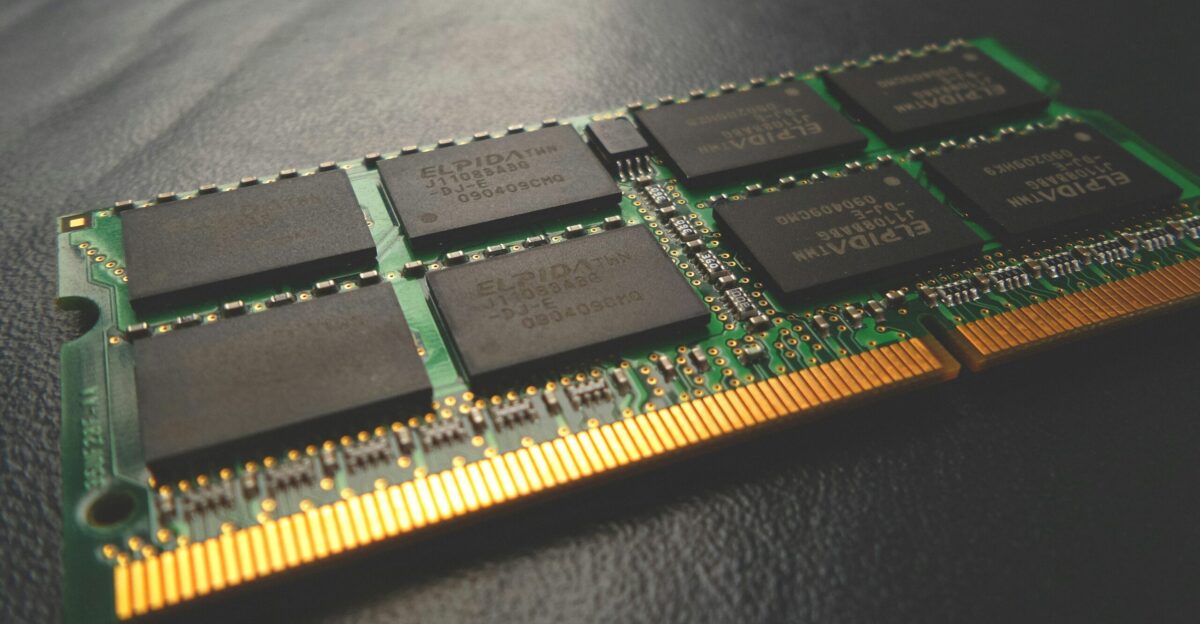

Memory chips—the most affordable part of your computer or smartphone—just got far more expensive. Since September 2025, prices have surged by 60-100%, driven by the fierce competition in the AI space.

With manufacturers now facing an agonizing choice between swallowing these costs or passing them to consumers, affordable hardware upgrades for everyday users are being sacrificed.

The Global Supply Crunch

Three companies—Samsung, SK Hynix, and Micron—control around two-thirds of global DRAM production. Now, all of them are redirecting resources toward high-bandwidth memory (HBM) for AI data centers, where margins far exceed consumer electronics.

This shift has created the tightest memory market in over a decade, with prices set to increase by 5-30% across laptops and smartphones.

