The 2026 Hyundai Palisade has features normally found on cars about twice the price, setting a new precedent for modern car manufacturers.

According to Jalopnik’s test drive review, the Calligraphy trim with massage seats and Nappa leather costs $58,000, yet “puts cars that are two or three times more expensive to shame.” This pricing strategy is rattling American competitors.

Market Takeover

In the first five months of 2025, Hyundai and Kia achieved a combined 11% U.S. market share, which is 0.5% more than in 2024.

According to Korea JoongAng Daily, the companies sold 752,778 vehicles despite facing 25% tariffs. Industry officials report this success came from “pre-tariff inventory stockpiling” and expanded hybrid lineups.

Family Revolution

Modern families in the U.S. demand luxury at an affordable price, so three-row SUVs are replacing America’s minivans. The midsize SUV segment now represents one of the industry’s most competitive battlegrounds.

Automakers pour billions into advanced safety systems, premium interiors, and hybrid powertrains to capture suburban household loyalty.

Mounting Tensions

American automakers face intensifying pressure from Korean competitors while navigating difficulties such as tariff policies, EV transition costs, and changing consumer preferences.

Ford’s stock tumbled nearly 20% in recent months, while Stellantis temporarily shut plants affecting 900 U.S. workers. The competitive landscape is forcing strategic pivots across Detroit.

Strategic Retreat

Three-row electric Ford SUVs were abruptly canceled in August 2024, abandoning what CEO Jim Farley called their “personal bullet train” project.

According to CNBC, Ford’s decision to focus on hybrid technologies instead of pure electric vehicles will cost $1.9 billion in write-downs and additional expenses.

Ripple Effects

The mounting pressure on the auto industry extends beyond Michigan. General Motors added 250+ jobs at Indiana plants while Stellantis paused operations in Canada and Mexico.

According to Logisoft analysis, automakers are launching “America’s Freedom of Choice” discount programs across their Jeep, Dodge, Ram, and Chrysler brands to combat Korean pricing advantages.

Market Reality

“The reality is that the market changed,” Ford executive Marin Gjaja explained about canceling the electric SUV.

CBS News cited AAA surveys showing nearly two-thirds of car buyers won’t buy electric vehicles due to high prices and range anxiety. This forced Ford to abandon its aggressive electric car timeline.

Korean Strategy

Korean automakers are taking advantage of American companies’ uncertainty by keeping prices steady while expanding hybrid offerings.

Reuters documented Kia’s plans to grab 6% of the U.S. market by late 2025, growing while Japanese competitors raise prices due to tariff pressures on imported cars.

Electric Overload

The SUV market faces chaos with 143 new electric vehicles planned for North America.

NPR’s coverage of S&P Global data reveals this flood of electric SUVs is creating price wars as buyers become pickier about expensive electric cars, wanting practical savings rather than trendy tech status symbols.

