On Aug 22, 2025, the Trump administration unveiled an extraordinary rescue for Intel. It converted $5.7 billion of CHIPS Act grants and $3.2 billion from a Secure Enclave program into 433.3 million Intel shares at $20.47 each, giving Washington a 9.9% stake and making it the chipmaker’s largest shareholder.

The investment is passive – no board seat or extra voting power – but marks an unprecedented intervention in private business.

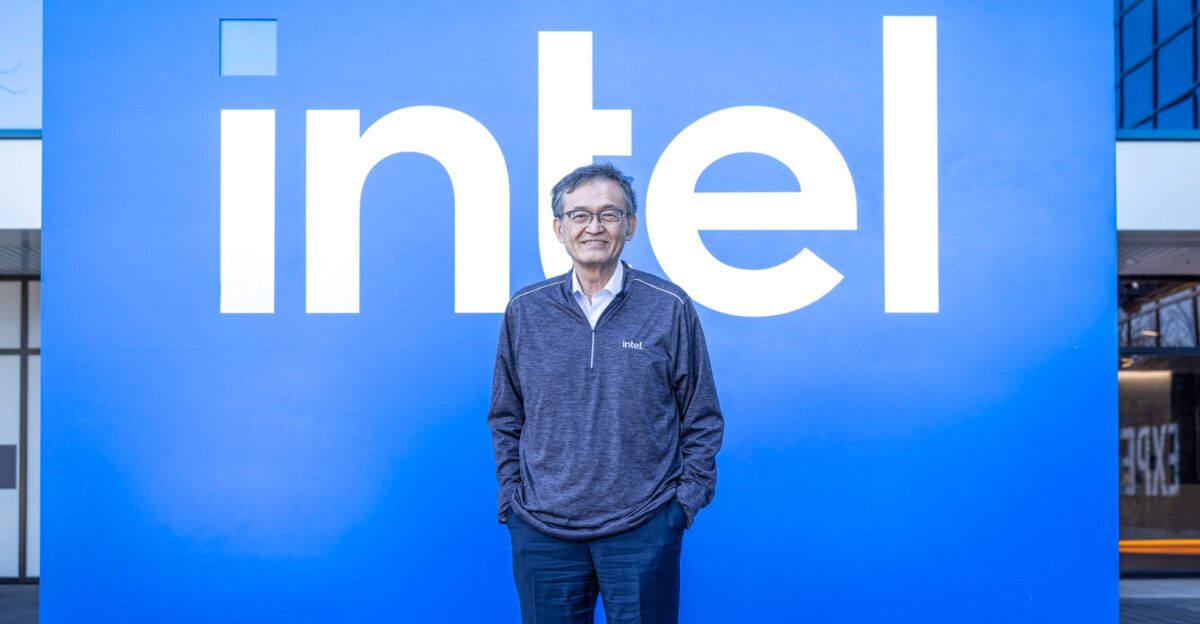

Intel CEO Lip-Bu Tan thanked the administration, saying, “President Trump’s focus on securing investments in vital industries has my thanks,” reflecting the deal’s significance.

Crisis Point

Intel posted a nearly $18.8 billion net loss in 2024 — its first annual deficit since 1986. That dismal performance was driven by falling PC and data-center chip sales and a failure to capitalize on the AI boom.

Meanwhile, rival Nvidia vaulted to a trillion-dollar market cap on surging AI demand. Intel’s Foundry Direct service also hemorrhaged cash over multiple quarters.

As a result, some analysts warn the company may have to halt its bleeding-edge fabs if it cannot secure major external customers by 2027. Intel’s core business must turn around fast or risk a steep retrenchment.

CHIPS Act Origins

President Biden signed the CHIPS and Science Act in mid-2022, committing $52 billion to bolster U.S. semiconductor manufacturing against rising China competition.

Intel, which pledged roughly $100 billion in new factories, was initially slated to receive about $8.5 billion. After review, Commerce finalized roughly $7.86 billion in direct grants to Intel in late 2024.

