You pass them every day without realizing it. They drive sensible cars, wear understated clothes, and live in modest homes, yet their bank accounts tell an entirely different story. The truly affluent don’t flaunt their wealth. Instead, they exhibit subtle behavioral patterns that signal their financial prowess. This article reveals the key characteristics of wealthy individuals who prefer to maintain a low-key financial status, based on extensive research.

The Concept of Time Affluence

The first clue to identifying wealthy individuals is their perception of time. Unlike middle-class workers, who are often pressed for time, affluent individuals tend to exhibit a more relaxed pace in life. Studies reveal that they engage in leisurely conversations and make thoughtful decisions rather than rushing. A 2020 study found that Dutch millionaires allocate approximately 22% of their leisure time to active pursuits, highlighting the luxury of time.

Consistency Over Constant Upgrading

Wealthy individuals often maintain a consistent lifestyle, resisting the urge to upgrade their possessions continually. They stick to reliable choices, such as a favorite coffee or a trusted car brand. This intentional consistency reduces decision fatigue, allowing them to focus their mental energy on more significant choices. As such, their choices reflect confidence rather than anxiety, showcasing a strategic approach to consumption that avoids burnout from constant upgrading.

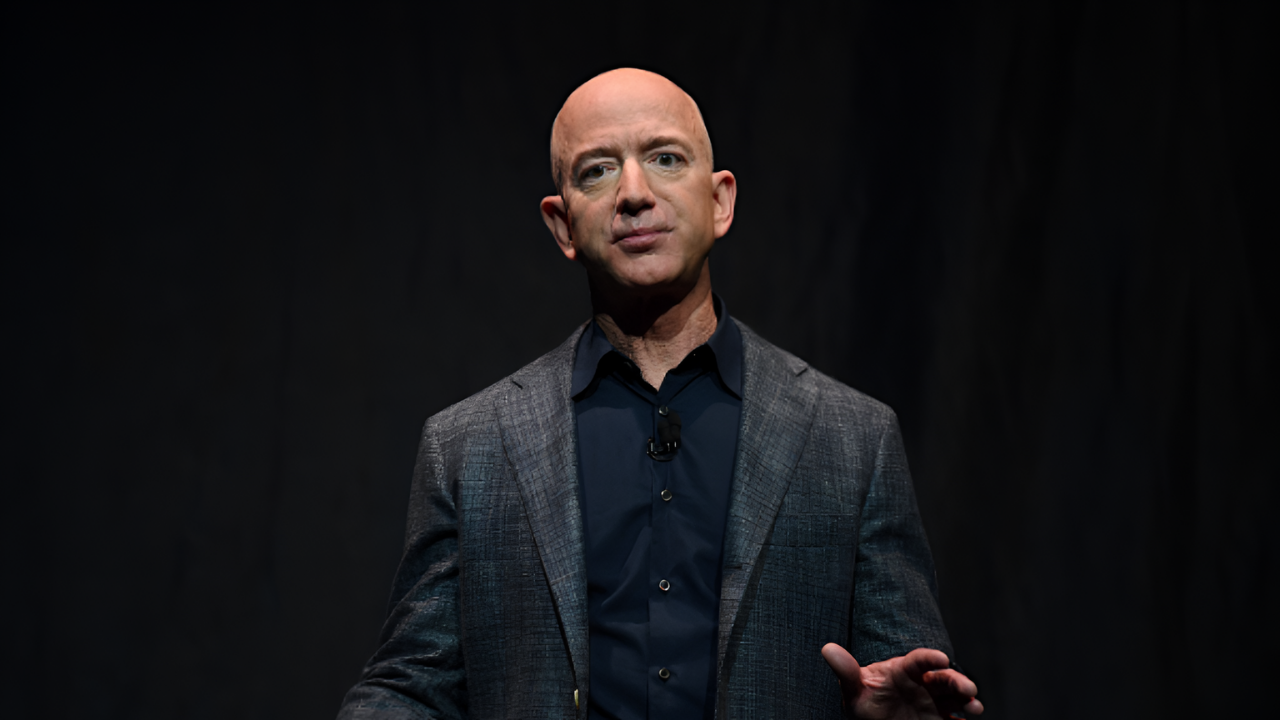

Indifference to Material Accoutrements

When entering a high-end store, the reaction of affluent individuals might surprise you with indifference. Wealthy people often assess purchases based on utility rather than prestige or price tags. Warren Buffett exemplifies this mindset; despite his immense wealth, he favors modest attire and lives in a house purchased decades ago for a small sum. A 2022 survey revealed that 46% of millionaires prioritize investment decisions based on perceived returns instead of brand allure.

Long-Term Planning Mindset

Another key characteristic of wealthy individuals is their ability to think long-term. Unlike others who focus on immediate gratification, the affluent often plan in 10, 20, or even 30-year increments. They invest in education and health, knowing the benefits will compound over time. This patient approach influences their financial decisions, such as investing in properties to hold for appreciation, demonstrating emotional discipline in navigating market fluctuations.

Generosity Without Expectation

Surprisingly, millionaires tend to be more generous than average income groups, yet they often give quietly. A 2015 study revealed that millionaires with assets exceeding €1M are more likely to give without seeking recognition or publicity. Their donations usually flow through private channels, establishing genuine connections without the need for public acknowledgment. This reinforces the idea that true generosity involves contributing without seeking recognition for one’s actions.

