Kroger’s quarterly loss had just been announced—$1.3 billion. It was a moment that rattled the grocery giant’s leadership, prompting immediate and sweeping changes. As news of nearly 1,000 corporate job cuts, dozens of store closures, and significant price reductions on 3,500 items spread, shoppers and analysts alike began to wonder: What had gone wrong? Was this an unavoidable consequence of external forces, or had Kroger’s internal strategies failed?

The company’s bold moves in response to its staggering losses would reshape the future of grocery retail, but could they turn things around before it was too late?

Ron Sargent’s Strategy: Cutting Costs, Rebuilding

Interim CEO Ron Sargent, who took over after Rodney McMullen’s sudden resignation, is refocusing Kroger’s strategy.

His approach includes slashing corporate costs, consolidating divisions, and eliminating failing e-commerce operations. Despite a 44% surge in operating expenses, Sargent plans to redirect funds to improve store operations and pricing.

Price Cuts and Promotions for Shoppers

In an effort to attract budget-conscious shoppers, Kroger is reducing prices on 3,500 key grocery items, from chuck roasts to eggs.

These price cuts are aimed at consumers who have become more selective, buying fewer items and opting for discounts. However, these cuts come at a cost—job losses and asset write-downs.

Corporate Restructuring: Jobs on the Line

Kroger’s restructuring includes laying off almost 1,000 corporate employees. The company has already eliminated hundreds of roles earlier in the year and plans more cuts as part of an ongoing effort to streamline operations.

These moves are aimed at freeing up capital for reinvestment in stores and customer service.

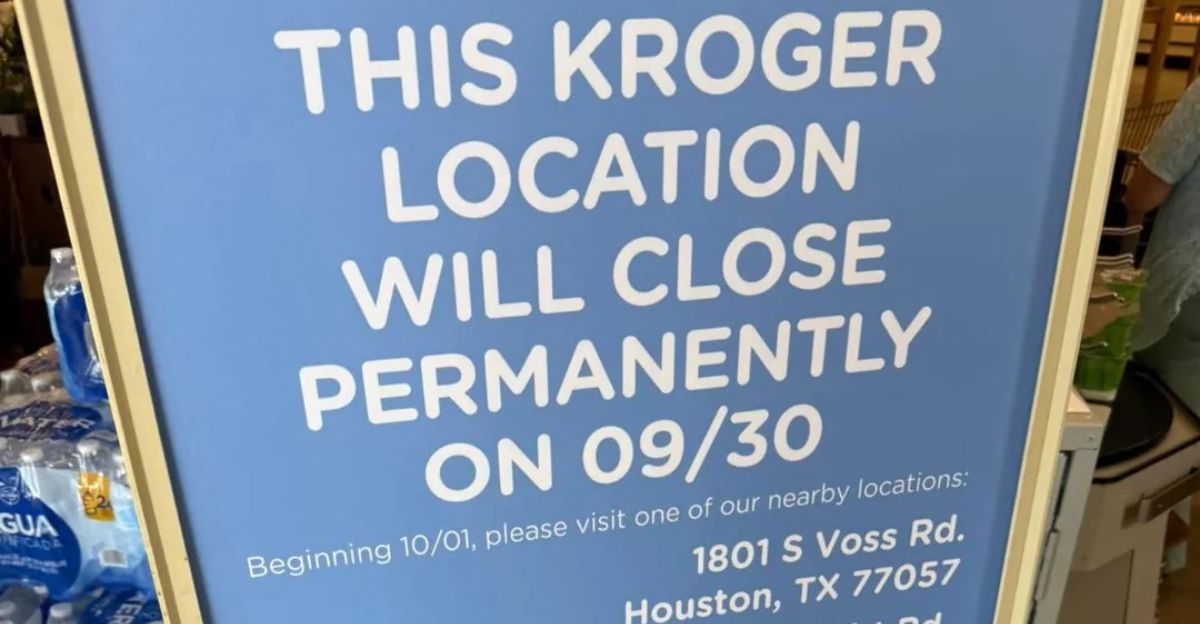

Store Closures Across the Country

Kroger is closing about 60 underperforming stores over the next 18 months, a move that will impact employees and shoppers alike.

