The warning message appears without notice — “Stop Safely Now” — as a Ford Escape Plug-In Hybrid abruptly loses propulsion in traffic, forcing the driver to drift toward the shoulder. Under the hood, damaged battery cells risk overheating, a flaw affecting 20,558 Ford Escape and Lincoln Corsair PHEVs built between 2020 and 2024.

Ford previously deployed a software fix in 2024, but seven thermal incidents occurred afterward, proving that it was insufficient. And this second recall reveals a deeper problem automakers now struggle to contain.

Why It’s Happening

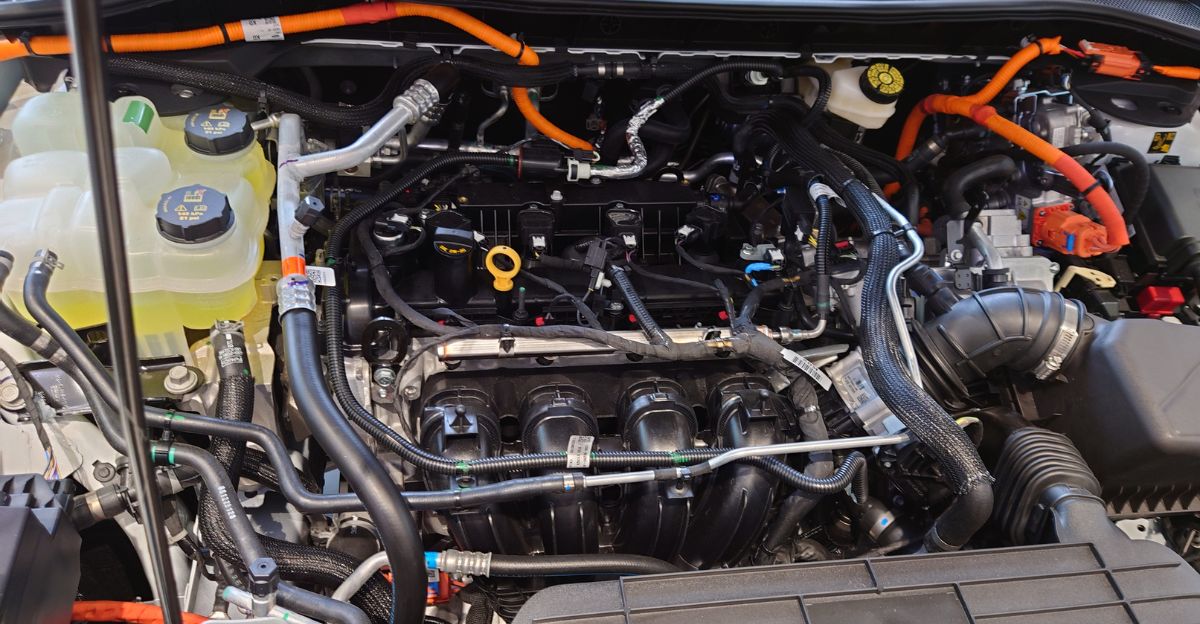

At the center is a Samsung SDI battery cell manufactured in Hungary with microscopic separator defects capable of triggering internal shorts. Ford’s 2024 software update attempted to detect anomalies and stop charging before temperatures spiked, but seven thermal venting events occurred afterward, exposing gaps in Ford’s approach.

COO Kumar Galhotra previously blamed “build problems during the Covid pandemic,” but defects span multiple model years, leaving dealerships overwhelmed and safety regulators deeply skeptical of early software-only solutions.

Your Driveway Becomes a Fire Hazard

Ford instructed owners to limit the maximum state of charge and drive exclusively in “Auto EV” mode until a permanent solution exists. Vehicles may display “Stop Safely Now” and abruptly shut down, raising safety risks in traffic.

Worse, batteries can vent heat unexpectedly while parked, making everyday spaces fire-risk zones. Owners who purchased these SUVs for efficiency now face uncertainty, inconvenience, and lowered functionality until a hardware solution exists. Ford has not provided a definitive timeline for permanent fixes.

Dealership Service Bays Overwhelmed

Ford has issued over 100 recalls in 2025, breaking records and overwhelming service centers that are typically designed for routine maintenance. Many recalls, including this one, require physical inspections, potential battery replacements, and specialized repair capacity.

Parts shortages keep vehicles sidelined, while dealers juggle thousands of recall appointments. For Escape and Corsair owners, dealers can only provide interim measures until Ford finalizes solutions. The backlog grows weekly as new recalls arrive—creating a costly, time-consuming repair environment nationwide.

Insurance Premiums Rise

The insurance industry increasingly links plug-in hybrid ownership with higher risk exposure. EV thermal events have resulted in significant insurance claims, forcing insurers to reassess policies based on battery-fire likelihood.

When a recalled vehicle experiences documented safety failures—especially recurring ones—premium adjustments or coverage considerations often follow. Owners of Escape and Corsair PHEVs now face quantifiable fire risk tied to defective Samsung SDI cells. Insurance providers may react accordingly, leaving affected drivers financially exposed even before vehicles are repaired.

Resale Values Crater

Escape PHEVs already depreciated faster than rivals like the Toyota RAV4 Prime, and the double recall accelerates that decline. Buyers are reluctant to purchase vehicles with documented fire risks or unresolved battery problems.

