American Freight’s sudden collapse on Nov. 5, 2024 — announced as part of its parent Franchise Group’s Chapter 11 filing — sent shock waves through the furniture market.

The Delaware-based chain had grown to hundreds of stores under discount founder Steve Belford, but years of rising debt and shrinking margins finally broke it. Retail analysts immediately noted that this was one of the biggest furniture‐store failures in recent history.

It underscores a broader retail downturn: as big-ticket spending softens, even long‑standing chains are vulnerable to high inflation and higher borrowing costs.

Crisis Escalates

Store closings have accelerated sharply in 2024. According to industry data, U.S. retailers announced 6,481 store closures by October — already eclipsing the entire 2023 count of 5,553.

Furniture chains have been particularly hard hit. With consumers wrestling with inflation and credit crunches, many postponed or downsized home purchases. The year has seen a string of bankruptcies — from Conn’s HomePlus to 99 Cents Only — and thousands of layoffs.

Coresight Research warned that 2024 closures are at their highest level since 2020, reflecting a retail climate in crisis. In this context, American Freight’s liquidation is part of a nationwide trend of shrinking store networks and mounting industry stress.

Founded Dreams

American Freight began in 1994 when Ohio entrepreneur Steve Belford sold furniture out of a warehouse in Lima, Ohio. The “for working families” concept grew steadily: by late 2014 it had about 95 stores in 18 states.

That year Belford sold a majority stake to a Jordan Company private-equity fund to fuel expansion. Belford remained involved, even doing TV commercials proclaiming, “The savings are great at American Freight.”

In 2020, Franchise Group acquired American Freight in a $450 million deal. FRG’s CEO Brian Kahn praised AF’s deep‑discount model and “cash-on-cash unit economics,” seeing it as a category‑defining franchise opportunity. Under FRG’s wing, AF grew to over 300 stores — until this year’s downturn reversed its fortunes.

Mounting Pressures

By 2023 and 2024, a wave of cost pressures was battering furniture retail. Raw materials and energy prices — from lumber spikes to petrochemical shortages for upholstery foam — drove up manufacturers’ expenses.

At the same time, U.S. labor costs rose as retailers competed for scarce workers. Many stores tried to absorb costs rather than raise prices sharply for cash‑strapped buyers.

As FRG told investors, the durable-goods sector had seen “sustained inflation and macroeconomic challenges” that eroded demand. Supply-chain disruptions lingering from the pandemic only compounded the pain. By fall 2024, analysts warned that high costs and skittish consumers had created a “perfect storm” of headwinds for furniture sellers.

Liquidation Begins

On Nov. 3, 2024, Franchise Group announced it would wind down the American Freight chain. All 328 stores nationwide would enter going‑out‑of‑business sales starting Nov. 5.

Hilco Consumer-Retail, a turnaround specialist, was appointed to manage the liquidations. Hilco CEO Ian Fredericks told customers, “Our goal is to deliver outstanding value… Everything is on sale and must be sold”.

This meant steep discounts on sofas, mattresses, appliances, and more. The liquidation blitz covered every state, with banners in windows and website promotions urging bargain hunters to act fast. Behind the scenes, employees were preparing to clear out inventory and shut down operations.

Regional Impact

The shutdown left big holes in many local markets. Florida alone had 33 American Freight stores, and there were dozens more across the Midwest, South, and West. In smaller cities and rural areas, AF was often the only low‑price furniture source.

Its absence means families on tight budgets must now travel farther or buy more expensive goods. Independent furniture dealers and even big-box retailers saw an opportunity: suddenly, thousands of customers were looking elsewhere for living-room sets and bedroom furniture.

In some towns, independent store owners said they’d seen a surge of Americans wanting budget furniture. “We lost our main source of low-cost couches,” one small‐town dealer told the press, underscoring how communities once served by AF are scrambling to fill the void.

