Hundreds of employees filed out of General Motors’ Factory Zero in Detroit on a frigid December afternoon, clutching tool bags and cardboard boxes after being told their jobs will end on January 5, 2026. The plant, once promoted as a flagship of GM’s all-electric future, is cutting 1,140 positions in what is expected to be the largest electric-vehicle workforce reduction of 2025. For many workers, the news arrives just weeks before the holidays, at a moment when household budgets are already stretched.

Why Incentives Vanished And Demand Plunged

The immediate backdrop is the end of the $7,500 federal tax credit for new EVs on September 30, 2025. In the weeks before the deadline, GM’s electric-vehicle sales hit record highs in September as buyers rushed to capture the incentive. When the subsidy expired, orders dropped sharply, revealing that much of the demand had been driven by policy rather than enduring consumer appetite.

Factory Zero builds some of GM’s most expensive electric models, including the Silverado EV, Hummer EV, and Escalade IQ, many with prices exceeding $100,000. In October 2025, GM took a $1.6 billion accounting charge and signaled that its path to full electrification would be slower and more costly than it had projected only a few years earlier. The workforce reduction at Detroit-Hamtramck is one visible result of that reassessment.

Workers, Suppliers, And Battery Plants Feel The Shock

The human impact lands quickly. UAW-represented employees, who earn roughly $60 an hour in wages and benefits, face a steep drop to Michigan’s new maximum unemployment benefit of $530 per week in early 2026. Families have about five weeks between notification and the January 5 layoff date to adjust budgets, but alternative manufacturing jobs are limited and the financial gap is immediate.

Outside GM’s gates, the cutbacks are even more severe. Auto suppliers typically employ several workers for every one at an assembly plant, and those positions often disappear without severance or transfers. One supplier tied heavily to EV programs saw its workforce fall from more than 800 employees to about 80 within months. Dana Thermal Products shut its EV battery cooling plate factory in Auburn Hills, eliminating about 200 positions. Yanfeng is closing its facility in Romulus on January 5, cutting 192 jobs, while International Automotive Components is shutting two Michigan plastics operations and eliminating around 250 roles.

GM’s battery joint venture with LG Energy Solution, Ultium Cells, will suspend operations at its plants in Warren, Ohio, and Spring Hill, Tennessee, starting January 5 and running until roughly mid-year. Warren faces about 850 temporary layoffs and 550 permanent job losses; Spring Hill expects about 700 temporary layoffs. With shutdowns stretching close to six months, some workers will exhaust Michigan’s 26 weeks of unemployment assistance just as facilities are scheduled to restart, leaving them exposed if timetables slip.

Detroit’s Economy And Safety Net Under Strain

Factory Zero’s 1,140 workers collectively earn about $140 million a year in wages and benefits, money that supports restaurants, landlords, retailers, and service providers throughout the Detroit area. Manufacturing roles carry high economic multipliers, so each lost paycheck can translate into indirect losses two-and-a-half to three times larger across the local economy. As high-wage spending contracts, small businesses already operating on thin margins report declines in customer traffic of 10–15%, prompting their own staffing cuts and a pullback in orders from suppliers.

Food assistance networks are bracing for additional stress. Detroit’s system of food pantries has already been strained by disruptions to federal nutrition benefits and higher grocery costs. In November 2025, Mayor Mike Duggan directed $1.75 million in emergency funds to expand food distribution, enabling more than 100 pickup locations. Even so, local organizations report that supplies are being depleted quickly as more families seek help.

Michigan’s unemployment insurance system is also under renewed pressure. The state is increasing its maximum weekly payment to $530 on January 1, 2026, with dependent allowances rising to $19.33 per week, and benefits lasting up to 26 weeks. Past surges in claims have created backlogs in processing, and state officials now face the task of handling thousands of new applications from auto and supplier workers who must also manage rent, mortgages, and other bills while they wait.

