On Friday, December 12, The GIANT Company and Giant Food announced the closure of 6 centralized e-commerce fulfillment centers across Pennsylvania and Virginia by the end of Q1 2026. This decision affects at least 299 workers and triggers a $50 million impairment charge. What once looked inevitable is now being dismantled, piece by piece, and the details explain why.

What Is Actually Happening Inside GIANT

Ahold Delhaize USA, parent company of GIANT and Giant Food, is shutting down centralized fulfillment hubs and shifting to store-based order picking. Six facilities across Pennsylvania and Virginia will close: Philadelphia, Lancaster, Willow Grove, Coopersburg, North Coventry, and Manassas. Store employees will pick orders for third-party delivery. However, growing pressure on speed and selection exposed cracks.

The Philadelphia Hub That Symbolized The Bet

The Philadelphia fulfillment center, opened in November 2021, captured GIANT’s automation vision. The 124,000-square-foot site, built with Swisslog and AutoStore robotics, aimed for 15,000 weekly delivery orders. It stocked 22,000+ products, employed 120+ workers, and operated with nearly 70 robots. Less than 5 years later, it will close, raising uncomfortable questions.

Closures Hit Fast From February To April

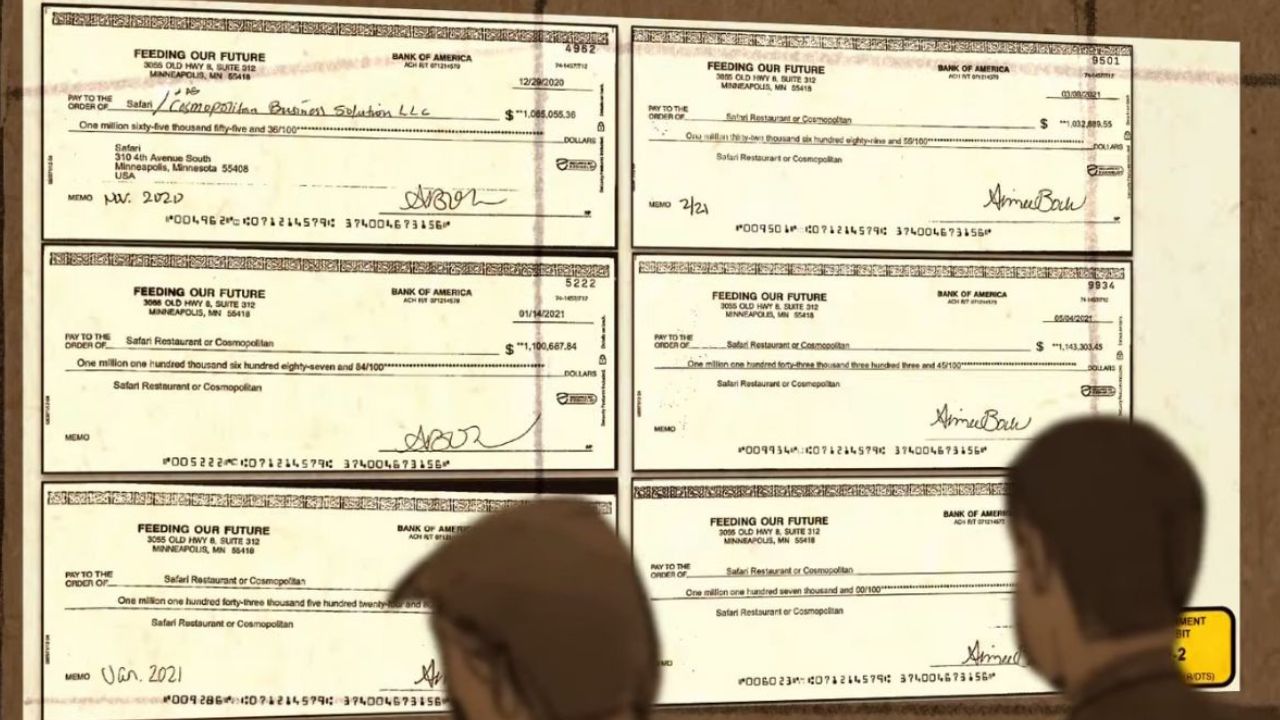

orgThe shutdown timeline is compressed. Giant Food’s Manassas facility closes February 10, 2026, affecting 90 workers. The GIANT Company’s Philadelphia location closes February 13, 2026, eliminating 128 jobs. Lancaster winds down by end of April, while Willow Grove, Coopersburg, and North Coventry close by March 31. Why the urgency behind this retreat?

At Least 299 Workers Lose Jobs Quickly

At minimum, 299 confirmed workers are displaced: 128 in Philadelphia, 90 in Manassas, and 81 in Lancaster. Counts for Willow Grove, Coopersburg, and North Coventry were not disclosed, pushing possible totals toward 400 to 500. These roles paid about $40,000-$50,000 annually. Ahold Delhaize says workers may find other roles, but options vary.

The Company Says Customers Changed The Rules

Ahold Delhaize USA framed the pivot around shifting demand: “Customers are increasingly expecting fast delivery, more assortment, and delivery availability to meet their preferences.” Centralized hubs cannot consistently meet expectations of 30 minutes to 1 hour because distance makes speed expensive. Store-based picking puts inventory closer to homes, turning proximity into an advantage, but speed was only part of it.

Why Assortment Became A Dealbreaker

