On a sprawling 18,000-acre site near Orovada, Nevada, approximately 700 construction workers assemble mining infrastructure. Steel columns rise from freshly graded earth as heavy equipment moves across the Nevada desert. Beneath their feet lies a geological prize: up to 40 million metric tons of lithium worth $1.5 trillion—hidden inside McDermitt Caldera supervolcano.

This construction represents a 2023 peer-reviewed discovery that captured Washington’s attention. The Thacker Pass mine, expected to begin commercial production in early 2028, signals the first operational breakthrough in accessing this extraordinary resource.

Hidden in a Supervolcano: How 40 Million Tons of Lithium Were Discovered

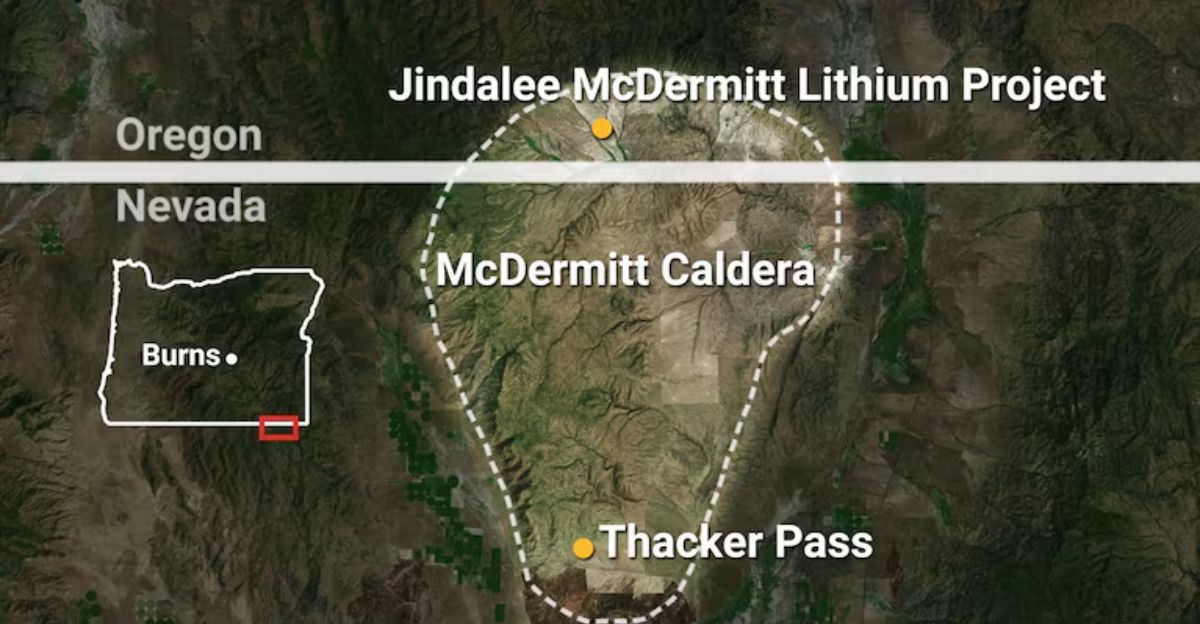

The McDermitt Caldera formed 16 million years ago during a catastrophic volcanic eruption that expelled roughly 1,000 cubic kilometers of lithium-rich material across the Nevada-Oregon border. Over millions of years, a long-lived lake accumulated volcanic sediments, forming clay minerals.

A resurgence event brought fresh magma beneath the crater, triggering the circulation of hydrothermal fluids exceeding 300°C through the rock layers. These hot fluids transformed clays into illite, a mineral that concentrates lithium, increasing its levels to double or triple those found in typical clay deposits.

A Trillion-Dollar Prize and the Reality of Lithium’s Volatile Market

Converting geological estimates to market value requires translating lithium metal into lithium carbonate equivalent, then multiplying by recent contract prices. Using 2024 average prices of $14,000 per metric ton, analysts calculate the deposit’s theoretical value to be between $1.5 trillion and $3 trillion.

However, only a fraction will likely prove economically recoverable. Lithium prices plummeted from $71,000 per ton in 2022 to $610 in mid-2025—a 90 percent decline. Goldman Sachs projects $11,000-$13,250 per ton by 2026, levels supporting Thacker Pass’s profitability if maintained.

