In a stunning blow to one of the largest children’s clothing chains in North America, the company is now facing a $250 million annual tariff hit. By 2026, 150 stores will close across the continent, and 300 corporate jobs will vanish.

The retail giant, which has been dressing American children for over 160 years, is struggling to cope with a tariff surge that has tripled costs. How did it reach this point, and what lies ahead for this iconic brand?

Margins Plunge 50%

In Q3 2025, the company’s adjusted operating income dropped to $39 million, down from $77 million the year before, marking a nearly 50% decline.

The sharp rise in tariff costs has been one of the largest contributors to this financial downturn. With uncertainty still surrounding tariffs, the company has refrained from providing sales guidance. How much longer can this retail giant weather these pressures?

Baby Brand Legacy

Founded over 160 years ago, this children’s clothing brand became a staple for young families across North America, particularly among Gen Z.

Known for its popular brands like OshKosh B’gosh, it has built a loyal customer base. But with rising costs due to increased tariffs, the company’s long-standing dominance is now at risk. Can this iconic name continue to thrive in an increasingly challenging market?

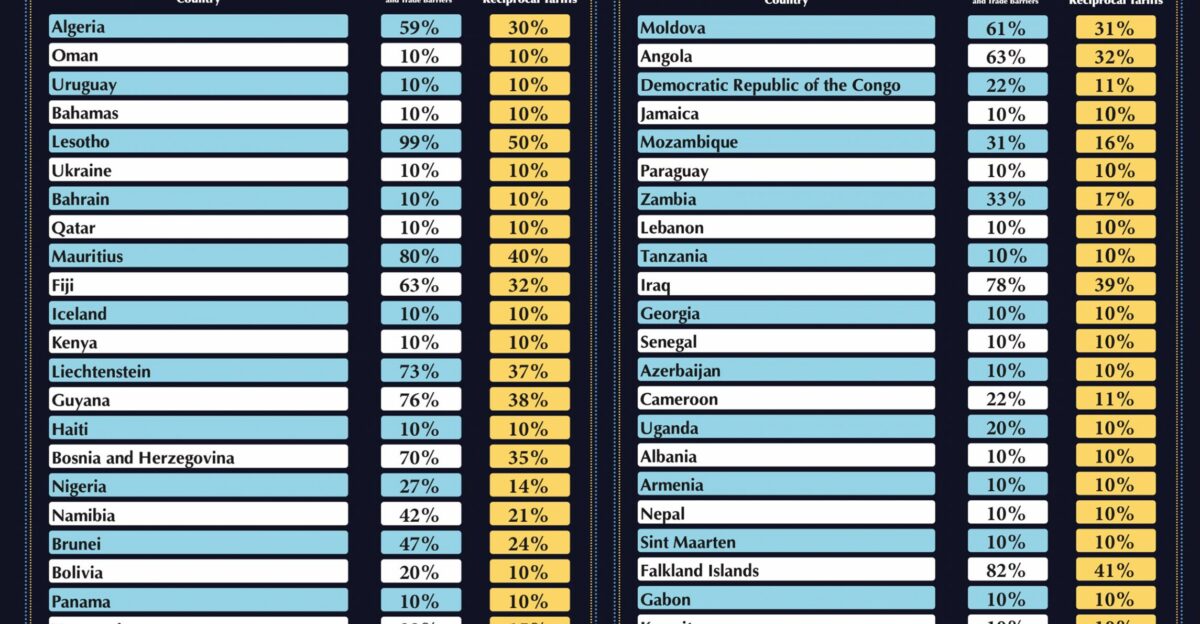

Duties Surge

Under the Trump administration, the tariff rate on imported goods for the company surged from 13% to as high as 30%.

This dramatic increase in duties is expected to cost the company $200–$250 million annually, leading to price hikes and a reduction in product offerings. What impact will these changes have on customer shopping habits and brand loyalty?

150 Stores Shuttered

By 2026, Carter’s plans to close 150 stores across North America, reducing its store fleet by one in eight locations.

The closures are driven by expiring leases and the mounting financial strain of tariffs. Why has the company chosen to close these locations now, and how will this affect loyal customers?

North America Hit Hard

The store closures will primarily impact locations across the U.S. and Canada, with the Bay Area seeing the loss of 13 Carter’s stores.

By 2026, the company will have closed around 100 stores, reducing its physical footprint significantly. What does this mean for communities that have relied on Carter’s as a convenient shopping option for baby products?

Jobs Vanish Holidays

In addition to store closures, 300 corporate jobs are set to be eliminated, with employees being notified by the end of 2025.

This reduction in the workforce, combined with the upcoming holiday season, adds a layer of hardship for those affected. The company is focused on eliminating costs, but what does this mean for workers and their families?

