At dawn on February 6, 2026, workers at a long-established auto-parts plant in New Lexington, Ohio, are handed their layoff notices. The plant, a staple in the local economy for decades, is closing its doors.

Over the next 17 months, 228 employees will lose their jobs as the company behind the facility, Cooper Standard, slashes its operations in the face of rising costs and technological shifts.

The announcement is part of a larger pattern of factory closures reshaping the American industrial landscape—one that is rapidly leaving towns like New Lexington behind. But what led to this sudden decision, and what happens to the workers who spent decades building the company?

Sector Squeeze

The auto-parts sector is under intense pressure, with 2025 being one of the most challenging years since the Great Recession. Falling orders, high interest rates, and price pressure from automakers are squeezing suppliers.

Meanwhile, companies like Cooper Standard are investing heavily in electric-vehicle technologies, often while grappling with significant debt, forcing many players toward drastic cuts or bankruptcy.

65-Year Legacy

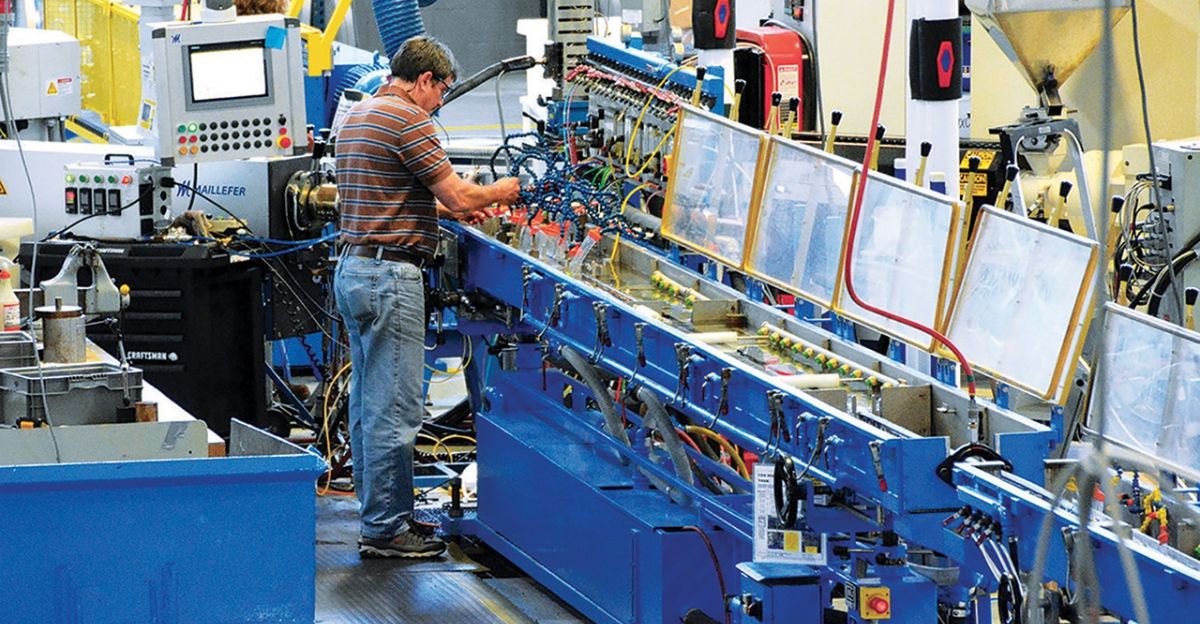

Cooper Standard, founded around 1960, has been a key player in the automotive industry for 65 years. The Michigan-based company has grown into a global supplier, employing 22,000 people across 20 countries.

It has played a pivotal role in providing components to major vehicle manufacturers worldwide. This scale helped it earn the title of an industry “giant.”

Mounting Pressures

The challenges facing auto-parts makers like Cooper Standard are mounting. From rising inflation and labor costs to volatile raw-material prices, manufacturers are under pressure.

At the same time, the demand for vehicles is slowing due to affordability concerns, complicating long-term planning. Suppliers must balance investing in electric vehicles while maintaining legacy parts, leading many to reevaluate their operations.

Closure Confirmed

The closure of Cooper Standard’s New Lexington plant is confirmed, following a WARN notice filed on December 8, 2025.