The Thacker Pass Mine: America’s $3 Billion Answer to Chinese Dominance

Lithium Americas develops Thacker Pass on McDermitt Caldera’s southern edge as North America’s largest lithium mining operation. Designed to produce 40,000 metric tons of battery-grade lithium carbonate annually, the project represents a supply of lithium for approximately 800,000 to 940,000 electric vehicles per year.

The $3 billion project is fully funded through a $2.26 billion Department of Energy loan, $625 million General Motors investment for 38 percent ownership, and additional backing. Construction began in March 2023; as of November 2025, engineering had reached 80 percent completion with over 700 workers on-site.

Why Washington Is Betting Billions: Breaking China’s Processing Monopoly

The United States imports approximately 95 percent of its processed lithium, with China accounting for 80 percent of the global processing capacity. This strategic dependency creates vulnerability, as China restricts exports, imposes tariffs, and exerts geopolitical pressure on its dependent nations.

American officials view domestic lithium production as essential to national security and EV manufacturing goals. The Department of Energy’s record loan and 5 percent equity stake signal a significant commitment to securing lithium supply. General Motors’ $625 million investment and 20-year offtake agreements demonstrate that automakers recognize the importance of projects like Thacker Pass in securing battery supply.

Global Supply Chain Realignment: McDermitt Changes the Lithium Map

For decades, South America’s “lithium triangle” and Australia dominated global production. Bolivia’s Salar de Uyuni contains 23 million tons but produces less than 0.1 percent of global supply due to infrastructure limitations. McDermitt’s discovery, combined with Arkansas’s Smackover Formation deposit containing 5-19 million tons, reshapes geopolitical assessment.

The U.S. Geological Survey revised the U.S. lithium resources from 750,000 tons to 14 million tons (13.3 percent globally), placing the United States in third place after Bolivia and Argentina. This repositioning impacts trade balances and the allocation of energy transition infrastructure.

Lithium Demand Explosion: 400 Percent Growth Expected by 2030

Global lithium demand reached 720,000 metric tons in 2022, then accelerated as EV sales surged. Analysts project a 400 percent demand growth over the next five years, driven by EV adoption accelerating to 7 million units globally by 2025. Goldman Sachs forecasts 3.1 million metric tons by 2030, with EVs consuming 80 percent of battery-grade lithium.

Data centers powering artificial intelligence require enormous quantities of power through lithium-ion battery backup systems, creating parallel demand. Thacker Pass’s production ramp, coinciding with a surge in demand, creates favorable conditions if execution proceeds on schedule.

Environmental and Indigenous Rights Challenges: The Human Cost of Lithium Mining

McDermitt’s geological fortune masks environmental and social complexities, igniting fierce opposition. Thacker Pass requires 2,850-5,200 acre-feet of water annually in a water-scarce region. Environmental groups warn that large-scale extraction could strain regional aquifers and degrade streams critical to the habitat of the threatened Lahontan cutthroat trout and the Greater Sage Grouse.

The site known as Peehee Mu’huh holds profound cultural significance for Northern Paiute and Western Shoshone tribal nations—the site of an 1865 massacre where U.S. cavalry killed dozens of Indigenous people.

Human Rights Concerns and International Standards Violations

In February 2025, the ACLU and Human Rights Watch released a 133-page report documenting alleged violations of international human rights standards. The report states BLM permitted the mine without ensuring indigenous communities possessed genuine veto power or meaningful negotiation capacity.

Federal courts allowed construction despite acknowledging procedural flaws, concluding that lithium extraction’s strategic importance justified proceeding. This tension represents a defining feature of America’s clean energy transition: balancing energy security against environmental justice and Indigenous rights.

Technical Extraction Challenges: From Clay to Battery-Grade Lithium

Converting McDermitt’s lithium-rich illite clays into battery-grade lithium carbonate requires sophisticated processes distinct from traditional brine or hard-rock mining. Brine extraction utilizes solar evaporation, while hard rock requires crushing and thermal processing. Clay extraction demands roasting, acid leaching, selective precipitation, and refining.