This funding supports advanced fabs in Arizona, New Mexico, Ohio and Oregon under Intel’s expansion plans. It also includes a 25% investment tax credit on qualifying spending.

Intel said these investments would support over 10,000 company jobs and tens of thousands more in construction and supplier roles, underscoring bipartisan support for reviving domestic chipmaking.

Mounting Pressures

By mid-2025, Intel’s troubles were intensifying. Its chips were lagging AMD in PCs and Nvidia in AI, even as foundry rivals began winning customers.

In an internal memo, CEO Lip-Bu Tan declared the end of “blank check” spending, vowing to build fabs only when there is confirmed demand. Intel moved aggressively: about 22% of its workforce (roughly 20–25,000 employees) was set to be cut by end-2025, and two planned fabs (in Germany and Poland) were shelved.

These steps underscore a new discipline: Intel must squeeze costs and focus on projects with clear customer commitments if it hopes to survive.

The Conversion Revealed

On Aug 22, 2025, officials revealed the rescue terms. The government converted $5.7 billion of CHIPS grants and $3.2 billion of Secure Enclave funding into 433.3 million Intel shares at $20.47 each.

This roughly 9.9% stake was bought at a discount to market price. Washington stressed the investment is passive – no board seats or special rights for the U.S.. Intel’s CEO Lip-Bu Tan welcomed the deal: “President Trump’s focus on securing investments in vital industries has my thanks,” he said.

Intel noted the agreement “provides American taxpayers with a discount… while enabling the U.S. and existing shareholders to benefit from Intel’s long-term success”.

Market Response

Investors initially cheered. Intel’s shares spiked about 5.5% intraday (to ~$24.80) after the announcement, settling around $24.55 at the close.

Trading volume roughly doubled as markets absorbed the news. By late 2025, the stock was up about 23% for the year, clawing back from a 60%+ slide in 2024.

Still, analysts caution the rally may prove fragile: the bailout should steady the stock short-term, but Intel has yet to land new customers or revenue to justify a significantly higher valuation.

Without new orders, some investors say, the capital injection may only delay deeper restructuring.

Executive Confidence

Supporters lauded the rescue. SoftBank CEO Masayoshi Son — who had invested $2 billion at $23 a share in Intel ahead of the bailout — said it reaffirmed his faith in U.S. chipmaking: “This strategic investment reflects our belief that advanced semiconductor manufacturing and supply will further expand in the United States, with Intel playing a critical role,” Son said.

