Job cuts are hitting every corner of the economy. Through October 2025, 1,099,500 layoffs were announced across seven major sectors, marking a 65% jump from last year. October alone saw 153,074 cuts, the worst October in 22 years.

Treasury Secretary Scott Bessent warned last month, “I think there are sectors of the economy that are in recession”. Here’s what’s happening and why these layoffs signal broader economic stress.

What’s Driving the Surge?

Companies cite multiple causes: AI and automation, economic conditions, store closures, restructuring, and federal cuts. Total AI-related layoffs reached 48,414 through October 2025.

These overlapping factors are triggering a self-reinforcing cycle: job losses reduce spending, weakening revenue and prompting more cuts. But was this the first sign of deeper trouble beneath the surface?

#1: Mass Layoffs Across Industries

Through October 2025, 1.1 million jobs were cut, the highest total since 2009 (excluding pandemic-related cuts). Month-over-month, October surged 183% from September’s 54,064.

Employers cited AI, economic shifts, and store closures. Treasury Secretary Bessent called some areas “particularly sensitive to interest rates” , highlighting uneven stress across the economy. The next sector shows how trade shocks worsen the problem.

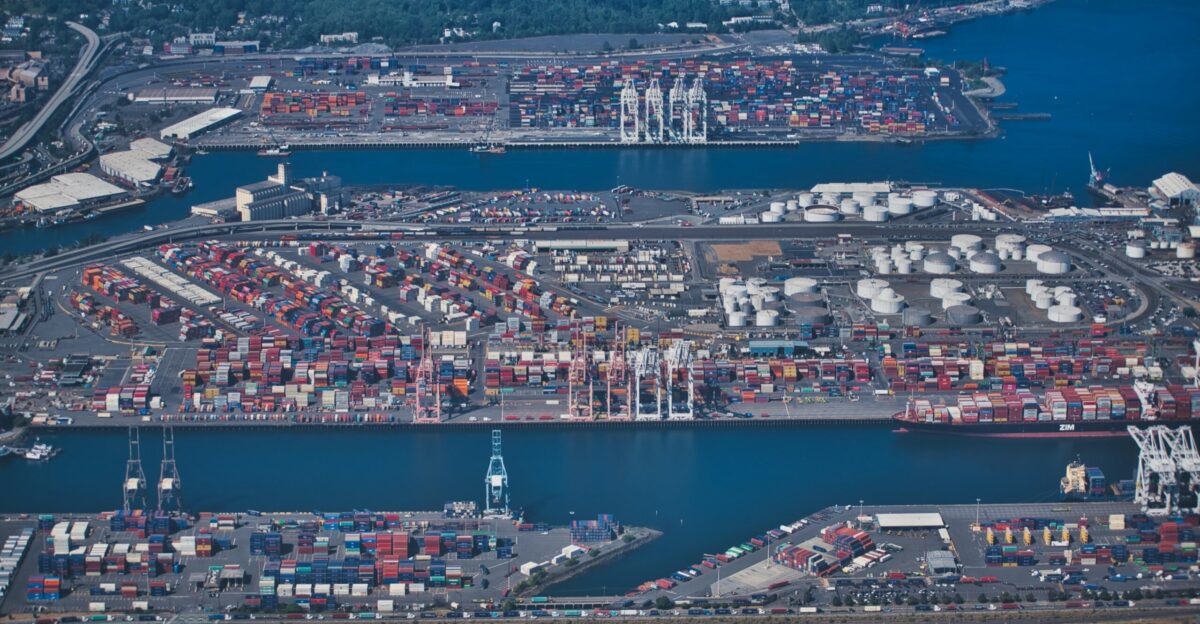

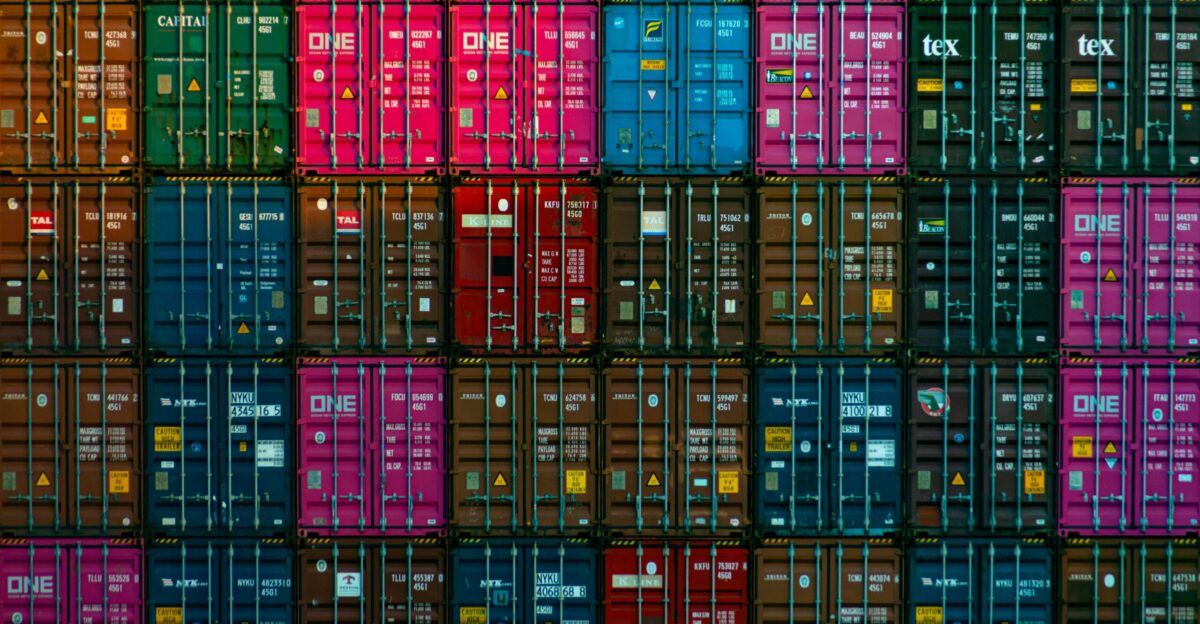

#2: Trans-Pacific Shipping Collapse

Imports from Asia to the U.S. dropped 8.4% year-over-year in September 2025. Imports from China plunged 22.9%, affecting aluminium, toys, footwear, machinery, and apparel.