Pilot studies indicate that recovery rates of 70-92 percent are achievable, but scaling to 40,000 tons annually introduces risks related to consistency, quality control, and efficiency. Lithium Americas has selected engineering firm Bechtel to develop the facility; however, limited commercial-scale experience with clay extraction at this volume creates execution risk.

EV Battery Potential: Billions of Vehicles and Decades of Supply

Each EV battery contains approximately 8 kilograms of lithium. At realistic recovery rates, the deposit could theoretically supply lithium for 1.75-4 billion vehicles—sufficient for decades of global EV production if demand materializes as projected. The International Energy Agency’s Net Zero by 2050 pathway projects 2 billion battery electric vehicles on roads by 2050.

However, lithium serves multiple uses: grid-scale energy storage, consumer electronics, aerospace, and emerging technologies. In 2030, global demand is projected to be 3.1 million tons. McDermitt’s lower estimate represents 6.5 years of supply, while the upper estimate represents 12.9 years.

The Phased Expansion: From 40,000 Tons to 160,000 Tons Annually

Lithium Americas envisions Thacker Pass as a phased, decades-long operation rather than a single build-and-operate project. Phase 1, scheduled for completion in late 2027, with a production ramp-up in 2028, will produce 40,000 metric tons annually—one-fifth of projected U.S. demand in 2030. The long-term vision encompasses five phases, ultimately producing 160,000 metric tons annually, making Thacker Pass North America’s largest lithium mine.

A five-phase buildout requires decades of sustained capital investment, price sustainability, and stable regulatory conditions—assumptions that history suggests are optimistic for long-term mining.

Investment Sentiment: Why Wall Street Still Believes Despite Price Collapse

Despite lithium’s 90 percent price collapse from its 2022 peaks, significant investment continues to flow to McDermitt and other U.S. projects. General Motors’ $625 million investment signals that automakers view supply security as worth premium valuations, even where spot lithium appears to be cheap.

The Department of Energy’s multibillion-dollar commitment reflects confidence that depressed prices don’t reflect long-term equilibrium—demand will eventually overcome supply constraints. Investment analysts project lithium recovering to $11,000-$17,000 per ton by 2027-2028, precisely when Thacker Pass Phase 1 begins producing.

The Moment When It All Begins: Late 2027 and Beyond

The transition from construction to operational reality is expected to occur between late 2027 and early 2028. That’s when Lithium Americas’ Phase 1 processing infrastructure is completed, and commercial production begins. Assuming no major delays, the first battery-grade lithium from the McDermitt Caldera will flow into North American battery factories.

General Motors’ commitment to purchase 100 percent of Phase 1 output and 38 percent of Phase 2 output guarantees offtake capacity, reducing commercial risk. By 2030, Phase 1, at full capacity, will supply lithium for approximately one million EVs annually, transforming energy independence from aspiration to reality.

The Bottom Line: A Test of American Execution and Commitment

McDermitt’s lithium deposit represents an extraordinary geological fortune and tests whether America can execute massive infrastructure projects while honoring environmental and Indigenous rights. Success at Thacker Pass between 2028 and 2035 will signal whether the U.S. can break Chinese dominance in critical minerals and build a domestic battery ecosystem.

The outcome determines whether America’s EV transition depends on imports and foreign processing, or whether domestic production reshapes global supply chains. Failure—through cost overruns, technical difficulties, litigation, or price collapse—leaves energy independence vulnerable to geopolitical disruption and Chinese leverage.

Sources:

Science Advances Journal: “Hydrothermal enrichment of lithium in intracaldera illite, McDermitt Caldera, Nevada-Oregon” (2023)

U.S. Geological Survey: Mineral Commodity Summaries 2025 — Lithium Report

Department of Energy: Thacker Pass Loan Guarantee Announcement and Project Overview (2024)

Lithium Americas Corporation: Thacker Pass Phase 1 Construction Updates and Project Specifications (2025)

Goldman Sachs Equity Research: Global Lithium Supply-Demand Forecasts and Price Projections (2025)

American Civil Liberties Union & Human Rights Watch: “The Land of Our People, Forever” — Indigenous Rights Impact Report on Thacker Pass (February 2025)

U.S. Geological Survey: National Mineral Resource Assessment — U.S. Lithium Reserves Revision (2024)