The Rise of AI Demand

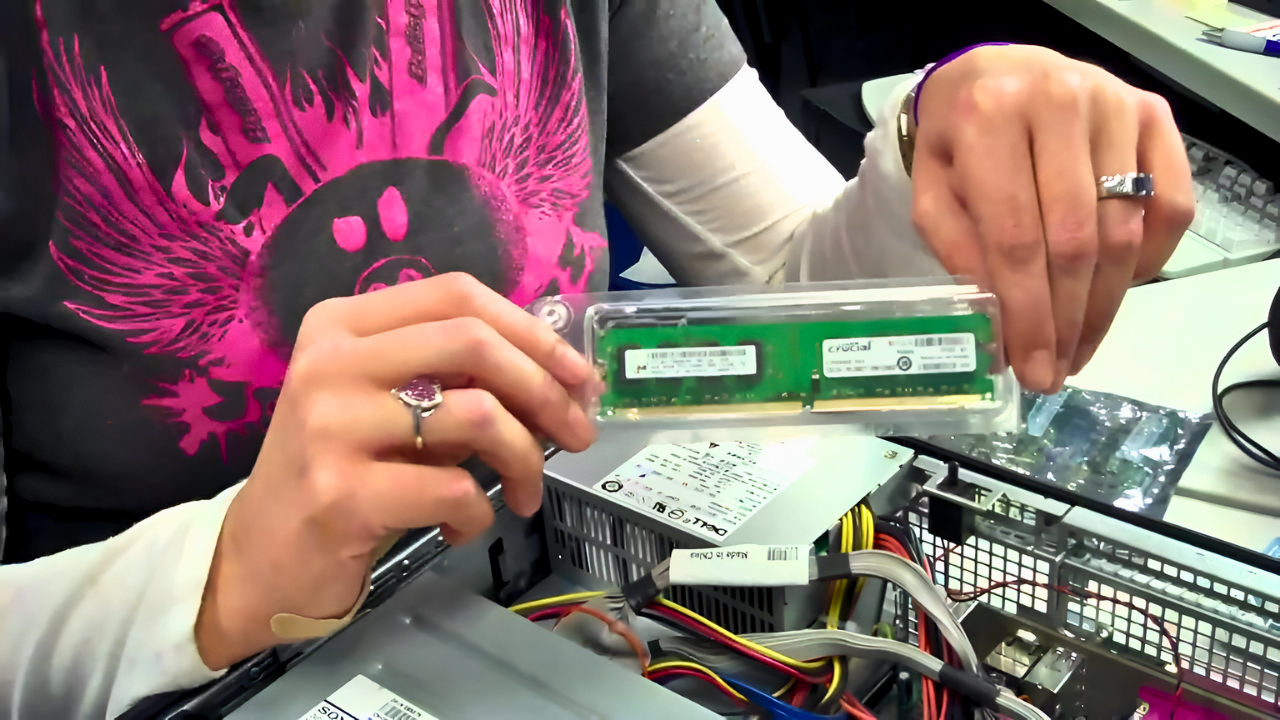

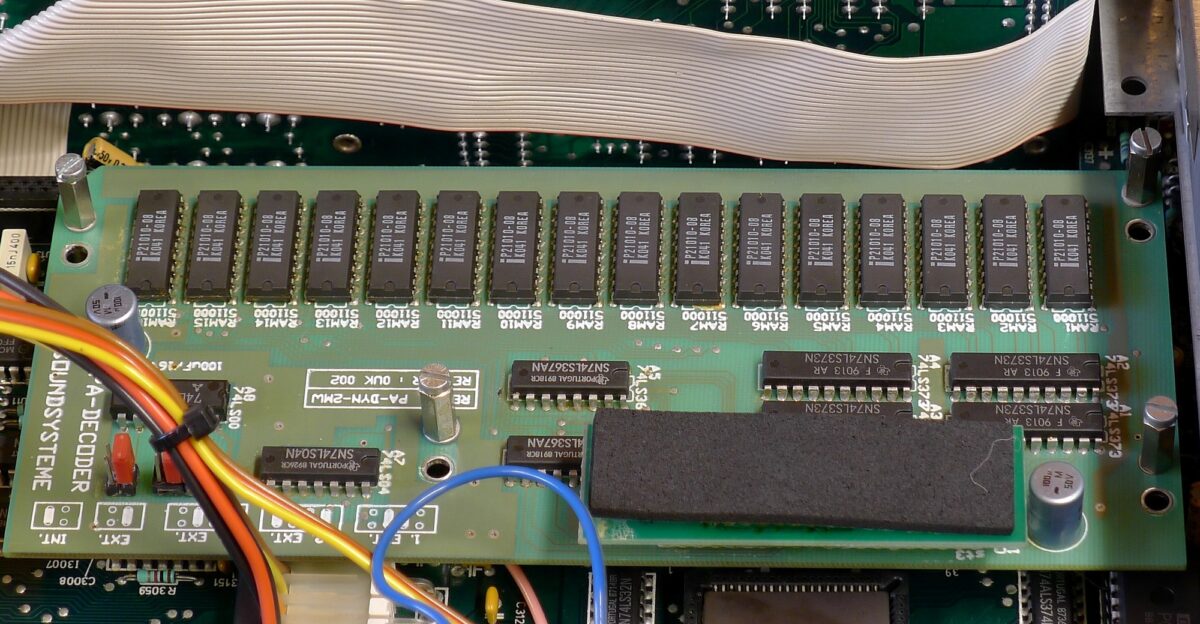

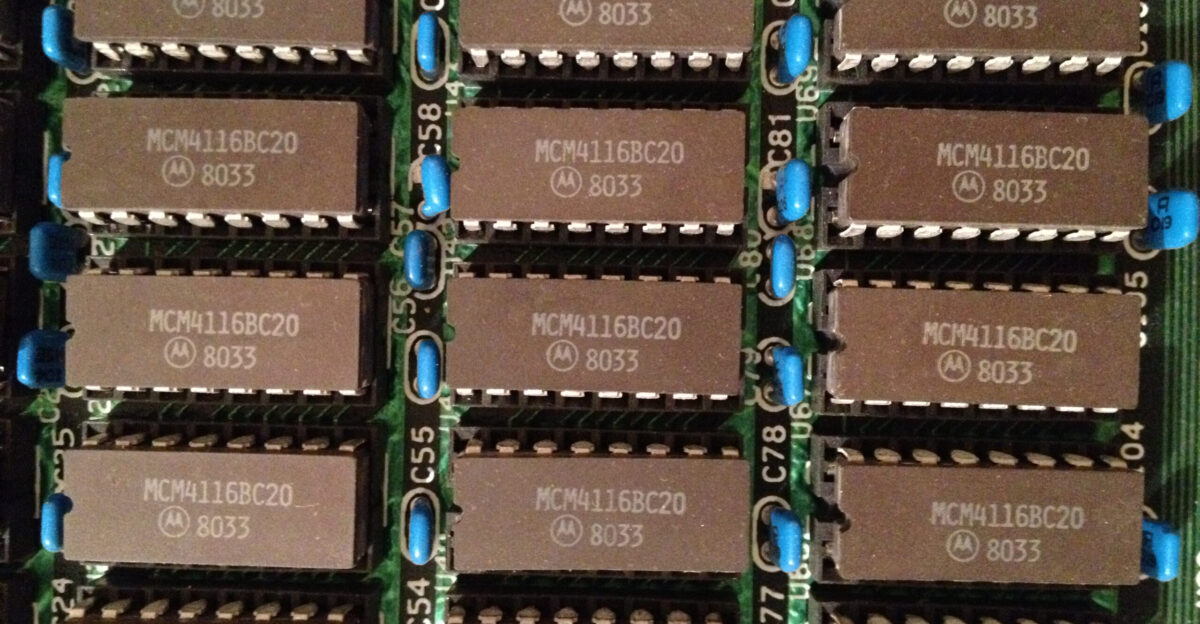

For decades, affordable consumer memory chips like Micron’s “Crucial” brand formed the backbone of the PC market. But with the explosion of AI in 2023-2024, memory requirements for data centers soared, shifting priorities in the semiconductor industry.

As AI’s demand for specialized memory skyrocketed, traditional DRAM revenue was left behind.

Memory Manufacturing Crisis

Memory manufacturing requires specialized equipment and years of lead time. As AI’s demand for HBM chips surged, companies like Samsung and SK Hynix prioritized HBM over consumer DRAM.

Micron, too, had to decide: stay in the consumer market or allocate resources to the $8 billion-a-year AI sector. By late 2025, it became clear—there was no way to serve both markets.

Micron’s Bombshell Announcement

On December 3, 2025, Micron made a groundbreaking decision: they would exit the consumer memory business. Their popular Crucial brand will be discontinued by February 2026, marking the first time a major DRAM maker has abandoned the retail market.

This decision is driven by the need to focus on high-demand, high-margin AI markets.