Rivals Raise Prices

Carter’s isn’t alone in facing the financial strain of rising tariffs. Other major retailers are also grappling with tariff-related cost pressures as imported goods become more expensive.

The company has stated it will seek to recover tariffs paid if the Supreme Court strikes down the challenged tariff regime. Separately, Costco and over 100 other companies have filed lawsuits at the U.S. Court of International Trade to preserve their right to tariff refunds. How are other companies adapting to these tariff-related challenges?

Retail Closures Surge

Carter’s joins other major retailers like Joann and Rite Aid in closing a significant number of stores. Retail closures are becoming a growing trend due to the escalating impact of tariffs and shifting consumer behavior.

The company’s operating income dropped over 60% in the first three quarters of 2025. What’s driving these retail closures, and who will be affected next?

20-30% SKUs Axed

Carter’s has announced it will reduce its product line by 20–30% in order to create a more unified global product assortment.

This decision, which aims to offset tariff costs of up to $35 million, will result in fewer options for consumers. How will this product reduction affect parents who have relied on Carter’s for a wide selection of affordable baby clothing?

Exec Frustration Boils

Carter’s executives, including CFO Richard Westenberger, continue to express frustration with the ongoing tariff situation.

Despite efforts to cut costs, the company is facing significant financial strain. They remain uncertain about future growth due to the unpredictable tariff landscape. How will Carter’s leadership navigate this turbulent period?

Leadership Stays Firm

CEO Douglas Palladini remains committed to driving the company’s pivot, halting the expansion of U.S. stores in favor of a new store model.

The focus is now on improving productivity and reducing costs. Despite ongoing challenges, Carter’s leadership is determined to adapt. But will the new model prove successful in the long run?

Price Hikes Planned

In an effort to recover from rising costs, Carter’s plans to raise prices on its products. The company is closely monitoring consumer response to these increases.

Will loyal customers continue to shop at Carter’s, or will the higher prices push them to look for more affordable alternatives?

Analysts Eye Risks

Industry analysts view the tariffs as a major threat to Carter’s bottom line, with the company’s historical resilience now being tested.

The upcoming Supreme Court decision on the legality of the tariffs could provide some relief, but until then, the outlook remains uncertain. How will this legal battle unfold, and what does it mean for Carter’s future?

Future Uncertain

Carter’s continues to withhold sales and earnings guidance due to the uncertainty surrounding tariffs. The company’s new store models and global product assortment may help mitigate some of the damage, but the long-term impact of the tariffs remains unclear.

Will Carter’s be able to recover, or is this the beginning of a larger decline?

Policy Battle Rages

The legality of Trump’s tariffs is under review by the Supreme Court, which will decide whether the use of the International Emergency Economic Powers Act (IEEPA) to impose the tariffs was constitutional.

If the court strikes down the tariffs, Carter’s may recover millions in tariffs paid. What will the court decide, and how will this affect other retailers?

Global Chains Strain

The impact of tariffs is not limited to U.S. companies. Retailers and manufacturers worldwide are facing higher costs due to increased duties on imported goods.

Carter’s shift to a unified global product assortment is an attempt to adapt to these pressures. What’s the global toll of these tariffs, and who will be next to feel the squeeze?

Court Fight Heats

Photo by Sora Shimazaki on Pexels

With the Supreme Court expected to rule on the legality of Trump’s IEEPA tariffs, Carter’s has stated it will seek tariff refunds if the court strikes down the challenged regime.

Meanwhile, numerous companies including Costco have filed protective lawsuits at the Court of International Trade to preserve their refund rights as liquidation deadlines approach. This legal battle could result in significant financial relief for affected companies, but the timeline for resolution remains uncertain. How much could Carter’s recover, and what implications does this have for other businesses?

Parents Adapt Slowly

For many young families, Carter’s has been a trusted brand for generations. But now, with higher prices and fewer store locations, parents are adjusting to a new shopping reality.

As the retail landscape shifts, will families stick with Carter’s, or will they turn to more affordable options?

Retail Reckoning Dawns

The closure of 150 stores and the ongoing legal battles over tariffs signal a major turning point for Carter’s.

As the company grapples with the financial fallout, the broader retail sector faces uncertainty. What’s next for Carter’s and other U.S. retailers? The future of American brands is now more uncertain than ever.

Sources:

“Carter’s Inc. Reports Third Quarter Fiscal 2025 Results.” Market Wire, 26 Oct 2025.

“Blaming Tariffs, Children’s Apparel Chain Carter’s to Close 150 Stores.” CoStar Group, 26 Oct 2025.

“Costco Sues Trump Administration for ‘Full Refund’ of Tariffs.” BBC News, 1 Dec 2025.