Centralized centers typically carry fixed inventories of around 20,000 to 30,000 SKUs, set for robotic efficiency. But shoppers now expect online ordering to match or exceed in-store choice. Store-based fulfillment can tap into a full store assortment, often comprising 40,000 to 50,000+ SKUs, depending on the format. That flexibility beats curated hub inventories, yet it undermines the very logic automation relied on.

“Ultimately Those Were Hard Places”

Ken Fenyo, former Kroger executive, summarized the core obstacle: “Ultimately, those were hard places to make this model work. You didn’t have enough people ordering, and you had a fair amount of distance to drive to get the orders to them.” Centralized automation requires a stable, dense volume to be practical. In the U.S., demand remained volatile, and distance continued to erode margins.

Kroger’s $2.6 Billion Signal To Everyone

In November, Kroger announced that it would close nine automated fulfillment centers and pay Ocado $350 million in penalties, while taking a $2.6 billion write-down. Interim CEO Ron Sargent said the company would refocus on stores to expand rapid delivery without incurring significant capital expenditures. Kroger projected $400 million in annual operational improvements. Did GIANT see the writing on the wall?

Why The U.K. Blueprint Failed In The U.S.

Ocado’s “hive” systems were designed for U.K. shopping habits, featuring scheduled weekly slots, large and predictable baskets, and long delivery windows that accommodate wave-based automation. U.S. e-grocery leaned into same-day demand, smaller baskets, and rapid, on-demand expectations. That mismatch created constraints robots could not solve. Technology could not force Americans into a scheduled model, but something else changed internally.

A New Digital Platform Made Stores Work

In November 2025, Ahold Delhaize USA completed rollout of its proprietary omnichannel platform across 5 grocery brands, serving 26 million customers weekly. The cloud system enhances real-time inventory visibility across over 2,000 stores and supports order routing at scale. Store-based fulfillment becomes far more workable with this foundation. The timing hints that the closures were planned once the platform was ready.

The $50 Million Write-Off Tells The Story

Ahold Delhaize USA expects $50 million in non-cash impairment charges tied to the shutdowns: $35 million for The GIANT Company’s Pennsylvania facilities and $15 million for Giant Food’s Virginia facility. These write-offs reflect abandoned automation equipment, facility improvements, and software investments. Leadership appears to be choosing a one-time hit over ongoing operating losses, but who benefits next?