What Consumers Will Face

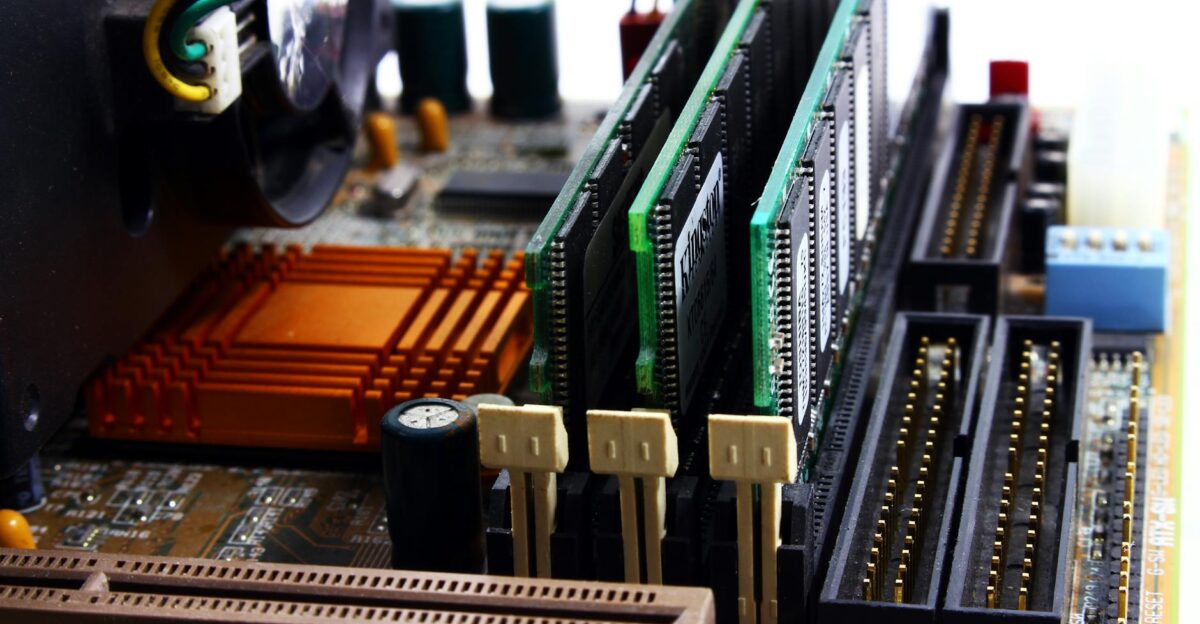

In the coming months, PC gamers and budget shoppers will feel the impact. Retailers like Newegg and Amazon report DDR5 memory stocks running out. Popular gaming PC maker CyberPowerPC has already raised prices by $80-$160 per system, with Dell, HP, and Lenovo predicting similar hikes of 5–20% in 2026.

This doubling of memory costs is a primary driver of the “computer price” increases referenced by industry analysts, as RAM is a foundational component whose soaring price fundamentally alters system value. While total system costs are rising more modestly, the effective price to build or upgrade a computer’s core performance has, in many cases, doubled.

Frustration

For many tech enthusiasts, the dream of affordable PC upgrades is slipping away.

DIY PC builders, once loyal to Crucial, are now faced with skyrocketing component prices, while complete systems see more modest price hikes.

Samsung and SK Hynix’s Position

With Micron out of the picture, Samsung and SK Hynix hold an even greater share of the consumer memory market. However, they’re not stepping in to absorb the demand.

Samsung raised DDR5 prices by 60% between September and November 2025, while SK Hynix ramped up production of data center memory, signaling long-term price stability at elevated levels.

The Regulatory Void

While Micron’s exit shakes the consumer market, there’s been no regulatory intervention. U.S., EU, and Japanese authorities remain silent. Though such market changes usually trigger antitrust scrutiny, exiting a market is legally permissible—even if it harms consumers.

This legal gray zone leaves the market vulnerable to monopolistic shifts.