Port throughput fell sharply at Long Beach, Baltimore, Savannah, and New York/New Jersey. Slowing trade ripples through manufacturing, logistics, and retail, reducing demand for labor across the supply chain.

#3: Rail Freight Weakness

Rail traffic is up 2.7% year-to-date, yet weekly volumes show declines between 1.3–4.8%, signaling weakening demand.

This uneven pattern suggests regional slowdowns and shifting economic activity. Rail-dependent industries, including warehousing and manufacturing, are feeling the strain. Could this signal broader supply chain disruptions ahead?

#4: Commercial Real Estate Decline

Commercial property values have fallen 20–30%, with office spaces down 30–40%. This six-quarter downturn is unprecedented even with new AI data center investment.

Falling rents and property sales squeeze developers and investors, cutting employment in construction, management, and services. The ripple extends to adjacent sectors relying on commercial property stability.

#5: Residential Housing Crisis

Housing inventory reached 121,000 unsold new homes in July 2025—the highest since 2009. Construction employment hit a 24-year low, down 1.3% to 2.05 million workers.

Labor shortages reached 32% across residential contractors, slowing starts 18% nationwide. Treasury Secretary Bessent called housing “the clearest example of sectoral recession” (02 November 2025). The next sector shows stress in everyday spending.

#6: Restaurant Industry Weakness

Sweetgreen’s Q3 revenue fell to $172.4M, with same-store sales down 9.5%, and profit margins collapsed from 20.1% to 13.1%. Chipotle saw only 0.3% same-store sales growth.

Younger customers are dining out less, shifting to groceries. Rising costs, lower discretionary income, and inflation drive this pullback. How this affects the broader service economy becomes clearer in the next sector.

#7: Higher Education Contraction

USC faced a $230M+ deficit, cutting 259 positions in October alone, totaling over 900 layoffs. Michigan State eliminated 99 positions, with 83 more lost due to federal funding cuts.

Federal research cuts caused 10% workforce reductions at institutes like Carnegie Mellon. Declining enrollment and budget stress threaten employment stability across campuses nationwide.

Who Is Most Affected?

Young workers aged 25–35 face rising unemployment, student loan pressure, and slower wage growth (Chipotle CEO Scott Boatwright, 30 October 2025).

Black Americans, especially women, see 7.5% unemployment, compared with 3.7% for whites. Since January 2025, 265,000 fewer Black women are working. These shifts reflect deep inequities across demographics and sectors.

When Did the Crisis Escalate?

Layoffs accelerated from April 2025, peaking in October. September saw 54,064 cuts, jumping 183% to 153,074 in October—the worst October in 22 years.

The 43-day government shutdown caused an $11 billion permanent hit, with federal employment down 97,000+. These events magnified sectoral weakness and signaled broader economic risk.

Where Are the Hotspots?

Shipping declines hit major ports: Long Beach, Baltimore, Savannah, New York/New Jersey, with Tacoma as the only growth point.

Construction, restaurants, and education layoffs are nationwide, with concentrated impacts in housing markets and large universities. The geographic spread highlights how interconnected sectoral stress can drive a national slowdown.

Why Are These Layoffs Happening?

Multiple factors converge: high mortgage rates, Fed policies, consumer financial strain, tariffs, AI adoption, labor shortages, and changing spending patterns.

Treasury Secretary Bessent said, “The Fed has caused a lot of distributional problems”. Structural issues amplify temporary shocks, creating a cascading effect across industries.

How The Cycle Spreads

Layoffs reduce income, cutting spending on dining, retail, and services. Weak demand prompts additional cuts, eroding business revenue.

Small businesses struggle to hire or access credit. This self-reinforcing cycle magnifies unemployment, with early signs appearing in marginalized groups like young workers and Black women.

The Economic Disconnect

Despite overall GDP near 3% and unemployment at 4.4%, seven major sectors show sharp stress: layoffs up 65% YoY, restaurant sales down 9.5%, housing inventory highest since 2009.

This uneven pattern masks vulnerabilities, historically preceding recessions. Consumer spending, business confidence, and hiring could tip once cascading effects fully unfold.

Outlook: Tipping Point Ahead

Early warning signs show nonlinear unemployment jumps, particularly among Black women. Retail sales growth slowed to 0.2% in late November, below expectations.

If sectoral weakness spreads further, layoffs may escalate, consumer demand may contract, and the economy could face broader recessionary pressures.

Sources

U.S. Bureau of Labor Statistics – Employment Situation Summary, September 2025

U.S. Census Bureau / HUD – Housing Inventory Data, July 2025

Descartes Global Shipping Report – September 2025 Container Trade Data

Sweetgreen, Inc. – Q3 2025 Financial Results and Earnings Call

Chipotle Mexican Grill – Q3 2025 Earnings Report and CEO Commentary

U.S. Treasury Department Statements – Scott Bessent CNN/NBC

University of Southern California – Official Statement