Human Toll

About 3,000 people across the country worked for American Freight when the bankruptcy was filed. Store associates, delivery drivers, warehouse staff, and head-office employees all faced layoffs.

Many got WARN notices just days before the sales kicked off, giving them little time to prepare. The human impact was raw: single mothers and longtime store managers suddenly found themselves jobless.

One former employee told NPR she had worked at AF for a decade; she described waking up on Nov. 5 to an email saying, “Everything is on sale and must be sold.” In offices and break rooms from Ohio to Oregon, coworkers comforted each other. The scene underscored that behind the statistics are thousands of livelihoods lost in one weekend.

Competitor Moves

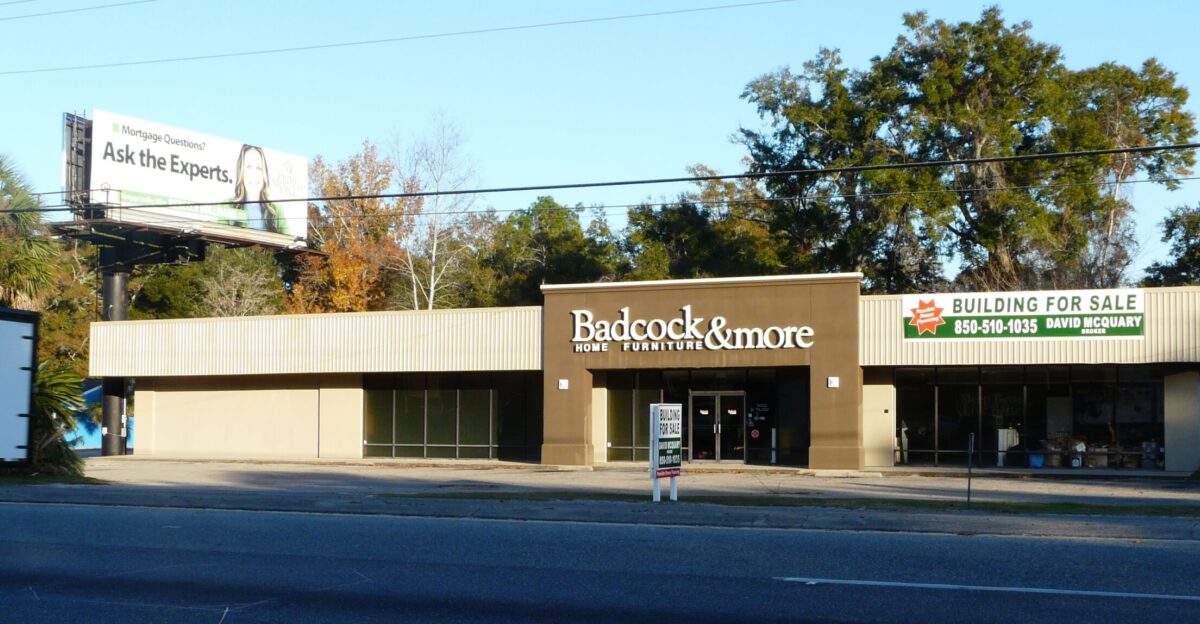

American Freight’s failure was not isolated. In mid-2024, Conn’s HomePlus — the parent of Badcock Home Furniture — filed Chapter 11 and liquidated over 550 stores. Other mid-market retailers like Rooms To Go and Slumberland cut back or closed outlets.

Analysts estimate that U.S. furniture bankruptcies in 2024 have forced 15,000+ layoffs so far.

At the same time, surviving giants are seizing the moment. Stores like Ashley Furniture, IKEA, and home-furnishings sections at Target and Walmart are expanding aggressively to grab displaced customers. Even nontraditional entrants (for example, grocery chains adding home-decor sections) are circling.

Macro Trends

Broad economic shifts have reshaped furniture demand. Higher interest rates have slowed home buying, which normally fuels furniture sales. One industry survey found that roughly a quarter of recent homebuyers say high mortgage rates have curtailed their furniture budgets.