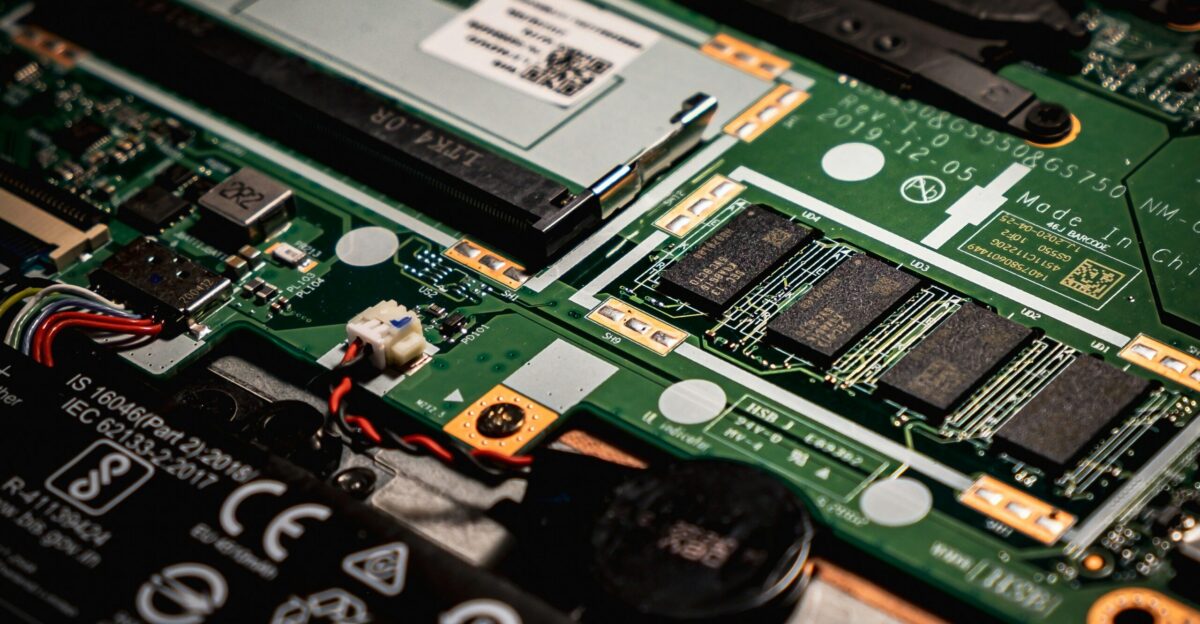

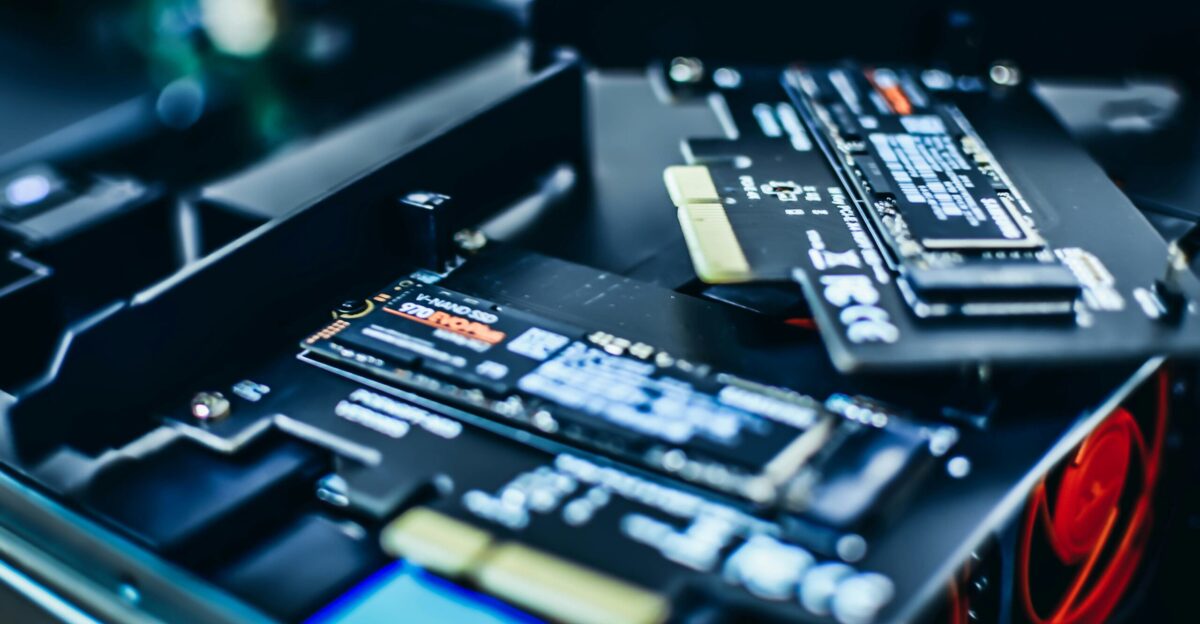

A Hidden Shock: Storage Prices Rise

Along with rising memory prices, SSD prices are climbing too. Consumer SSDs are already on average 10% more expensive, with NAND prices doubling and wholesale prices expected to increase by an additional 5-10% by end of year, potentially pushing consumer SSD price increases to 15-25% by mid-2026.

As a result, the price of an average $899 laptop could climb to $1,079—just from memory and storage price hikes, representing a 20% increase typical of current PC market pressures. While RAM modules themselves have in some cases doubled in price, complete PC systems are generally rising more modestly—often in the range of about 5-20% as manufacturers absorb part of the cost.

