Nvidia’s position in China stands at the crossroads of global technology, economics, and geopolitics, making its business there a focal point of discussion among analysts, investors, and policymakers. After a remarkable run of outperforming Wall Street projections, Nvidia’s recent quarterly results shed new light on how U.S. export controls and trade policies affect it.

With China historically contributing over 13% of Nvidia’s revenue and representing a $50 billion annual opportunity, the stakes remain high for the company and the broader AI industry.

1. Massive AI Market Growth Potential

The Chinese AI market is undergoing an extraordinary expansion, driven by strategic government policies, massive investment in infrastructure, and a dynamic private sector rapidly integrating AI into daily life and business. Recent industry analyses project China’s artificial intelligence market value to reach $26.44 billion by 2026, with a compound annual growth rate (CAGR) exceeding 20% between 2021 and 2026.

2. Strategic Partnership With Governments

Nvidia’s strategic partnerships with governments will become a defining feature of its China strategy for 2025. In exchange for remitting 15% of sales revenue from certain AI chips (like the H20) to the U.S. government, Nvidia would receive export licenses to sell certain AI chips (like the H20) in China. This arrangement, described by The New York Times as “highly unusual,” effectively makes the U.S. government a stakeholder in Nvidia’s Chinese operations.

3. Unquenchable Demand for AI Chips

Generative AI adoption is a leading force, prompting hyperscale cloud providers, internet giants, and startups to rapidly expand their compute capacity using Nvidia’s advanced GPU architectures and AI accelerators. Cloud and enterprise customers could spend up to $600 billion on AI infrastructure this year, and Chinese organizations represent a substantial portion of this outlay.

“Businesses racing to build generative AI systems continue to buy the company’s processors, which are designed to handle huge amounts of data quickly,” said Nvidia CFO Colette Kress.

4. Flexibility in Product Development

When 2023 export controls blocked the sale of its most advanced AI chips, Nvidia responded by designing the H20 chip, a product tailored specifically for the Chinese market. This product balances performance and regulatory compliance. The company demonstrated that it can quickly pivot, engineering “China-compliant” hardware to sustain local sales even as rules changed.