Layoffs are set to begin on February 6, 2026, with the plant closing fully by July 1, 2027. The company refers to the move as part of a strategy to optimize its manufacturing footprint, despite the severe impact on the local workforce.

228 Jobs Lost

Cooper Standard’s decision to close the Ohio plant will cost 228 jobs—193 hourly and 35 salaried positions. The layoffs will occur over a 17-month period as production winds down.

This significant job loss in Perry County, where the plant has been a major employer, will send ripples through local businesses and services reliant on manufacturing wages.

Small-Town Shock

For New Lexington, losing 228 jobs at a single plant is a severe blow. The local economy, which relies heavily on manufacturing wages, will face declines in consumer spending and pressure on social services.

Though some workers may transfer to other Cooper Standard locations, many will face difficult decisions, including long commutes, relocation, or starting over in a new field.

Broader Crisis

Cooper Standard’s closure isn’t an isolated case. Other auto-parts suppliers, like Marelli and First Brands, have also filed for bankruptcy in recent months.

Marelli filed for Chapter 11 in June 2025, followed by First Brands in September, signaling widespread financial stress across the sector. Combined, these bankruptcies total more than $16 billion in obligations.

Industry Headwinds

The auto-parts industry faces widespread challenges, including supply-chain disruptions, semiconductor shortages, and high financing costs. Many suppliers are also struggling with the transition to electric vehicles, which is proving costlier than expected.

Analysts predict that more bankruptcies or restructuring are likely as automakers renegotiate contracts and push for lower prices, leaving suppliers vulnerable.

Crisis Deepens

Though Cooper Standard is shrinking its footprint to avoid bankruptcy, its closure still highlights the growing crisis in the auto-parts sector.

While companies like Marelli and First Brands are restructuring under Chapter 11, Cooper Standard’s proactive cuts show that even large suppliers are struggling to maintain profitability in a challenging market. The result: fewer jobs and a strained supply chain.

Worker Frustration

The shutdown of Cooper Standard’s New Lexington plant has stirred frustration among workers, represented by UAW Local 1686. Under the collective bargaining agreement, some workers may have “bumping” rights, allowing them to transfer to other positions.

However, a WARN Act investigation has been launched, questioning whether Cooper Standard adhered to required notice periods for the layoffs.

Leadership Choices

Cooper Standard’s leadership describes the New Lexington closure as part of a broader strategy to “optimize our manufacturing footprint.” The company is consolidating production and investing in technologies for sealing and fluid handling.

The goal is to focus on higher-margin programs in sectors like electrification, but for the workers in New Lexington, this strategic pivot means losing their jobs.

Restructuring Path

Cooper Standard’s closure is part of a larger realignment of its global manufacturing network. While the company is not filing for bankruptcy, its actions mirror the sector’s restructuring path.

Some employees will be offered transfers to other locations, but the company has not yet disclosed where production from New Lexington will shift. This move is designed to help the company stay competitive amid rising costs.

Expert Doubts

Analysts are skeptical that cost-cutting and plant closures will be enough to save auto-parts suppliers. Rising operating costs are outpacing revenue, and unless demand improves or pricing power strengthens, more layoffs and plant closures are expected.

This raises concerns about the sustainability of small-town plants like New Lexington, especially as the industry grapples with a volatile market.

What’s Next?

The loss of 228 jobs in New Lexington is just one part of a larger crisis in the auto-parts sector. With more than $16 billion in recent bankruptcies and ongoing plant closures, the future of the industry remains uncertain.

Communities, workers, and policymakers must now confront difficult decisions about retraining, diversification, and industrial policy to secure the long-term health of the auto-parts ecosystem.

Sources:

“Cooper Standard files WARN notice for closure of New Lexington plant.” Rubber World, 6 Jan 2026.

“Nissan supplier Marelli files for Chapter 11, secures $1.1 billion in new financing.” Reuters, 11 Jun 2025.

“First Brands files for bankruptcy, revealing billions of dollars in hidden debt.” Reuters, 29 Sep 2025.

“65-year-old auto parts brand shuts plant, fires 100s of workers.” TheStreet, 31 Dec 2025.