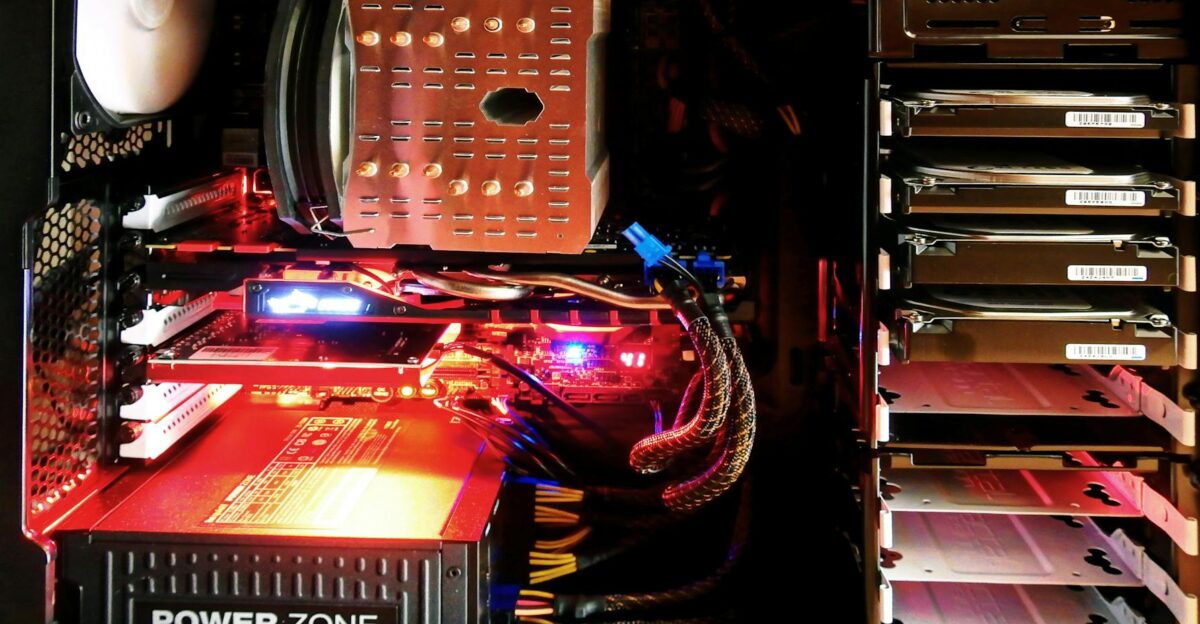

Strain Within the Industry

PC manufacturers are stuck between a rock and a hard place. Dell’s supply chain executives reported severe margin compression, while smaller builders like Asus and MSI struggle to manage rising costs.

Some independent system builders are even considering abandoning the consumer market as larger players dominate with scale.

Strategic Shifts Ahead

To adapt, some manufacturers are shifting to direct-to-consumer models, bypassing retailers to control pricing. Lenovo is focusing on made-to-order systems to mitigate risk, while HP invests in energy-efficient processors.

Meanwhile, Asus and Lenovo are exploring partnerships in South Korea to secure alternative memory sources.