In practice, many consumers are delaying décor purchases after a move or skimping on big-ticket items. Housing-market slackness adds to the pain: fewer home sales mean fewer newly furnished rooms.

Compounding this, pandemic-era stimulus spending has run out, and inflation has eaten into savings. The result is a more cautious buyer. As Home News Now summarized, higher rates are “delaying some existing homeowners from moving” and thereby postponing furniture purchases.

Financial Entanglement

American Freight’s collapse rippled into Wall Street. B. Riley Financial — which had backed Franchise Group’s leveraged buyout — was hit especially hard. After AF’s shutdown, B. Riley warned it would take an additional $120 million loss on loans and equity tied to FRG.

Its stock plunged about 13% on the news. Co-CEO Bryant Riley summed up the mood bluntly: “I feel personally sick about this result”.

The roots go back to last year’s deal: FRG was taken private for $2.8 billion in a transaction that leaned heavily on debt financing from B. Riley. B. Riley’s pledge of stock in a $200M loan to FRG’s founder (Brian Kahn) is now almost worthless. To make matters worse, a pending SEC probe into Kahn’s previous hedge fund dealings hung over the deal.

Internal Turmoil

The Chapter 11 filings revealed internal drama at FRG. Company records show that just before the bankruptcy, executives approved $5.75 million in retention bonuses to keep themselves from quitting.

Another $2.16 million in bonuses went to rank-and-file staff (these are clawbackable if employees leave early). Because the payments were made prior to the Nov. 3 petition, they cannot be clawed back by creditors under existing U.S. law.

Critics complained the bonuses seemed excessive, while defenders argued they were needed to keep specialists during the wind‑down. Either way, this episode echoed a familiar pattern in bankrupt retail chains and has raised questions about whether laws should better govern such payouts.

Ownership Chaos

Behind the scenes at Franchise Group was a tale of financial intrigue. Founder and ex-CEO Brian Kahn resigned in early 2024 amid reports he was named as a co-conspirator in a fraud tied to a hedge fund (Prophecy Asset Management).

Kahn denies any wrongdoing. Meanwhile, B. Riley’s heavy support of FRG complicated matters: in August 2023 B. Riley invested roughly $280 million in FRG equity and arranged $600 million in debt financing for the take-private deal.

Those commitments have largely gone up in smoke. After U.S. regulators subpoenaed B. Riley over its Kahn dealings, Riley’s investors grew skittish. In the end, questions about Kahn’s past and massive debt loads turned what might have been a routine retail bankruptcy into a labyrinth of liability for investors and executives alike.

Recovery Attempts

Not all of American Freight’s stores will vanish forever. In January 2025, a Delaware bankruptcy court approved the sale of 28 store locations (plus one distribution center) to a new entity called AF Newco I LLC.

The deal — for about $1.12 million plus lease cure costs — covers stores in Florida, Ohio, Michigan, and several other states.

NewCo’s principals say they have $35 million in financing ready to restock these outlets and expect them to generate roughly $9 million of cash in 2025. A banner on American Freight’s website now proclaims that it will “reopen in select locations” later this year. For employees of those 28 stores, the news offers hope.

Expert Skepticism

Industry analysts caution that the problems run deeper than any one brand. Many furniture retailers carry heavy debt from buyouts and expansion sprees; in a higher-interest-rate world, this makes them fragile. “A lot of these retailers had a significant amount of debt just when interest rates started rising,” notes one retail economist.

Combined with inflation‑pinched consumers, this creates a “twin pressure” on margins. Some observers argue we are seeing more than a cyclical downturn — they say the industry faces structural change.

As CoStar News summed it up, the sector rode a pandemic boom and stimulus bump into a sudden trough as spending cooled and costs climbed. Many predict a wave of consolidation: only those who cut costs, control inventory, and meet customers wherever they shop (online or off) will endure.

