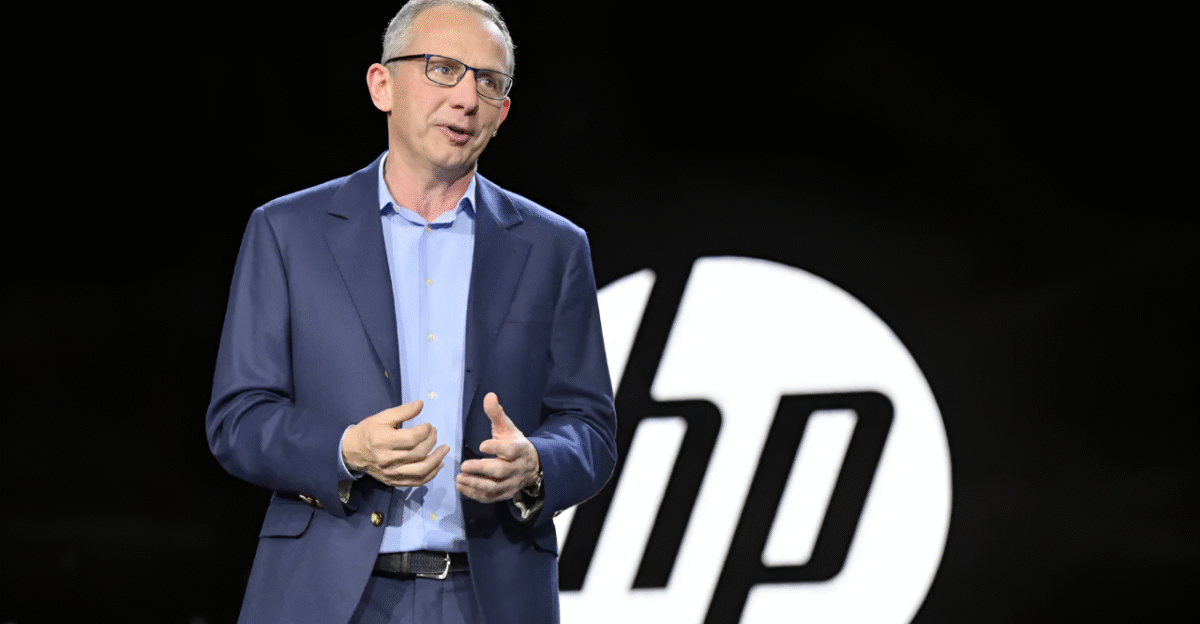

Hewlett-Packard announced on November 25, 2025, that it would eliminate between 4,000 and 6,000 positions—roughly 10 percent of its global workforce—by 2028, targeting $1 billion in cost savings. The announcement came after market close, with CEO Enrique Lores framing the restructuring as essential to navigating an artificial intelligence-driven business environment. Yet the timing reveals a fundamental contradiction: HP reported fourth-quarter revenue of $14.64 billion, up 4 percent year-over-year, even as profit projections disappointed investors and shares fell 5 percent in extended trading.

The layoffs represent the company’s second major workforce reduction in three years, following a similar 4,000-6,000 position cut announced in 2022 and additional reductions of 1,000-2,000 roles in February 2025. With an estimated 60,000 global employees, the upper-end scenario would remove one in every ten positions across offices worldwide.

Why Growth Coexists With Cuts

HP’s paradox mirrors broader industry dynamics. The company cited rising memory chip costs, trade-related regulations, and aggressive automation as drivers of restructuring urgency. Management stated that artificial intelligence would perform tasks “more efficiently and rapidly,” reducing human labor requirements. Yet this efficiency push arrives amid revenue expansion, suggesting the cuts reflect strategic repositioning rather than financial distress.

Fiscal 2026 earnings-per-share guidance of $2.90 to $3.20 fell below analyst consensus of $3.33, while first-quarter guidance of 73 to 81 cents also trailed expectations. The earnings miss, not operational failure, triggered the market’s negative reaction. Memory inflation and margin pressure from component costs created a gap between top-line growth and bottom-line performance.

Component Costs Force Price Increases

Rising DRAM and NAND pricing threatens consumer wallets. HP warned that elevated memory costs could force laptop price increases and lower default specifications. The company maintains sufficient inventory to buffer increases through early 2026, but analysts expect higher retail prices and reduced memory configurations beginning mid-2026.

This cost pressure extends industry-wide. JPMorgan analyst Samik Chatterjee forecasted a 6.6 percent increase in personal computer shipments in 2025, followed by a 2.2 percent decline in 2026, with earnings pressure mounting. HP and Dell face particular exposure given their large DRAM footprints and thinner margins relative to premium semiconductor suppliers. Retailers report rising component quotes and inventory tightening, with boutique builders warning of uncertain pricing into 2026 as supply allocation prioritizes data center demand.

AI Products Grow While Workforce Shrinks

HP’s artificial intelligence-enabled personal computers reached more than 30 percent of shipments in the fourth quarter—the largest single-quarter share recorded. Analysts expect AI PCs to exceed 50 percent of market share by 2026, with long-term projections approaching full adoption. Yet this product expansion coincides with workforce contraction, illustrating what economists describe as emerging white-collar automation.

HP explicitly stated that artificial intelligence would replace functions currently requiring human involvement in engineering and customer support. These are professional roles, not factory positions. The paradox is stark: AI-driven products accelerate while human labor tied to their creation shrinks.

Broader Economic Ripples

Economists warn of multiplier effects in technology-dense regions. If approximately 6,000 HP roles gradually disappear, local service-sector losses could compound that figure through reduced spending on restaurants, logistics, retail, housing, and childcare. Combined with prior reductions at Meta, Google, Amazon, and others, HP’s restructuring contributes to a multi-year economic adjustment in Northern California’s labor market.

Over 118,000 technology layoffs occurred in 2025, signaling that restructuring represents modernization strategy rather than cyclical downturn response. The industry message is unmistakable: efficiency is capital, and productivity should scale with computing power, not payroll.

Looking Ahead

HP’s restructuring reveals how quickly artificial intelligence supply chains reprice global hardware. Memory disruption demonstrates the speed at which automation can reshape labor markets and consumer costs simultaneously. Revenue growth, product innovation, and workforce reduction now move in parallel—a pattern likely to define technology economics through 2026 and beyond. The question ahead is whether gains at the firm level scale sustainably across society or fracture it.

Sources:

HP Inc. Press Release, November 25, 2025

Reuters, November 25, 2025

Yahoo Finance/Detailed HP Reporting, November 25-26, 2025

Financial Analyst Reports and Market Data Archives