5. Nvidia’s Unique Value Proposition

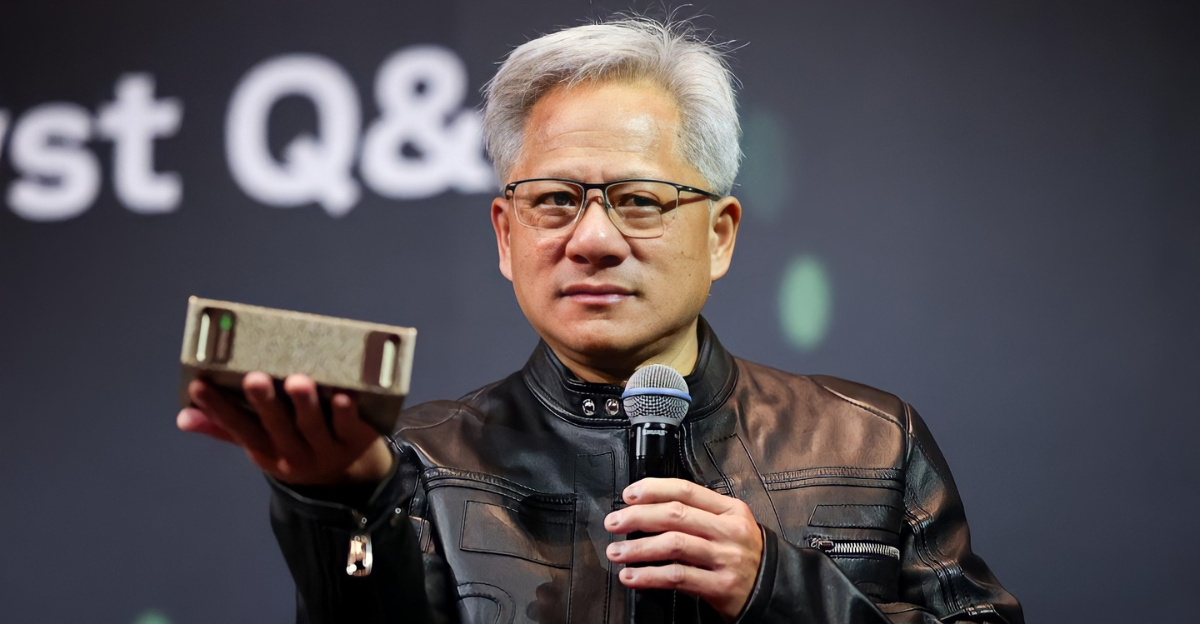

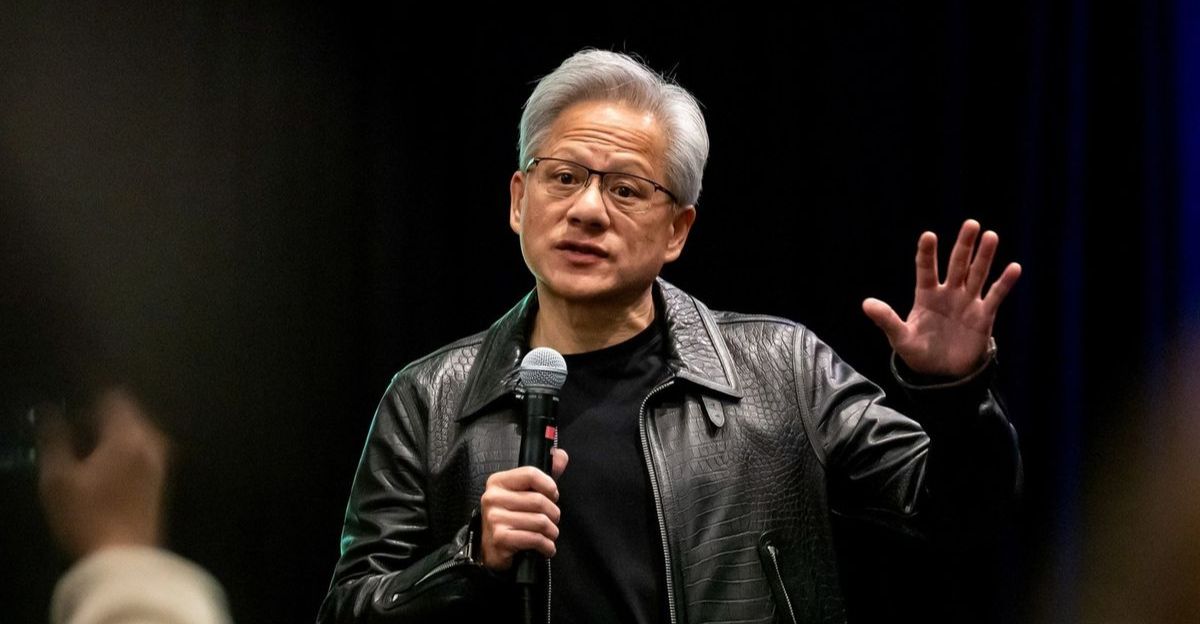

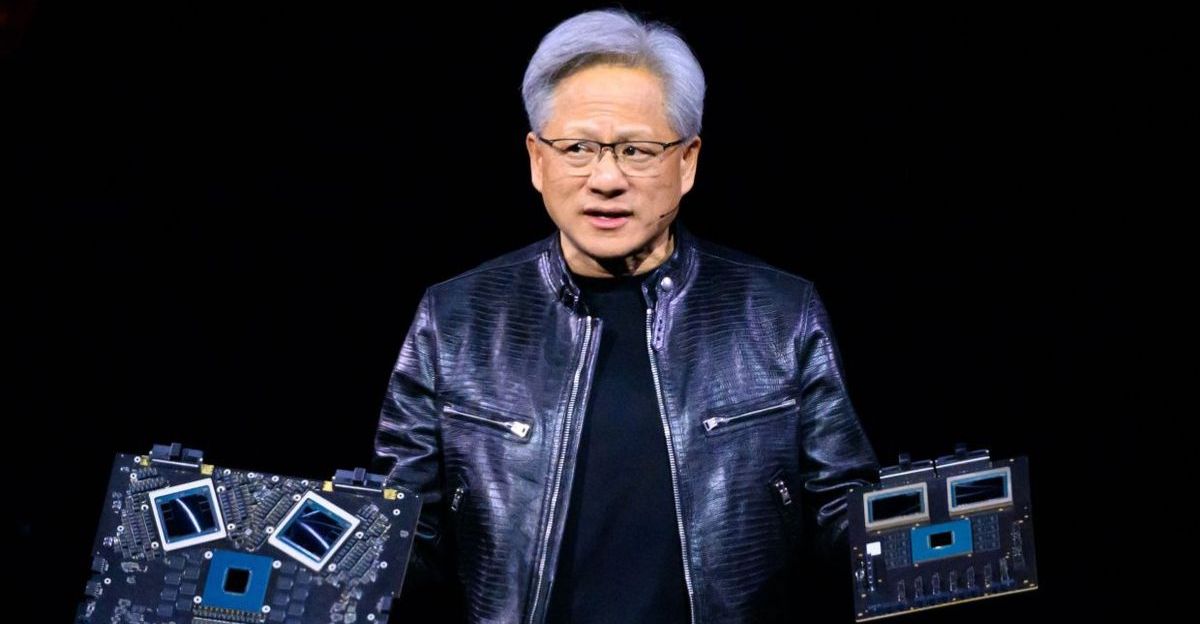

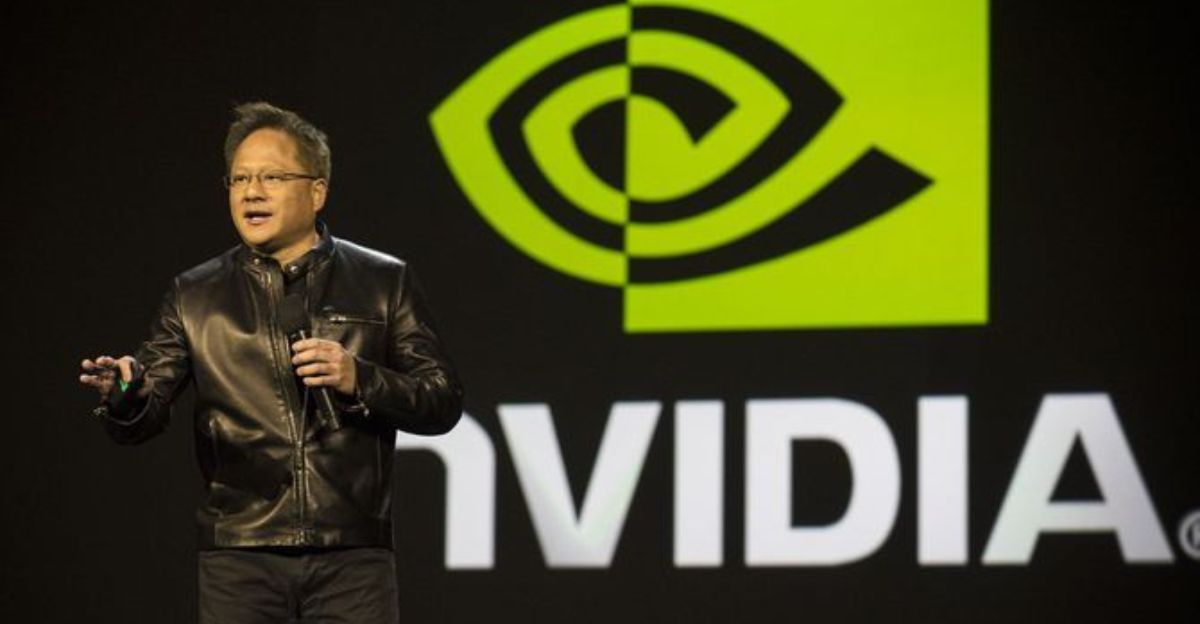

Nvidia’s unmatched hardware performance, mature software ecosystem, and deep technical support are what set the company apart from local competitors, even amid regulatory tension. “It is better for Chinese AI developers to use Nvidia’s chips rather than force them to use homegrown Chinese options by restricting exports,” said CEO Jensen Huang.

He estimates the Chinese AI sector could grow 50% annually and still prefers Nvidia’s chips because they enable state-of-the-art model training, faster data throughput, and superior reliability.

6. Official Endorsement of Market Access

The Trump administration struck an unprecedented deal with Nvidia CEO Jensen Huang, allowing the company to resume AI chip sales, specifically the H20 model, in China, provided that Nvidia pays 15% of its revenue from these sales to the U.S. government.

This arrangement was made public following Huang’s repeated visits to the White House and direct negotiations with U.S. and Chinese officials. While U.S. regulators have expressed expectations around the 15% cut, Nvidia’s CFO Colette Kress highlighted in earnings calls that the agreement is not yet codified in official regulation, pointing out possible legal and competitive risks as the framework evolves.