However, this is balanced by plans for new store openings, as the company reshapes its presence in various regions. The closures represent a shift in strategy toward profitability rather than sheer expansion.

Resetting the E-Commerce Strategy

The closure of three automated Ocado fulfillment centers marks a major pivot in Kroger’s e-commerce approach.

Despite a $2.6 billion charge related to these closures, the company expects an improvement of $400 million in e-commerce profit by 2026. This reflects a move toward a more sustainable e-commerce model.

The Impact on Workers and Store Staff

While corporate staff bear the brunt of the cuts, frontline workers are also feeling the strain. Dozens of store closures will affect thousands of employees, forcing many to seek new opportunities.

However, Kroger has promised to offer hours at remaining stores and support for workers in other locations.

Struggling After the Albertsons Merger Failure

Kroger’s restructuring follows the collapse of its $24.6 billion merger with Albertsons, blocked by regulators.

Without the merger, Kroger is now faced with intense competition from Walmart and Amazon, pushing the company to focus on cost-cutting measures, store closures, and lower prices to remain competitive.

Inflation, Tariffs, and Consumer Concerns

Kroger is grappling with rising inflation and tariffs on goods like bananas and flowers, pushing up costs. At the same time, a sluggish economy and a government shutdown have reduced consumer spending, especially in lower-income households.

These external factors are squeezing Kroger’s margins as it tries to offer lower prices.

Changing Shopper Behavior

E-commerce is a growing part of Kroger’s sales, with around 11% of its revenue coming from online orders.

As shoppers become more budget-conscious, they’re increasingly mixing online shopping with in-store visits, gravitating toward private-label products and discount deals as they adjust to rising costs.

The Automation Dilemma

The shutdown of Ocado’s automated warehouses raises questions about the future of high-tech, capital-intensive solutions in grocery retail.

These facilities were once seen as the future of e-commerce fulfillment, but their failure to meet financial expectations has prompted Kroger to reassess its automated strategy and focus more on regional warehouses.

Trust and Leadership Challenges

Kroger is navigating these challenges under the leadership of Ron Sargent, following the abrupt resignation of long-time CEO Rodney McMullen.

Sargent, a former Staples CEO, is guiding the company through a major transition, but the board is actively searching for a permanent CEO. This leadership uncertainty could shape the company’s future direction.

How Retail Rivals Could Benefit

While Kroger implements its cost-saving measures, rivals such as discount grocers and big-box stores may see an influx of former Kroger customers.

Local competitors could benefit from store closures, gaining market share in regions where Kroger is scaling back. Additionally, private-label manufacturers might see a boost as Kroger expands its store-brand offerings.

Investor Scrutiny and Market Reactions

Kroger’s stock fell by 4.6% after the announcement of its $1.3 billion loss and lowered sales forecast. Investors are closely watching the company’s efforts to turn around its finances.

For consumers, the message is clear: be on the lookout for deeper discounts, but be aware that these price cuts may not last.

What’s Next for Kroger’s Future?

Looking ahead, Kroger aims to improve e-commerce profitability by $400 million by 2026. With a new external CEO potentially in the works, the company is at a crossroads.

Whether the restructuring efforts will stabilize margins and lead to lasting price reductions remains to be seen, but these bold steps could reshape the future of grocery retail.

Sources:

Kroger Reports Third Quarter 2025 Results and Updates Guidance

Kroger Announces Resignation of CEO Rodney McMullen

Kroger to Close Around 60 Stores Nationwide Over Next 18 Months

Kroger Makes Massive Coupon Change & Lowers Prices on 3,500+ Items