Future Questions

Will the furniture business come back fighting, or is a lull here to stay? American Freight’s collapse raises big questions about the value of low‑price retail in today’s economy. The FRG press release itself asks whether its balance sheet reset can “enable our market‑leading businesses… to realize their full potential”.

Franchise Group still operates Pet Supplies Plus, Vitamin Shoppe, and Buddy’s Home Furnishings — businesses it believes are stable. But the fate of discount home goods remains uncertain.

Will consumers return to furniture stores once inflation eases, or will online and used‑goods alternatives keep them away? Industry leaders say the answers will unfold as 2025 proceeds.

Policy Implications

The fallout has reignited debate over private equity’s role in retail. Critics note that heavy financial engineering — leveraged buyouts and roll‑ups — set up businesses for trouble when markets turn. Research groups point out that PE‐owned retailers have faced higher bankruptcy rates than typical companies.

“Data on bankruptcies suggests a different reality,” said one campaigner, “Private equity firms load companies with unsustainable amounts of debt and leave them financially vulnerable.”.

The situation also spotlights worker protections. U.S. bankruptcy law currently allows companies to pay large bonuses before filings, as seen here. Some lawmakers and regulators are now considering whether to tighten oversight of such payments or to require stronger safeguards for employees in leveraged transactions.

International Ripples

Furniture manufacturing and logistics feel the shockwaves overseas. In Canada and Mexico — where many U.S. retailers source or sell products — companies are bracing for softer demand.

Mexican factories and Canadian wood suppliers report canceling shifts and shelving new hires as American orders dry up. Meanwhile, U.S. tariffs on imports (especially from China) have already raised costs for raw materials and components.

New proposed tariffs could further dampen trade. Chinese exporters, facing a slowdown in U.S. consumption, have been cutting production in 2024. The result is a global adjustment: as U.S. buyers pause, international supply chains are pruning capacity, and cross-border furniture flows are expected to stay lighter until demand recovers.

Legal Ramifications

The bankruptcies have spawned complex lawsuits. One key issue: Franchise Group’s 2023 sale of the Badcock Home Furniture chain to Conn’s HomePlus. Under that deal, FRG guaranteed all the Badcock store leases. When Conn’s/Badcock later went into Chapter 11 in mid-2024, those guarantees became FRG’s problem.

Court filings confirm FRG “remained as the guarantor” on Badcock’s leases even after the merger.

With Conn’s now rejecting many store leases, commercial landlords are preparing to sue FRG for unpaid rent under those guarantees. In effect, the American Freight and Badcock cases are linked: creditors all along the chain may end up chasing FRG’s assets. This tangle of claims — including Buddy’s franchise suits and investor lawsuits — means the fallout is still unfolding in court.

Cultural Shifts

Beyond economics, changes in consumer culture are reshaping furniture demand. A TikTok trend called “underconsumption core” has swept young Americans. Influencers encourage repairing and thrifting furniture rather than buying new.

As one Furniture Today columnist observes, millions of Gen-Z and young Millennials now connect over “celebrating… thrifted and hand-me-down furniture”.

Younger consumers are rejecting the “buy new” ethos of previous generations. Sustainability and frugality drive their choices, and many prefer flea markets or online resale sites. Traditional retailers note that younger shoppers aren’t flocking to big furniture stores; instead, they buy essentials at discount chains or even grocery stores.

Market Evolution

American Freight’s liquidation may mark a broader market turning point. Analysts say the survivors will be those who adapt to omnichannel retail and shifting tastes. Stores that blend online convenience with compelling in‑store experiences — and embrace secondhand or rental models — stand the best chance.

As one executive put it, “We are in a time of unprecedented change” for furniture.

The industry must innovate with flexible supply chains and sustainable products or risk obsolescence. The lesson from AF’s demise is clear: low prices alone won’t save a retailer. Only nimble companies that give customers exactly what they want, where they want it, while keeping costs under control, will thrive in the evolving market.