DoorDash And Instacart Step Into The Gap

With hubs closing, delivery shifts toward platforms with existing scale. Instacart held 17.2% of the e-grocery share in July 2025, while DoorDash kept expanding grocery after building dominance in food delivery. GIANT will rely on their driver networks, routing tools, and fast delivery capability. Instacart reported 258 million annual orders by 2025. The infrastructure moves outward, changing labor too.

Store Picking Shifts Pressure Onto Associates

Store associates will pick online orders while still serving in-store shoppers, stocking shelves, and handling checkout demands. That boosts complexity but keeps fulfillment closer to customers. Wage differences matter: store roles averaging $18-$22 hourly can be lower than dedicated warehouse jobs, creating possible pay declines for workers who transition. Managers also face new scheduling challenges as demand spikes unpredictably, and legal issues may follow.

A WARN Act Investigation Adds Uncertainty

Law firm Strauss Borrelli initiated a WARN Act investigation in December 2025 over whether The GIANT Company provided adequate notice for Philadelphia’s 128 affected employees. WARN requires 60+ days’ notice before mass layoffs. Ahold Delhaize issued notices on December 12 for a February 13 closure, but questions remain about notice clarity and information adequacy. If violations are found, liability could include back pay and benefits.

Local Economies Lose More Than Paychecks

Lancaster loses 81 jobs, Philadelphia 128, and Manassas 90, with additional undisclosed losses in Willow Grove, Coopersburg, and North Coventry. These were steady roles with benefits, supporting local spending and tax bases. Lancaster’s impact stings because GIANT invested $22 million in 2019 to build fulfillment infrastructure tied to economic development promises. Now communities face empty facilities and uncertain reuse plans, which customers will notice too.

Customers Get Speed, But Give Up Control

Store-based fulfillment can shrink delivery windows from hours or next-day to as little as 30 minutes through Instacart or DoorDash, while expanding selection to full store inventory. Dense urban areas benefit most. However, shoppers may lose a direct relationship with GIANT’s owned digital channels, instead ordering through third-party apps with different policies and fees. Will service quality hold steady during the transition?

The Industry Is Quietly Backing Away From Robots

GIANT’s retreat fits a broader shift. Kroger dismantled major Ocado plans in November 2025. Amazon cooled Amazon Fresh expansion while leaning more on micro-fulfillment tied to existing Whole Foods locations. Walmart, H-E-B, and regional chains are leaning into hybrid models. Food Trade News argued the consensus is that innovation must prioritize proximity and sustainable unit economics, not automation for its own sake.

The Profitability Question Still Haunts Everyone

Kroger expects $400 million in annual operational improvements from its pivot, and GIANT likely anticipates similar savings from cutting hub leases, maintenance, and fixed overhead. Yet 83% of U.S. grocery retailers report dissatisfaction with e-commerce profitability, and 51% lose money or earn under 10% margin per order. Store picking helps, but labor complexity rises and third-party fees squeeze margins. The real test is whether savings outpace pressure.

Pragmatism Replaces The Automation Dream

The 2026 closures mark an inflection point. The automation-first vision popular from 2018 to 2023 is being replaced by hybrid pragmatism: store-based fulfillment for speed and flexibility, selective automation only where volume supports it, and partnerships that reduce capital risk. For workers and communities, the costs are immediate, and for investors, the write-offs are real. Yet the industry seems to be admitting that customer behavior, not robotics, sets the rules.

Sources

GIANT and Giant Food to Close 6 Centralized E-commerce Fulfillment Centers. Ahold Delhaize USA, December 18, 2025

Kroger Acknowledges Bet on Robotics Went Too Far. Supply Chain Dive, November 18, 2025

Kroger Cancels Charlotte CFC, Closing Nashville Spoke. Grocery Dive, November 2025

The GIANT Company WARN Act Investigation. Strauss Borrelli PLLC, December 17, 2025

Grocery E-Commerce Isn’t Failing—Centralized Fulfillment Is. Food Trade News, December 22, 2025