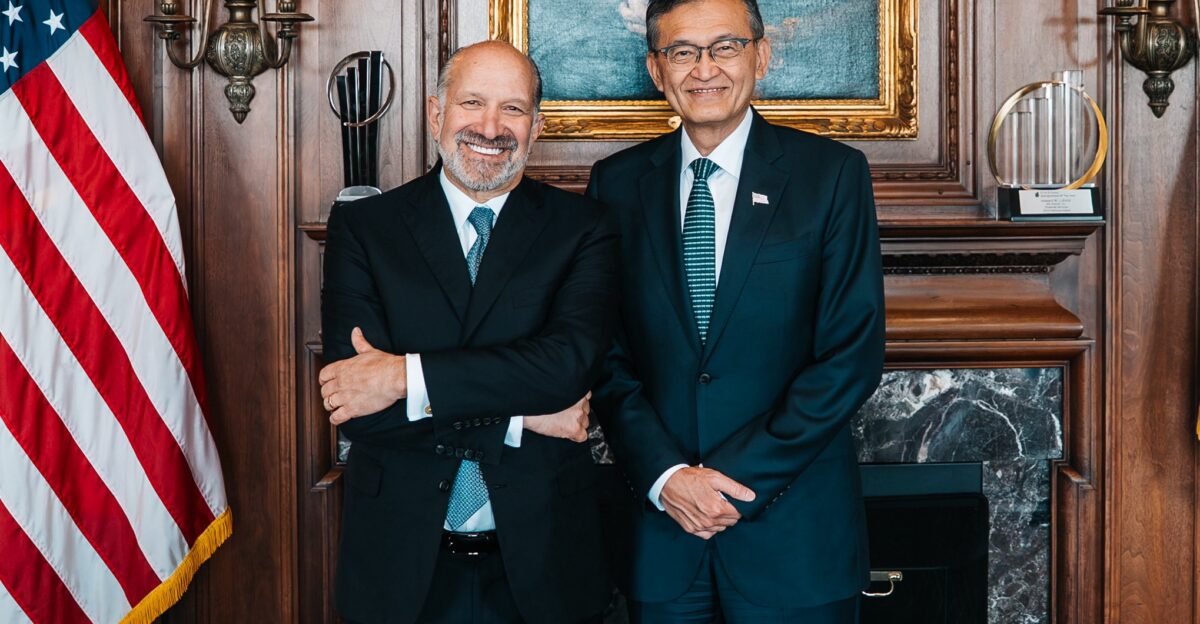

Commerce Secretary Howard Lutnick tweeted, “The United States of America now owns 10% of Intel”, underscoring the national stakes.

Analysts note these endorsements signal that Intel’s turnaround is being framed as a patriotic mission, blending business goals with national strategy.

Competitor Concerns

Critics raised questions about fairness. Even Intel’s own filings warned that U.S. ownership could invite new scrutiny: “Having the U.S.

Government as a significant stockholder…could subject the Company to additional regulations, obligations or restrictions,” they noted.

Industry analysts point out this might muddle competition: if Intel, now partly state-owned, bids against TSMC or Samsung for Pentagon contracts, rival governments could cry foul.

The Commerce Department insists the U.S. stake is a passive backstop only; still, some in Washington worry this precedent may challenge long-standing antitrust norms.

Broader Trend

Observers see this as part of a broader swing toward economic nationalism. The administration has hinted at “many more” such interventions to secure critical industries, mirroring years of Chinese state subsidies for its semiconductor champions.

Internationally, allies are watching warily: if direct state ownership of tech leaders becomes U.S. policy, could it spark retaliatory moves or WTO disputes?

China has already decried the Intel deal as “economic nationalism,” even as it champions its own subsidies.

The Intel saga thus feeds into a global debate on whether government aid distorts competition or simply defends national interests.

The Warning Shot

Intel’s own filings delivered a stark warning. The company admitted that without a major outside customer for its upcoming 14A process, it may have to “pause or discontinue” further development.

Intel’s leading-edge fabs could be mothballed if new orders aren’t secured.

Industry analysts highlight the gravity: Joshua Buchalter of TD Cowen says the disclosure “revives long-unanswered questions” about Intel’s foundry prospects and that “it’s hard to understate the significance of this potential outcome”.

Intel’s advanced manufacturing strategy hangs on landing a big new client — immediately.

Internal Tensions

Inside Intel, the atmosphere is tense. Tan has acknowledged that the early transition has been “challenging” as he overhauls priorities. He scrapped Pat Gelsinger’s over-ambitious roadmap and is refocusing on customers and margins.

The result has been more layoffs and a leaner project list.

Some engineers and mid-level managers say morale is uncertain: after years of aggressive roadmaps, many now wonder if the company will even pursue cutting-edge nodes without clear demand.

The new era at Intel is defined by accountability, but employees wonder if caution will stifle innovation.

Leadership Gamble

Tan’s appointment is itself a gamble. A former tech executive (once CEO of chip design firm Cadence and ex-SoftBank board member), he knows the industry but lacks a resume running a giant foundry.

His SoftBank ties helped secure that $2 billion private investment, but no amount of cash replaces firm orders.

Competitors note that without concrete business, a focus on manufacturing prowess risks creating idle fabs. Still, Intel’s board bet that Tan’s semiconductor pedigree and close ties to investors give him a better shot at signing those elusive customers.

All eyes are on whether his bet pays off.

Recovery Strategy

Intel’s engineering roadmap is now crystalized. The company plans to ramp its 18A (Panther Lake) process into volume in 2026.

To land customers for 14A (targeted for 2028), Intel has already distributed design kits to prospective clients, showing that development is underway.

But industry experts remain cautious. “If the yield is bad, then new customers won’t use Intel Foundry,” warns analyst Ryuta Makino.