Smart Planning

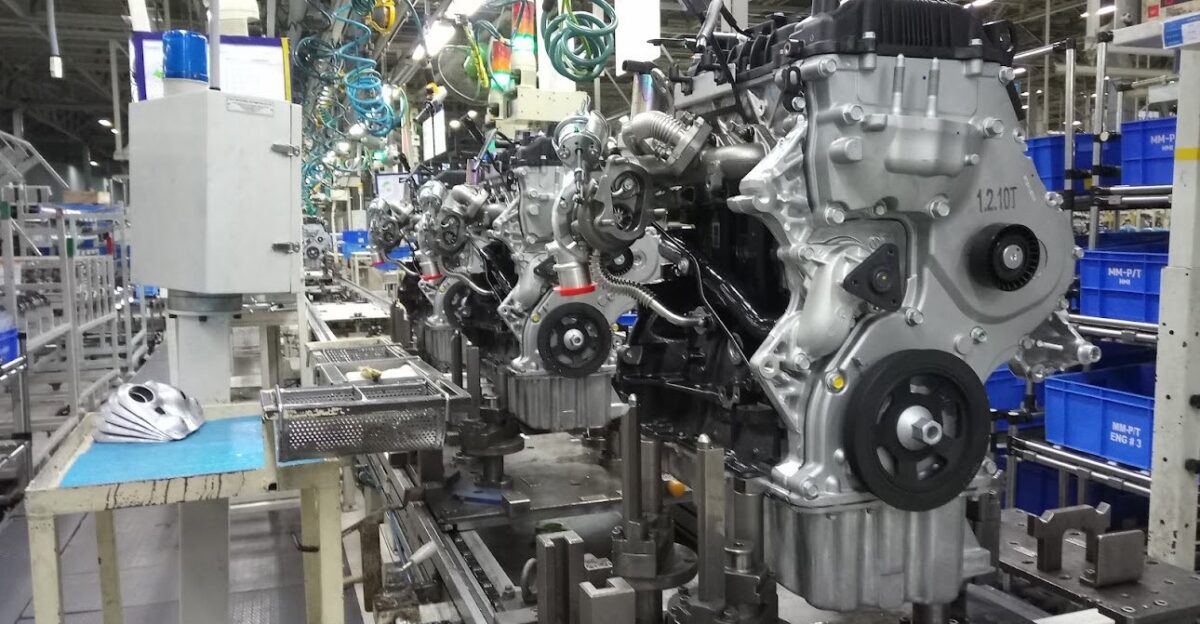

Hyundai’s success came from smart planning and U.S. factory expansion. The Korea Herald tracked Hyundai’s best April ever with 162,615 vehicles sold, including 65.8% more hybrid sales than last year.

They stockpiled inventory before tariffs hit, letting them keep prices low while competitors struggled with costs.

Money Problems

Ford executives faced angry investors over huge electric car losses. The company’s electric division lost $1.3 billion in early 2024 alone.

The Verge revealed that Ford demands all new cars make money within 12 months of launch. This strict rule killed the electric SUV project before it started.

Leadership Change

Ford CEO Jim Farley cut electric car spending from 40% to 30% of the budget.

CBS News quoted Farley as admitting Ford learned hard lessons about what customers want as “the No. 2 U.S. electric vehicle brand.” He acknowledged that Ford’s original electric car timeline was too ambitious for real-world business needs.

New Direction

American car companies are switching to hybrid technology as a middle ground between gas and electric. This could be a logical move, as hybrid vehicle sales nearly doubled from 6.8% in Q1 2024 to 13% in Q1 2025.

Logisoft’s research indicates Ford plans hybrid engines for its truck lineup and new SUVs. GM invests in U.S. factories while Toyota and Honda carefully watch tariff impacts before changing prices.

Expert Doubt

While American car manufacturers scramble, car industry experts question whether these companies can match Korean value.

Korea JoongAng Daily interviewed an industry official who said Hyundai and Kia “secured ample supply of vehicles to minimize tariff impact.” This planning showed strategic thinking that U.S. manufacturers failed to match in the competitive race.

Future Battle

The competition gap may widen as Hyundai plans a powerful 329-horsepower hybrid Palisade with even more luxury features.

Car and Driver poses a crucial question: Can American automakers innovate fast enough to counter Korean advances in regular and hybrid engines before permanently losing more customers?

Tariff Limits

Korean companies’ success despite 25% tariffs proves that trade barriers alone aren’t protect U.S. companies’ market share.

AJU Press notes that Trump officials consider higher tariffs. Still, experts doubt whether trade wars can fix fundamental problems in product development and factory efficiency that give Korean companies an edge.

Global Stakes

The world is watching America’s SUV battle as a test of global car industry leadership.

Electrek’s analysis suggests that if Korean companies dominate America’s biggest luxury SUV market, they could expand into Europe and other premium markets, potentially ending traditional German, American, and Japanese control of the global car industry.

Green Reality

Korean and American companies now focus on hybrids over pure electric cars, matching buyers’ wants. CBT News data shows electric cars reached only 10.9% of sales in July, and federal tax credits expire September 30, 2025.

Companies adjust environmental plans to match real consumer behavior, not government wishes.

American Change

The Palisade’s success shows how Asian brands now define luxury and innovation in America, not just cheap alternatives.

Edmunds’ assessment found Hyundai offers Genesis-level interior quality at mainstream prices, challenging old ideas about car prestige and value that have ruled American car buying for decades.

Historic Moment

The 2026 Palisade represents more than just competition—it marks a potential turning point where American car leadership faces its biggest challenge since Japanese quality beat Detroit in the 1970s and 1980s.

Car and Driver’s rankings suggest how well Detroit responds, which will determine whether it stays relevant or becomes a follower in a Korean-led global market.