From EV Bet To Course Correction

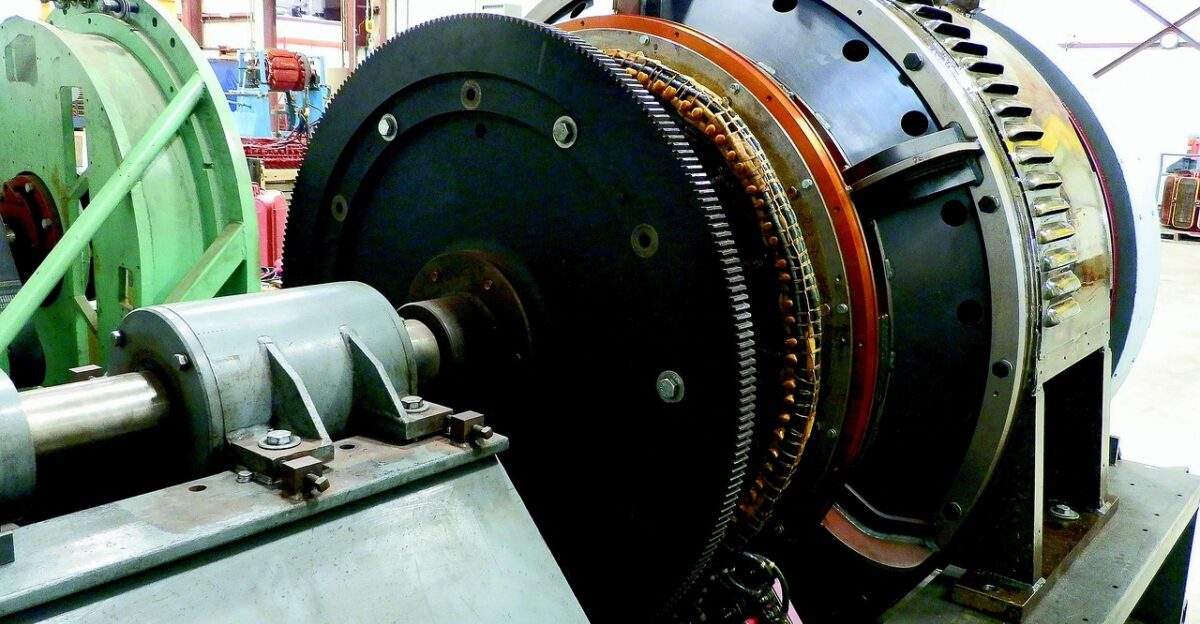

Factory Zero was central to GM’s pledge of “zero crashes, zero emissions, zero congestion.” In 2020, the company committed $2.2 billion to convert the Detroit-Hamtramck site into an all-electric assembly complex. Two years later, GM announced a record $7 billion Michigan investment package, promising 5,000 new manufacturing jobs across multiple facilities. That plan envisioned a rapid build-out of EV capacity, including converting GM’s Orion Assembly plant to electric pickup production.

By late 2025, the strategy had shifted. GM canceled the Orion EV conversion and now plans to retool the site for gasoline-powered Escalade, Silverado LD, and Sierra LD models by 2027. Workers who previously installed EV lines are now watching them being dismantled, with some describing the process as wasteful and demoralizing. Across the wider industry, Ford, Stellantis, Rivian, and Volkswagen have all curtailed electric production, cut staff, or idled plants after incentives ended and demand cooled, while hybrid and gasoline models retain stronger order books.

State officials are reassessing as well. Michigan had positioned itself as a national center of EV manufacturing, offering large incentive packages and promoting the MI Healthy Climate Plan’s infrastructure and emission goals for 2030. Yet EV purchases have fallen short of projections, charging buildout has not fully eased customer concerns about access, and high sticker prices remain a major barrier. At the same time, the state has lost about 6,300 manufacturing jobs since February 2025, three times the national rate, while federal spending reductions have removed $1.1 billion from Michigan’s budget. Lawmakers now weigh options such as extended jobless benefits, targeted subsidies, and retraining efforts with fewer federal dollars available.

Looking Ahead: Detroit’s Setback And The National EV Question

The cut of 1,140 permanent positions at Factory Zero is only part of the broader picture. Reduced hours, supplier contractions, battery plant furloughs, and secondary layoffs in retail and services are expected to put an estimated 10,000 to 15,000 households in the Detroit region under financial strain. Housing markets, which entered 2025 with rising prices and high apartment occupancy, may see stress emerge gradually through higher delinquency and vacancy rates. Workforce housing segments once viewed as stable are now more vulnerable as paychecks disappear and refinancing becomes more difficult.

For workers, immediate steps include filing unemployment claims quickly, reaching out to lenders or landlords before missing payments, and looking for opportunities in sectors such as health care, logistics, skilled trades, and advanced manufacturing. Local food-distribution organizations like Forgotten Harvest, Gleaners, and Metro Food Rescue are among the first lines of support during the transition.

Nationally, the turmoil around Detroit’s EV hub raises a central question: how far and how fast can the United States move toward electric mobility without sustained public subsidies and clear consumer confidence? Tesla still holds about half of the domestic EV market, but that dominance underscores the difficulty for traditional automakers trying to scale electrified fleets while preserving profitability and jobs. Investors, policymakers, companies, and communities will all be watching what happens next in Michigan, where a bold bet on an all-electric future has turned into a test of how to manage a slower, more uncertain transition.

Sources

Reuters; GM to take $1.6 billion charge as tax credit blow muddies EV plans (October 14, 2025)

CBS Detroit / WARN Act filings; GM permanent layoffs of 1,140 workers at Factory Zero Detroit-Hamtramck; Ultium Cells furloughs

Detroit Free Press / Michigan.gov LEO WARN notices; Dana Thermal Products Auburn Hills closure; Yanfeng Romulus layoffs; International Automotive Components Michigan plant closures

State of Michigan UIA unemployment law changes; unemployment benefits and dependent allowances