7. Domestic Chinese Competition Still Lagging

Chinese firms like Huawei and Cambricon have made headway, with Cambricon posting a 4,000% revenue surge and a market valuation near $80 billion in 2025. Their chips are increasingly featured in local AI deployments, and Beijing is aggressively investing in chip plants and production capacity to reduce reliance on Nvidia.

Despite these advances, experts and developers view Nvidia’s products as the gold standard for training large language models and powering generative AI. As noted by S&P Capital IQ, “Nvidia’s dominance is not solely due to its hardware but also its software, which developers have become accustomed to utilizing.”

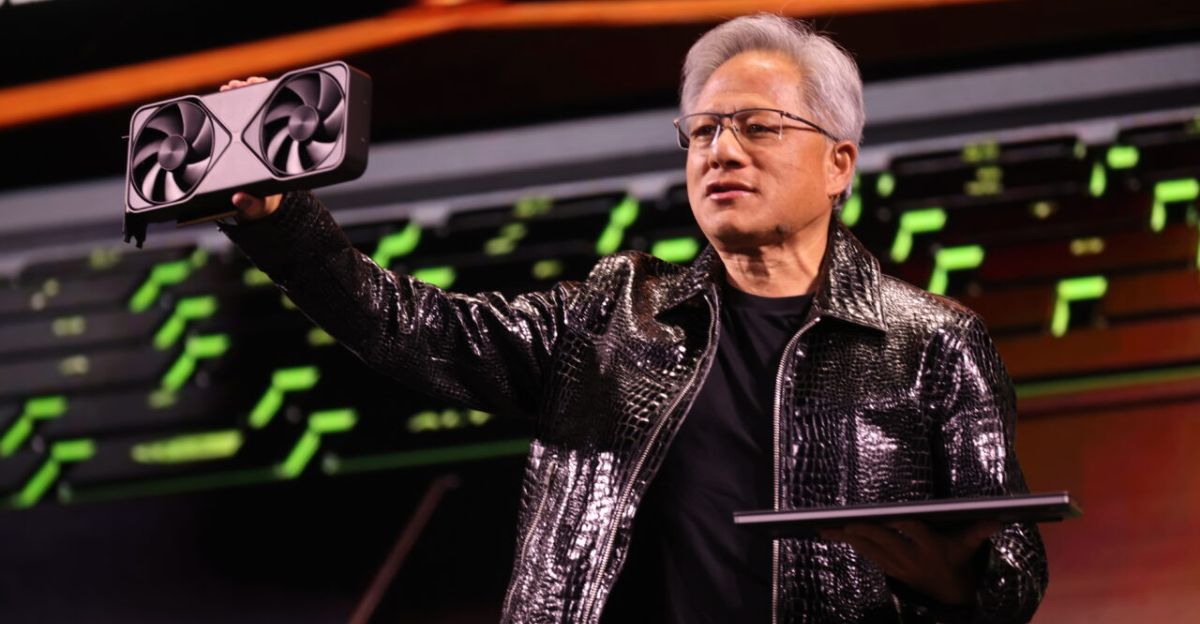

8. Strong Gaming Segment Performance

Nvidia’s gaming revenue hit a new record of $4.3 billion, marking a remarkable 49% year-over-year increase. This surge is driven by unrelenting demand for GeForce GPUs and gaming laptops, which dominate the Chinese PC gaming landscape.

Despite export restrictions affecting AI-focused chips, consumer gaming products have largely avoided these headwinds, enabling Nvidia to maintain strong brand visibility and customer loyalty in China.

9. Cloud and Enterprise Expansion

Demand for advanced Nvidia AI chips from Chinese cloud service providers, major tech firms, and large-scale data centers remains exceptionally strong. In 2025, Chinese cloud and enterprise customers have committed billions to acquiring Nvidia’s modified H20 chips, tailored to comply with the latest U.S. export restrictions. Reuters reports that Nvidia secured $18 billion in H20 chip orders from China since January.

These purchases fuel the construction of dozens of new data centers, especially in western provinces like Xinjiang. Plans are to deploy up to 115,000 Nvidia GPUs for AI-driven computing and research.

10. Sovereign AI Push Offers New Revenue Streams

The company’s AI strategy includes selling hardware and AI software solutions to clients in China and globally. In 2025, Nvidia reported that its sovereign AI initiatives will generate up to $20 billion in revenue this year alone.