Intel insists it can meet top-tier quality, but skeptics note TSMC still sets the bar for manufacturing efficiency. The race now is not just to build the chips, but to build confidence in them.

Analyst Skepticism

Most Wall Street watchers remain skeptical. CreditSights’ Andy Li observes that the government investment came with no fresh subsidy, suggesting “the company is not receiving incremental government funding,” which he interprets as Washington’s tentative support.

Bernstein’s Stacy Rasgon is blunt: Intel has barely 18 months to “land a hero customer on 14A” or it may have to pause its leading-edge fabs.

He emphasizes this window is “extremely tight,” meaning failure to sign a major client soon could spell the end for Intel’s most advanced manufacturing ambitions.

Analysts say the clock is ticking.

The Clock Ticks

Every passing quarter raises the stakes. Intel’s foundry arm earned only about $53 million from external customers in the first half of 2025 – essentially nothing compared to the multibillion-dollar investment.

By contrast, Taiwan’s TSMC still commands roughly 60% of the global contract-foundry market and charges premium rates.

Intel’s leadership now faces the daunting task of persuading major chip designers to trust their latest products to unproven U.S. nodes.

Each delayed order or missed forecast chips away at Intel’s financial cushion. As one industry observer puts it, the company cannot afford any more false starts.

Geopolitical Stakes

In Washington, Intel’s rescue is framed as a national security imperative. U.S. defense strategists warn that semiconductor supply is dangerously concentrated abroad.

Former CIA officer Martijn Rasser explains that if Beijing were ever to seize Taiwan’s fabs, it “would be a devastating blow for the American economy and the ability of the U.S. military to field its platforms”.

That stark scenario places Intel’s fate in a new light: reviving domestic fabs is not just about chips for phones and PCs, but chips for jets, ships and critical defense systems.

Intel’s success, the government believes, could help assure the U.S. of secure access to advanced semiconductors.

International Implications

Global partners are watching warily. Some European and Asian officials worry that government equity in a tech firm blurs market norms: will it encourage similar bailouts elsewhere?

China has already criticized the move as protectionist, even as it doubles down on its own subsidies.

Observers note that the Intel precedent could trigger WTO debates over state aid in strategic industries.

In Japan and Taiwan, leaders privately question whether such deals might distort competition for future contracts. The Intel episode highlights a new technology cold war: every industrial subsidy now carries geopolitical weight.

Regulatory Questions

Legal experts say the deal raises novel issues. Even a “passive” 10% stake can give the government insider knowledge and informal influence.

Antitrust lawyers note that while the U.S. agreed not to control corporate decisions, lines may blur if officials privately lobby for preferred outcomes.

The Federal Trade Commission hasn’t publicly signaled a review yet, but some legislators demand congressional hearings on “government ownership” of private industry.

At stake is the principle of corporate independence. Will regulations be needed to ensure Intel operates competitively despite its partial government ownership?

Corporate Culture Shift

The Intel saga reflects a generational shift in Silicon Valley. Many younger tech leaders now view public funding as just another resource, not a stigma.

In recent years, a slew of startups have actively sought CHIPS Act grants or formed public-private partnerships. As one venture capitalist observes, “Younger entrepreneurs see government as a partner, not an antagonist.” Indeed, Intel’s case may normalize state aid in strategic tech fields.

Already, some CEOs say they would welcome Washington as a minority investor if it helps scale operations.

The rescue suggests that American tech culture is adapting to global realities: government can be an ally in strategic sectors.

Defining Moment

Ultimately, Intel’s government bailout stands as a defining fork in the road. If it succeeds in winning customers and rebuilding competitiveness, it could spark an American chipmaking renaissance.

If it fails, critics say it will only postpone the inevitable shift of advanced production overseas.

The next 18 months are critical: Intel must prove that taxpayer dollars can translate into customers and volume.

The outcome will determine not just Intel’s fate, but whether Western nations can maintain viable advanced foundries or must accept manufacturing consolidation in Asia. All eyes are on Intel – and the broader lessons of this unprecedented experiment.