The Future of Alternative Memory

Emerging memory technologies like ReRAM and MRAM are being researched across the semiconductor industry and could provide alternatives to traditional DRAM in specialized applications by 2027. However, mainstream consumer adoption remains years away, with technical and compatibility issues still requiring resolution.

These alternative memory technologies have the potential to disrupt the market and provide some competition to the current memory giants in the longer term. Widespread adoption is still a long way off, leaving the memory market under the control of the existing players for the time being.

Will Prices Drop?

Analysts point out that previous DRAM shortages led to price drops when new fabrication capacity came online.

However, the massive capital required for AI chip production means this shortage might be more permanent.

The Smartphone Squeeze

Smartphones will see sharper price pressures than traditional PCs. Flagship phones will face material cost challenges, with memory accounting for 10-15% of smartphone BOM costs. Industry analysts estimate overall BOM increases of 5-7% in 2026 as DRAM and NAND prices remain elevated, though manufacturers may absorb portions of these increases before passing costs to consumers.

With memory prices climbing, manufacturers like Apple and Samsung may not be able to shield consumers from rising prices, forcing longer upgrade cycles. The impact on smartphones is especially severe. As memory prices rise, the cost of flagship models will climb, making it harder for consumers to keep up with regular device upgrades.

The Hidden TV Tax: AI Upscaling Drives Costs

The memory crisis is also hitting the high-end television market, where advanced AI processors are now essential for upscaling content to 4K and 8K resolutions. These premium TVs rely on the same high-bandwidth DDR5 memory modules used in PCs.

As a result, while the total price of a TV is not doubling, the cost for its most critical AI-enabling components has. This surge places extreme pressure on manufacturers like Samsung and Sony, threatening to either erase margins on their flagship models or pass the “AI tax” directly to consumers in the form of higher prices for next-generation smart televisions.

Micron’s Exit: A Geopolitical Shift

Micron’s decision to leave the consumer market has significant geopolitical implications. As the only U.S.-based DRAM maker, Micron’s exit leaves South Korea’s Samsung and SK Hynix with a stranglehold on global memory production.

This has raised concerns about U.S. semiconductor independence, especially in light of the CHIPS Act.

Global Impact: Europe and Asia Hit Hard

Europe faces sizable PC price increases by mid-2026, with even steeper rises expected in India and other emerging markets. While China’s emerging chipmakers are ramping up production, they still lag behind global standards, leaving budget markets vulnerable to high prices and limited options.

The price pressure on the global market is being felt hardest in Europe and Asia. As these regions face limited competition from Chinese chipmakers and supply chain difficulties, consumers in emerging markets will experience the brunt of price increases, widening the digital divide.

Environmental Consequences

Higher prices may reduce upgrade cycles, inadvertently slowing e-waste growth. However, many consumers will hold on to older devices, increasing energy consumption.

Older systems are far less energy-efficient, contributing to a larger carbon footprint as people extend the life of outdated technology.

The End of Cheap Upgrades

For years, affordable memory upgrades have been a rite of passage for tech enthusiasts. But with prices soaring, this era is coming to an end. If current trends continue, future generations will never experience the “upgrade culture” that defined early personal computing.

The days of easy and affordable PC upgrades may be behind us. As prices continue to climb, a whole generation of tech enthusiasts may miss out on the DIY upgrades that were once the hallmark of personal computing culture.

The Future of Consumer Hardware

Micron’s exit marks a pivotal moment in the memory chip market. AI’s demand for memory is now so dominant that companies are abandoning consumer markets for high-margin data center contracts.

This sets the stage for a fragmented market where legacy players and startups compete while AI infrastructure captures the industry’s top talent and funding.

Sources:

Micron Technology Official Press Release — December 3, 2025

Micron Announces Exit from Crucial Consumer Business

DropReference — November 2025

Increase in DDR5 RAM prices in November 2025: shortage analysis

The Register — November 19, 2025

Memory prices set to double as fabs pivot to AI parts

TrendForce — December 5, 2025

Memory Crunch Hits PCs: Dell Hikes Prices, Lenovo from January

Club386/PC World — November 26, 2025

CyberPowerPC Announces Upcoming System Price Increases