EVs and plug-in hybrids depreciate quickly due to high battery replacement costs, but vehicles with two recalls for the same issue face deeper value erosion. For 20,558 affected units, the defect becomes a permanent record, instantly limiting resale prospects and undermining owner equity.

Samsung SDI Faces Global Reputation Crisis

Samsung SDI’s defective cells affected vehicles from Ford, Stellantis, Volkswagen, and Audi, totaling more than 180,000 battery packs manufactured between 2020 and 2023. The company admitted its software-based fix “may not be effective” in certain conditions.

Compounding the crisis, Hungarian authorities suspended production at the Göd plant due to environmental violations. A breakdown in quality control now affects drivers, automakers, and investors, damaging confidence in one of the world’s key battery suppliers during a pivotal period of electrification.

NHTSA Tightens Regulatory Scrutiny

NHTSA placed Ford under a consent order requiring retroactive evaluation of recalls issued over the past three years. This resulted in an audit identifying software fixes as incomplete in multiple campaigns, contributing to Ford’s record-setting recall count in 2025.

Regulators now require evidence that safety issues are genuinely resolved before approving closure. The Escape PHEV double recall illustrates the consequences of software-first fixes: seven failures revealed that “protective” updates were never sufficient, forcing deeper regulatory intervention.

Ford’s $4.8 Billion Warranty Crisis Deepens

In 2023, Ford spent $4.8 billion on warranty repairs, setting aside $1,203 per vehicle sold and fueling concerns about escalating costs. A brief improvement in 2024—$450 million fewer warranty expenses in Q3—suggested progress, but recent recalls undermine that narrative.

Quality issues could account for up to $2 billion EBIT loss, and the Escape PHEV recall may require high-voltage battery replacements across thousands of vehicles. The result is a widening financial burden as warranty obligations escalate faster than quality fixes.

Competitors Capitalize on Ford’s Crisis

Toyota, Honda, and Hyundai are benefiting as consumers shift toward non-plug-in hybrids with strong reliability reputations. Toyota’s electrified vehicles made up more than 50% of the company’s U.S. sales in Q1 2025, while hybrid sales broadly increased as plug-in hybrids dropped 11% year-over-year.

Ford’s double recall reinforces consumer preference for simpler solutions, allowing competitors to frame themselves as safer and more dependable. Recalls affecting new 2025-2026 vehicles make Ford’s quality assurances difficult to sustain while rivals strengthen their advantage.

The “Covid Excuse” Loses Credibility

Ford attributes long-standing problems to “build issues during the Covid pandemic,” yet brand-new 2025 and 2026 models are also being recalled. Over 200,000 Broncos and Bronco Sport models were recalled for instrument panel failures, affecting core driving functions.

These aren’t pandemic-era products—they reflect current manufacturing. While Ford claims launch quality has “radically improved,” the data suggests otherwise. The Escape PHEV recall stretches across 2020-2024 models, contradicting claims that problems were isolated to early Covid disruptions.

The Least Proactive Automaker

A 31-year study found fewer than 30% of Ford recalls were initiated proactively; the majority were triggered externally by consumers, regulators, or suppliers. The Escape PHEV recalls follow this pattern: field failures, warranty claims, and European thermal incidents exposed gaps in Ford’s response.

Even after issuing a software fix, Ford did not verify whether it resolved defects under all conditions. The result is reactive crisis management, costly retroactive solutions, and continued risk exposure for affected owners and dealers.

PHEV Market Share Declines

Plug-in hybrid market share is falling globally as consumers gravitate to either pure EVs or traditional hybrids. Leading automaker BYD reported PHEV sales fell 22.4% in November 2025 compared to the previous year. U.S. plug-in hybrid volume fell 11% year-over-year in early 2025 to roughly 2% of the market.

Recalls from Ford, Stellantis, and Volkswagen—affecting nearly 180,000 vehicles—undermine the central promise of PHEVs: reliable dual-fuel flexibility. Many consumers now view PHEVs as high-risk compromises rather than transitional solutions.

Trust Gap Emerges

The Escape PHEV recall reveals systemic failures across manufacturing, regulation, and quality control. Ford’s more than 100 recalls in 2025, Samsung SDI’s widespread defects, and failed software remedies expose underlying fragilities in electrification scaling.

Statements like Galhotra’s claim that “improving quality lowers warranty expense and reduces recalls” clash with record-setting recall volumes. For thousands of owners, unresolved safety risks and rapid depreciation create a daily reminder that promises of reliability were not fulfilled.

Final Wrap-Up: What Comes Next

This recall raises broader questions about whether the auto industry can scale electrification while maintaining safety and reliability. Defective Samsung SDI batteries affected multiple global automakers, indicating systemic supply chain risk.

The PHEV segment is shrinking in both the U.S. and China, as consumers lose confidence following repeated failures. Ford’s double recall—combined with seven thermal incidents after the “fix”—highlights a widening gap between promises of innovation and measurable performance. The industry’s next challenge is rebuilding trust before adoption slows further.

Sources:

NHTSA Part 573 Safety Recall Report 25V789 (November 2025)

NHTSA Consent Order and Civil Penalty Press Release (November 2024)

Samsung SDI Battery Recall Notice (February 2025)

Ford Motor Company Form 10-K Annual Report (2023)