This is largely driven by partnerships with national governments eager to build large language models, operate AI-powered public services, and maintain control over sensitive data. If geopolitical tensions ease and licensing arrangements solidify, sovereign AI solutions could add an extra $2–5 billion in quarterly revenue from China alone.

11. Positive Analyst Outlook On Revenue Prospects

Daniel Heyler of EFM Asset Management and other analysts believe China will be the greatest economic beneficiary of AI and thus predict that any positive policy turn or export license for Nvidia will result in a “spike” in revenue and stock price.

While trade tensions still weigh, most analysts assert that Nvidia’s “rock solid” global demand and competitive positioning make its long-term revenue trajectory highly compelling.

12. Innovation in Robotics and Physical AI

At CES 2025, Nvidia unveiled a suite of technologies designed to power the next generation of robotic and autonomous systems, including its Blackwell-powered GeForce RTX 50 Series GPUs, Cosmos AI platform, and Project DIGITS personal AI supercomputer. The Cosmos platform integrates extensive human activity data and advanced AI models to help robots and autonomous vehicles “better understand and interact with the physical world,” marking a step closer to the so-called ChatGPT moment for robotics.

13. Resilience Against Stock Fluctuations

The company’s shares fell by nearly 30% earlier in the year amid export restrictions and China concerns, but have rebounded 92% and are now 35% higher. This rebound highlights Nvidia’s deep market confidence and the enduring demand for its AI chips, even in uncertain environments.

As Goldman Sachs analysts note, “historical trading patterns indicate the stock rebounds sharply from dips, as investors recognize the long-term potential of Nvidia’s platform beyond short-term semiconductor volatility”.

14. Capability to Out-Engineer Restrictions

Each time new limitations emerged, Nvidia has rapidly developed and launched customized chips for the Chinese market. Nvidia’s team expertly adapts memory configurations, packaging technology, and power limits to design chips that avoid banned technologies, leverage alternative suppliers, and ultimately ensure regulatory compliance.

15. High-Level Analyst Support

Nvidia enjoys exceptionally strong support from high-level analysts, who continue to rate the company as a top pick for growth and innovation—even in the face of short-term volatility and China policy uncertainties. Of the 44 Wall Street analysts covering Nvidia, 38 currently rate it as a “Buy” or “Strong Buy,”.

Major investment banks, including Goldman Sachs, Morgan Stanley, JPMorgan, and Wedbush Securities, have issued repeated price target upgrades and maintained “overweight” or “outperform” ratings.

16. Localization of Manufacturing

The company has commissioned over one million square feet of manufacturing space in Arizona for Blackwell AI chips, with supercomputer factories ramping up in Houston and Dallas through partnerships with Foxconn and Wistron.

This localization drive is not just about physical infrastructure—it is a resilience strategy against global shocks such as tariffs, trade wars, and supply disruptions. CEO Jensen Huang explained, “Adding American manufacturing helps us better meet the incredible and growing demand for AI chips and supercomputers, strengthens our supply chain, and boosts our resiliency.”

17. Gaming and Consumer Tech as Buffer

In Q1 2025, Nvidia secured an unprecedented 92% market share in the discrete GPU sector, solidifying its dominance over competitors AMD and Intel as the preferred choice for gamers and content creators. Despite AI-centric headlines, analysts note that Nvidia’s origins—PC gaming—remain a “thriving business segment” with broad global reach and resilience, especially in China and the U.S..

18. Sustained Global Leadership

Nvidia holds an industry-leading estimated 86% share of the AI GPU segment, and is forecast to report about $49 billion in AI-related revenue for 2025, maintaining a rapid growth trajectory as rivals like AMD and Intel seek to expand their footprints. Even occupying the geopolitical spotlight, Nvidia continues to manage policy headwinds, export restrictions, and competitive threats while staying crucial to global digital strategy.

19. Optimism Amid Uncertainty

Despite moments where stock price retreats, Nvidia’s fundamentals keep analysts and investors bullish on long-term prospects. Even data center revenue, which fell slightly below consensus, is poised for a rebound. Analysts now forecast an average share price of $235.48 for 2025, with some price targets approaching $250 and a low end near $174, even in a volatile macro environment.

If that doesn’t prove that they’re on to big things, then nothing will. This company has shown resilience in thhe face of every challenge that has been thrown their way, and they aren’t backing down anytime soon.