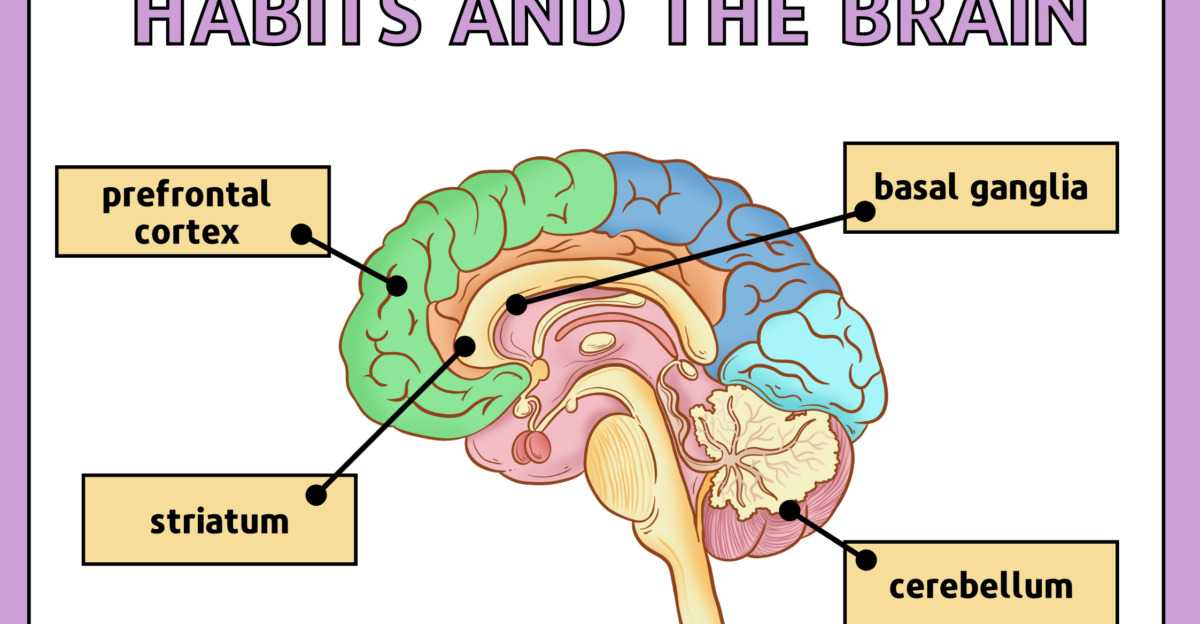

For intelligent people, shopping becomes a hobby masquerading as a form of productivity. The brain’s dopamine system activates powerfully during the hunt—researching, comparing, pursuing. Neuromarketing research indicates that visual cues can trigger spending impulses before rational decision-making processes are engaged.

Shopping becomes intellectual stimulation, a puzzle to solve. The hunt matters more than acquisition. Yet these purchases accumulate to thousands annually for temporary dopamine hits.

7. Confusing Financial Knowledge With Financial Discipline

Understanding compound interest doesn’t guarantee consistent investing. Knowing credit cards cost money doesn’t stop habitual swiping. Financial literacy and discipline represent entirely different skills. People with strong self-control tend to manage their money better, regardless of their level of education. Intelligence provides information; discipline offers results. Theory without implementation remains theory.

The gap between knowing and doing traps smart people the longest because they expect knowledge alone to drive behavior change.

8. Measuring Your Worth by Your Wallet’s Contents

The deepest trap links identity to purchasing power. Self-esteem influences spending independent of income or constraints. People unconsciously use purchases to confirm self-image and boost confidence. Shopping provides dopamine surges that feel like genuine improvement.

Surveys reveal that people often admit to overspending on maintaining their lifestyles or keeping up with their peers. Self-worth becomes entangled with spending power, creating cycles where purchases feel necessary for preserving identity.

The Pattern Nobody Admits But Everyone Recognizes

These eight habits don’t appear suddenly. They develop quietly over the years, each reinforced by rationalizations that feel reasonable. The professional earning $120,000 recognizes herself in multiple patterns. Doctors, lawyers, and engineers often find themselves trapped in similar cycles, despite their diverse careers.

The pattern extends beyond education and income levels. What changes everything is recognizing it and deciding to interrupt it intentionally.

Why This Matters More Than Your Salary Ever Will

Avery White’s core insight: you cannot earn your way out of behavioral patterns. More money without behavioral change exacerbates problems. Someone earning $50,000 with poor habits will likely remain paycheck-to-paycheck. Someone earning $200,000 with identical habits experiences proportional struggle.

The path forward isn’t another raise—it’s modifying behavior while earning what you make. This reframing from external income to internal discipline unlocks freedom.

The Monthly Money Date That Changes Everything

White’s recommended action: review finances for two hours monthly. Most people work 60 hours a week, earning without investing 90 minutes a month on spending. A money date means reviewing accounts, identifying where money actually goes, and making one conscious decision differently next month.

Financial advisors report that this habit creates more progress than salary increases. It’s not complicated. It’s just uncommonly practiced.

Start With One Habit This Month, Not All Eight

Attempting all eight simultaneously guarantees failure and overwhelm. Instead, identify which habit costs the most financially and target that pattern. Maybe it’s card spending creep. Perhaps it’s skipped refinancing. Maybe it’s shopping cycles.

Pick one. Understand why. Change it deliberately. Small shifts compound like interest over time, building momentum that creates lasting change without feeling overwhelming.

The Uncomfortable Question

Which habit is yours? Everyone recognizes themselves somewhere. That discomfort means the message is landing. Recognition is valuable—it’s the first step toward change. Denial keeps people trapped. Acknowledgment opens possibility.

The professional earning $120,000 finally recognized her salary illusion trap. Once she named it, everything shifted. She spent less time justifying upgrades and more directing income toward investments. Money didn’t increase. Choices did.

Financial Freedom Requires Different Behavior

Warren Buffett said, “Price is what you pay. Value is what you get.” Financial freedom comes from understanding that distinction and acting consistently. Intelligence secured your education and employment. Behavior will secure your wealth. You already possess the required intelligence. You’re reading this, analyzing yourself, considering change.

That capacity means you’re entirely capable of different choices. Start this week. Review one account. Make one different decision. Build from there.

Sources:

Bankrate. “Living Paycheck To Paycheck Statistics.” August 2024.

Federal Reserve. “Report on the Economic Well-Being of U.S. Households.” 2025.

Warren Buffett. “Price is what you pay. Value is what you get.” (Documented Investment Philosophy)

Dun & Bradstreet / Consumer Behavior Research. Credit Card Spending Analysis Studies.

Federal Reserve Board of Governors. “Consumer Credit Panel and Household Finances Report.” 2024-2025.