The Value of Privacy

Affluent individuals often prioritize privacy, choosing to maintain a limited online presence and avoiding public accolades. A 2020 survey indicated that 41% of the public perceives wealthy individuals who prefer to stay “invisible” negatively, but many affluent people consciously opt for discretion. They understand that reduced visibility minimizes scrutiny and unnecessary solicitation, enabling them to engage in activities without the burdens of public attention.

Calm Confidence Over Arrogance

In social situations, wealthy individuals often radiate calm confidence rather than arrogance. They listen intently, rarely interrupt, and refrain from flaunting their achievements. A German study of wealthy individuals highlighted their temperament, characterized by lower levels of neuroticism and higher levels of conscientiousness. Such quiet assurance stems from their financial security, allowing them to engage meaningfully without needing to prove their worth to others or display dominance.

Nonconformity and Individuality

When it comes to status symbols, wealthy individuals are often nonconformists. Unimpressed by societal expectations, they prefer to express their identity on their own terms rather than succumbing to trends or public approval. Their choices transcend typical markers of wealth, allowing their individuality to shine through. This rejection of conformity reflects a broader understanding that true self-worth is not tied to what others perceive of us.

The Importance of Relationships

An essential factor for the affluent is their approach to relationships. They prioritize quality over quantity, building networks with genuine connections that provide support and collaboration. Wealthy individuals often prefer deep, meaningful relationships over superficial associations. This understanding reinforces the idea that strong ties are formed through authenticity rather than status, making interpersonal connections vital in their lives.

Discomfort as a Tool for Growth

Wealthy individuals possess an extraordinary ability to endure discomfort for long-term gain. They see temporary setbacks, such as market downturns, as opportunities for strategic growth. This capacity for delayed gratification empowers them to make decisions that might be uncomfortable but ultimately yield significant benefits in the long run. Their understanding of the value of patience cultivates financial resilience.

Supportive Environments

Many wealthy individuals create supportive environments by surrounding themselves with people who uplift and challenge them. This network fosters personal and professional growth, allowing them to thrive in various aspects of life. By intentionally building circles of influence that promote a growth-oriented mindset, they ensure sustained progress toward their goals, emphasizing the critical role of community in cultivating wealth.

Investing in Financial Education

Wealthy individuals often prioritize financial literacy, understanding its pivotal role in wealth accumulation. By continuously educating themselves about investment trends and economic strategies, they make informed decisions that uphold their financial stability. Their commitment to learning not only benefits their financial management but also enables them to navigate complex markets with confidence and effectiveness, setting a strong foundation for lasting wealth.

Navigating Risks Wisely

High-net-worth individuals are typically adept at evaluating risks. Their decision-making processes involve extensive research, allowing them to approach potential investments or expenditures strategically. By understanding their risk tolerance and aligning it with well-informed expectations, they navigate financial endeavors judiciously, increasing the likelihood of achieving favorable outcomes over time while minimizing unnecessary exposure to economic uncertainty.

Sustainability in Wealth Management

A growing trend among affluent individuals is the increasing focus on sustainable investment strategies. By prioritizing companies with strong environmental, social, and governance (ESG) practices, they not only aim for financial returns but also contribute positively to global challenges. This shift showcases their desire to leave a lasting legacy while aligning their financial activities with personal values, merging ethics with investing.

Cultural Appreciation Over Materialism

Affluent individuals often cultivate a deep appreciation for cultural experiences rather than material wealth. Travel, art, and education become core components of their lifestyle, reflecting their understanding that enriching life experiences hold profound value. Their avoidance of materialism in favor of meaningful memories enriches their lives and fosters a broader perspective on what constitutes a fulfilling existence.

Flexibility in Lifestyle Choices

Wealthy individuals typically exhibit flexibility in their lifestyle choices, adapting quickly to changing circumstances. This agility allows them to seize opportunities that others might miss. Their ability to pivot efficiently when necessary demonstrates not just a fluid understanding of market dynamics but also an intrinsic adaptability that contributes to maintaining and growing their wealth over time.

The Emotional Quotient of Wealth

Investing in emotional intelligence plays a crucial role in the lives of affluent individuals, affecting both their personal and professional dynamics. Possessing a high emotional quotient enables individuals to understand their own emotions and those of others, facilitating stronger relationships and more informed decision-making capabilities. This emotional awareness nurtures resilience within fluctuating environments, further empowering their ability to thrive amidst challenges.

Recognizing Hidden Wealth

Understanding these stealth traits can help identify individuals who embody true affluence beneath the surface. Recognizing that wealth is often marked by behavior and values, rather than ostentation, reshapes our perspective on financial success. Through their calm confidence, investment strategies, and prioritization of relationships, wealthy individuals reveal traits that offer valuable lessons for personal development and financial literacy.

Final Thoughts and Reflection

In summary, the lifestyle and behaviors exhibited by wealthy individuals often contradict societal narratives surrounding wealth. Instead of opulence and extravagance, true affluence embodies a purposeful living characterized by patience, generosity, and deep, meaningful relationships. Reflecting on these traits not only enhances our understanding of wealth but also encourages us to cultivate essential habits that lead to lasting prosperity, whether financial or personal.

Sources

SAGE Journals – Time Use and Happiness of Millionaires: Evidence From the Netherlands

Forbes – New Psychological Studies: How The Wealthy Really Are Different From Everyone Else

ScienceDirect – Millionaires Speak: What Drives Their Personal Investment Decisions

PMC/NIH – Giving Behavior of Millionaires

Transmission Private – Ultra-Rich Are Risking Their Reputations by Staying ‘Invisible’ Online

Warren Buffett Official Interviews & Biographies – Berkshire Hathaway Letters to Shareholders and The Snowball: Warren Buffett and the Business of Life